Dc Nonresident Tax Form

Dc Nonresident Tax Form - You can download or print. Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. Type of property address #1. Upon request of your employer, you must file this. You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Web where can i get tax forms? You qualify as a nonresident if:. Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. Get ready for tax season deadlines by completing any required tax forms today. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in.

You qualify as a nonresident if:. Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in. Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. Upon request of your employer, you must file this. You qualify as a nonresident if: Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. Web where can i get tax forms? If the due date for filing a. Web dc inheritance and estate tax forms;

Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. You qualify as a nonresident if: Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in. Web dc inheritance and estate tax forms; Type of property address #1. Web where can i get tax forms? You qualify as a nonresident if:

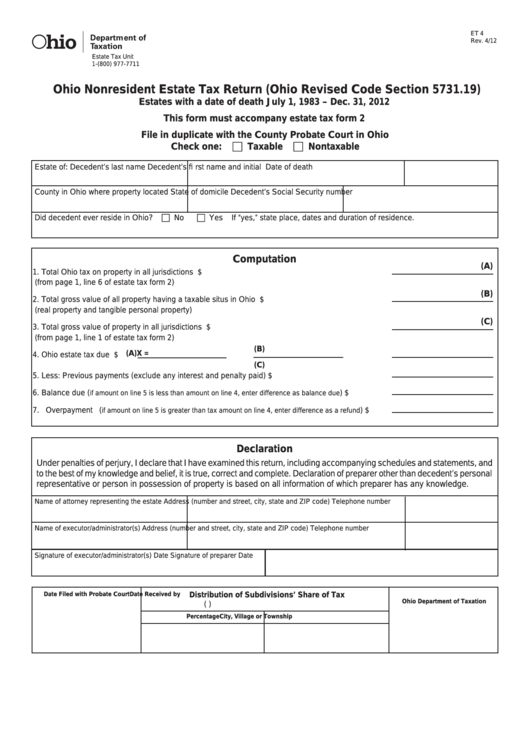

Fillable Form Et 4 Ohio Nonresident Estate Tax Return printable pdf

Web where can i get tax forms? Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. List the type and location of any dc real property you own. You.

