Dc Non Resident Tax Form

Dc Non Resident Tax Form - Failure to file the appropriate certificate will cause your wages to be subject to d.c. Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid. If the due date for filing a return falls on a saturday, sunday or legal holiday, the return is due the next business day. Sales and use tax forms. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. Monday to friday, 9 am to 4 pm, except district holidays. Web office of tax and revenue. Web tax, this form must be filed with your employer upon his request. You qualify as a nonresident if: Ask the chief financial officer.

Web registration and exemption tax forms. Web you can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the district of columbia by also visiting tax forms, publications, and resources to find these locations. Sales and use tax forms. On or before april 18, 2022. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web tax, this form must be filed with your employer upon his request. 1101 4th street, sw, suite 270 west, washington, dc 20024. Monday to friday, 9 am to 4 pm, except district holidays. If the due date for filing a return falls on a saturday, sunday or legal holiday, the return is due the next business day. Web office of tax and revenue.

Failure to file the appropriate certificate will cause your wages to be subject to d.c. Web you can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the district of columbia by also visiting tax forms, publications, and resources to find these locations. If the due date for filing a return falls on a saturday, sunday or legal holiday, the return is due the next business day. Web office of tax and revenue. 1101 4th street, sw, suite 270 west, washington, dc 20024. Web registration and exemption tax forms. • you are a service member’s spouse. Web a nonresident is anyone whose permanent home was outside dc during all of the tax year and who did not live in dc for a total of 183 days or more during the year. You qualify as a nonresident if: Web tax, this form must be filed with your employer upon his request.

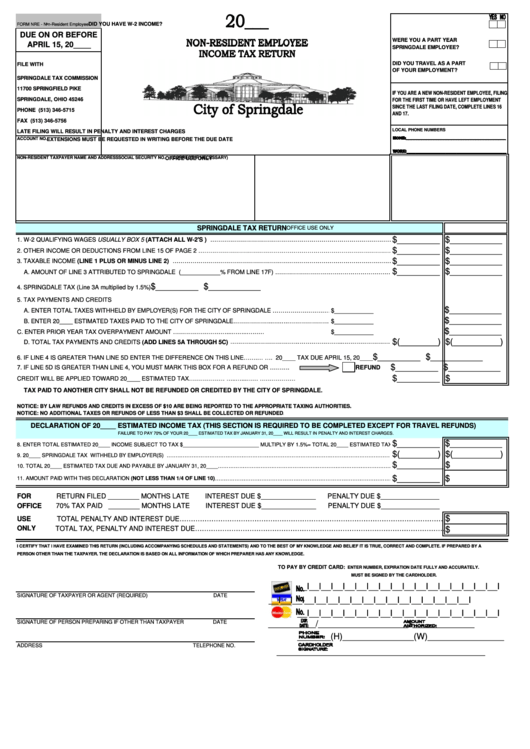

Form Nre NonResident Employee Tax Return printable pdf download

You qualify as a nonresident if: • you are a service member’s spouse. Failure to file the appropriate certificate will cause your wages to be subject to d.c. Ask the chief financial officer. If the due date for filing a return falls on a saturday, sunday or legal holiday, the return is due the next business day.

