Dallas County Homestead Exemption Form 2023

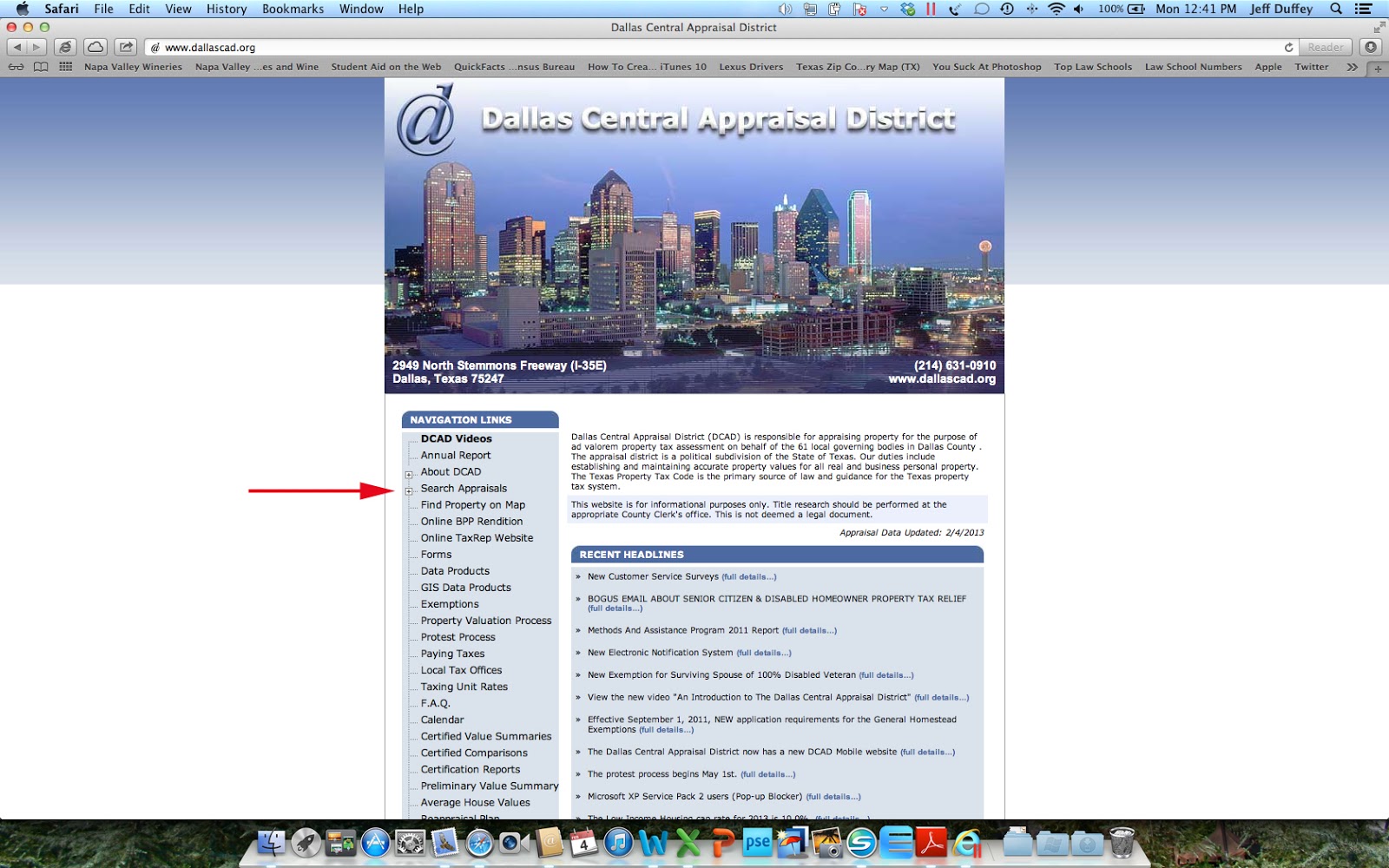

Dallas County Homestead Exemption Form 2023 - 1 and april 30 of the. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Contact your local appraisal district. Web dallas texas application for residence homestead exemption category: Web how can i find out what my listed exemptions are? You can search for your property and print the homestead exemption pdf and fill it up manually. Web if you encounter any difficulties with uploading files or submitting your residence homestead exemption application, then please mail your application and documents to. For filing with the appraisal district office in each county in which the property is located generally between jan. That 20% is the highest amount allowed. Contact your local appraisal district.

