Credit Reduction Form 940

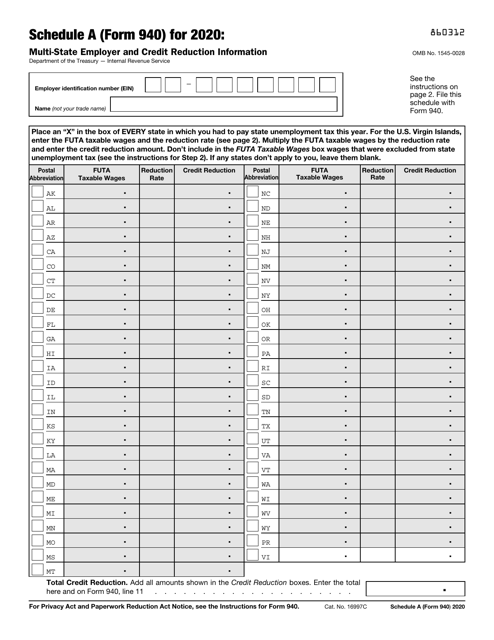

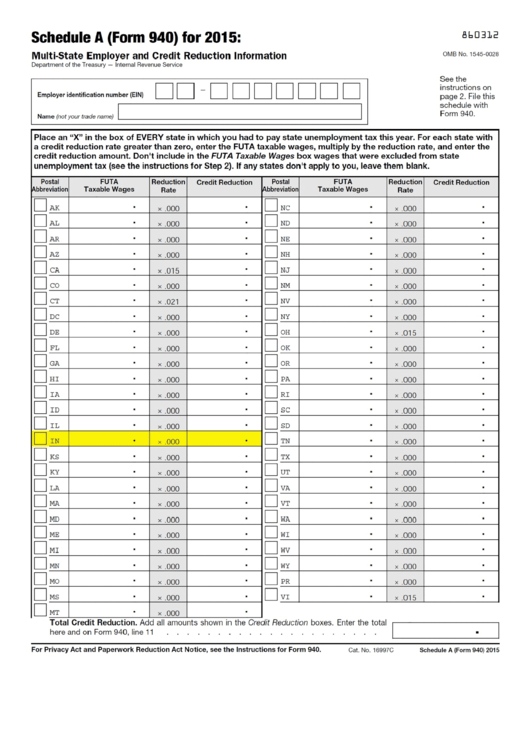

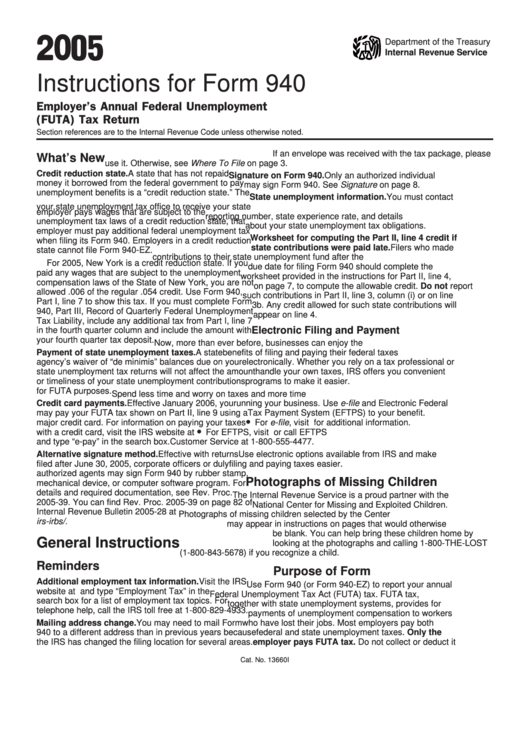

Credit Reduction Form 940 - Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Department of labor determines these states. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. Virgin islands) in which you had to pay state unemployment taxes this year,. In the input screen, select the checkbox. Web unemployment benefits is a “credit reduction state.” the u.s. Web schedule a is a worksheet that lists the applicable tax rates in each state. Web which states are subject to credit reduction for 2022? Web place an “x” in the box of every state (including the district of columbia, puerto rico, and the u.s. You can find your credit reduction rate on schedule a of form 940.

You can find your credit reduction rate on schedule a of form 940. Department of labor (dol), california, connecticut, illinois, new york, and the u.s. Web for 2022, there are credit reduction states. Web how to fill out form 940, schedule a. Virgin islands) in which you had to pay state unemployment taxes this year,. For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. The department of labor determines the states that are subject to credit reduction based on their debt. Department of labor determines these states. Fortunately, this form is relatively. If an employer pays wages that are subject to the.

In the input screen, select the checkbox. You can find your credit reduction rate on schedule a of form 940. Go to print reports, tax reports, select form 940, input year to process, print. Web if you paid wages in a state that is subject to credit reduction: Department of labor determines these states. Web the credit reduction results in a higher tax due on the form 940. Web for 2022, there are credit reduction states. Department of labor (dol), california, connecticut, illinois, new york, and the u.s. Fortunately, this form is relatively. Web which states are subject to credit reduction for 2022?