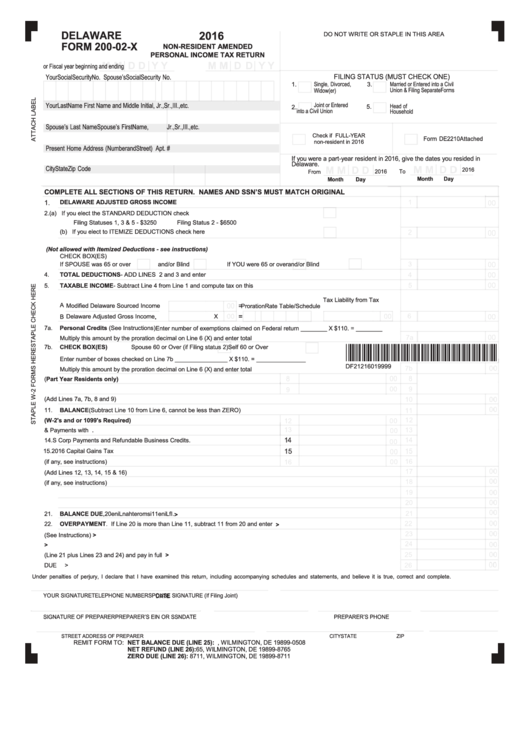

Delaware Non Resident Form 200 02 Fill Out and Sign Printable PDF

Monday to friday, 9 am to 4 pm, except district holidays. Web office of tax and revenue. You qualify as a nonresident if: Web you can download tax forms by visiting tax forms, publications, and resources or you can obtain forms from several locations around the district of columbia by also visiting tax forms, publications, and resources to find these.

FORM 210 NON RESIDENT TAX DECLARATION AF Consulting

Dc inheritance and estate tax forms. • you are a service member’s spouse. Web a nonresident is anyone whose permanent home was outside dc during all of the tax year and who did not live in dc for a total of 183 days or more during the year. • your permanent residence is outside dc during all of the tax.

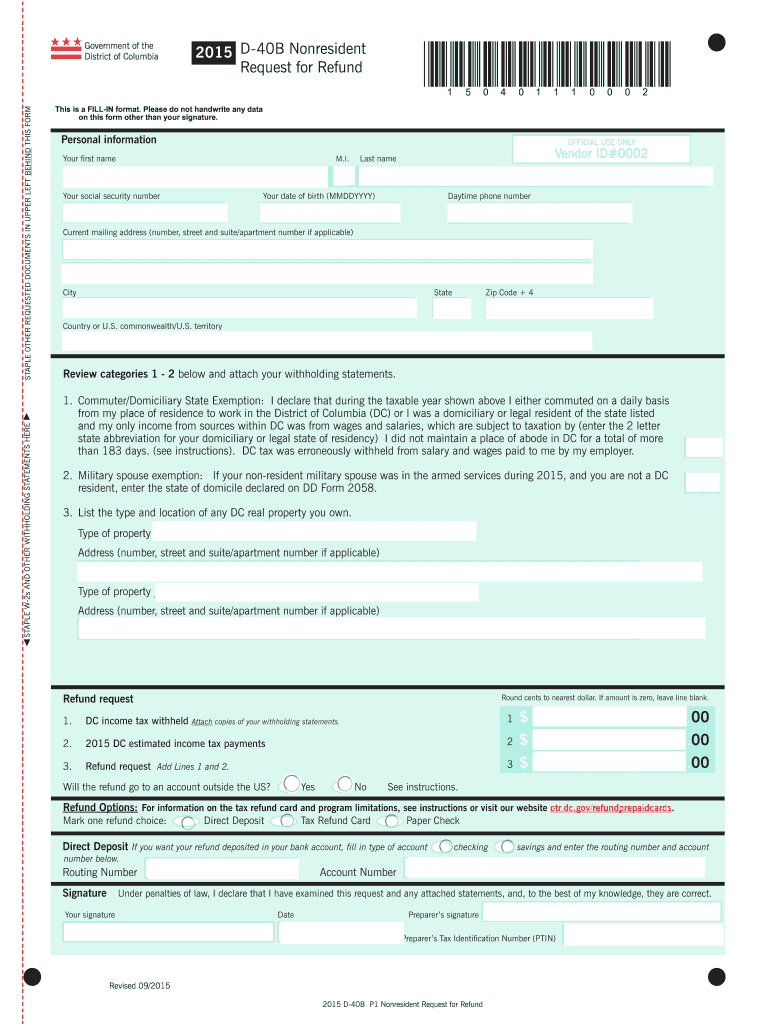

D 40B Fill Out and Sign Printable PDF Template signNow

Monday to friday, 9 am to 4 pm, except district holidays. 1101 4th street, sw, suite 270 west, washington, dc 20024. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers. Web tax, this form must be filed with your employer upon his request. Web you are not required to file a.

