Ct Conveyance Tax Form

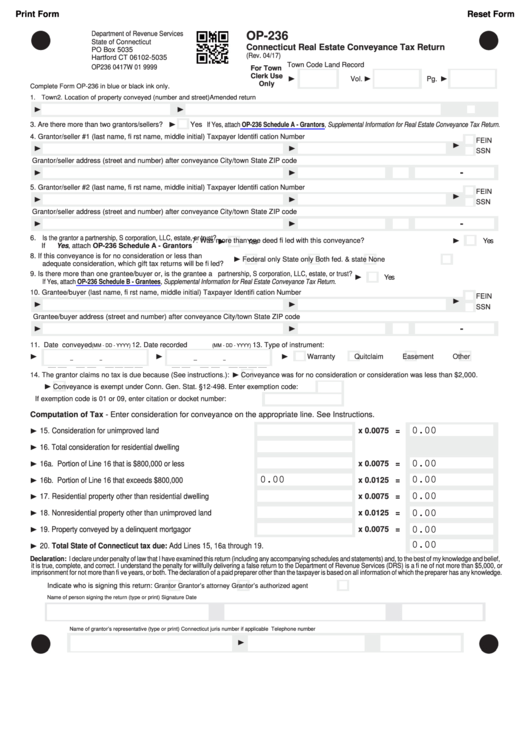

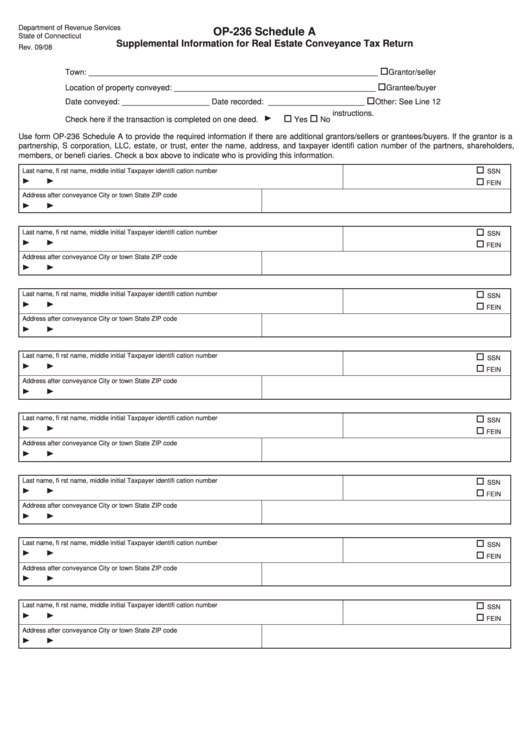

Ct Conveyance Tax Form - Town connecticut real estate conveyance tax return (rev. Location of property conveyed (number and street) amended return 3. A state tax and a municipal tax. Web supplemental information for connecticut real estate conveyance tax return (rev. Are there more than two grantors/sellers? 04/17) for town clerk use only town code land record vol. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. If the grantee is a partnership, Web connecticut real estate conveyance tax return (rev. Are there more than two grantors/sellers?

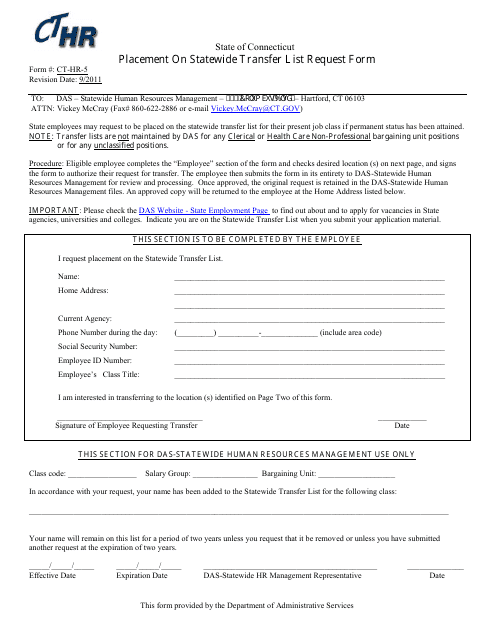

Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: Web connecticut real estate conveyance tax return (rev. Yes if yes, attach 4. The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance. Forms for state of connecticut/department of administrative services Town connecticut real estate conveyance tax return (rev. 04/17) for town clerk use only town code land record vol. Are there more than two grantors/sellers? 04/17) for town town code clerk use only 2. The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less.

