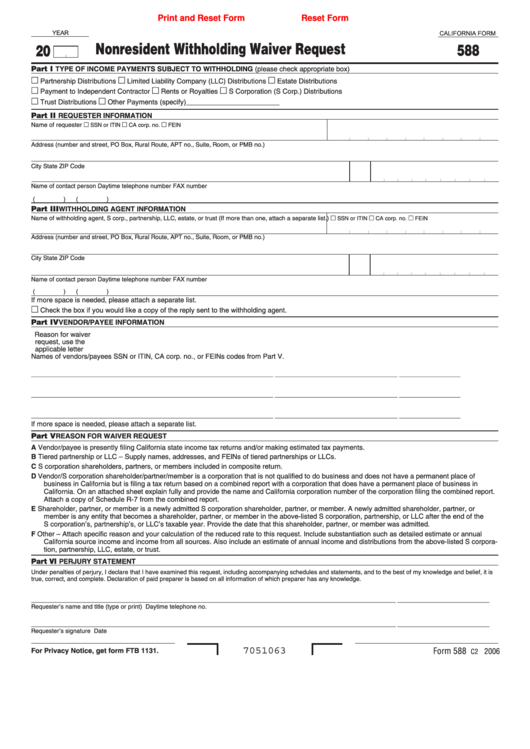

California Form 588

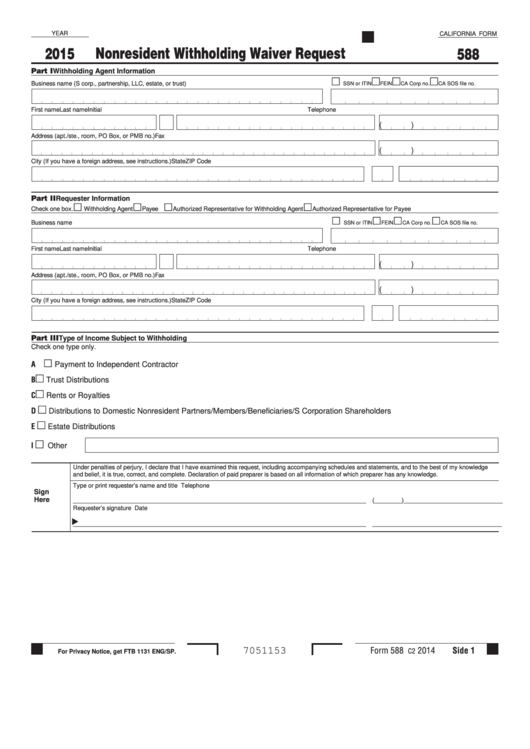

California Form 588 - Please provide your email address and it will be emailed to you. Withholding agent keeps a copy of the waiver certificate in records. No withholding required with a waiver certificate. Web nonresident withholding allocation worksheet (form 587) use form 587 to allocate california source payments and determine if withholding is required. Web california form 588 form 588 2022 side 1 part i withholding agent information part ii requester information part iii type of income subject to withholding business name business name ssn or itin ssn or itin fein fein ca corp no. Web this california form is for nonresidents of the state who want to file a withholding waiver for any type of income listed. We last updated the nonresident withholding waiver request in january 2022, so this is the latest version of form 588, fully updated for tax year 2022. Web a nonresident payee may request a waiver from withholding by submitting form 588, nonresident withholding waiver request. Form 588 must be submitted at least 21 business days before payment is made. A nonresident payee may request a reduction in the amount to be withheld by submitting form 589,.

If we approve the waiver, no withholding is required. Web waivers from domestic owners consenting to the california pet. • seller of california real estate. We last updated the nonresident withholding waiver request in january 2022, so this is the latest version of form 588, fully updated for tax year 2022. Electing entities can file form 588 on behalf of its partners/members/shareholders. There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. No withholding required with a waiver certificate. Web do not use form 588 to request a waiver if you are a: Form 588 must be submitted at least 21 business days before payment is made. Web 2023, 588, instructions for form 588 nonresident withholding waiver request.

