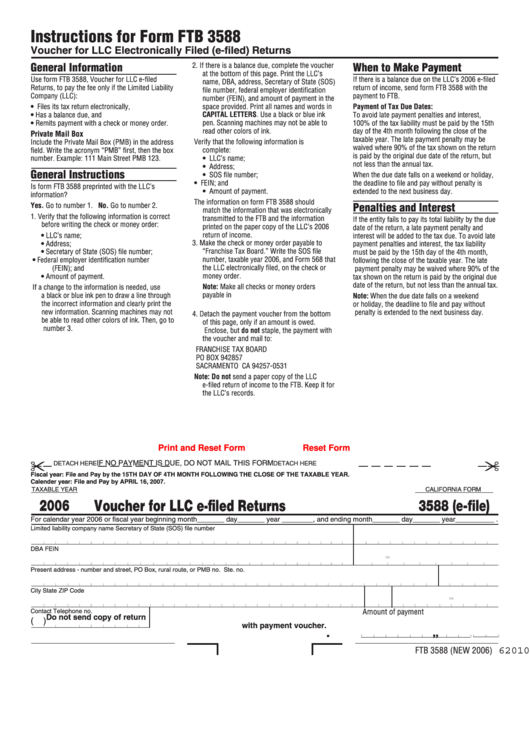

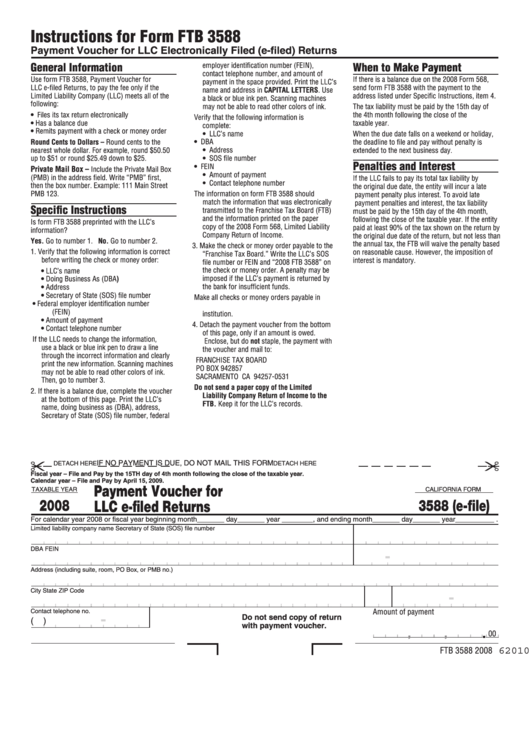

California Form 3588

California Form 3588 - This form is required for any individual or estate who owes taxes on property that was transferred to. Pick the template you want from our collection of legal form samples. Web the california form 3588 is used to report estate and inheritance taxes. Use get form or simply click on the template preview to open it in the editor. You can print other california tax forms here. Web general information use form ftb 3588, payment voucher for llc e‑filed returns, to pay the total amount due on form 568, limited liability company return of income, except. Withholding agent business name payee authorized representative for withholding agent ssn or. Use form ftb 3588, payment voucher for llc e‑filed returns, to pay the. All llcs in the state are required to pay this annual tax to stay compliant. Files its tax return electronically has a balance due.

Printable california state 540 540. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Start completing the fillable fields and carefully. Web use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. Pick the template you want from our collection of legal form samples. Files its tax return electronically has a balance due. Web the information on form ftb 3588 should match the information that was electronically transmitted to the franchise tax board (ftb) and the information printed on the paper. This form is required for any individual or estate who owes taxes on property that was transferred to. Use form ftb 3588, payment voucher for llc e‑filed returns, to pay the. Web 2017 instructions for form ftb 3588.

Web use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. California tax forms 2015 : Files its tax return electronically has a balance due. Click the get form button. Start completing the fillable fields and carefully. Web use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. Web the information on form ftb 3588 should match the information that was electronically transmitted to the franchise tax board (ftb) and the information printed on the paper. Web the california form 3588 is used to report estate and inheritance taxes. Printable california state 540 540. All llcs in the state are required to pay this annual tax to stay compliant.

Fillable California Form 3588 (EFile) Voucher For Llc EFiled

Web california form 588 part ii requester information check one box only. This form is required for any individual or estate who owes taxes on property that was transferred to. Web general information use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except. Click.

The International 3588 Precision Key Series 2

Printable california state 540 540. California tax forms 2015 : This form is required for any individual or estate who owes taxes on property that was transferred to. Start completing the fillable fields and carefully. Web use form ftb 3588, payment voucher for llc e‑fled returns, to pay the total amount due on form 568, limited liability company return of.

Instructions For Form Ftb 3588 Draft Payment Voucher For Llc

Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Use get form or simply click on the template preview to open it in the editor. All llcs in the state are required to pay this annual tax to stay compliant. Web the information on form ftb.