Forms for state of connecticut/department of administrative services Are there more than two grantors/sellers? Web supplemental information for connecticut real estate conveyance tax return (rev. Up to and including $800,000: Location of property conveyed (number and street) amended return 3. Web the marginal tax brackets for residential real property are as follows: 04/17) for town clerk use only town code land record vol. 04/17) for town town code clerk use only 2. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Web connecticut real estate conveyance tax return (rev.

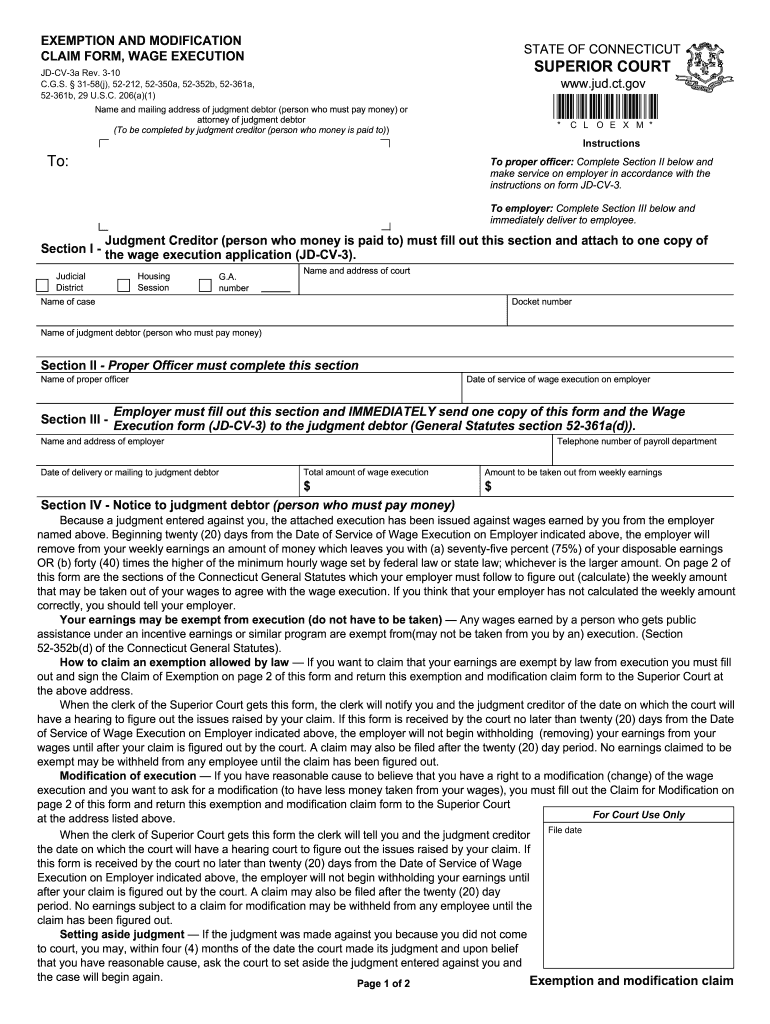

Ct Exemption and Modification Claim Form Fill Out and Sign Printable

04/17) for town town code clerk use only 2. Location of property conveyed (number and street) amended return 3. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code Are there more than two grantors/sellers? Web connecticut’s real estate conveyance tax the real estate conveyance tax has two.