Web do not use form 588 to request a waiver if you are a: Please provide your email address and it will be emailed to you. Nonresident withholding waiver request (form 588) submit form 588 to apply for a waiver. File the form by mail or fax: Web this california form is for nonresidents of the state who want to file a withholding waiver for any type of income listed. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Web california form 588 form 588 2022 side 1 part i withholding agent information part ii requester information part iii type of income subject to withholding business name business name ssn or itin ssn or itin fein fein ca corp no. Withholding agent keeps a copy of the waiver certificate in records. Web 2023, 588, instructions for form 588 nonresident withholding waiver request. If you need to request a waiver prior to this date, please complete nonresident withholding waiver request ( form 588 ).

ftb.ca.gov forms 09_588

Web california form 588 form 588 2022 side 1 part i withholding agent information part ii requester information part iii type of income subject to withholding business name business name ssn or itin ssn or itin fein fein ca corp no. Withholding agent keeps a copy of the waiver certificate in records. Web this california form is for nonresidents of.

Fillable California Form 588 Nonresident Withholding Waiver Request

A nonresident payee may request a reduction in the amount to be withheld by submitting form 589,. Web nonresident payee who qualifies can use form 588 to get a waiver from withholding based generally on california tax filing history. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to.

Instructions for Form 588 Nonresident Withholding Waiver Request

A nonresident payee may request a reduction in the amount to be withheld by submitting form 589,. Web 2023, 588, instructions for form 588 nonresident withholding waiver request. Web do not use form 588 to request a waiver if you are a: We last updated the nonresident withholding waiver request in january 2022, so this is the latest version of.

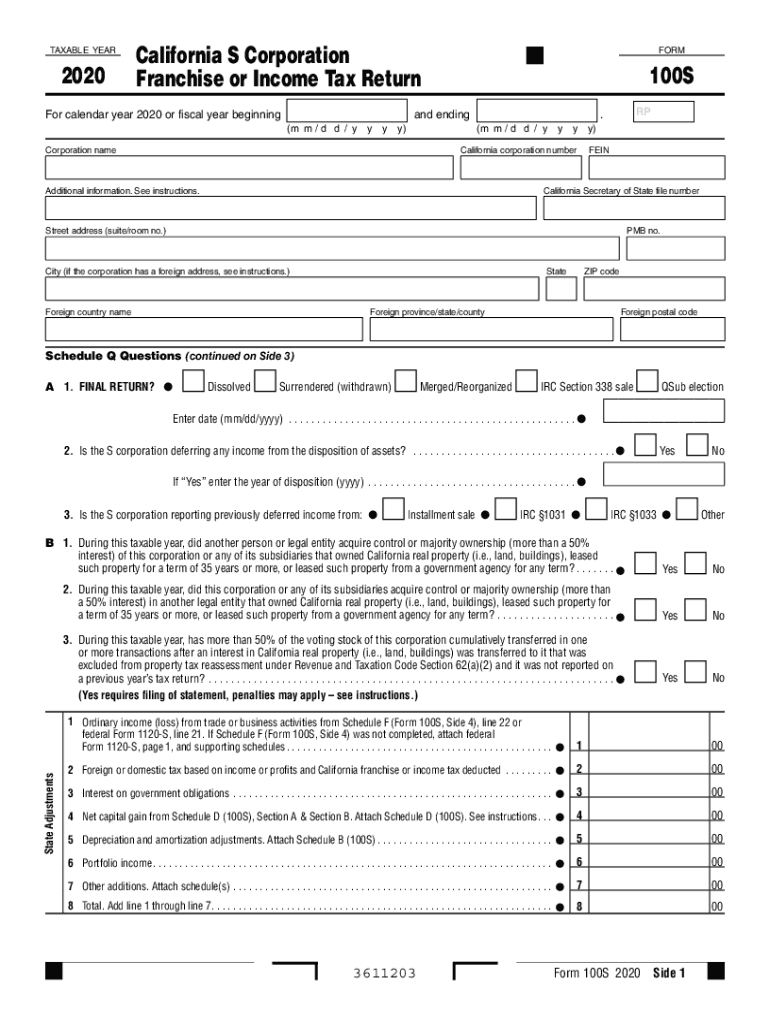

Ca Franchise Tax Board Form Fill Out and Sign Printable PDF Template

Web nonresident payee who qualifies can use form 588 to get a waiver from withholding based generally on california tax filing history. Electing entities can file form 588 on behalf of its partners/members/shareholders. If you need to request a waiver prior to this date, please complete nonresident withholding waiver request ( form 588 ). No withholding required with a waiver.

