Cash Contribution Form

Cash Contribution Form - Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Ad contributions worksheet form & more fillable forms, register and subscribe now! Web child support applications & forms; Here are the details of the amount you can deduct. Web charitable contribution deductions under irc § 170 summary. Web phfa, recurring cash contribution verification form, recurring cash contribution created date: Upload, modify or create forms. Web total charitable contributions (cash & check) cash contributions (letter from donee required if greater than $250) 1/2014 the intent of this worksheet is to summarize your charitable. Application for child support services : Subject to certain limitations, taxpayers can take deductions from their adjusted gross incomes (agis) for.

In order to process the application, all income and insurance coverage must be verified. But the irs notes that cash contributions don’t include the value of volunteer services,. Web scroll down to the cash contributions smart worksheet above line 11 and enter the charitable contributions. Web cash donations include payments made in the form of cash, check, credit card, debit card or payroll deduction. Web 1 day agofec form 3x report of receipts and disbursements for other than an authorized committee. Web if you claim a deduction of more than $500,000 for a contribution of noncash property, you must fill out form 8283, section b, and also attach the qualified appraisal. November 2022) department of the treasury internal revenue service. Here are the details of the amount you can deduct. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Web charitable contribution deductions under irc § 170 summary.

Web if you claim a deduction of more than $500,000 for a contribution of noncash property, you must fill out form 8283, section b, and also attach the qualified appraisal. In order to process the application, all income and insurance coverage must be verified. Web cash donations include payments made in the form of cash, check, credit card, debit card or payroll deduction. November 2022) department of the treasury internal revenue service. Ad contributions worksheet form & more fillable forms, register and subscribe now! Cash on hand, january 1, 2023: Form 8283 is used to claim a deduction for. Solicitud de manutención de los hijos:. Web total charitable contributions (cash & check) cash contributions (letter from donee required if greater than $250) 1/2014 the intent of this worksheet is to summarize your charitable. Web federal regulations require us to verify recurring cash contributions made to all members of the household applying for participation in the home program which we.

Cash Contribution management Database 2 YouTube

Web this form gives authorization for the home pj to verify recurring cash contributions made to all members of the household applying for participation in the home program. Ad contributions worksheet form & more fillable forms, register and subscribe now! Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Form.

FREE 12+ Donation Receipt Forms in PDF MS Word Excel

Attach one or more forms 8283 to your tax return if. Web scroll down to the cash contributions smart worksheet above line 11 and enter the charitable contributions. Web charitable contribution deductions under irc § 170 summary. Subject to certain limitations, taxpayers can take deductions from their adjusted gross incomes (agis) for. Here are the details of the amount you.

Download Non Cash Charitable Contribution Worksheet for Free Page 15

Form 8283 is used to claim a deduction for. Try it for free now! Upload, modify or create forms. Web 1 day agofec form 3x report of receipts and disbursements for other than an authorized committee. Here are the details of the amount you can deduct.

Charitable Donation Form Template charlotte clergy coalition

Web thank you for your contribution of cash in the amount of _____ dollars ($_____). Web federal regulations require us to verify recurring cash contributions made to all members of the household applying for participation in the home program which we. Web cash donations include payments made in the form of cash, check, credit card, debit card or payroll deduction..

Free Cash Donation Receipt PDF Word eForms

Web if you claim a deduction of more than $500,000 for a contribution of noncash property, you must fill out form 8283, section b, and also attach the qualified appraisal. But the irs notes that cash contributions don’t include the value of volunteer services,. Upload, modify or create forms. Web cash contribution verification has applied for assistance. Web child support.

Download Non Cash Charitable Contribution Worksheet for Free Page 4

Cash on hand, january 1, 2023: Web 1 day agofec form 3x report of receipts and disbursements for other than an authorized committee. Web this form gives authorization for the home pj to verify recurring cash contributions made to all members of the household applying for participation in the home program. But the irs notes that cash contributions don’t include.

Download Non Cash Charitable Contribution Worksheet for Free Page 11

Upload, modify or create forms. November 2022) department of the treasury internal revenue service. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Web federal regulations require us to verify recurring cash contributions made to all members of the household applying for participation in the home program which we. Web.

