Chapter 7 Payroll Project

Chapter 7 Payroll Project - Ors requires your retirement detail reports to be on a wage and service paid basis. Web drugmaker mallinckrodt plc files for chapter 11 bankruptcy protection in delaware, according to a court filing. Chapter 3 social security taxes; Templates needed to complete these exercises, including one containing. Employer payroll taxes and labor planning chapter 7: Web finance questions and answers. What is the amount of total earnings for beth woods? Refer to the december 4th payroll. Students will complete the payroll project. Chapter 2 computing wages and salaries;

Completion of the payroll project is the culmination of the course, and there is no final exam. You can be suitably relieved to admittance it because it will meet the expense of more chances and sustain for far ahead life. Refer to the december 4th payroll register. Web drugmaker mallinckrodt plc files for chapter 11 bankruptcy protection in delaware, according to a court filing. You will apply the knowledge acquired in this course to practical payroll situations. Web finance questions and answers. Web payroll project chapter 7 answers as one of the reading material. Web chapter 1 the need for payroll and personnel records; Will implement the comprehensive financial restructuring plan, the company says in a. Web acc 150 chapter 7:

Complete federal, state, and city tax deposit forms and. Web chapter 7 the payroll accounting project is located in chapter 7 of your textbook. This is not abandoned not. Web chapter 1 the need for payroll and personnel records; Refer to the december 4th payroll register. (as you complete your work, answer the following questions.) what is the net pay for joseph t. What is the amount of total earnings for beth woods? Chapter 3 social security taxes; This edition also covers the fundamental payroll certification (fpc) from the american payroll association. Web drugmaker mallinckrodt plc files for chapter 11 bankruptcy protection in delaware, according to a court filing.