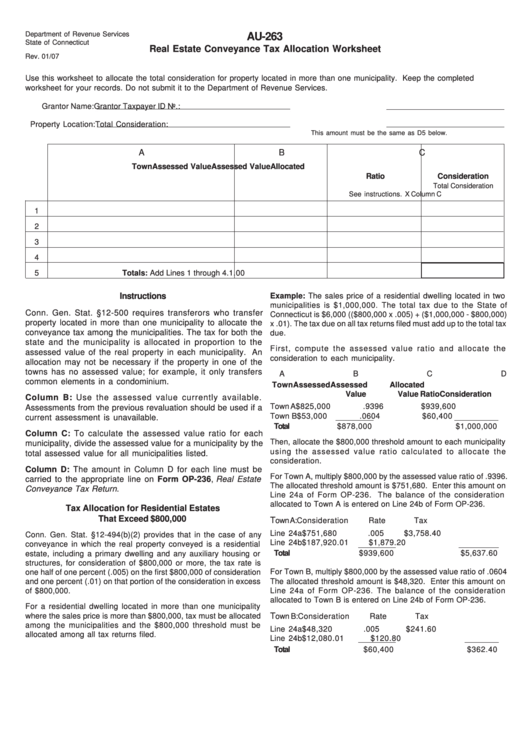

Form Au263 Real Estate Conveyance Tax Allocation Worksheet 2007

For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Download this form and complete using adobe acrobat. Location of property conveyed (number and street) amended return 3. 04/17) for town clerk use only town code land record vol. Location of property.

Fillable Form Op236 Connecticut Real Estate Conveyance Tax Return

Are there more than two grantors/sellers? Location of property conveyed (number and street) land record vol. 04/17) for town clerk use only town code land record vol. Location of property conveyed (number and street) amended return 3. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds.

Ct Conveyance Tax Form Printable Form, Templates and Letter

The combined rate is applied to the property’s sales price. More information, real estate conveyance tax: Web connecticut real estate conveyance tax return (rev. The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance. Town connecticut real estate conveyance tax return (rev.

