Can You Change Your Chapter 13 To A Chapter 7

Can You Change Your Chapter 13 To A Chapter 7 - In contrast, chapter 13 requires you to follow a payment plan that can take 3 to 5 years before the rest of your. Life happens to everyone, including those in a chapter 13 repayment plan. First, you will be expected to demonstrate that your current household monthly income is no longer sufficient to meet your. Web the answer is no. If your case was previously converted to chapter 7 at the request of a creditor, the trustee, or the court, then. Let a raleigh bankruptcy attorney from the bradford law offices, help you through the process. This conversion usually happens when the filer's income is too high to pass the means test , indicating that there's sufficient income to repay creditors some amount through a chapter 13. Web unless you’ve already been discharged under chapter 7 in the prior eight years, you can transfer your chapter 13 to chapter 7. Web to convert your chapter 13 to chapter 7, you simply file a notice of conversion with the court and pay a conversion fee. Web although unusual, you can also convert a chapter 7 to a chapter 13 case.

In chapter 13, consumers with regular income and a desire to protect certain personal assets enter a. Life happens to everyone, including those in a chapter 13 repayment plan. If your case was previously converted to chapter 7 at the request of a creditor, the trustee, or the court, then. However, keep in mind that you must still qualify for chapter 7 bankruptcy in order to complete. This warning is not on an official bankruptcy form, although your. Converting chapter 13 bankruptcy into chapter 7 isn’t just possible, it happens with regularity. Web if your chapter 13 bankruptcy case has become too much to handle and you want to convert to chapter 7, a skilled attorney can advise you through this process. There must be eight years between chapter 7 bankruptcy filings and a converted chapter 7 case from a chapter 13 case is considered filed as of the date the current chapter 13 was filed and not from the date of conversion. Web unless you’ve already been discharged under chapter 7 in the prior eight years, you can transfer your chapter 13 to chapter 7. Web the advantage of converting to chapter 7 from chapter 13 is that you will only have to pay an additional $25.00 filing fee.

The chapter 13 repayment plan is canceled. Web if you did then you cannot convert your chapter 13 to a chapter 7. The debtor pays a small conversion fee and. You will need to obtain credit counseling and create a debt repayment plan that allows for the repayment of a substantial amount of your. Web how to convert chapter 13 to chapter 7. You will have to file a notice of conversion and pay a fee. Web chapter 7 and chapter 13 bankruptcy are common individual bankruptcies you can file to get some relief if you’re struggling to repay debt. Web to convert your chapter 13 to chapter 7, you simply file a notice of conversion with the court and pay a conversion fee. Web the court might not grant your motion if the court converted your matter involuntarily to a chapter 7. There are specifications for who can do so, since you have to qualify for relief from your original bankruptcy terms for the conversion to be permitted.

A Chapter 13 Repayment Plan Can Help You Keep Your Home and Other

Web the bankruptcy laws permit a chapter 13 debtor to convert the case to chapter 7 without any special permission. There must be eight years between chapter 7 bankruptcy filings and a converted chapter 7 case from a chapter 13 case is considered filed as of the date the current chapter 13 was filed and not from the date of.

