Ct 1099 Form

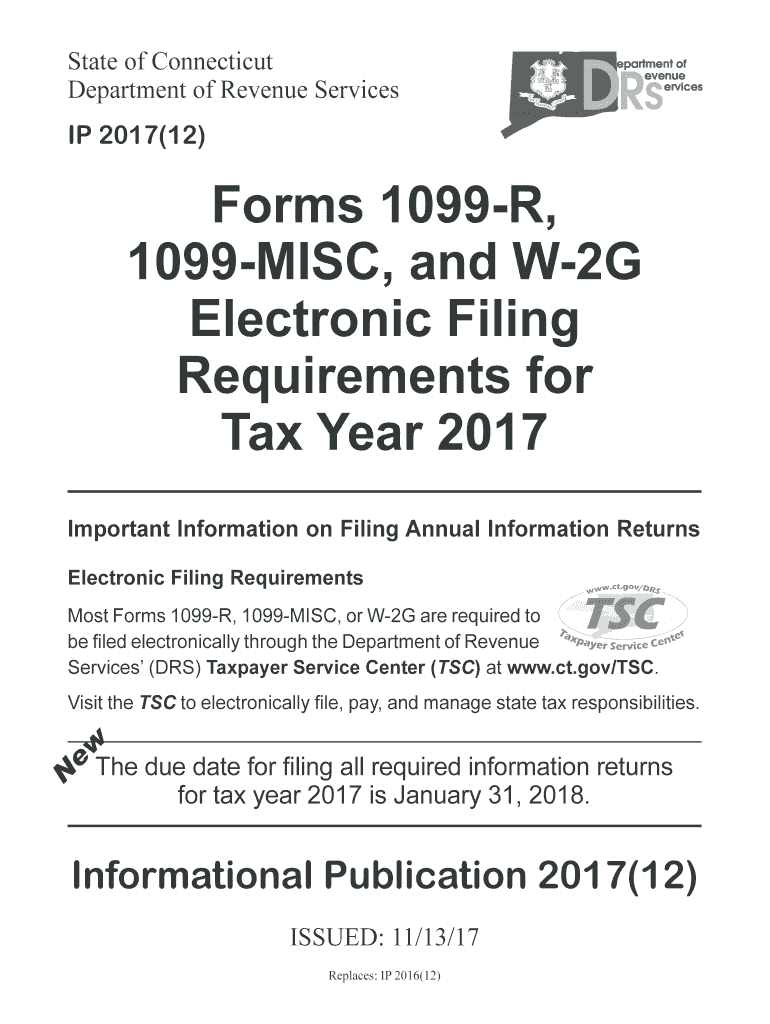

Ct 1099 Form - File the state copy of form 1099 with the connecticut taxation agency by january 31, 2021. State of connecticut department of revenue services. Web file your 2022 connecticut income tax return online! Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Results in an immediate confirmation that. Please allow up to 14 days for it to be received. After 14 days, you may request that a reprint be sent to you by submitting the request for. Simple, secure, and can be completed from the comfort of your home. However, if filing more than 25 forms, then electronic filing is mandatory.

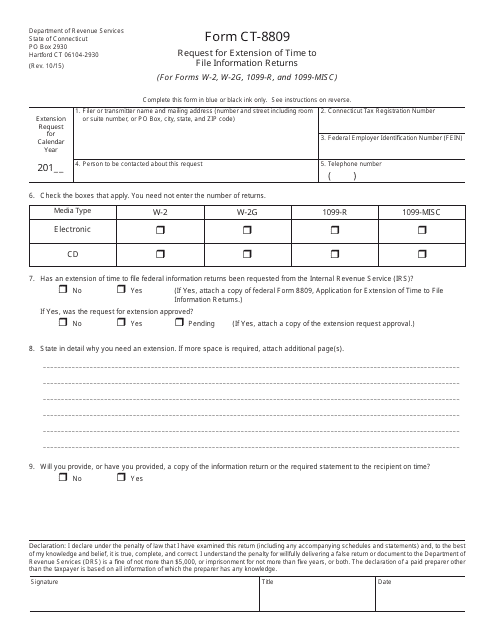

State of connecticut department of revenue services. How must forms 1099 be filed with connecticut? After 14 days, you may request that a reprint be sent to you by submitting the request for. January 31, 2023 for connecticut state taxes withheld. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Please allow up to 14 days for it to be received. January 31, 2023 for without tax withheld. However, if filing more than 25 forms, then electronic filing is mandatory. If you file 25 or more 1099 forms with connecticut you must file electronically. Of revenue by january 31.