Non Cash Charitable Contributions Worksheet 2021 Fill Online

Solicitud de manutención de los hijos:. Web thank you for your contribution of cash in the amount of _____ dollars ($_____). Attach one or more forms 8283 to your tax return if. In order to process the application, all income and insurance coverage must be verified. Application for child support services :

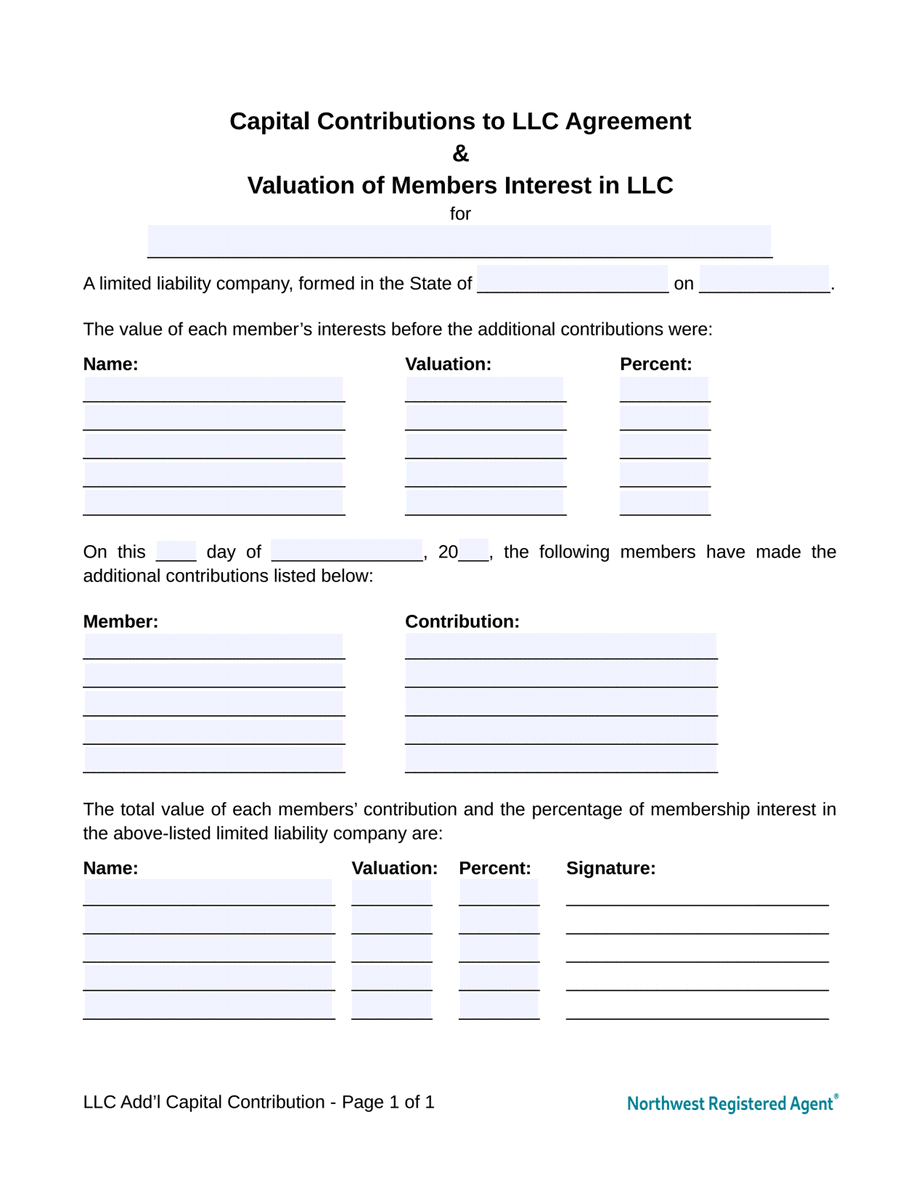

LLC Capital Contribution Agreement FREE Template

Subject to certain limitations, taxpayers can take deductions from their adjusted gross incomes (agis) for. Try it for free now! Web this form gives authorization for the home pj to verify recurring cash contributions made to all members of the household applying for participation in the home program. Web 1 day agofec form 3x report of receipts and disbursements for.