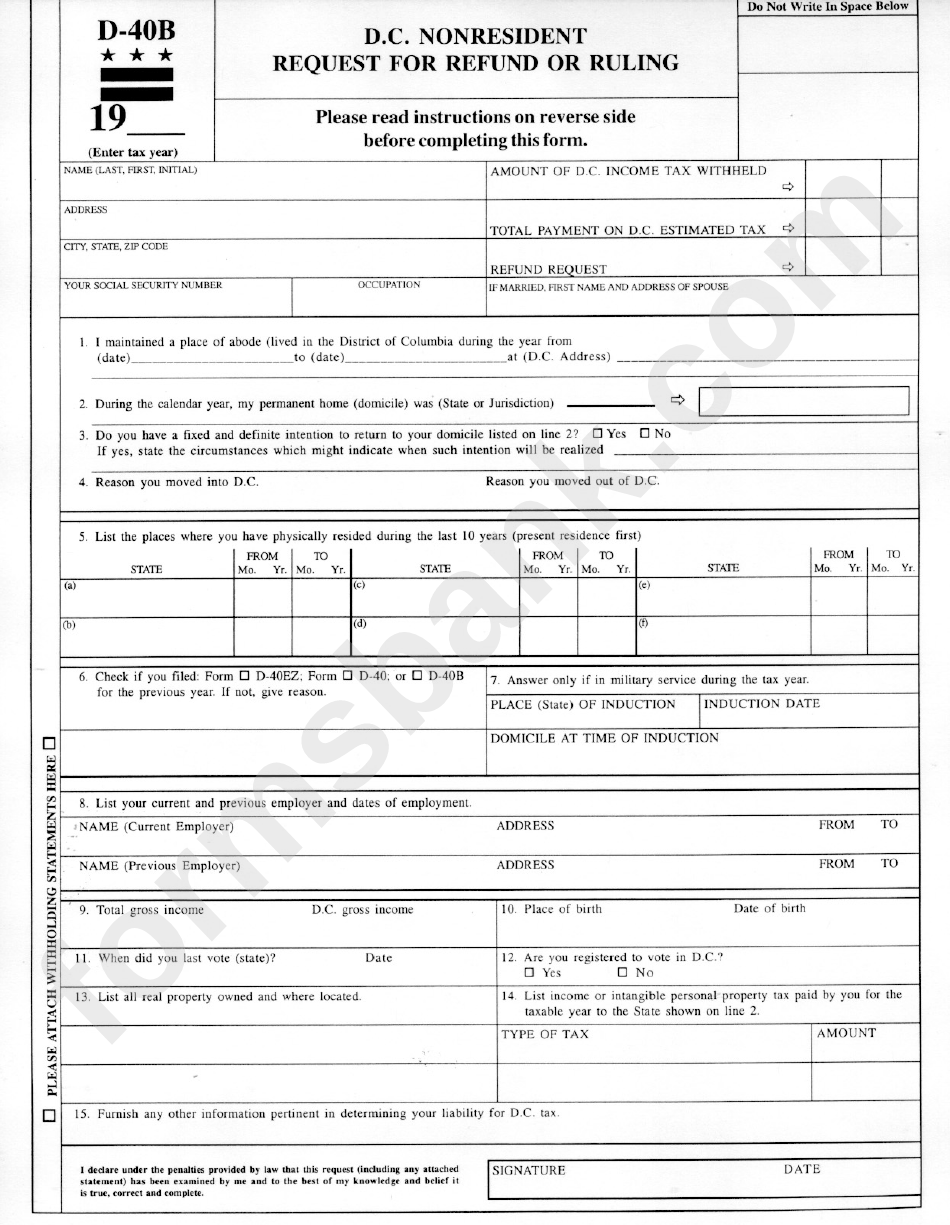

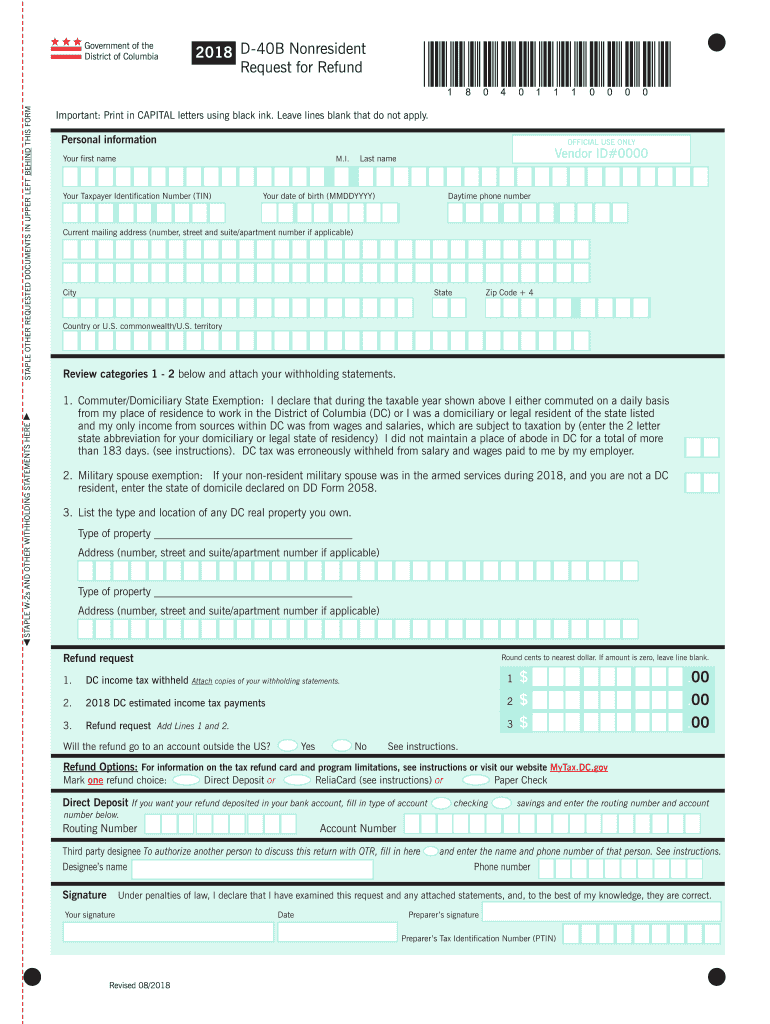

Fillable Form D40b Nonresident Request For Refund Or Ruling

If the due date for filing a. You qualify as a nonresident if: Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Web where.