Web residence homestead exemption application. Complete, edit or print tax forms instantly. That 20% is the highest amount allowed. Web residence homestead exemption application for. Contact your local appraisal district. Web homeowner exemptions residence homestead exemption to qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. So whether you’ve just bought one of dallas’s condos or are simply. Refer to the eligibility requirements for other factors that. You may be eligible to apply. 1 and april 30 of the.

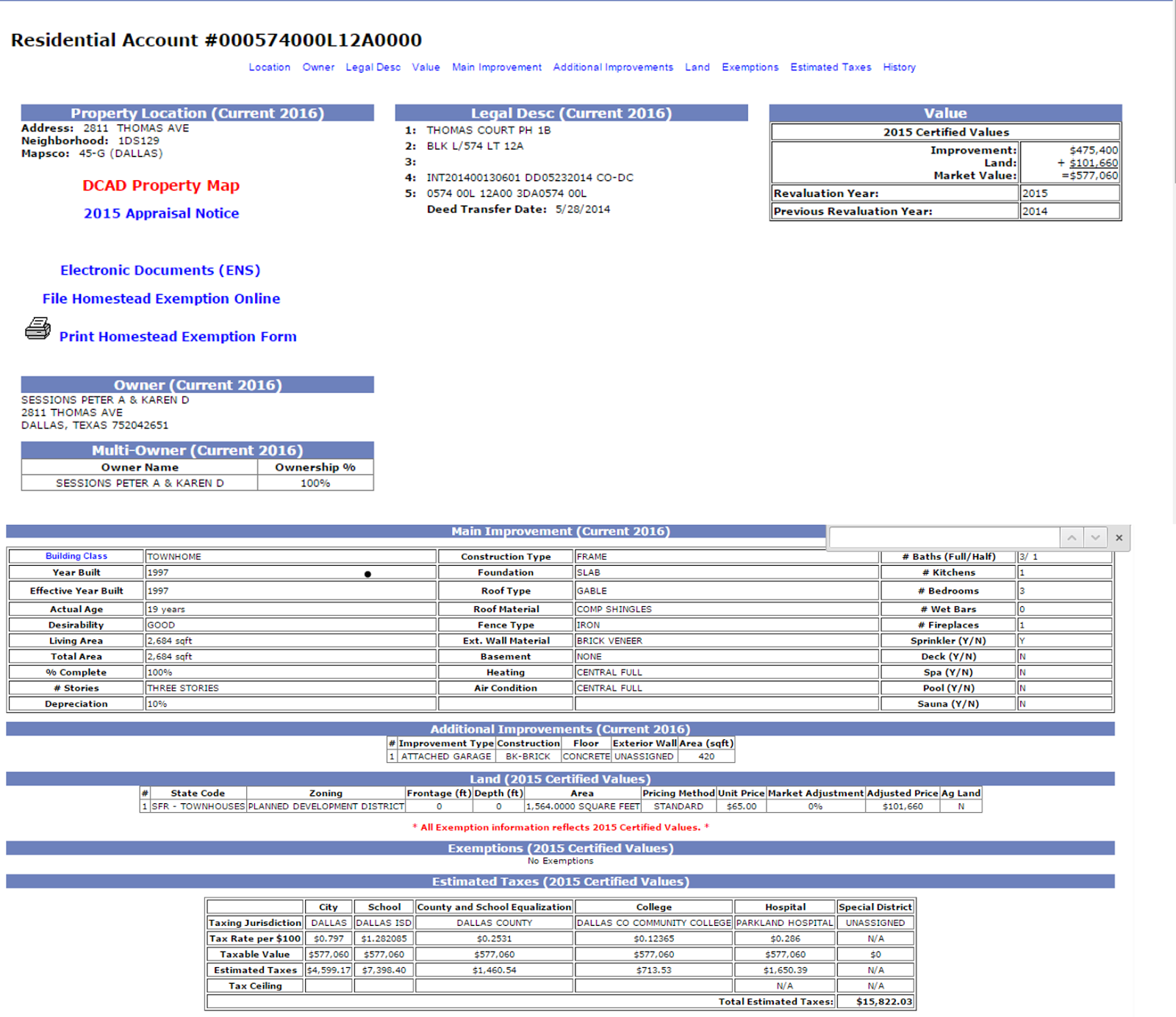

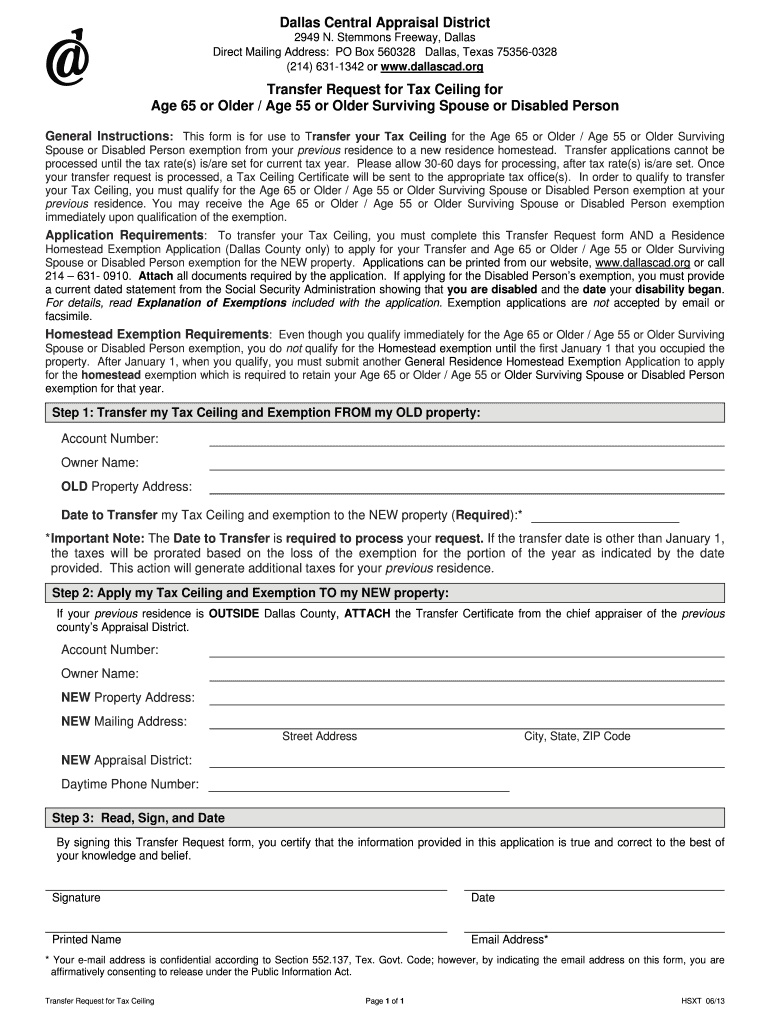

Other sections of the tax code provide additional write. Refer to the eligibility requirements for other factors that. Web homeowner exemptions residence homestead exemption to qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Web click the blue property address link to view the details of your account. So whether you’ve just bought one of dallas’s condos or are simply. Web (as on march 24th 2023). Web to apply for any other exemptions, including (age 65 or older exemption, disability exemption, age 55 or older surviving spouse of a person who received the age 65 or. Web how can i find out what my listed exemptions are? What if my exemptions are wrong?

