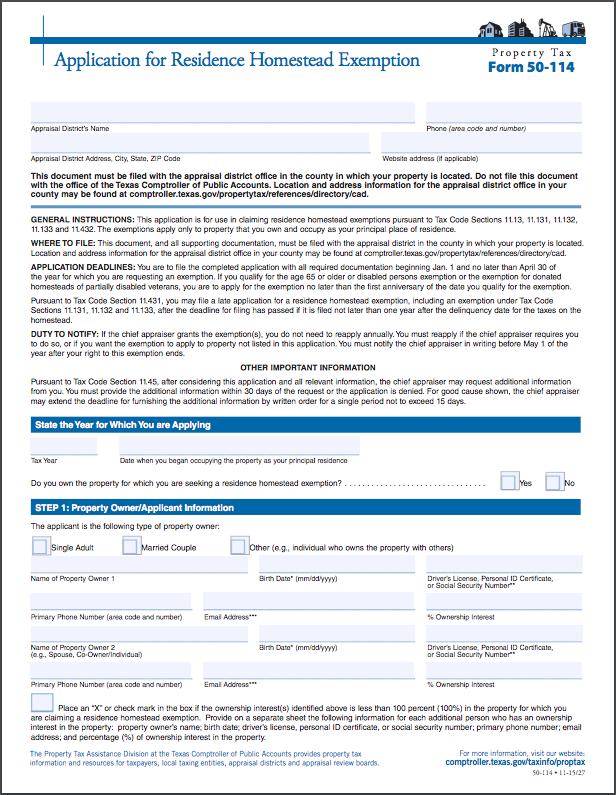

Dallas County Homestead Exemption Form 2022

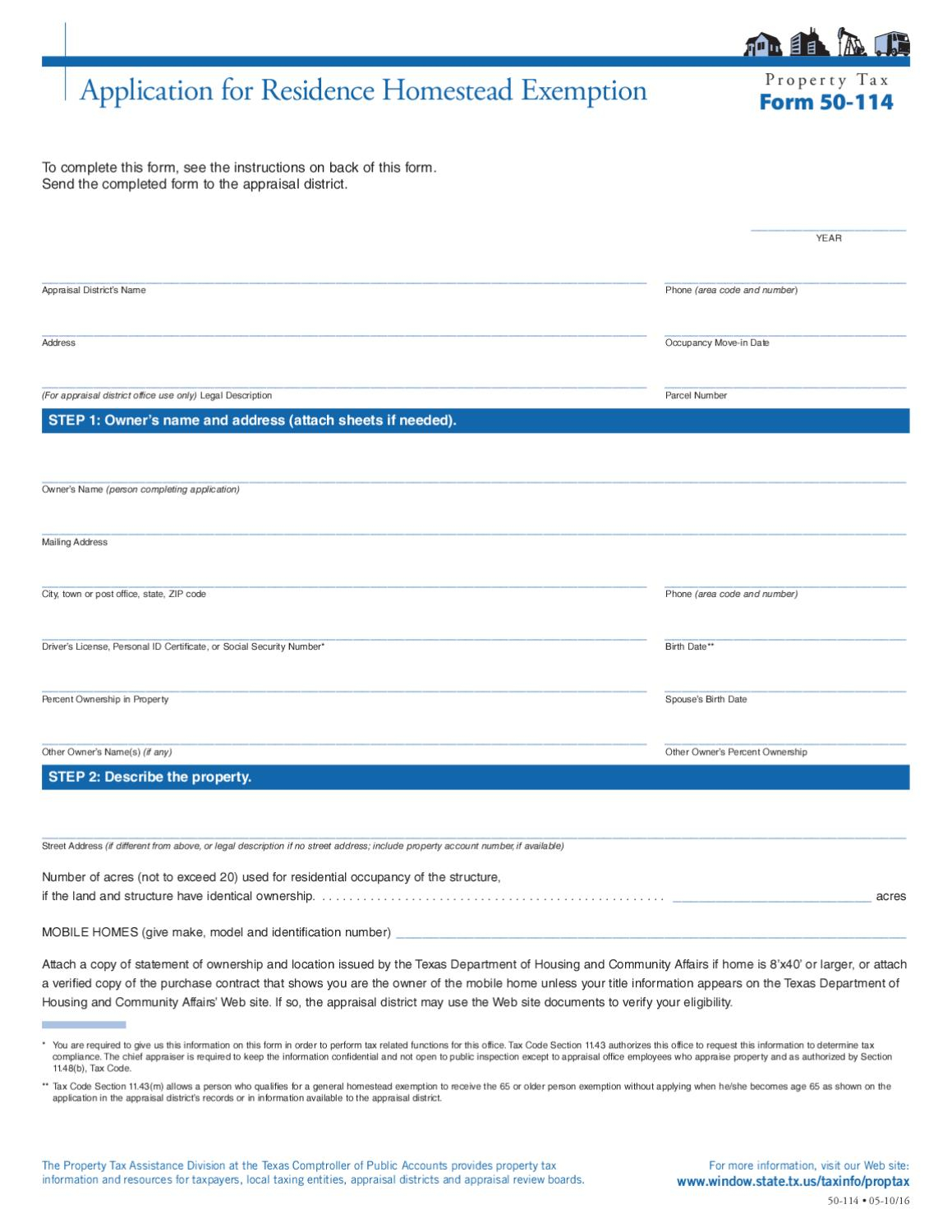

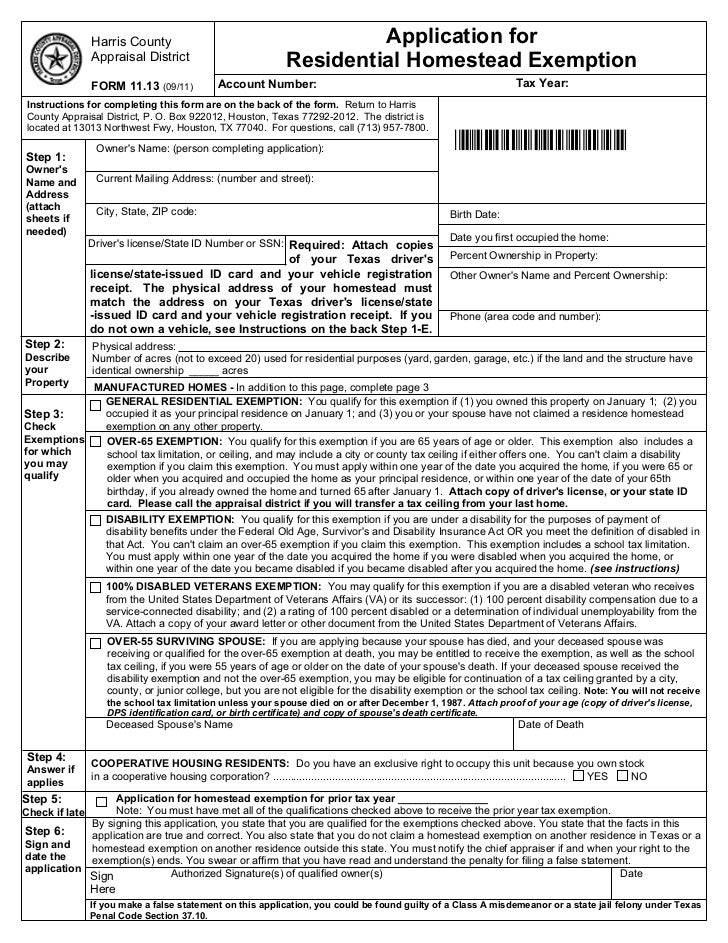

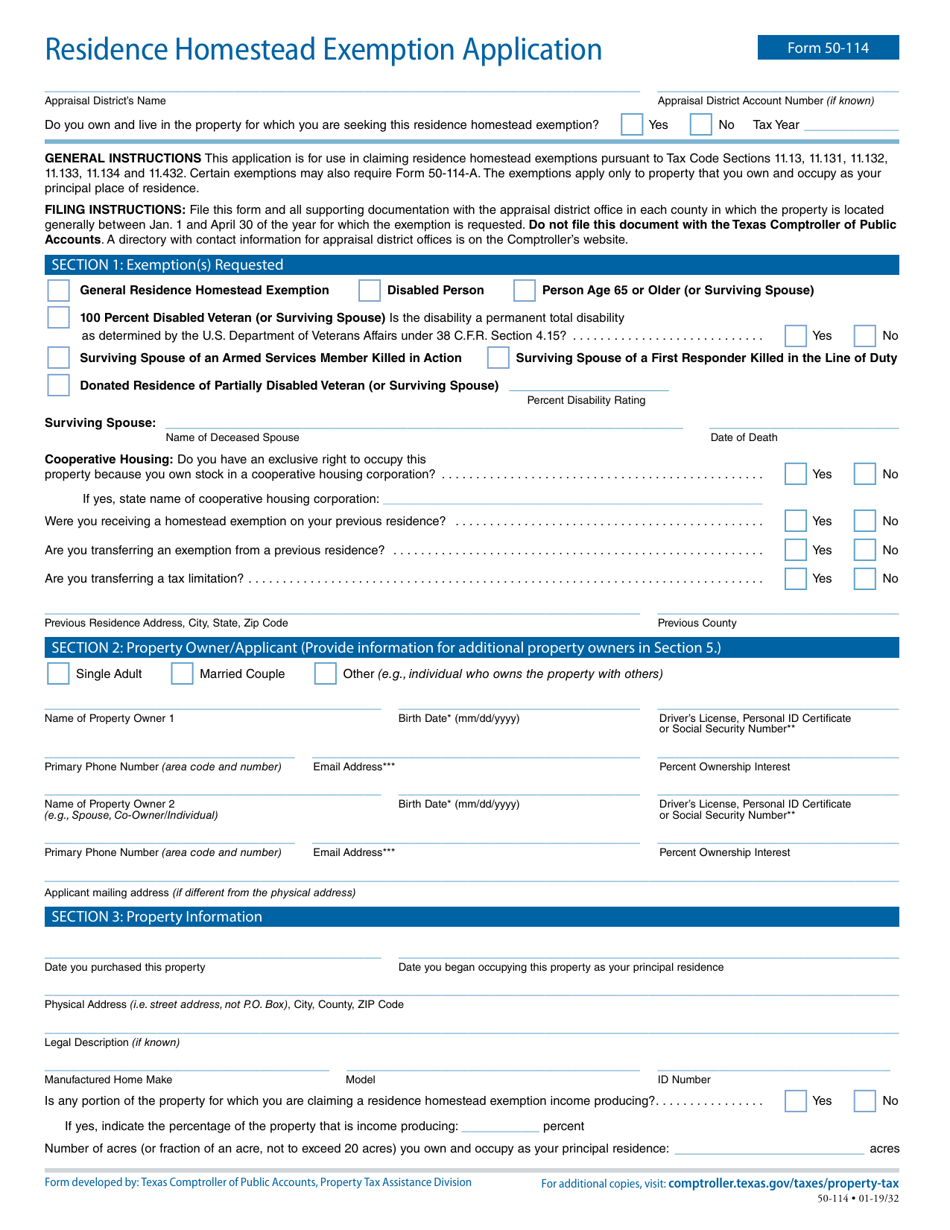

Dallas County Homestead Exemption Form 2022 - See the explanation of exemptions for more information. Web to apply for a homestead exemption, you need to submit an application with your county appraisal district. Web an application form to all new property owners around the first of february. Web visit the texas comptroller’s residence homestead exemptions faq site: Prior to 2022, a homeowner had to wait. Web if you encounter any difficulties with uploading files or submitting your residence homestead exemption application, then please mail your application and documents to. Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. You must own and occupy the. Web welcome to online filing of the general residence homestead exemption application for 2023 dcad is pleased to provide this service to homeowners in dallas county. County appraisal district offices collin county:

Web the residence homestead exemption application form is available from the details page of your account. Web visit the texas comptroller’s residence homestead exemptions faq site: Web welcome to online filing of the general residence homestead exemption application for 2023 dcad is pleased to provide this service to homeowners in dallas county. Web effective january 1, 2022, a property owner who acquired property after january 1 may receive the residence homestead exemption for the applicable portion of that tax year. Web what is a residence homestead? How do i get a general $40,000 residence homestead exemption? Web advertisement city officials say senior and disabled homeowners with an average home value of $328,453 would pay $1,141 in city taxes, working out to a $63 annual reduction. Web dallas texas application for residence homestead exemption category: Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. County appraisal district offices collin county:

Web an application form to all new property owners around the first of february. Filing an application is free and only needs to be filed once. Web if you encounter any difficulties with uploading files or submitting your residence homestead exemption application, then please mail your application and documents to. To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Web advertisement city officials say senior and disabled homeowners with an average home value of $328,453 would pay $1,141 in city taxes, working out to a $63 annual reduction. You may search for your account by owner, by account or by address. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. Web submit applications for the standard $40,000 residential homestead exemption and any required documentation to the appraisal district in the county where. You must own and occupy the. Web the residence homestead exemption application form is available from the details page of your account.

How To File Homestead Exemption 🏠 Dallas County YouTube

Web dallas texas application for residence homestead exemption category: Web 1 you may now apply as soon as you close on your home, which is new for 2022 and the result of legislative action for the state of texas. Web welcome to online filing of the general residence homestead exemption application for 2023 dcad is pleased to provide this service.

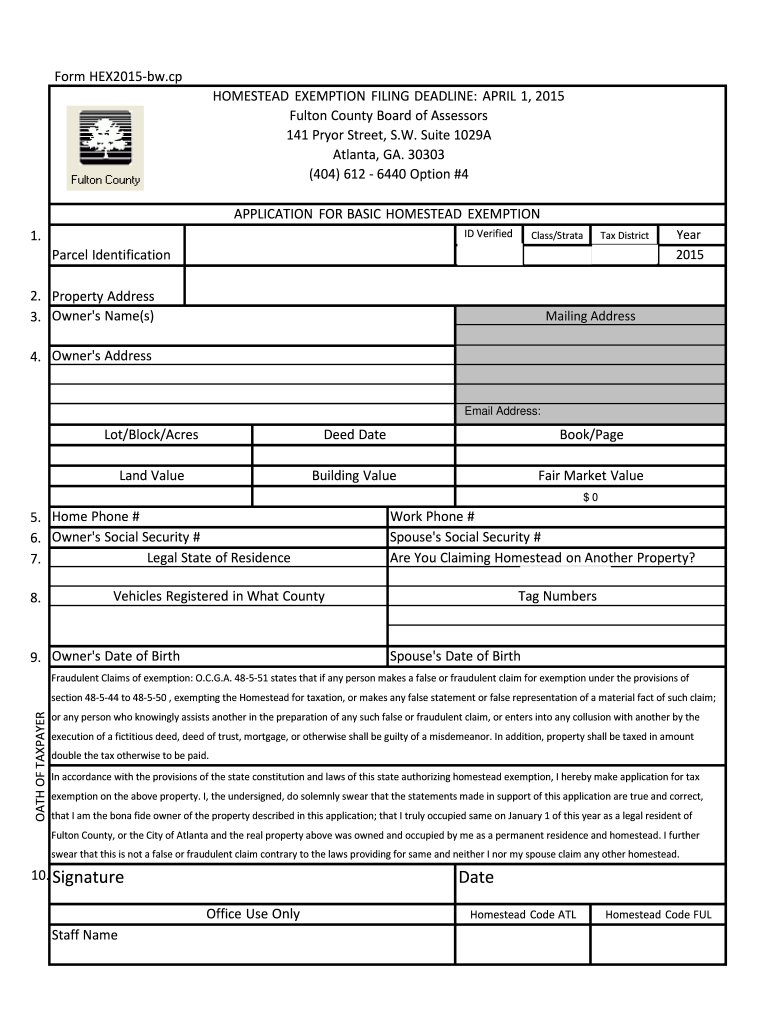

Fulton County Homestead Exemption Form Fill Out and Sign Printable

To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. You must own and occupy the. How do i get a general $40,000 residence homestead exemption? Web check to apply for a homestead exemption. Web the residence homestead exemption application form is available from the details page.