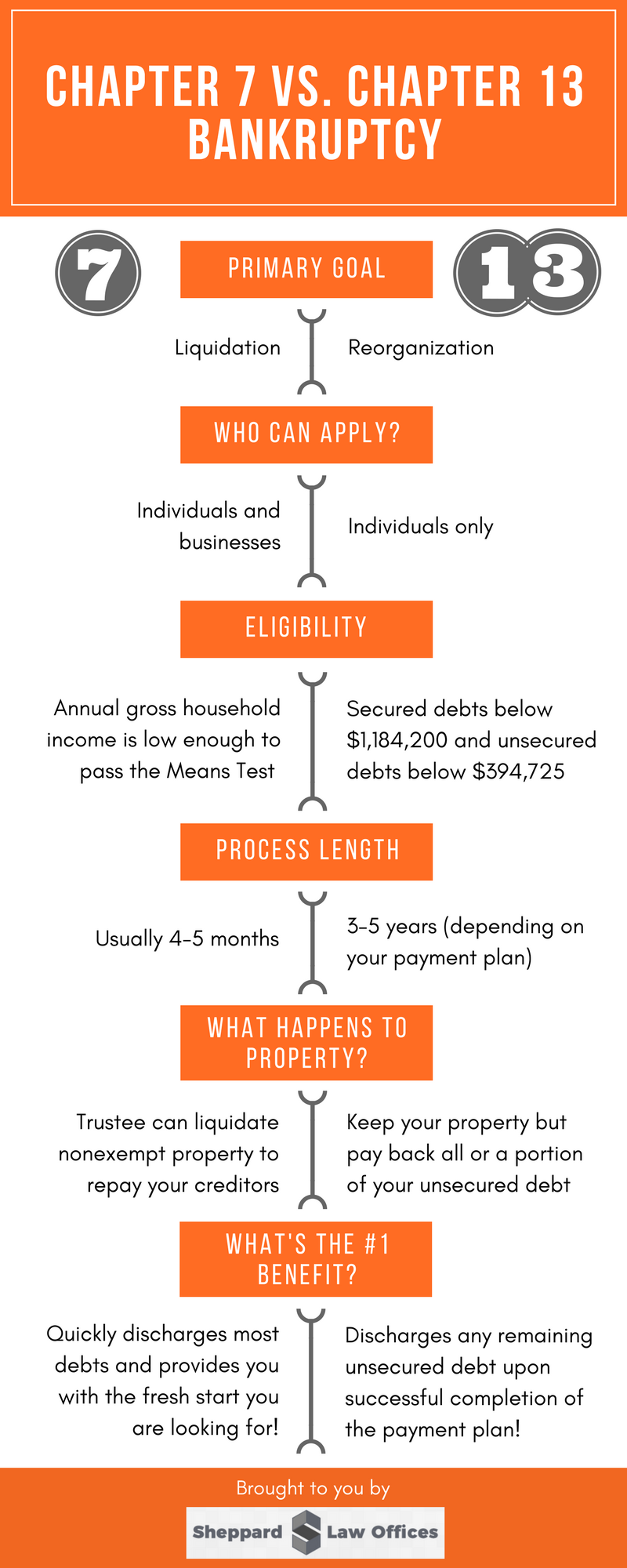

Chapter 7 vs Chapter 13 Bankruptcy Sheppard Law Office

Web how to convert chapter 13 to chapter 7. Chapter 7 helps you discharge certain. This conversion usually happens when the filer's income is too high to pass the means test , indicating that there's sufficient income to repay creditors some amount through a chapter 13. Web chapter 7 and chapter 13 bankruptcy are common individual bankruptcies you can file.

Infographic Chapter 7 vs. Chapter 13 BankruptcyWeaver Bankruptcy Law Firm

Web how to convert chapter 13 to chapter 7. There are specifications for who can do so, since you have to qualify for relief from your original bankruptcy terms for the conversion to be permitted. Web if you did then you cannot convert your chapter 13 to a chapter 7. There must be eight years between chapter 7 bankruptcy filings.

Chapter 7 Vs Chapter 13 Bankruptcy Alabama Bankruptcy Law Blog

The chapter 13 repayment plan is canceled. Converting the case is a very simple process. Chapter 7 helps you discharge certain. Web the answer is no. This conversion usually happens when the filer's income is too high to pass the means test , indicating that there's sufficient income to repay creditors some amount through a chapter 13.