FormoftheWeek Notice of Intent to Enter Dwelling and Notice of

Form 588 must be submitted at least 21 business days before payment is made. No withholding required with a waiver certificate. This is only available by request. Electing entities can file form 588 on behalf of its partners/members/shareholders. First name first name check one box only.

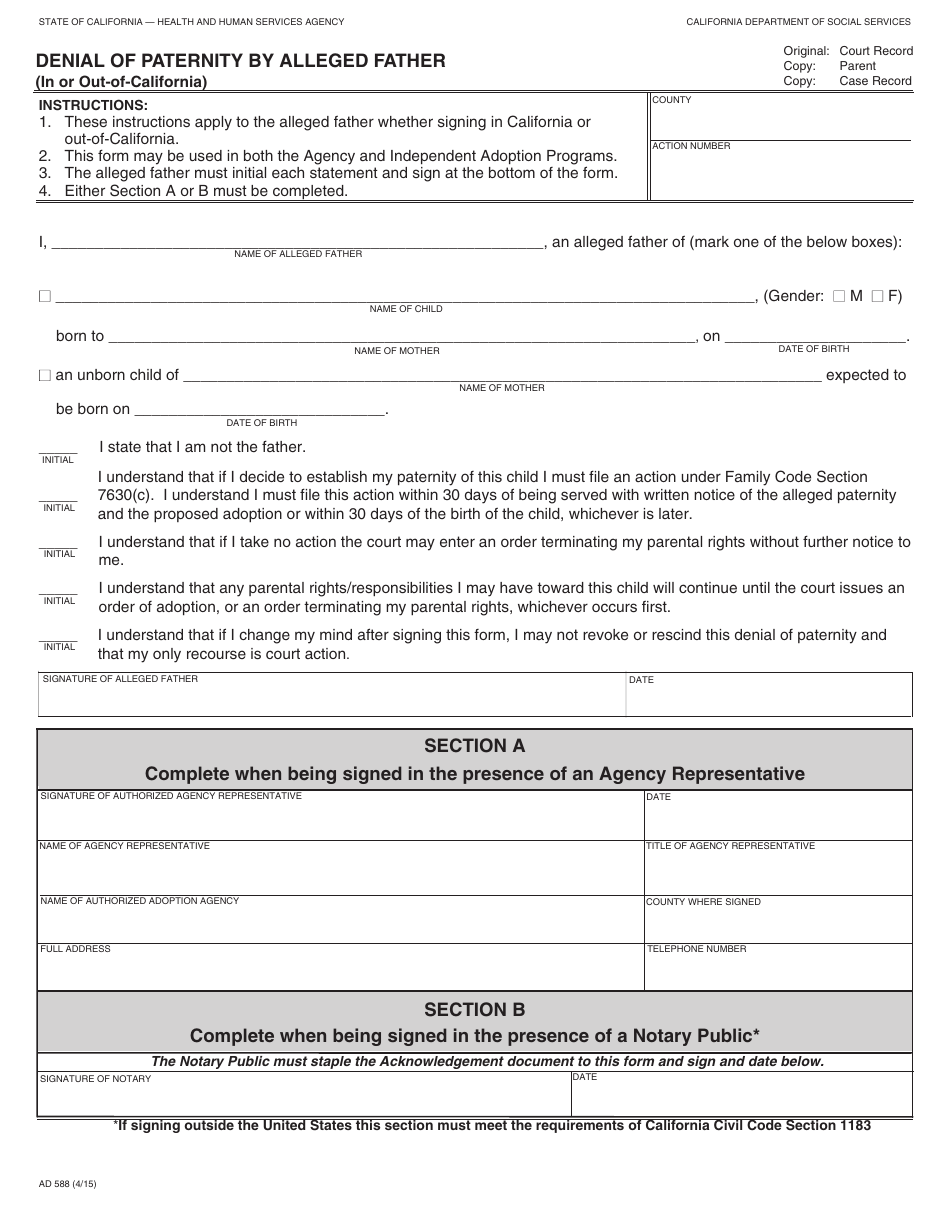

Form AD588 Download Fillable PDF or Fill Online Denial of Paternity by

There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. If you need to request a waiver prior to this date, please complete nonresident withholding waiver request ( form 588 ). Web california form 588 form 588 2022 side 1 part i withholding agent information part ii requester information part.