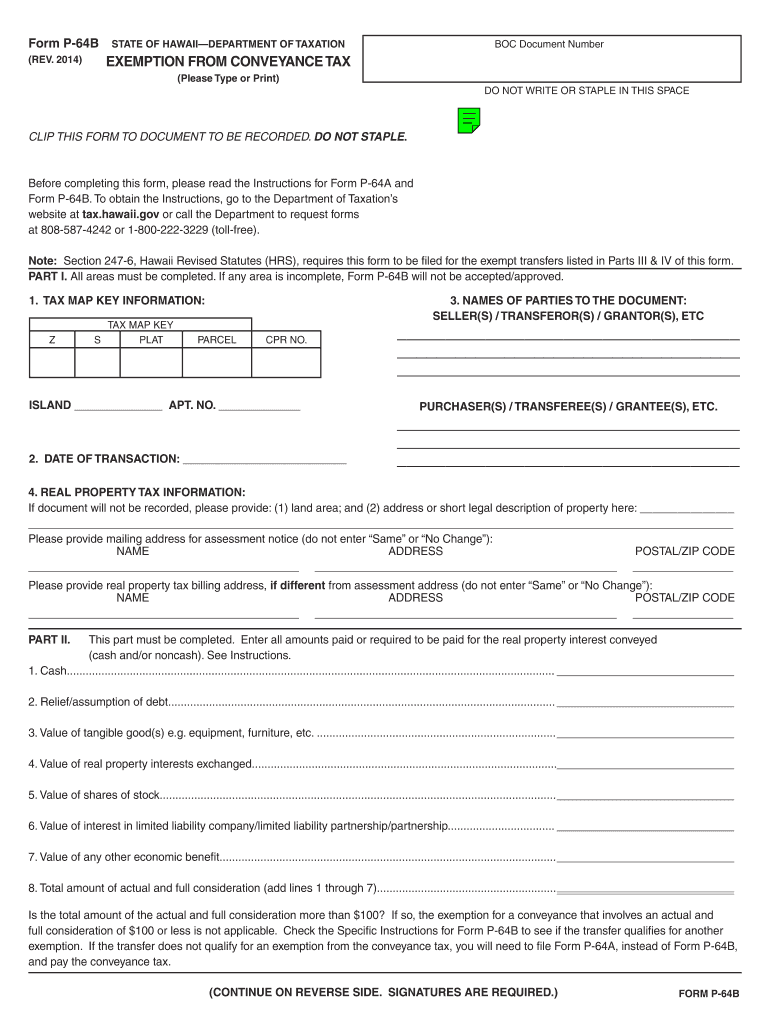

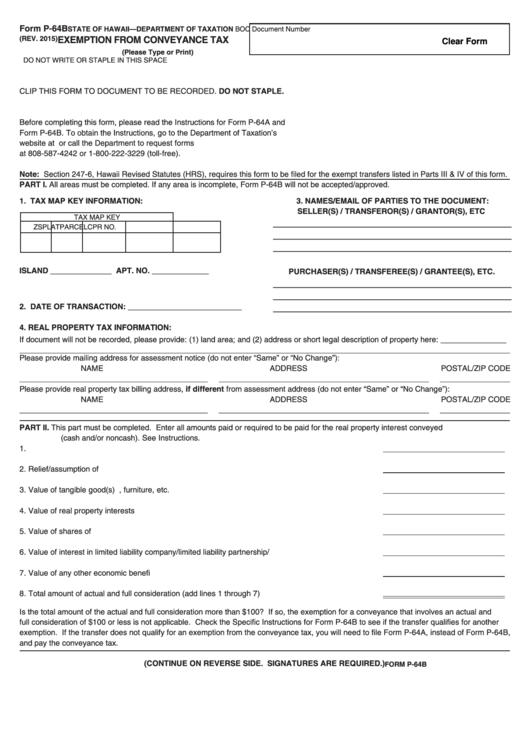

P64B Fill Out and Sign Printable PDF Template signNow

More information, real estate conveyance tax: Location of property conveyed (number and street) land record vol. Forms for state of connecticut/department of administrative services Are there more than two grantors/sellers? 04/17) for town clerk use only town code land record vol.

Schedule A (Form Op236) Supplemental Information For Real Estate

For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Web supplemental information for connecticut real estate conveyance tax return (rev. Up to and including $800,000: The combined rate is applied to the property’s sales price. Download this form and complete using.

20192022 Form HI DoT P64A Fill Online, Printable, Fillable, Blank

Yes if yes, attach 4. Town connecticut real estate conveyance tax return (rev. If the grantee is a partnership, Web the marginal tax brackets for residential real property are as follows: Location of property conveyed (number and street) amended return 3.

Form CTHR5 Download Fillable PDF or Fill Online Placement on

The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance. The combined rate is applied to the property’s sales price. 04/17) for town town code clerk use only 2. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip.

Deed of Reconveyance Form PDF Sample Templates Sample Templates

Are there more than two grantors/sellers? Web supplemental information for connecticut real estate conveyance tax return (rev. 04/17) for town clerk use only town code land record vol. Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: Up to and including $800,000:

Fillable Form P64b Exemption From Conveyance Tax printable pdf download

Location of property conveyed (number and street) land record vol. Are there more than two grantors/sellers? Are there more than two grantors/sellers? A state tax and a municipal tax. Download this form and complete using adobe acrobat.

Town Connecticut Real Estate Conveyance Tax Return (Rev.

For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code More information, real estate conveyance tax: Up to and including $800,000:

The State Conveyance Tax Is 0.75% Of The Sales Price For Properties With A Sales Price That Is $800,000.00 Or Less.

Web the marginal tax brackets for residential real property are as follows: Location of property conveyed (number and street) land record vol. A state tax and a municipal tax. Web connecticut real estate conveyance tax return (rev.

If The Grantee Is A Partnership,

Download this form and complete using adobe acrobat. Location of property conveyed (number and street) amended return 3. Yes if yes, attach 4. Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts:

The Applicable State And Municipal Rates Are Added Together To Get The Total Tax Rate For A Particular Property Conveyance.

Are there more than two grantors/sellers? Forms for state of connecticut/department of administrative services 04/17) for town town code clerk use only 2. Web supplemental information for connecticut real estate conveyance tax return (rev.