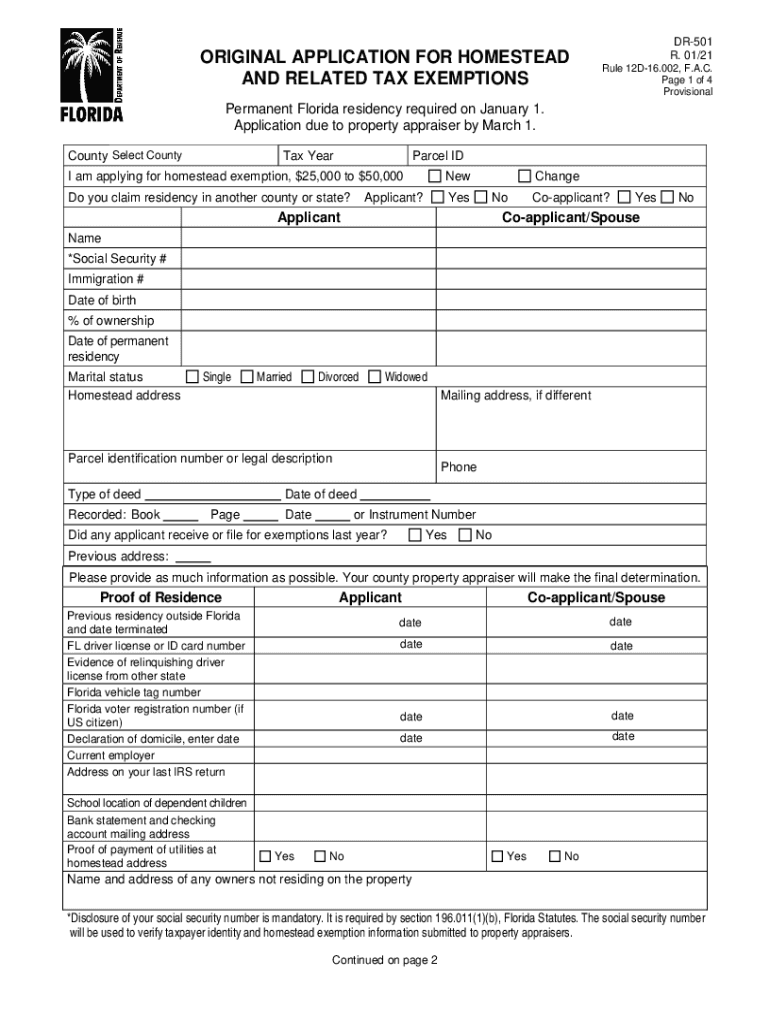

Form 11 13 Download Printable PDF Or Fill Online Application For

Alternatively, you can also use the. Web to apply for any other exemptions, including (age 65 or older exemption, disability exemption, age 55 or older surviving spouse of a person who received the age 65 or. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. For filing with.

Dr 501 Fill Fill Out and Sign Printable PDF Template signNow

Web dallas texas application for residence homestead exemption category: Web that tally also includes the standard 20% homestead exemption, which can be applied for every dallas homeowners’ primary residence. You may be eligible to apply. Contact your local appraisal district. So whether you’ve just bought one of dallas’s condos or are simply.