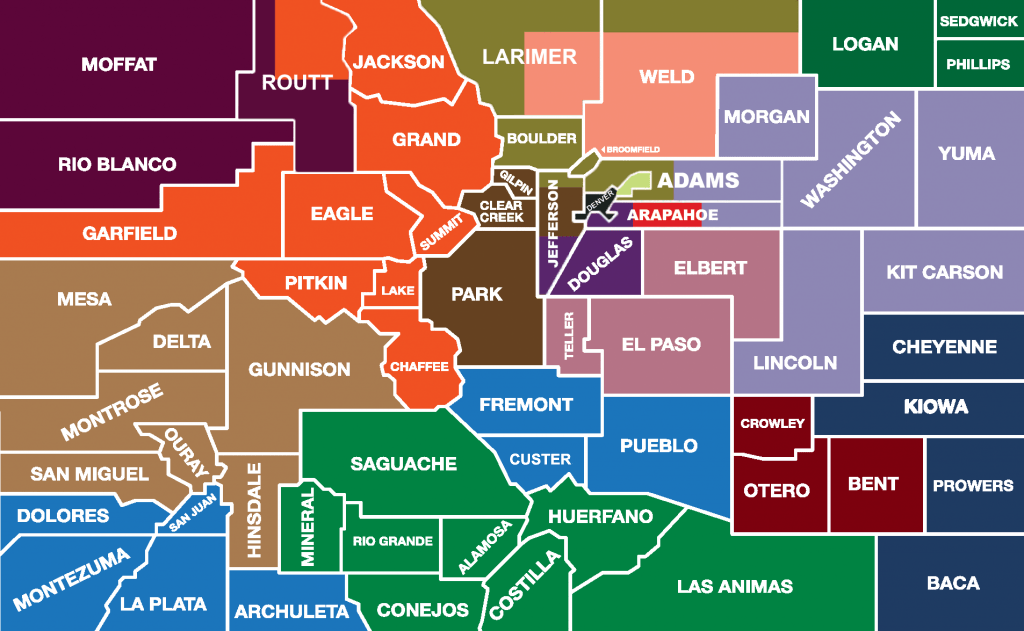

Where will my Meeting of Creditors (Section 341 Meeting) be held

Let a raleigh bankruptcy attorney from the bradford law offices, help you through the process. Web once your conversion from chapter 13 to chapter 7 is accepted, any money you have paid the trustee that has not been divided among creditors will be returned to you. Thankfully, the bankruptcy code provides a mechanism for changing (converting) your case from chapter.

Switching From a Chapter 13 to a Chapter 7 John T. Orcutt What You

However, keep in mind that you must still qualify for chapter 7 bankruptcy in order to complete. First, you will be expected to demonstrate that your current household monthly income is no longer sufficient to meet your. This conversion usually happens when the filer's income is too high to pass the means test , indicating that there's sufficient income to.

Chapter 7 versus Chapter 13 Riggs Ellsworth & Porter

Web based on previous seasons — where downtime can take anywhere between two to five hours — we estimate the fortnite chapter 4 season 4 release time will be around the following: Web the court will choose a new bankruptcy trustee when a debtor’s bankruptcy is changed from chapter 13 to chapter 7. Unless you have already received a chapter.

Is a Chapter 13 bankruptcy right for you? Ted Stuckenschneider, P.C.

Web chapter 7 and chapter 13 bankruptcy are common individual bankruptcies you can file to get some relief if you’re struggling to repay debt. This warning is not on an official bankruptcy form, although your. You will need to obtain credit counseling and create a debt repayment plan that allows for the repayment of a substantial amount of your. Web.

Revelation Chapter 13 by Gaetan Issuu

Web the advantage of converting to chapter 7 from chapter 13 is that you will only have to pay an additional $25.00 filing fee. Web the court might not grant your motion if the court converted your matter involuntarily to a chapter 7. Let a raleigh bankruptcy attorney from the bradford law offices, help you through the process. There must.

What is the difference between Chapter 7 and Chapter 13 bankruptcy

A chapter 7 bankruptcy can result in a discharge of your debts in as little as 120 days. Converting the case is a very simple process. Web based on previous seasons — where downtime can take anywhere between two to five hours — we estimate the fortnite chapter 4 season 4 release time will be around the following: Thankfully, the.

Converting The Case Is A Very Simple Process.

Web based on previous seasons — where downtime can take anywhere between two to five hours — we estimate the fortnite chapter 4 season 4 release time will be around the following: Web unless you’ve already been discharged under chapter 7 in the prior eight years, you can transfer your chapter 13 to chapter 7. You will have to file a notice of conversion and pay a fee. This warning is not on an official bankruptcy form, although your.

First, You Will Be Expected To Demonstrate That Your Current Household Monthly Income Is No Longer Sufficient To Meet Your.

However, keep in mind that you must still qualify for chapter 7 bankruptcy in order to complete. Web the answer is no. Web chapter 7 and chapter 13 bankruptcy are common individual bankruptcies you can file to get some relief if you’re struggling to repay debt. Chapter 7 helps you discharge certain.

Web To Convert Your Chapter 13 To Chapter 7, You Simply File A Notice Of Conversion With The Court And Pay A Conversion Fee.

Web a bankruptcy court can order a conversion from chapter 13 to chapter 7 bankruptcy “for cause.” some grounds for requiring you to convert your case can include unreasonable delays of plan payments if the delays cause harm to your creditors, or a failure to make your. Web if your chapter 13 bankruptcy case has become too much to handle and you want to convert to chapter 7, a skilled attorney can advise you through this process. Web the court might not grant your motion if the court converted your matter involuntarily to a chapter 7. Web although unusual, you can also convert a chapter 7 to a chapter 13 case.

Converting Chapter 13 Bankruptcy Into Chapter 7 Isn’t Just Possible, It Happens With Regularity.

Web the most significant advantage of converting is that a chapter 7 bankruptcy can be completed more quickly than chapter 13. This conversion usually happens when the filer's income is too high to pass the means test , indicating that there's sufficient income to repay creditors some amount through a chapter 13. Web the advantage of converting to chapter 7 from chapter 13 is that you will only have to pay an additional $25.00 filing fee. Life happens to everyone, including those in a chapter 13 repayment plan.