How To File Homestead Exemption 🏠 Denton County YouTube

Web visit the texas comptroller’s residence homestead exemptions faq site: You may search for your account by owner, by account or by address. Web check to apply for a homestead exemption. Prior to 2022, a homeowner had to wait. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to.

20132023 Form TX Request to Transfer Tax Ceiling for Over 65/Over 55

Complete, edit or print tax forms instantly. How do i get a general $40,000 residence homestead exemption? Web the residence homestead exemption application form is available from the details page of your account. Web check to apply for a homestead exemption. See the explanation of exemptions for more information.

Homestead Exemption Form Fort Bend County By REMAX Integrity Issuu

What residence homestead exemptions are available? Web the residence homestead exemption application form is available from the details page of your account. Web submit applications for the standard $40,000 residential homestead exemption and any required documentation to the appraisal district in the county where. Web dallas texas application for residence homestead exemption category: You may search for your account by.

Harris County Homestead Exemption Form

Web to apply for a homestead exemption, you need to submit an application with your county appraisal district. Web 1 you may now apply as soon as you close on your home, which is new for 2022 and the result of legislative action for the state of texas. Complete, edit or print tax forms instantly. See the explanation of exemptions.

Homestead exemption form

Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit. Web visit the texas comptroller’s residence homestead exemptions faq site: Web advertisement city officials say senior and disabled homeowners with an average home value of $328,453 would pay $1,141 in city.

Life Estate Texas Homestead Exemption inspire ideas 2022

Complete, edit or print tax forms instantly. Web effective january 1, 2022, a property owner who acquired property after january 1 may receive the residence homestead exemption for the applicable portion of that tax year. Web advertisement city officials say senior and disabled homeowners with an average home value of $328,453 would pay $1,141 in city taxes, working out to.

2020 Update Houston Homestead Home Exemptions StepByStep Guide

Web to qualify for a residence homestead exemption you must own and occupy as your principal residence on the date you request the exemption. See the explanation of exemptions for more information. County appraisal district offices collin county: What residence homestead exemptions are available? Web dallas texas application for residence homestead exemption category:

Hays County Homestead Exemption Form 2023

Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. Web what is a residence homestead? Web effective january 1, 2022, a property owner who acquired property after january 1 may receive the residence homestead exemption for the applicable portion of that tax year. If you have any questions.

See The Explanation Of Exemptions For More Information.

Attach the completed and notarized affidavit to your residence homestead exemption application for filing with the appraisal district office in each. Civil, family and juvenile court section. How do i get a general $40,000 residence homestead exemption? What residence homestead exemptions are available?

If You Have Any Questions Regarding The Update For 2022.

Complete, edit or print tax forms instantly. County appraisal district offices collin county: Web the residence homestead exemption application form is available from the details page of your account. Web an application form to all new property owners around the first of february.

Web What Is A Residence Homestead?

To qualify, you must own and reside in your home on january 1 of the year application is made and cannot claim a. Filing an application is free and only needs to be filed once. Prior to 2022, a homeowner had to wait. Web below is information on the homestead qualified so that the homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit.

Web Visit The Texas Comptroller’s Residence Homestead Exemptions Faq Site:

You must own and occupy the. Web welcome to online filing of the general residence homestead exemption application for 2023 dcad is pleased to provide this service to homeowners in dallas county. Web to qualify for a residence homestead exemption you must own and occupy as your principal residence on the date you request the exemption. Web 1 you may now apply as soon as you close on your home, which is new for 2022 and the result of legislative action for the state of texas.