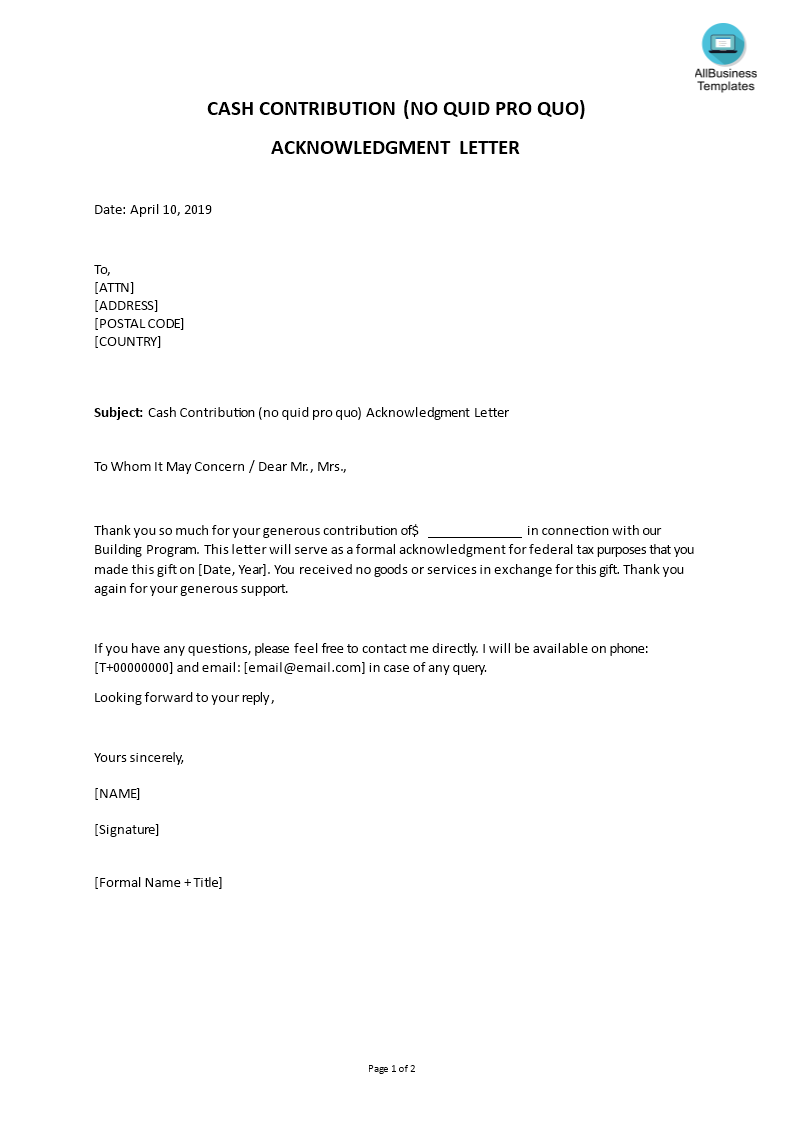

Cash Contribution (no quid pro quo) Acknowledgment Letter Sample

Here are the details of the amount you can deduct. Web 1 day agofec form 3x report of receipts and disbursements for other than an authorized committee. Subject to certain limitations, taxpayers can take deductions from their adjusted gross incomes (agis) for. Web cash donations include payments made in the form of cash, check, credit card, debit card or payroll.

Web Cash Contribution Verification Has Applied For Assistance.

Application for child support services : Solicitud de manutención de los hijos:. Web federal regulations require us to verify recurring cash contributions made to all members of the household applying for participation in the home program which we. Web if you claim a deduction of more than $500,000 for a contribution of noncash property, you must fill out form 8283, section b, and also attach the qualified appraisal.

Web 1 Day Agofec Form 3X Report Of Receipts And Disbursements For Other Than An Authorized Committee.

Web this form gives authorization for the home pj to verify recurring cash contributions made to all members of the household applying for participation in the home program. Web charitable contribution deductions under irc § 170 summary. Upload, modify or create forms. Web thank you for your contribution of cash in the amount of _____ dollars ($_____).

November 2022) Department Of The Treasury Internal Revenue Service.

Subject to certain limitations, taxpayers can take deductions from their adjusted gross incomes (agis) for. _____ the donor did not receive any good or services in. Web you can deduct cash contributions made by check, credit card or debit card. Web information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file.

In Order To Process The Application, All Income And Insurance Coverage Must Be Verified.

Web total charitable contributions (cash & check) cash contributions (letter from donee required if greater than $250) 1/2014 the intent of this worksheet is to summarize your charitable. Ad contributions worksheet form & more fillable forms, register and subscribe now! Here are the details of the amount you can deduct. But the irs notes that cash contributions don’t include the value of volunteer services,.