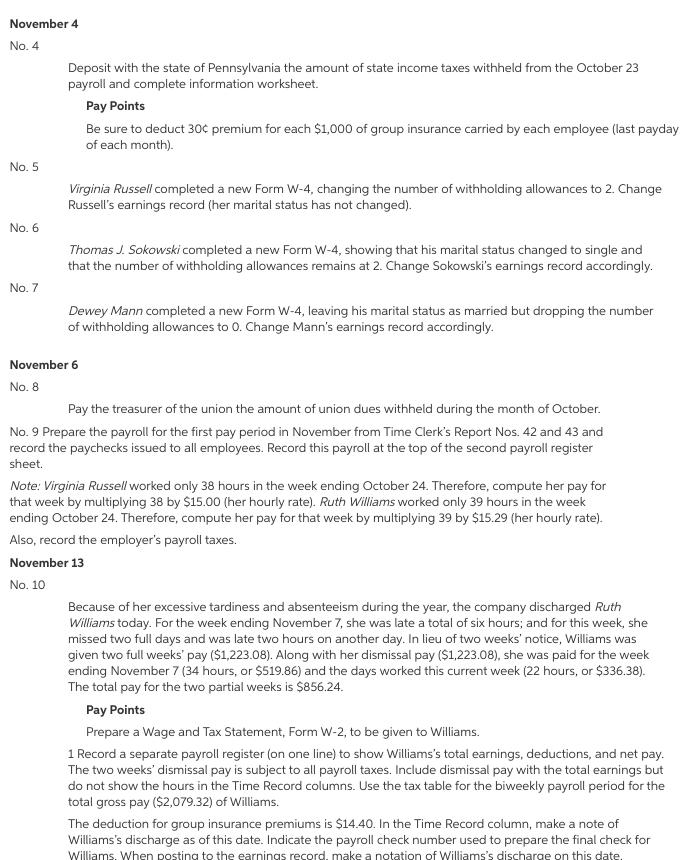

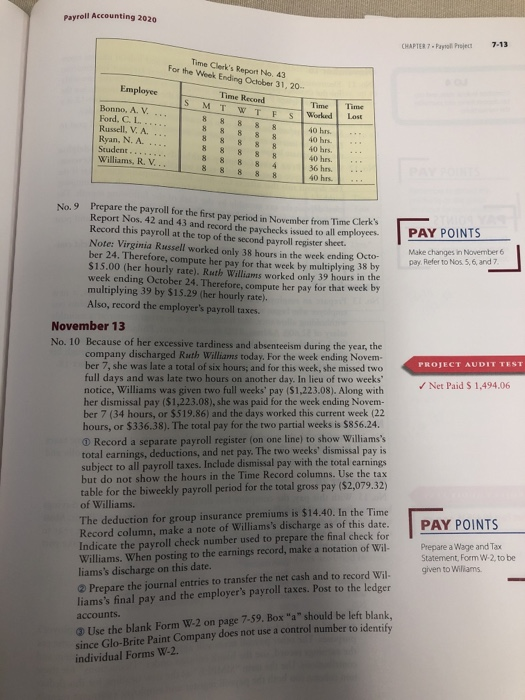

hi I need help with my chapter 7 payroll project 2021 edition , i

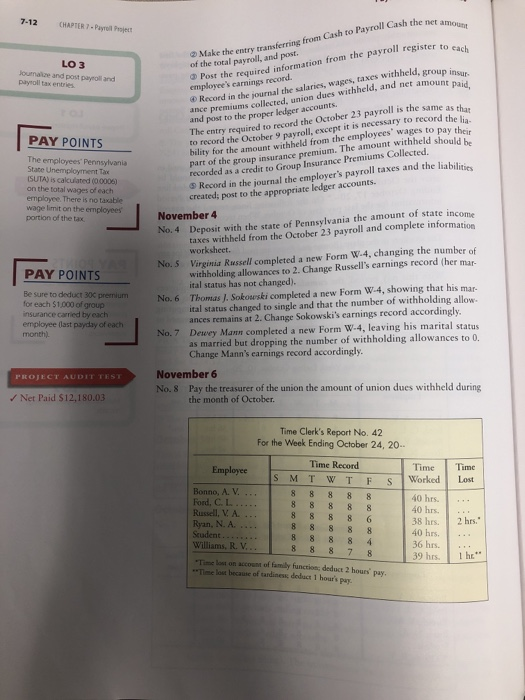

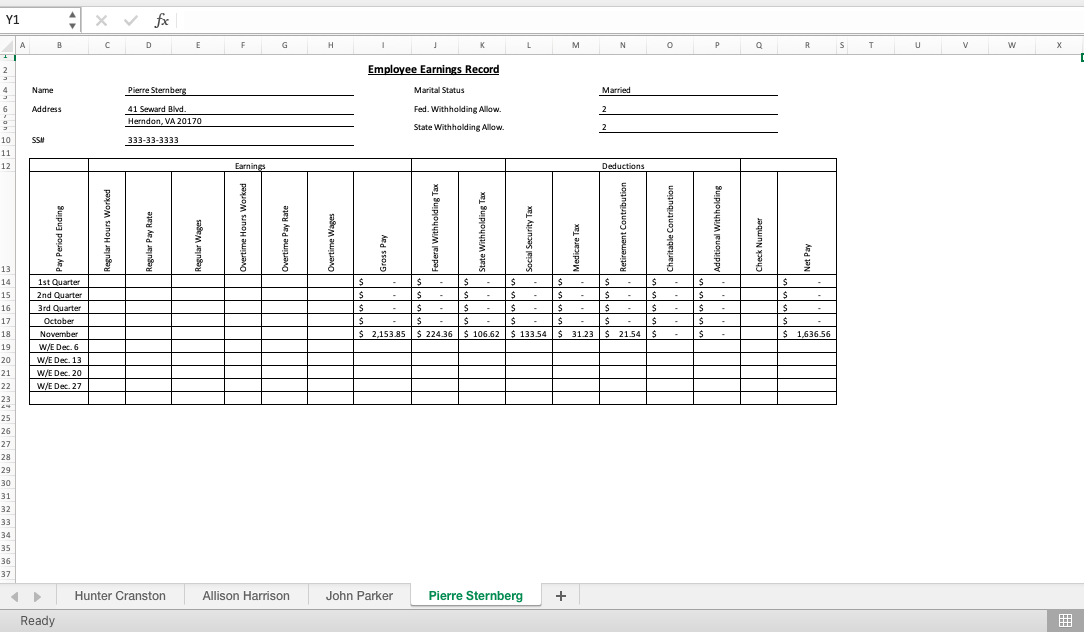

Journalize and post payroll and payroll tax entries. 226 payroll accounting chapter 7: (as you complete your work, answer the following questions.) what is the net pay for joseph t. This is not abandoned not. © all rights reserved available formats download as xlsx, pdf, txt or read online from scribd flag for inappropriate.