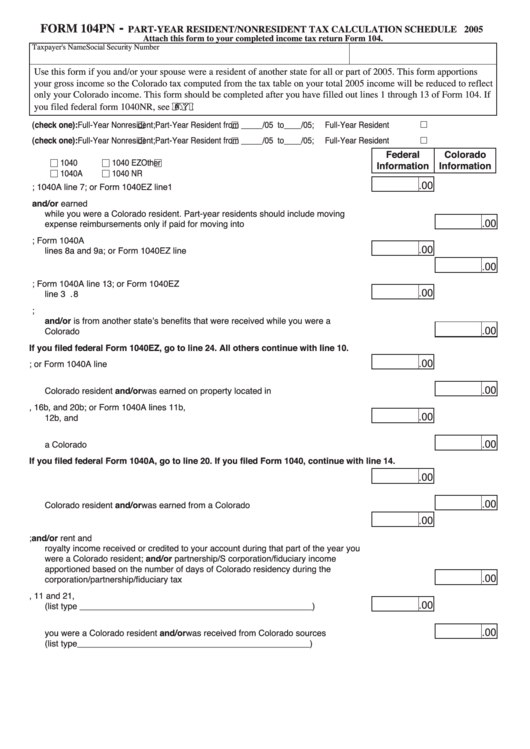

Fillable Form 104pn PartYear Resident/nonresident Tax Calculation

Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. If the due date for filing a. Type of property address #1. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers.

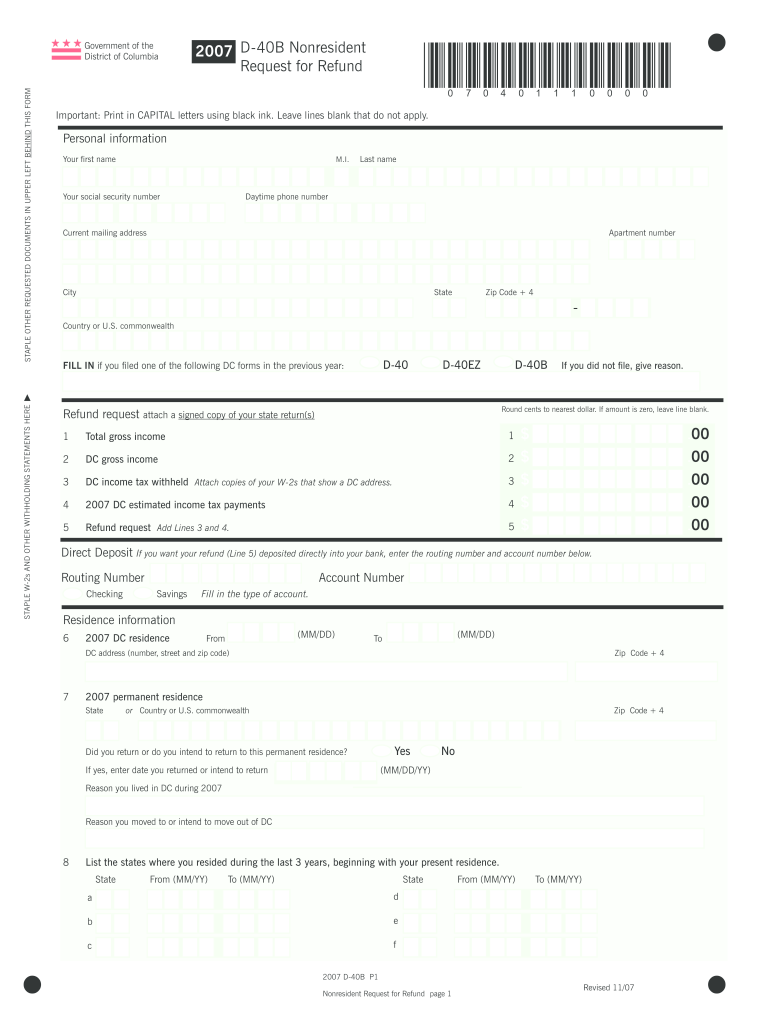

2007 Form DC D40B Fill Online, Printable, Fillable, Blank pdfFiller

Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. Type of property.