Benefits to electronic filing include: How must forms 1099 be filed with connecticut? Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. However, if filing more than 25 forms, then electronic filing is mandatory. Simple, secure, and can be completed from the comfort of your home. January 31, 2023 for connecticut state taxes withheld. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. After 14 days, you may request that a reprint be sent to you by submitting the request for. January 31, 2023 for without tax withheld. State of connecticut department of revenue services.

Form 1099 Misc Fillable Universal Network

Of revenue by january 31. Ip 2021(15) the due date for filing forms 1099‑r, 1099‑misc, 1099‑nec, and w‑2g for tax year 2022 is january 31, 2023. January 31, 2023 for without tax withheld. How must forms 1099 be filed with connecticut? Web file the following forms with the state of connecticut:

Form 1099INT Interest Definition

However, if filing more than 25 forms, then electronic filing is mandatory. How must forms 1099 be filed with connecticut? Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. Benefits to electronic filing include: File the state copy of form 1099 with the connecticut taxation agency by january 31, 2021.

1099 MISC Form 2022 1099 Forms TaxUni

Ip 2021(15) the due date for filing forms 1099‑r, 1099‑misc, 1099‑nec, and w‑2g for tax year 2022 is january 31, 2023. Web file your 2022 connecticut income tax return online! Benefits to electronic filing include: Simple, secure, and can be completed from the comfort of your home. Results in an immediate confirmation that.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. January 31, 2023 for connecticut state taxes withheld. Of revenue by january 31. State of connecticut department of revenue services.

Form 1099C Definition

However, if filing more than 25 forms, then electronic filing is mandatory. State of connecticut department of revenue services. After 14 days, you may request that a reprint be sent to you by submitting the request for. Simple, secure, and can be completed from the comfort of your home. Web yes, connecticut requires forms many forms 1099 to be filed.

How To File Form 1099NEC For Contractors You Employ VacationLord

After 14 days, you may request that a reprint be sent to you by submitting the request for. Web file your 2022 connecticut income tax return online! Results in an immediate confirmation that. File the state copy of form 1099 with the connecticut taxation agency by january 31, 2021. State of connecticut department of revenue services.

CT Forms 1099R 1099MISC and W2G Electronic Filing Requirements 2017

Of revenue by january 31. Please allow up to 14 days for it to be received. Simple, secure, and can be completed from the comfort of your home. January 31, 2023 for connecticut state taxes withheld. State of connecticut department of revenue services.

What is a 1099Misc Form? Financial Strategy Center

After 14 days, you may request that a reprint be sent to you by submitting the request for. Please allow up to 14 days for it to be received. Of revenue by january 31. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. January 31, 2023 for connecticut state taxes withheld.

CT Forms 1099R 1099MISC and W2G Electronic Filing Requirements 2019

Web file your 2022 connecticut income tax return online! Simple, secure, and can be completed from the comfort of your home. Ip 2021(15) the due date for filing forms 1099‑r, 1099‑misc, 1099‑nec, and w‑2g for tax year 2022 is january 31, 2023. However, if filing more than 25 forms, then electronic filing is mandatory. Of revenue by january 31.

13 Form Request You Will Never Believe These Bizarre Truth Of 13 Form

Please allow up to 14 days for it to be received. January 31, 2023 for connecticut state taxes withheld. If you file 25 or more 1099 forms with connecticut you must file electronically. State of connecticut department of revenue services. File the state copy of form 1099 with the connecticut taxation agency by january 31, 2021.

After 14 Days, You May Request That A Reprint Be Sent To You By Submitting The Request For.

Web 1099r's for 2021 distributions out of the teachers' retirement system will be mailed by january 31st, 2022. January 31, 2023 for without tax withheld. Web file the following forms with the state of connecticut: Of revenue by january 31.

Results In An Immediate Confirmation That.

File the state copy of form 1099 with the connecticut taxation agency by january 31, 2021. Please allow up to 14 days for it to be received. Web yes, connecticut requires forms many forms 1099 to be filed with the connecticut department of revenue services. If you file 25 or more 1099 forms with connecticut you must file electronically.

How Must Forms 1099 Be Filed With Connecticut?

State of connecticut department of revenue services. Simple, secure, and can be completed from the comfort of your home. Ip 2021(15) the due date for filing forms 1099‑r, 1099‑misc, 1099‑nec, and w‑2g for tax year 2022 is january 31, 2023. However, if filing more than 25 forms, then electronic filing is mandatory.

Benefits To Electronic Filing Include:

January 31, 2023 for connecticut state taxes withheld. Web file your 2022 connecticut income tax return online!

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.56.32AM-37cc88c042894d73946efcc05529c80f.png)