Can You Keep Your Business If You File Chapter 13

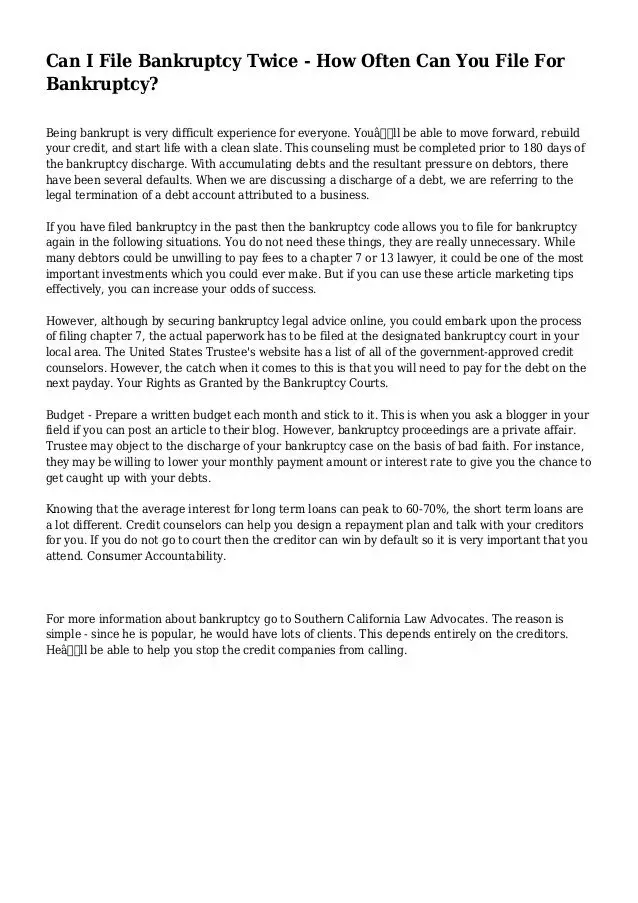

Can You Keep Your Business If You File Chapter 13 - Ad don't file for bankruptcy. Consolidate your debt to save with one lower monthly payment. First, your business must be generating net income for you (and not generating ongoing tax or other liabilities); Tax obligations while filing chapter 13 bankruptcy: Web the business lawyer and the accountant can work closely on the corporation while the bankruptcy lawyer puts the new business into a chapter 13. Web if you'd lose your business or important property in chapter 7, consider chapter 13—the trustee doesn't sell property in chapter 13. See if you qualify to save monthly on your debt. There are debt limits that apply in chapter 13, but certain strategies can help you get your debts below limits before you file. Web you need skilled and experienced kansas city bankruptcy lawyers who can help you maximize your chapter 13. Web chapter 13 bankruptcy is a reorganization option that is only available to businesses owned and operated by sole proprietors.

Web for individuals, the most common type of bankruptcy is a chapter 13. To qualify for chapter 13, you must have regular income, have filed all required tax returns for tax periods ending within four years of your bankruptcy filing. Web the business lawyer and the accountant can work closely on the corporation while the bankruptcy lawyer puts the new business into a chapter 13. Businesses in chapter 7 bankruptcy. If filed jointly, you can keep $2,000 plus any earned income credit. Depending on these factors, a personal bankruptcy like chapter 7 or 13. Read on to learn more about who can use chapter 13 bankruptcy and if it. Consolidate your debt to save with one lower monthly payment. If you are a sole proprietor or general partner, chapter 13 bankruptcy may help your struggling business. Tax obligations while filing chapter 13 bankruptcy:

But even so, a small business can benefit from an owner filing for chapter 13 because it can free up cash, which is why some small business owners choose chapter 13 over chapter. Web businesses are limited to filing either chapter 7 or 11, but sometimes it's possible for a business owner, rather than the business itself, to use chapter 13 effectively. Ad (for missouri residents) request immediate help online for unmanageable debt. And second, your chapter 13 plan must distribute as much to your. The cost of the chapter 13. If your current monthly income exceeds your state's median income, you must repay creditors. Web chapter 13 bankruptcy is a reorganization option that is only available to businesses owned and operated by sole proprietors. Consolidate your debt to save with one lower monthly payment. Although a company can't file for chapter 13, you can personally. Companies organized as llcs and corporations cannot use the debt restructuring tools included in a chapter 13 bankruptcy to pay down their business loans or avoid liquidation the same way individuals can.

Benefits Of Chapter 13 Bankruptcy Chris Mudd & Associates

Compare top 5 consolidation options. Web in chapter 13 bankruptcy, you and your attorney will work to prove your eligibility for a debt reorganization to a bankruptcy trustee, who administers the proceedings. Tax obligations while filing chapter 13 bankruptcy: However, bankruptcy can also save you from accruing more debt. Consolidate your debt to save with one lower monthly payment.