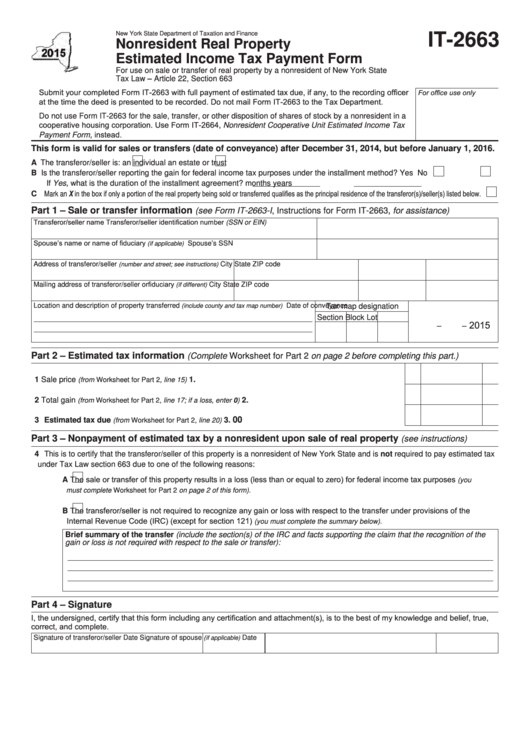

Fillable Form It2663 Nonresident Real Property Estimated Tax

Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. Upon request of your employer, you must file this. Web dc inheritance and estate tax forms; Web view individual income tax forms 2023.

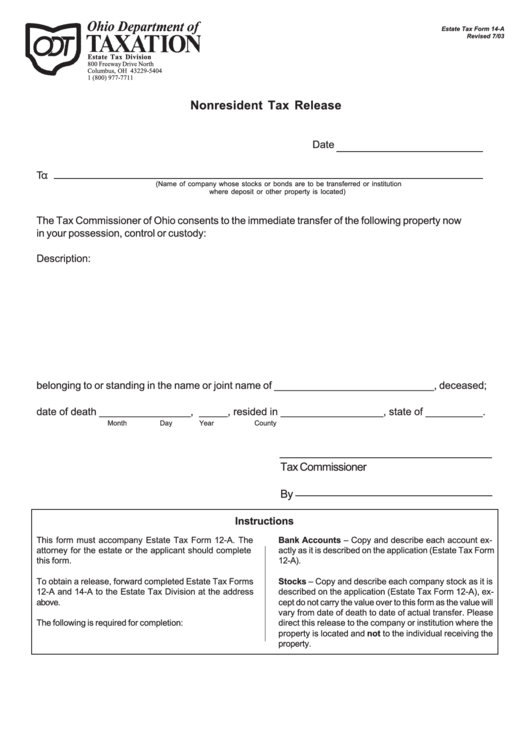

Fillable Form 14A Nonresident Tax Release Ohio Department Of

Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. List the type and location of.

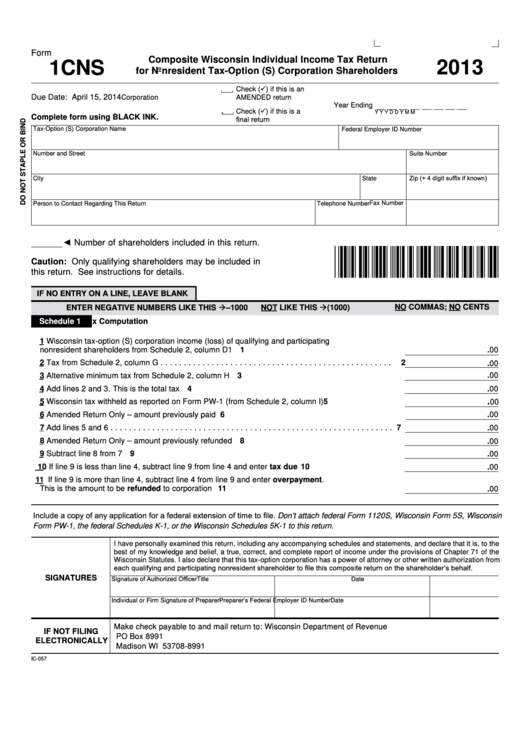

Fillable Form 1cns Composite Wisconsin Individual Tax Return

You qualify as a nonresident if: Web you qualify as a nonresident if: Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. You can download tax forms by visiting tax forms, publications, and resources.