Fillable Form 20002X NonResident Amended Personal Tax

Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid. You qualify as a nonresident if: Failure to file the appropriate certificate will cause your wages to be subject to d.c. Web registration and exemption tax forms. Individual.

Amended NonResident & Part Year Resident Tax Return

On or before april 18, 2022. Dc inheritance and estate tax forms. Monday to friday, 9 am to 4 pm, except district holidays. 1101 4th street, sw, suite 270 west, washington, dc 20024. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the.

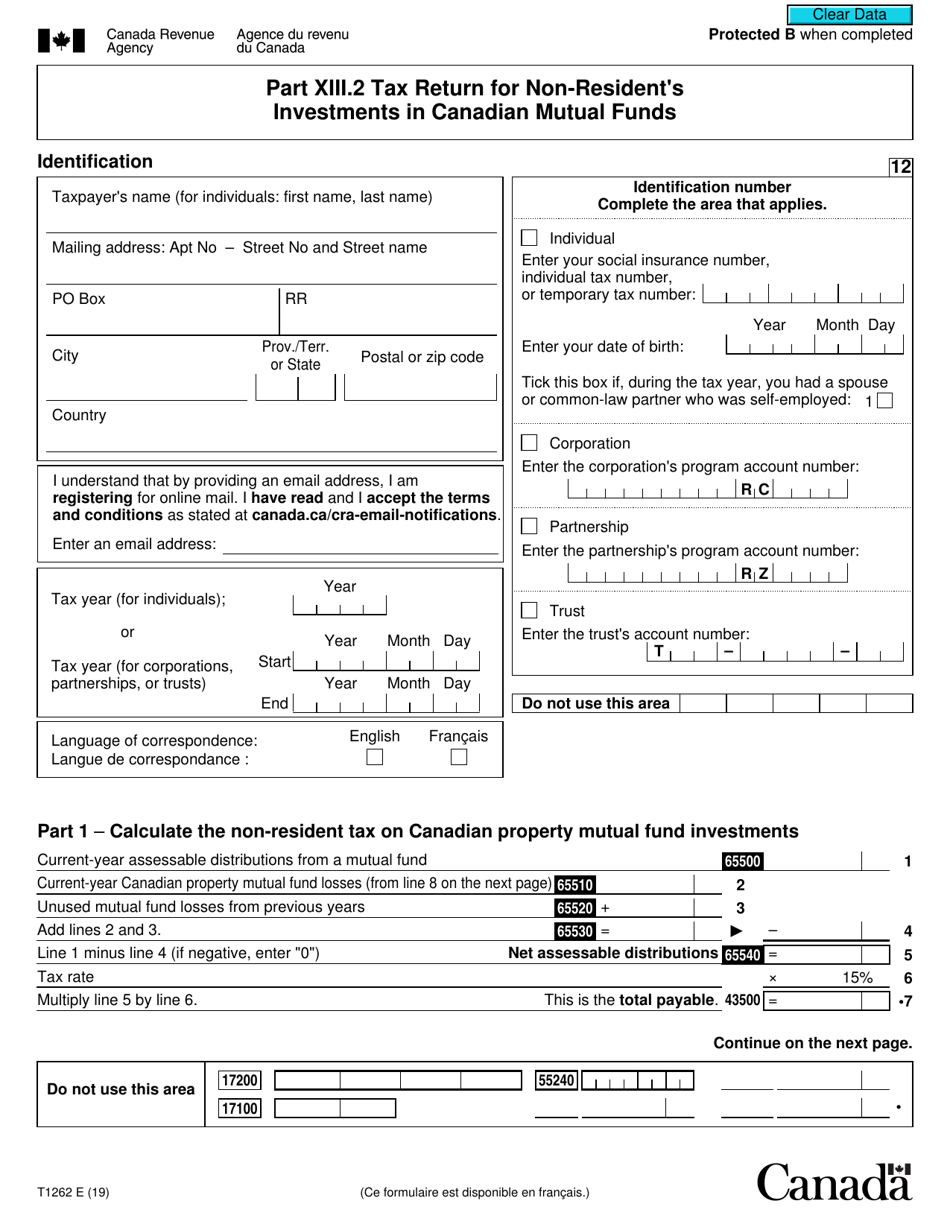

Form T1262 Fill Out, Sign Online and Download Fillable PDF, Canada

Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid. You qualify as a nonresident if: Web tax, this form must be filed with your employer upon his request. • your permanent residence is outside dc during all.

20162022 Form DC D4A Fill Online, Printable, Fillable, Blank pdfFiller

Sales and use tax forms. • you are a service member’s spouse. On or before april 18, 2022. You qualify as a nonresident if: If the due date for filing a return falls on a saturday, sunday or legal holiday, the return is due the next business day.

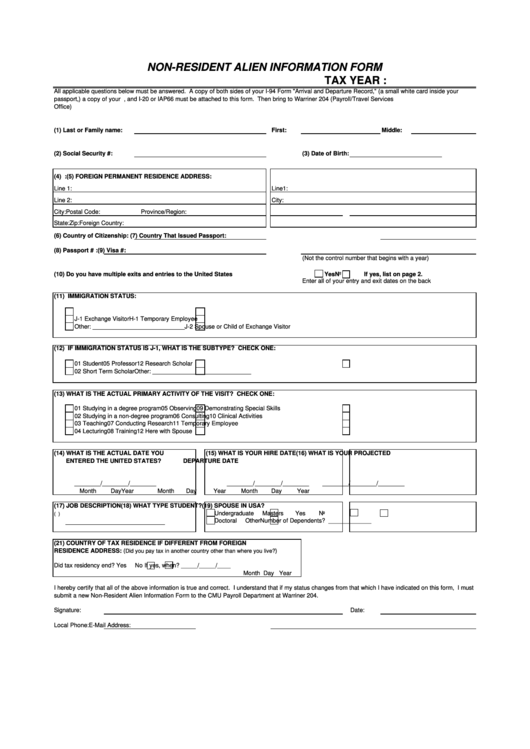

Non resident tax file number application form

Web registration and exemption tax forms. Ask the chief financial officer. Monday to friday, 9 am to 4 pm, except district holidays. Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid. Web you can download tax forms.