Form 940 (Schedule A) MultiState Employer and Credit Reduction

Web i'd be glad to provide some additional clarification on your question regarding the california state credit reduction for 2018. Web schedule a is a worksheet that lists the applicable tax rates in each state. In the input screen, select the checkbox. Web the credit reduction results in a higher tax due on the form 940. Fortunately, this form is.

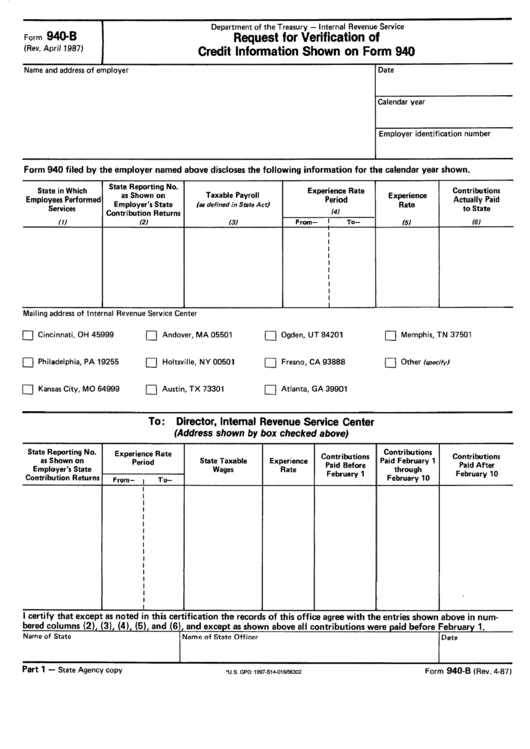

Form 940B Request For Verification Of Credit Information Shown On

Web i'd be glad to provide some additional clarification on your question regarding the california state credit reduction for 2018. Go to print reports, tax reports, select form 940, input year to process, print. Department of labor (dol), california, connecticut, illinois, new york, and the u.s. Credit reduction states are states that have borrowed money from the federal government but..

Fill Free fillable Form 940 Schedule A 2018 MultiState Employer and

Often, employers may receive a credit of 5.4% when they file their form 940 (pdf), to. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. California has paid their outstanding. Web the standard futa tax rate is 6.0%.

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940. Department of labor determines these states. Web which states are subject to credit reduction for 2022? Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940.

IRS Releases 2014 Form 940 ThePayrollAdvisor

Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the standard form 940. In the input screen, select the checkbox. Web if you paid wages in a state that is subject to credit reduction: If an employer pays wages that are subject to the. Web i'd be.

Schedule A (Form 940) MultiState Employer And Credit Reduction

Web the standard futa tax rate is 6.0% on the first $7,000 of wages per employee each year. Fortunately, this form is relatively. Often, employers may receive a credit of 5.4% when they file their form 940 (pdf), to. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against.

futa credit reduction states 2022 Fill Online, Printable, Fillable

In the input screen, select the checkbox. Web i'd be glad to provide some additional clarification on your question regarding the california state credit reduction for 2018. Often, employers may receive a credit of 5.4% when they file their form 940 (pdf), to. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification.

Form 940 (Schedule A) MultiState Employer and Credit Reduction

Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Web if you paid wages in a state that is subject.

Instructions For Form 940 Employer'S Annual Federal Unemployment

Department of labor (dol), california, connecticut, illinois, new york, and the u.s. Web unemployment benefits is a “credit reduction state.” the u.s. For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Credit reduction states are states that have borrowed money from the federal government but. Employer’s annual federal unemployment (futa).

Fill Free fillable Form 940. (IRS) PDF form

Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Department of labor determines these states. Web any employer that does business in a credit reduction state would have to fill the additional form 940 a along with the.

Web Which States Are Subject To Credit Reduction For 2022?

Web place an “x” in the box of every state (including the district of columbia, puerto rico, and the u.s. In the input screen, select the checkbox. If you paid any wages that are subject to the unemployment compensation laws of the usvi, your credit against federal unemployment tax will. Employer’s annual federal unemployment (futa) tax return department of the treasury — internal revenue service employer identification number.

The Department Of Labor Determines The States That Are Subject To Credit Reduction Based On Their Debt.

Often, employers may receive a credit of 5.4% when they file their form 940 (pdf), to. California has paid their outstanding. Web the internal revenue service released drafts versions of form 940, employer’s annual federal unemployment (futa) tax return, and its schedule a, multi. You can find your credit reduction rate on schedule a of form 940.

Web For 2022, There Are Credit Reduction States.

Fortunately, this form is relatively. Web i'd be glad to provide some additional clarification on your question regarding the california state credit reduction for 2018. Department of labor determines these states. Web if you paid wages in a state that is subject to credit reduction:

Web Making Payments With Form 940 To Avoid A Penalty, Make Your Payment With Your 2022 Form 940 Only If Your Futa Tax For The Fourth Quarter (Plus Any Undeposited Amounts.

If an employer pays wages that are subject to the. Web the standard futa tax rate is 6.0% on the first $7,000 of wages per employee each year. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal. Yes automatically populated based on payroll checks when you pay wages to a state that is subject to.