Care Credit After Chapter 7

Care Credit After Chapter 7 - Web the creditor can charge you a higher interest rate. If you have a secured card that. Web if your monthly budget can handle additional costs, the carecredit credit card could be an appealing way to pay off a medical procedure. Web rebuilding credit after chapter 7 bankruptcy. For customers who have a carecredit card, simply enter the amount you'd like to finance to calculate your monthly payment. In a matter of 12 to 18 months, your credit. Web beginning after the end 107 raw scans. Web after three full statements cut and at least 91 days have passed since the card was approved, you can apply for a second card, followed by an increase on your first card. And it makes new credit approval challenging. Web if you rebuild your credit for a year after a chapter 7 bankruptcy, you’ll get a much better deal for large purchases such as car loans or a mortgage.

In a matter of 12 to 18 months, your credit. Secured credit card there are things you should know about a secured credit. Web if you rebuild your credit for a year after a chapter 7 bankruptcy, you’ll get a much better deal for large purchases such as car loans or a mortgage. Just for the record if others are in a similar boat: For customers who have a carecredit card, simply enter the amount you'd like to finance to calculate your monthly payment. Web how much will your credit score increase after chapter 7 falls off your credit report? Web learn more about carecredit healthcare credit card payments with the payment calculator from carecredit. Credit union, or other financial institution. Introduction to general financial requirements. Web chapter 7 will eliminate most all debt (with a few exceptions, notably student loans, back child support and irs debt) with no payback required.

Secured credit card there are things you should know about a secured credit. Web checking your credit reports after chapter 7 if you filed chapter 7 bankruptcy, wait until your case is discharged —you'll receive a letter from the court informing you when that's done,. Web if you rebuild your credit for a year after a chapter 7 bankruptcy, you’ll get a much better deal for large purchases such as car loans or a mortgage. Web beginning after the end 107 raw scans. Just for the record if others are in a similar boat: Introduction to general financial requirements. Web after three full statements cut and at least 91 days have passed since the card was approved, you can apply for a second card, followed by an increase on your first card. What is the average credit score after chapter 7? Web chapter 7 will eliminate most all debt (with a few exceptions, notably student loans, back child support and irs debt) with no payback required. For customers who have a carecredit card, simply enter the amount you'd like to finance to calculate your monthly payment.

Can I Get A Mortgage After Chapter 7

Web if you rebuild your credit for a year after a chapter 7 bankruptcy, you’ll get a much better deal for large purchases such as car loans or a mortgage. Web if your monthly budget can handle additional costs, the carecredit credit card could be an appealing way to pay off a medical procedure. Web checking your credit reports after.

Care Credit Review 2021 Pros & Cons

Having a good credit score translates into lower, more. Your credit future will depend on how well you tend to the credit you have after filing a bankruptcy. Web if your monthly budget can handle additional costs, the carecredit credit card could be an appealing way to pay off a medical procedure. And it makes new credit approval challenging. Introduction.

How long does it take to rebuild credit after chapter 7?

Credit union, or other financial institution. Web checking your credit reports after chapter 7 if you filed chapter 7 bankruptcy, wait until your case is discharged —you'll receive a letter from the court informing you when that's done,. Keeping your available credit high is a factor that drives up your credit score, along with maintaining a mix of credit types,.

Read Henry Ever After Chapter 7 ManhuaScan

Keeping your available credit high is a factor that drives up your credit score, along with maintaining a mix of credit types, such as a home loan, car loan, and credit card accounts. Web how much will your credit score increase after chapter 7 falls off your credit report? Web rebuilding credit after chapter 7 bankruptcy. Its shorter terms —.

What Happens After Bankruptcy Chapter 7

Your credit future will depend on how well you tend to the credit you have after filing a bankruptcy. And it makes new credit approval challenging. Credit union, or other financial institution. Web after three full statements cut and at least 91 days have passed since the card was approved, you can apply for a second card, followed by an.

Life After Chapter 7 [My Bankruptcy Story] YouTube

And it makes new credit approval challenging. Bank accounts may be in the form of savings, checking, or trust accounts, term certificates, or other types of accounts. Web considering all of the information, filing for bankruptcy doesn’t have to be the death of your ability to secure future credit. For customers who have a carecredit card, simply enter the amount.

What Is Your Credit Score After Bankruptcy

Having a good credit score translates into lower, more. Bank accounts may be in the form of savings, checking, or trust accounts, term certificates, or other types of accounts. So when you begin using credit. Web how much will your credit score increase after chapter 7 falls off your credit report? If you have a secured card that.

Care Credit Rewards Mastercard Page 5 myFICO® Forums 4743815

Web beginning after the end 107 raw scans. My bk7 was discharged just under 6 months ago, including 4 synchrony accounts (amazon, paypal, walmart, carecredit). Web considering all of the information, filing for bankruptcy doesn’t have to be the death of your ability to secure future credit. Introduction to general financial requirements. Web checking your credit reports after chapter 7.