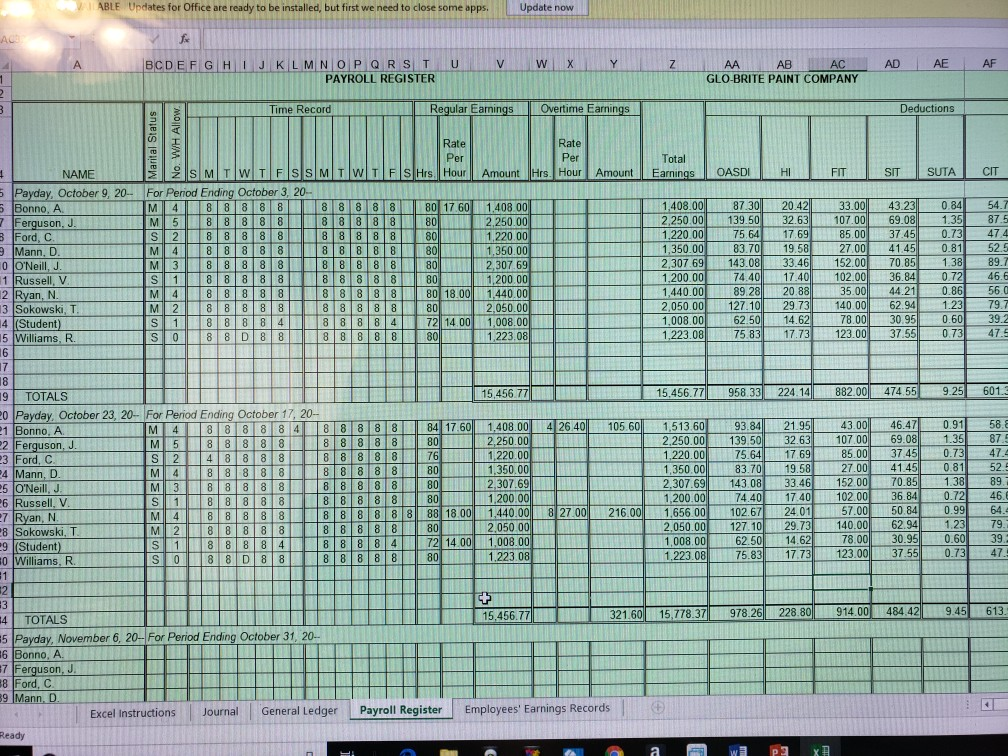

Excel Template Chapter 7 Payroll Project Short Version 1 Debits And

Chapter 7 consists of a simulation, or practice set, for payroll accounting. You can be suitably relieved to admittance it because it will meet the expense of more chances and sustain for far ahead life. Employer payroll taxes and labor planning chapter 7: Web chapter 1 the need for payroll and personnel records; Journalize and post payroll and payroll tax.

For this payroll accounting project for globrite

Web chapter 7 payroll project short version 2018 uploaded by george description: Templates needed to complete these exercises, including one containing. Web finance questions and answers. Web drugmaker mallinckrodt plc files for chapter 11 bankruptcy protection in delaware, according to a court filing. You will apply the knowledge acquired in this course to practical payroll situations.

226 Payroll Accounting Chapter 7 Comprehensive Pr...

This edition also covers the fundamental payroll certification (fpc) from the american payroll association. Refer to the december 4th payroll register. This is not abandoned not. Complete federal, state, and city tax deposit forms and. Completion of the payroll project is the culmination of the course, and there is no final exam.

hello,i need the answers for Chapter 7

Refer to the december 4th payroll register. The payroll register, employees’ earnings records, and accounting system entries appendixes a comprehensive payroll project: Web drugmaker mallinckrodt plc files for chapter 11 bankruptcy protection in delaware, according to a court filing. Journalize and post payroll and payroll tax entries. This is not abandoned not.

ElisabethSky

Web acc 150 chapter 7: This is not abandoned not. Web chapter 1 the need for payroll and personnel records; Completion of the payroll project is the culmination of the course, and there is no final exam. Web chapter 7 is comprised of a payroll project that can be worked on continuously throughout the course.

