Ccdo I Need To Generate Llc Income In First Year

Ccdo I Need To Generate Llc Income In First Year - New llcs expecting to earn no income may not. 10k+ visitors in the past month Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files. A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its. Llcs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an lcc without reporting. This guide covers the bare minimum you’ll need to do to file taxes for your llc.

A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its. 10k+ visitors in the past month New llcs expecting to earn no income may not. Llcs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an lcc without reporting. This guide covers the bare minimum you’ll need to do to file taxes for your llc. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files.

10k+ visitors in the past month New llcs expecting to earn no income may not. Llcs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an lcc without reporting. A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its. This guide covers the bare minimum you’ll need to do to file taxes for your llc. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files.

How can a LLC avoid paying too much taxes? Leia aqui How can I reduce

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files. 10k+ visitors in the past month This guide covers the bare minimum you’ll need to do to file taxes for your llc. Llcs aren't required to have income or post profits, but if a business owner is claiming.

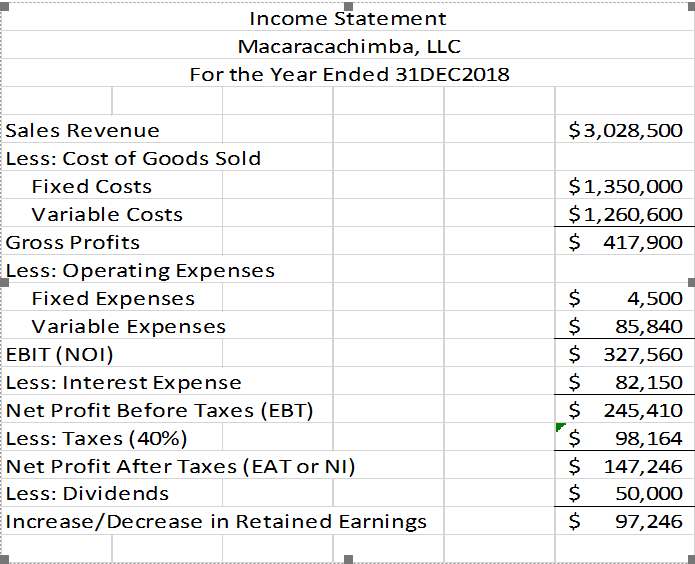

Solved Macaracachimba, LLC needs to prepare proforma

Llcs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an lcc without reporting. This guide covers the bare minimum you’ll need to do to file taxes for your llc. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it.

How to start an LLC in California Legalzoom

New llcs expecting to earn no income may not. This guide covers the bare minimum you’ll need to do to file taxes for your llc. A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its. Llcs aren't required to have income or.

Does an LLC Need an EIN? LegalZoom

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files. Llcs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an lcc without reporting. 10k+ visitors in the past month New llcs expecting to earn no income may not..