District of columbia tax form d 40 Fill out & sign online DocHub

Web where can i get tax forms? Type of property address #1. Get ready for tax season deadlines by completing any required tax forms today. Web 1 best answer keithb1 new member if you work in dc and live in any other state, you're not subject to dc income tax. Sales and use tax forms.

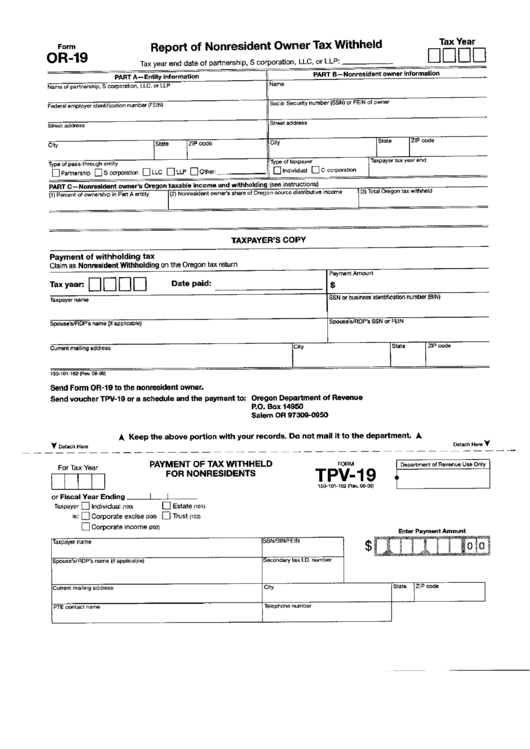

Form Or19 Report Of Nonresident Owner Tax Withheld/form Tvp19

Get ready for tax season deadlines by completing any required tax forms today. Web registration and exemption tax forms. Any nonresident of the district claiming a refund of district income tax withheld or paid by declaration of estimated tax. Sales and use tax forms. Type of property address #1.

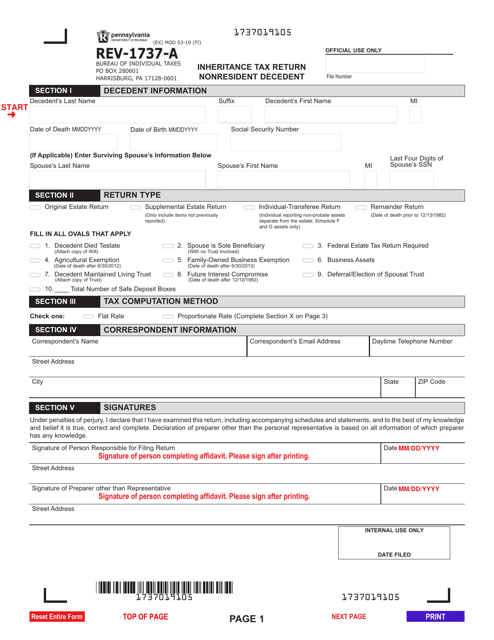

Form REV1737A Download Fillable PDF or Fill Online Inheritance Tax

You can download or print. Sales and use tax forms. You qualify as a nonresident if: Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. Web registration and exemption tax forms.

Type Of Property Address #1.

Web you qualify as a nonresident if: You qualify as a nonresident if: Upon request of your employer, you must file this. You qualify as a nonresident if:.

You Can Download Or Print.

You can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in. Miscellaneous tax forms and publications prior year tax forms real property tax forms and publications. Get ready for tax season deadlines by completing any required tax forms today.

Web 1 Best Answer Keithb1 New Member If You Work In Dc And Live In Any Other State, You're Not Subject To Dc Income Tax.

You qualify as a nonresident if: Sales and use tax forms. Web registration and exemption tax forms. Your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year.

Web Individual Income Tax Forms And Instructions For Single And Joint Filers With No Dependents And All Other Filers On Or Before May 17, 2021.

Web where can i get tax forms? Web view individual income tax forms 2023 tax filing season (tax year 2022) view individual income tax forms 2022 tax filing season (tax year 2021) view individual income tax. List the type and location of any dc real property you own. Web dc inheritance and estate tax forms;