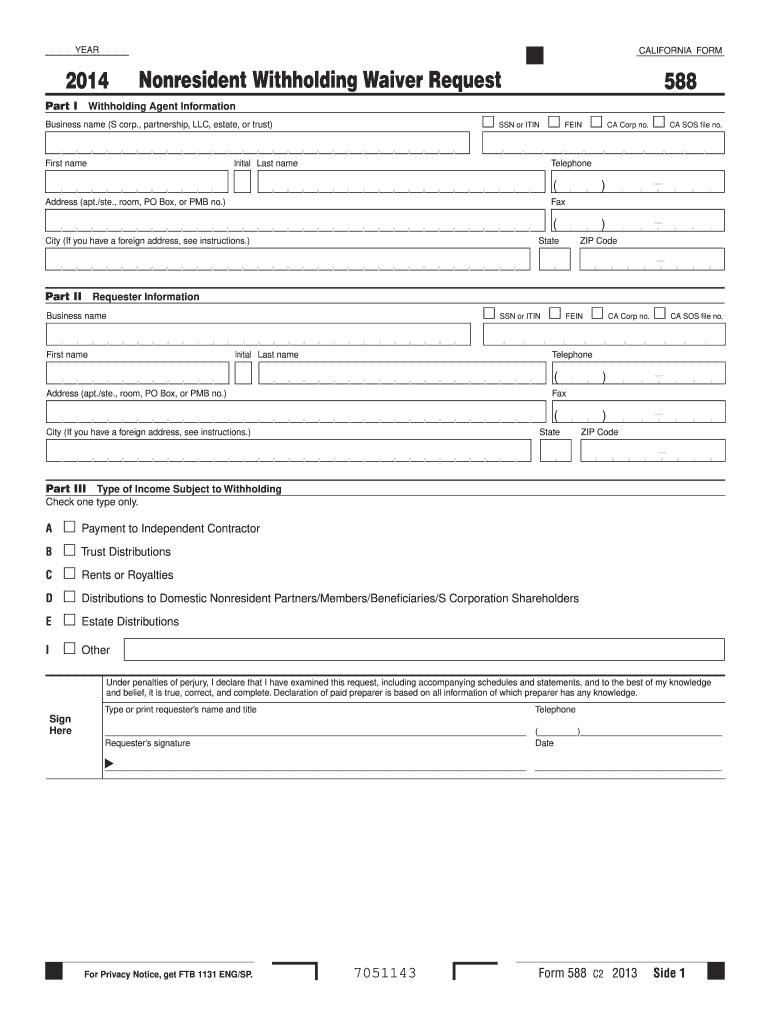

CA FTB 588 2013 Fill out Tax Template Online US Legal Forms

Electing entities can file form 588 on behalf of its partners/members/shareholders. If you need to request a waiver prior to this date, please complete nonresident withholding waiver request ( form 588 ). Web a nonresident payee may request a waiver from withholding by submitting form 588, nonresident withholding waiver request. Web we expect to have it available by october 1,.

Notice of Temporary Displacement — RPI Form 588

There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. Withholding agent keeps a copy of the waiver certificate in records. If we approve the waiver, no withholding is required. • seller of california real estate. This is only available by request.