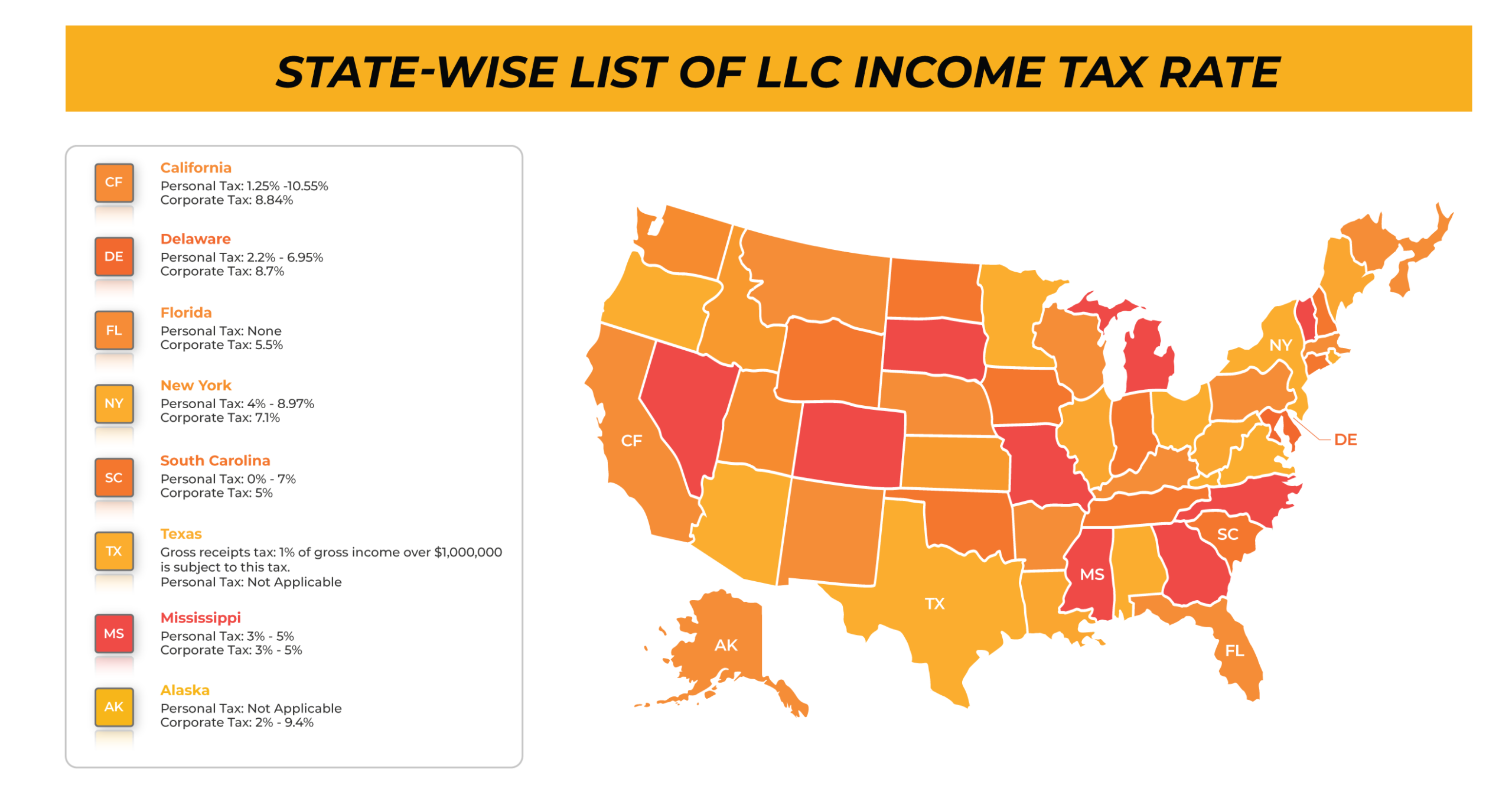

Everything you need to know on "What is the LLC Tax Rate?"

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files. New llcs expecting to earn no income may not. A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its. This.

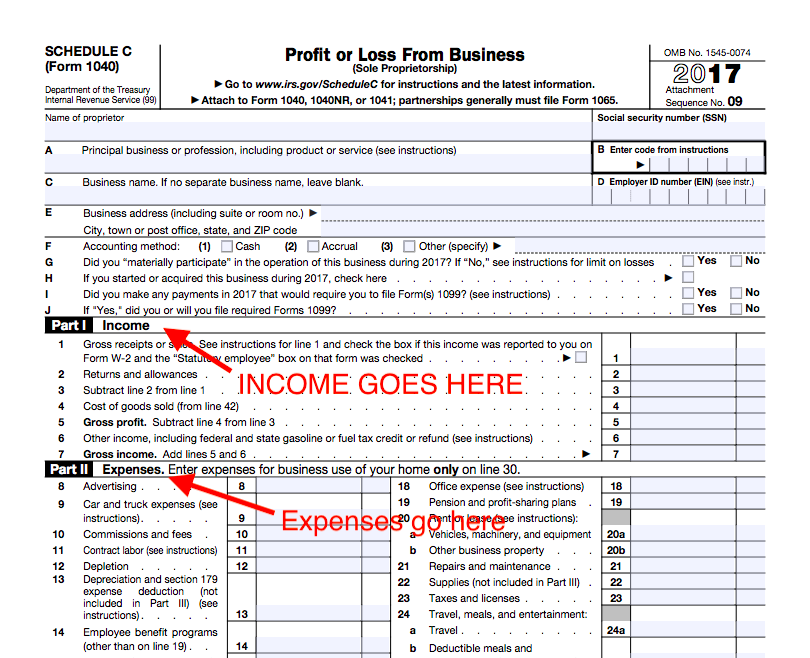

How to File LLC Taxes LegalZoom

This guide covers the bare minimum you’ll need to do to file taxes for your llc. A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its. 10k+ visitors in the past month Specifically, a domestic llc with at least two members is.

LLC tax filing What you need to know as a solo entrepreneur Business

10k+ visitors in the past month Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files. New llcs expecting to earn no income may not. Llcs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an lcc without reporting..

These are the 6 steps to set up an LLC in any state InvoiceBerry Blog

10k+ visitors in the past month New llcs expecting to earn no income may not. A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its. Specifically, a domestic llc with at least two members is classified as a partnership for federal income.

How to fill out an LLC 1065 IRS Tax form

Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files. This guide covers the bare minimum you’ll need to do to file taxes for your llc. New llcs expecting to earn no income may not. 10k+ visitors in the past month A member of an llc can face.

LLC Washington State How to Start an LLC in WA TRUiC

This guide covers the bare minimum you’ll need to do to file taxes for your llc. New llcs expecting to earn no income may not. Llcs aren't required to have income or post profits, but if a business owner is claiming tax deductions through an lcc without reporting. Specifically, a domestic llc with at least two members is classified as.

Llcs Aren't Required To Have Income Or Post Profits, But If A Business Owner Is Claiming Tax Deductions Through An Lcc Without Reporting.

This guide covers the bare minimum you’ll need to do to file taxes for your llc. Specifically, a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files. New llcs expecting to earn no income may not. A member of an llc can face double taxation when the llc files a corporate tax return, pays tax on the income, and distributes its profits to its.