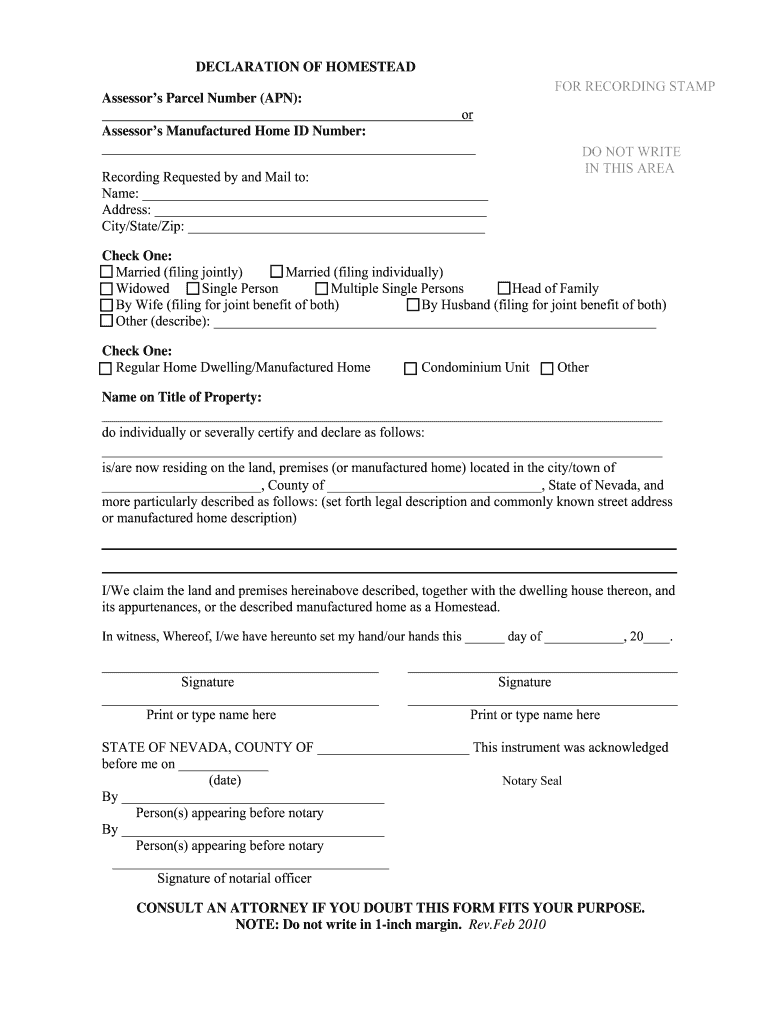

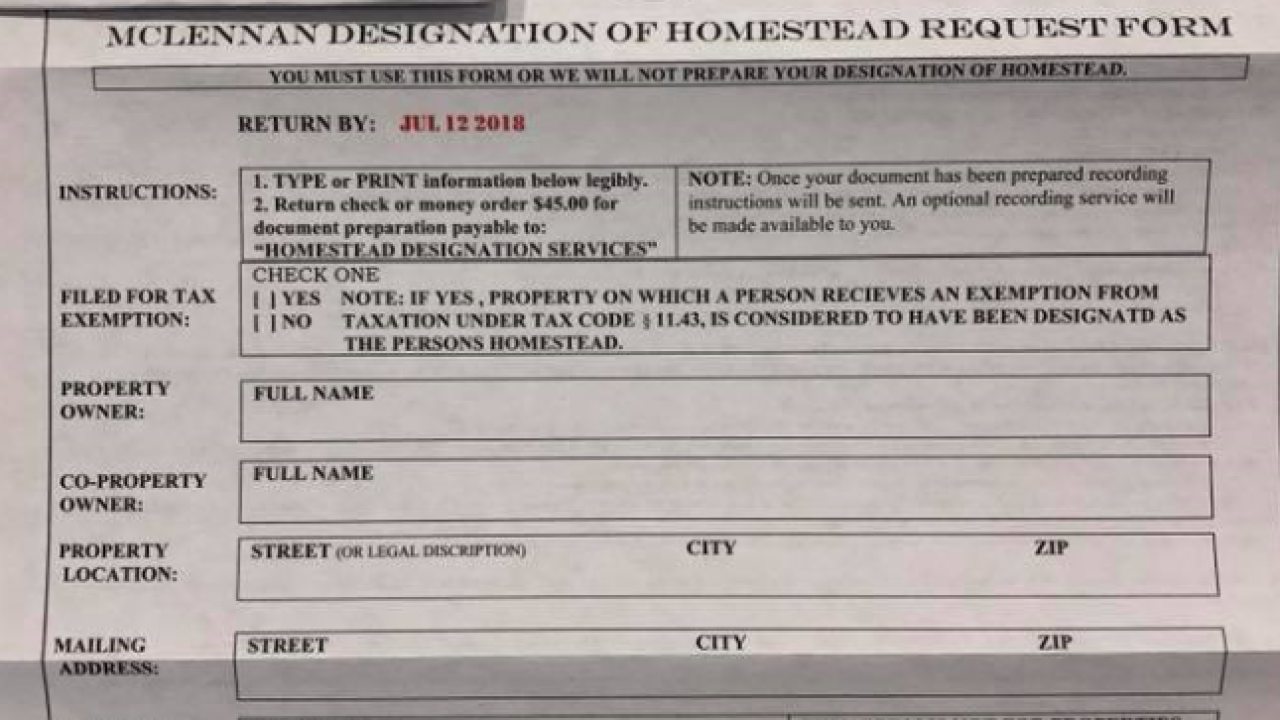

Nevada Homestead Fill Out and Sign Printable PDF Template signNow

Web this payment agreement is an option for properties with a homestead exemption. Refer to the eligibility requirements for other factors that. Web that tally also includes the standard 20% homestead exemption, which can be applied for every dallas homeowners’ primary residence. Alternatively, you can also use the. What if my exemptions are wrong?

Befuddled by the Clowns Pete Sessions the Florida Homesteader

So whether you’ve just bought one of dallas’s condos or are simply. Civil, family and juvenile court section. Web you'll also discover available exemptions and learn how to apply to your local appraisal district. Web dallas texas application for residence homestead exemption category: You may be eligible to apply.