• You Are A Service Member’s Spouse.

Web registration and exemption tax forms. Failure to file the appropriate certificate will cause your wages to be subject to d.c. If the due date for filing a return falls on a saturday, sunday or legal holiday, the return is due the next business day. Web tax, this form must be filed with your employer upon his request.

Monday To Friday, 9 Am To 4 Pm, Except District Holidays.

Web a nonresident is anyone whose permanent home was outside dc during all of the tax year and who did not live in dc for a total of 183 days or more during the year. On or before april 18, 2022. • your permanent residence is outside dc during all of the tax year and you do not reside in dc for 183 days or more in the tax year. Sales and use tax forms.

Web You Can Download Tax Forms By Visiting Tax Forms, Publications, And Resources Or You Can Obtain Forms From Several Locations Around The District Of Columbia By Also Visiting Tax Forms, Publications, And Resources To Find These Locations.

You qualify as a nonresident if: Dc inheritance and estate tax forms. Web you are not required to file a dc return if you are a nonresident of dc unless you are claiming a refund of dc taxes withheld or dc estimated taxes paid. Individual income tax forms and instructions for single and joint filers with no dependents and all other filers.

1101 4Th Street, Sw, Suite 270 West, Washington, Dc 20024.

Ask the chief financial officer. Web office of tax and revenue.