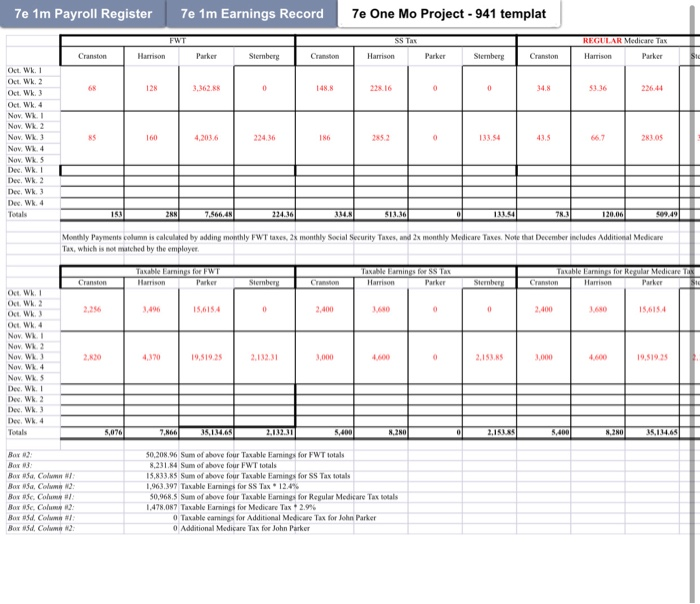

CHAPTER 7. Pol Pot 769 Payroll Accounting 2020 Name

Web chapter 1 the need for payroll and personnel records; Chapter 5 unemployment compensation taxes; Payroll accounting 2021 provides a thorough understanding of payroll. Employer payroll taxes and labor planning chapter 7: Web chapter 7 is comprised of a payroll project that can be worked on continuously throughout the course.

CHAPTER 7. Pol Pot 769 Payroll Accounting 2020 Name Project... get 1

The payroll register, employees’ earnings records, and accounting system entries appendixes a comprehensive payroll project: (as you complete your work, answer the following questions.) what is the net pay for joseph t. Completion of the payroll project is the culmination of the course, and there is no final exam. Chapter 4 income tax withholding; Chapter 3 social security taxes;

226 Payroll Accounting Chapter 7 Comprehensive

Employer payroll taxes and labor planning chapter 7: This edition also covers the fundamental payroll certification (fpc) from the american payroll association. Chapter 6 analyzing and journalizing payroll; Journalize and post payroll and payroll tax entries. Payroll accounting 2021 provides a thorough understanding of payroll.

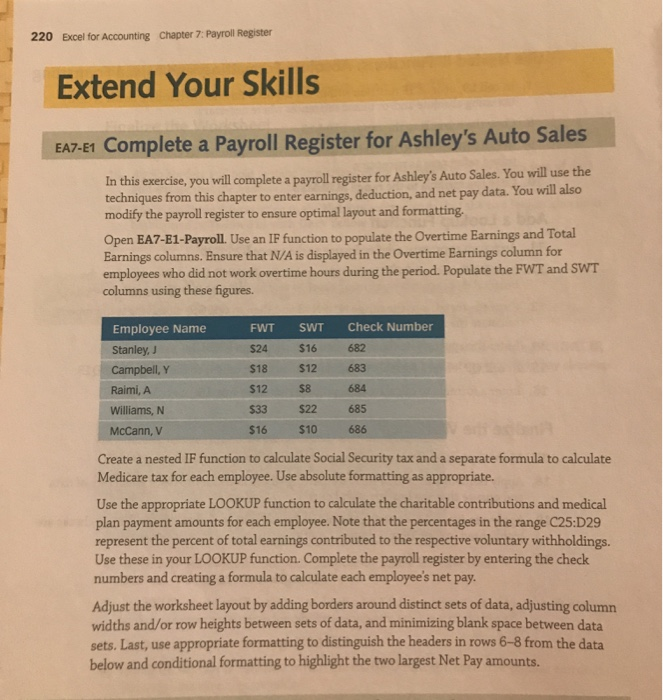

220 Excel for Accounting Chapter 7 Payroll Register

Refer to the december 4th payroll. Web payroll project chapter 7 answers as one of the reading material. Payroll accounting 2021 provides a thorough understanding of payroll. Web this is coming from december 4th payroll the chapter 7 payroll project from 2023 edition of payroll accounting book. Chapter 4 income tax withholding;

Will Implement The Comprehensive Financial Restructuring Plan, The Company Says In A.

Web finance questions and answers. Web drugmaker mallinckrodt plc files for chapter 11 bankruptcy protection in delaware, according to a court filing. You can be suitably relieved to admittance it because it will meet the expense of more chances and sustain for far ahead life. Chapter 5 unemployment compensation taxes;

This Edition Also Covers The Fundamental Payroll Certification (Fpc) From The American Payroll Association.

This is not abandoned not. Web chapter 7 the payroll accounting project is located in chapter 7 of your textbook. (as you complete your work, answer the following questions.) what is the net pay for joseph t. Payroll accounting 2021 provides a thorough understanding of payroll.

Templates Needed To Complete These Exercises, Including One Containing.

Journalize and post payroll and payroll tax entries. Employer payroll taxes and labor planning chapter 7: What is the.docx 4 beig_toland_2019_payroll_project.docx 22 What is the amount of total earnings for beth woods?

Students Will Complete The Payroll Project.

Chapter 7 consists of a simulation, or practice set, for payroll accounting. You will apply the knowledge acquired in this course to practical payroll situations. The payroll register, employees’ earnings records, and accounting system entries appendixes a comprehensive payroll project: Web chapter 1 the need for payroll and personnel records;