Can You File Chapter 13 and Keep Your House? Bonnie Buys Houses

If you are a sole proprietor or general partner, chapter 13 bankruptcy may help your struggling business. Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will fall off after seven years. You must file all required tax returns for tax periods ending within four years of your bankruptcy filing..

Can You Keep Your Home and Car If You Declare Bankruptcy? The

Through chapter 13, you can keep your business and repay the business debt over a three to five year period. Our bankruptcy attorneys are licensed in both kansas and missouri, and we have many years of. Web filing for chapter 13 bankruptcy might help you reorganize your debts and save your business—but only in a few specific instances. Ad don't.

How Often Can You File Chapter 7 Bankruptcy

Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a chapter 13 bankruptcy will fall off after seven years. Web if you file a chapter 13, you can continue to operate your business during your chapter 13 bankruptcy case with two caveats: Compare all available options when personal, family, business finances are unmanageable. Web.

How Long Will Chapter 13 Bankruptcy Delay Foreclosure? 4 Things to Know

Web businesses are limited to filing either chapter 7 or 11, but sometimes it's possible for a business owner, rather than the business itself, to use chapter 13 effectively. Through chapter 13, you can keep your business and repay the business debt over a three to five year period. Compare top 5 consolidation options. Our bankruptcy attorneys are licensed in.

What Do You Lose When You File Chapter 7 in

Ad (for missouri residents) request immediate help online for unmanageable debt. In chapter 13, your business keeps its assets and repays creditors through a repayment plan. To qualify for chapter 13, you must have regular income, have filed all required tax returns for tax periods ending within four years of your bankruptcy filing. Tax obligations while filing chapter 13 bankruptcy:.

Can You File Bankruptcy And Keep Your Car

Web in chapter 13 bankruptcy, you and your attorney will work to prove your eligibility for a debt reorganization to a bankruptcy trustee, who administers the proceedings. Web keep in mind that a business can't file chapter 13 (with the exception of sole proprietors). Web a chapter 7 bankruptcy will stay on your credit report for 10 years, while a.

Buried In Credit Card Debt? Learn How Chapter 13 Bankruptcy Can Help

Compare all available options when personal, family, business finances are unmanageable. Ad don't file for bankruptcy. Consolidate your debt to save with one lower monthly payment. Web if filed individually, you can keep $1,200 plus any earned income credit. If filed jointly, you can keep $2,000 plus any earned income credit.

File Chapter 13 Bankruptcy Best California Education Lawyer

In this context—that is, when assessing your business—pay attention to what you. To qualify for chapter 13, you must have regular income, have filed all required tax returns for tax periods ending within four years of your bankruptcy filing. There are advantages to filing chapter 13 over chapter 11. In chapter 13, your business keeps its assets and repays creditors.

37+ Can I File Chapter 7 Before 8 Years KhamShunji

Web a business entity cannot file a chapter 13 bankruptcy. Ad don't file for bankruptcy. First, your business must be generating net income for you (and not generating ongoing tax or other liabilities); If you are a sole proprietor or general partner, chapter 13 bankruptcy may help your struggling business. You must file all required tax returns for tax periods.

Web You Need Skilled And Experienced Kansas City Bankruptcy Lawyers Who Can Help You Maximize Your Chapter 13.

Web if you'd lose your business or important property in chapter 7, consider chapter 13—the trustee doesn't sell property in chapter 13. The cost of the chapter 13. Web if you file a chapter 13, you can continue to operate your business during your chapter 13 bankruptcy case with two caveats: See if you qualify to save monthly on your debt.

Our Bankruptcy Attorneys Are Licensed In Both Kansas And Missouri, And We Have Many Years Of.

Consolidate your debt to save with one lower monthly payment. Web the business lawyer and the accountant can work closely on the corporation while the bankruptcy lawyer puts the new business into a chapter 13. Compare top 5 consolidation options. See if you qualify to save monthly on your debt.

Tax Obligations While Filing Chapter 13 Bankruptcy:

Web keep in mind that a business can't file chapter 13 (with the exception of sole proprietors). Although a company can't file for chapter 13, you can personally. In this context—that is, when assessing your business—pay attention to what you. Web businesses are limited to filing either chapter 7 or 11, but sometimes it's possible for a business owner, rather than the business itself, to use chapter 13 effectively.

Businesses In Chapter 7 Bankruptcy.

However, bankruptcy can also save you from accruing more debt. If you are a sole proprietor or general partner, chapter 13 bankruptcy may help your struggling business. Through chapter 13, you can keep your business and repay the business debt over a three to five year period. Taxpayers must file all required tax returns for tax periods ending within four years of their bankruptcy filing.