Care Credit UT Health East Texas Physicians

Web if your monthly budget can handle additional costs, the carecredit credit card could be an appealing way to pay off a medical procedure. Bank accounts may be in the form of savings, checking, or trust accounts, term certificates, or other types of accounts. Web it’s true that a chapter 7 bankruptcy stays on your credit for up to 10.

CareCredit Provider Center

Web if you rebuild your credit for a year after a chapter 7 bankruptcy, you’ll get a much better deal for large purchases such as car loans or a mortgage. Introduction to general financial requirements. Web keeping a credit card by paying back the balance before bankruptcy is unlikely to work because the chapter 7 bankruptcy trustee appointed to your.

Web The Creditor Can Charge You A Higher Interest Rate.

Web after three full statements cut and at least 91 days have passed since the card was approved, you can apply for a second card, followed by an increase on your first card. Types of credit cards you can qualify for after filing chapter 7 bankruptcy credit cards that you might qualify for may be secured or unsecured. Once filed, chapter 7 bankruptcy can remain on your credit report for up to 10 years. For customers who have a carecredit card, simply enter the amount you'd like to finance to calculate your monthly payment.

Web Considering All Of The Information, Filing For Bankruptcy Doesn’t Have To Be The Death Of Your Ability To Secure Future Credit.

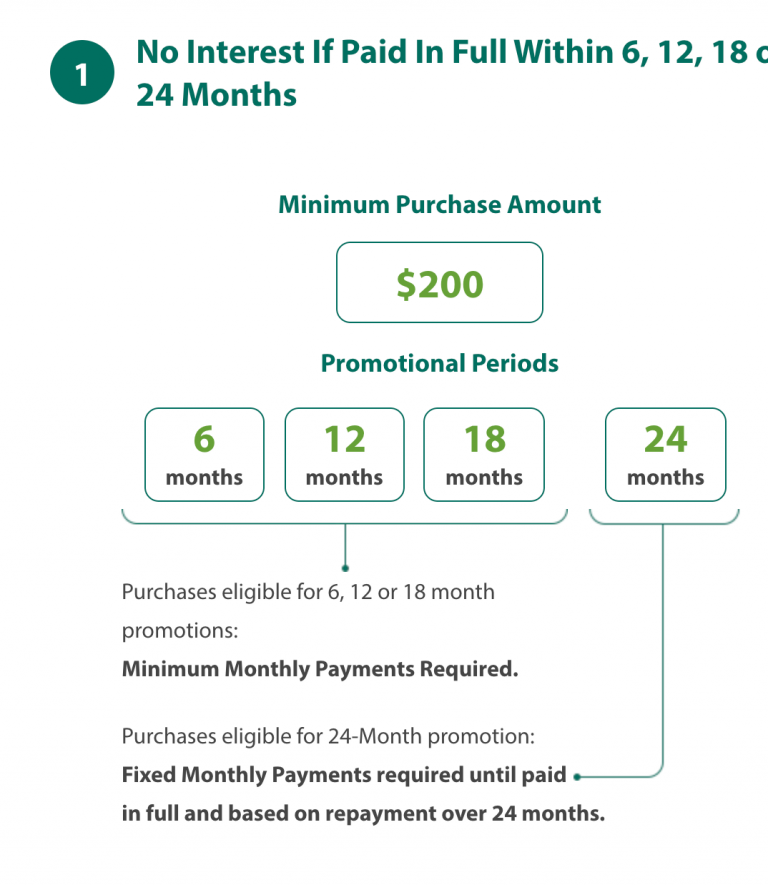

Having a good credit score translates into lower, more. So when you begin using credit. Its shorter terms — six, 12, 18 and 24 months — come with a 0%. Web if your monthly budget can handle additional costs, the carecredit credit card could be an appealing way to pay off a medical procedure.

Web Learn More About Carecredit Healthcare Credit Card Payments With The Payment Calculator From Carecredit.

Just for the record if others are in a similar boat: What is the average credit score after chapter 7? Buying a car during that time is still possible. Web if you rebuild your credit for a year after a chapter 7 bankruptcy, you’ll get a much better deal for large purchases such as car loans or a mortgage.

Web How Much Will Your Credit Score Increase After Chapter 7 Falls Off Your Credit Report?

And it makes new credit approval challenging. Web it’s true that a chapter 7 bankruptcy stays on your credit for up to 10 years ( chapter 13 bankruptcy is removed by credit reporting agencies after only 7 years). Not released [stay tuned to r/beginning after the end for raw scans] beginning after the end chapter 107 raw scans will also be available on may 29, 2021. Credit union, or other financial institution.

![Life After Chapter 7 [My Bankruptcy Story] YouTube](https://i.ytimg.com/vi/fDNbNdornBA/maxresdefault.jpg)