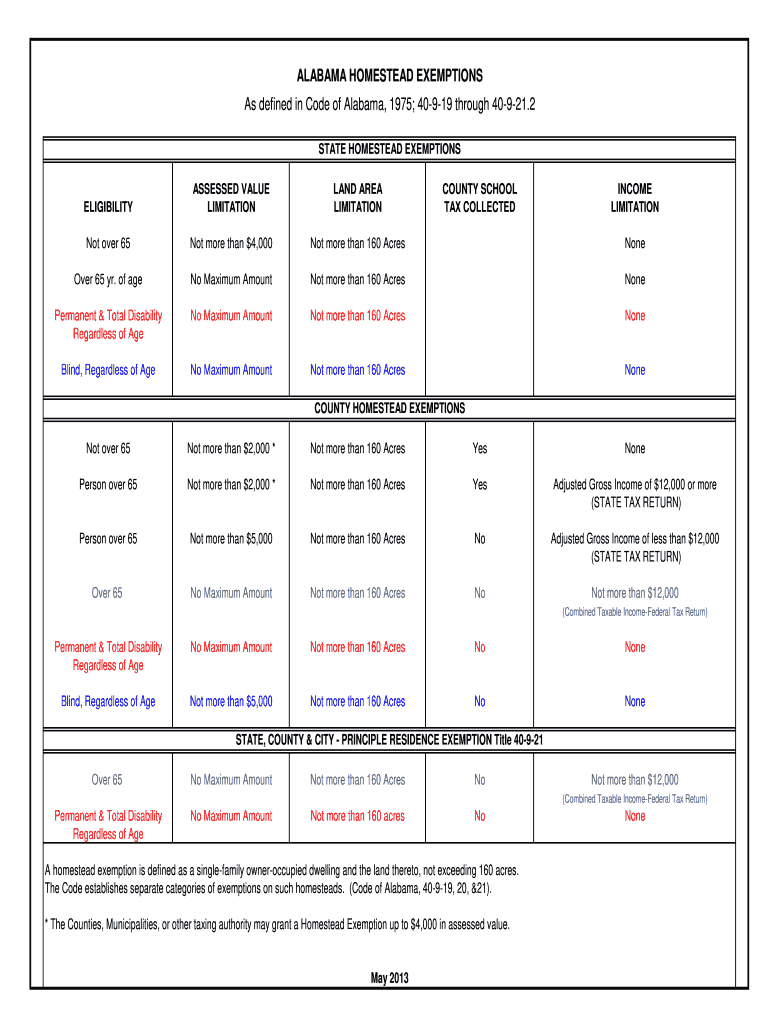

Alabama Homestead Exemption Fill Out and Sign Printable PDF Template

Contact your local appraisal district. The residence homestead exemption application form is available from the details page of your. Web to apply for any other exemptions, including (age 65 or older exemption, disability exemption, age 55 or older surviving spouse of a person who received the age 65 or. No fee is charged to process this application. Web dallas texas.

What is classstrata in homestead exemption form Fill out & sign online

Web you'll also discover available exemptions and learn how to apply to your local appraisal district. Web residence homestead exemption application for. Civil, family and juvenile court section. The residence homestead exemption application form is available from the details page of your. You can search for your property and print the homestead exemption pdf and fill it up manually.

Hays County Homestead Exemption Form 2023

Web the texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. Contact your local appraisal district. Complete, edit or print tax forms instantly. Web this payment agreement is an option for properties with a homestead exemption. Web (as on march 24th 2023).

214 631 1342 Or Www Fill Out and Sign Printable PDF Template signNow

Web the texas tax code stipulates a $40,000 residence homestead exemption for all qualified property owners. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Contact your local appraisal district. Other sections of the tax code provide additional write. What if my exemptions are wrong?

How To File Homestead Exemption 🏠 Dallas County YouTube

You may be eligible to apply. Complete, edit or print tax forms instantly. Web residence homestead exemption application. Contact your local appraisal district. Contact your local appraisal district.

Dallas Real Estate Blog How To File Your Homestead Exemption

Web to apply for any other exemptions, including (age 65 or older exemption, disability exemption, age 55 or older surviving spouse of a person who received the age 65 or. No fee is charged to process this application. The residence homestead exemption application form is available from the details page of your. Web that tally also includes the standard 20%.

So Whether You’ve Just Bought One Of Dallas’s Condos Or Are Simply.

Web how can i find out what my listed exemptions are? Contact your local appraisal district. Web you'll also discover available exemptions and learn how to apply to your local appraisal district. For filing with the appraisal district office in each county in which the property is located generally between jan.

Refer To The Eligibility Requirements For Other Factors That.

Web residence homestead exemption application. Web click the blue property address link to view the details of your account. No fee is charged to process this application. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432.

Web (As On March 24Th 2023).

You may be eligible to apply. 1 and april 30 of the. Web dallas texas application for residence homestead exemption category: Civil, family and juvenile court section.

Contact Your Local Appraisal District.

Web residence homestead exemption application for. That 20% is the highest amount allowed. Web homeowner exemptions residence homestead exemption to qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Web homeowner exemptions residence homestead exemption age 65 or older homestead exemption surviving spouse of person who received the 65 or older exemption.