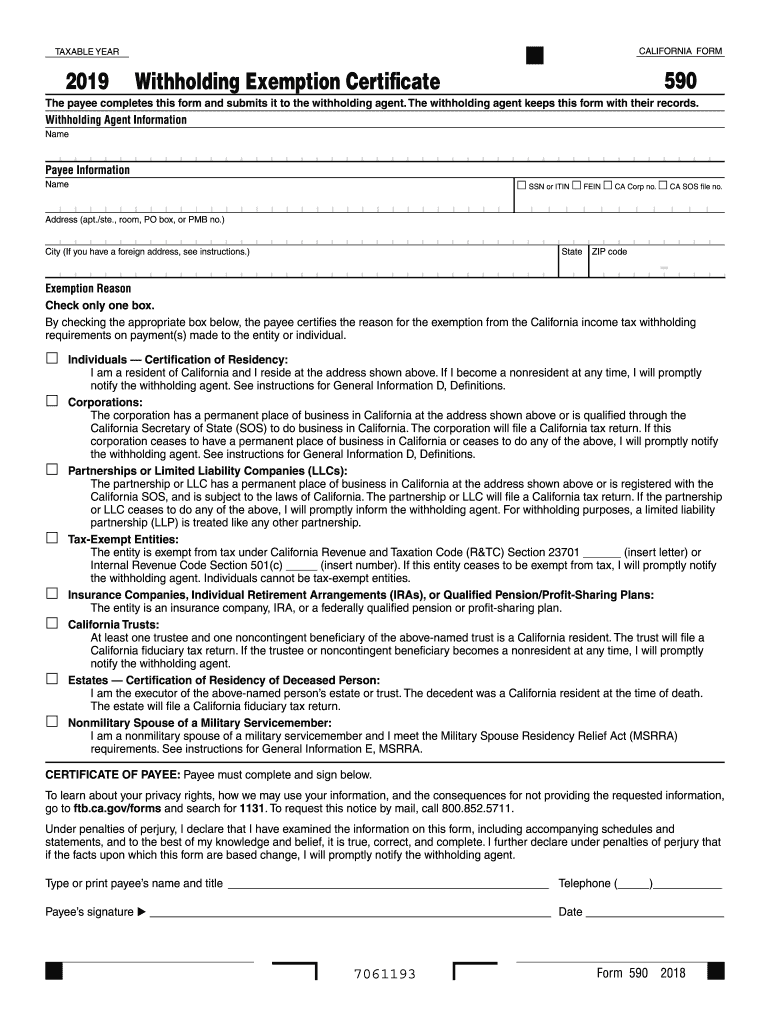

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Web waivers from domestic owners consenting to the california pet. There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. Withholding agent keeps a copy of the waiver certificate in records. Please provide your email address and it will be emailed to you. Web use form 588, nonresident withholding waiver.

Fillable California Form 588 Nonresident Withholding Waiver Request

Web waivers from domestic owners consenting to the california pet. First name first name check one box only. There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. Form 588, nonresident withholding waiver request, can be filed to request a waiver from withholding on payments of california source income to.

Web California Form 588 Form 588 2022 Side 1 Part I Withholding Agent Information Part Ii Requester Information Part Iii Type Of Income Subject To Withholding Business Name Business Name Ssn Or Itin Ssn Or Itin Fein Fein Ca Corp No.

Electing entities can file form 588 on behalf of its partners/members/shareholders. Web 2023, 588, instructions for form 588 nonresident withholding waiver request. First name first name check one box only. Web nonresident payee who qualifies can use form 588 to get a waiver from withholding based generally on california tax filing history.

We Last Updated The Nonresident Withholding Waiver Request In January 2022, So This Is The Latest Version Of Form 588, Fully Updated For Tax Year 2022.

There are no provisions in the california revenue and taxation code (r&tc) to waive withholding for foreign partners or members. This is only available by request. Web waivers from domestic owners consenting to the california pet. Web do not use form 588 to request a waiver if you are a:

Form 588, Nonresident Withholding Waiver Request, Can Be Filed To Request A Waiver From Withholding On Payments Of California Source Income To Nonresident Domestic Owners.

Please provide your email address and it will be emailed to you. Nonresident withholding waiver request (form 588) submit form 588 to apply for a waiver. File the form by mail or fax: Withholding agent keeps a copy of the waiver certificate in records.

Web Nonresident Withholding Allocation Worksheet (Form 587) Use Form 587 To Allocate California Source Payments And Determine If Withholding Is Required.

A nonresident payee may request a reduction in the amount to be withheld by submitting form 589,. Form 588 must be submitted at least 21 business days before payment is made. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Web a nonresident payee may request a waiver from withholding by submitting form 588, nonresident withholding waiver request.