California Form 1099 S Universal Network

Web use form ftb 3588, payment voucher for llc e‑fled returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. Use get form or simply click on the template preview to open it in the editor. Files its tax return electronically has a balance due. California tax forms 2015.

시간표 엑셀데이터

Pick the template you want from our collection of legal form samples. Withholding agent business name payee authorized representative for withholding agent ssn or. Web california form 588 part ii requester information check one box only. California tax forms 2015 : All llcs in the state are required to pay this annual tax to stay compliant.

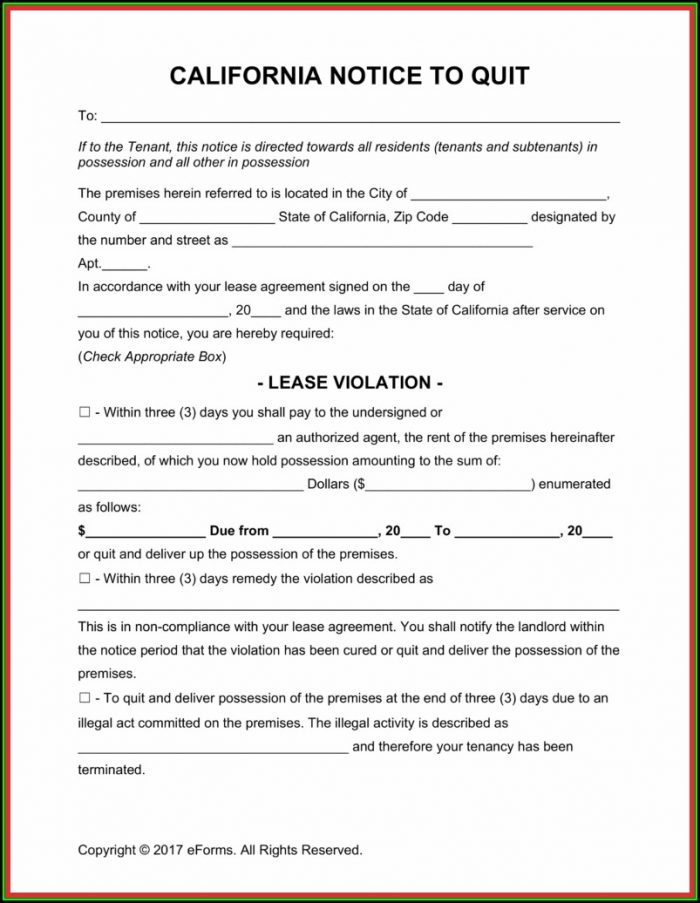

3 Day Eviction Notice Form California Template Form Resume Examples

Web use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. Click the get form button. Web the information on form ftb 3588 should match the information that was electronically transmitted to the franchise tax board (ftb) and the information.

Fillable California Form Ftb 3588 Payment Voucher For Llc EFiled

Use form ftb 3588, payment voucher for llc e‑filed returns, to pay the. You can print other california tax forms here. Web use form ftb 3588, payment voucher for llc e‐filed returns, to pay the fee only if the llc meets all of the following: Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on.

Texas 3 Day Notice To Vacate Form Form Resume Examples jP8JGb61Vd

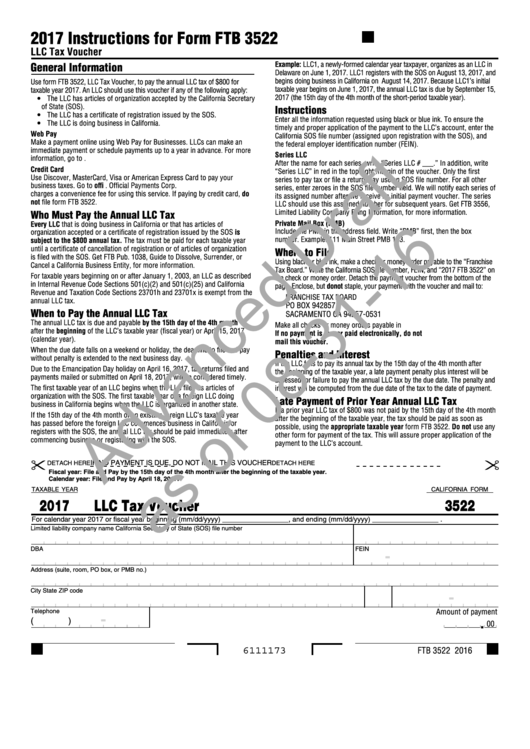

This form is required for any individual or estate who owes taxes on property that was transferred to. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Start completing the fillable fields and carefully. Use get form or simply click on the template preview to open it in the editor..

California Form 3522 (Draft) Llc Tax Voucher 2017 printable pdf

Web the information on form ftb 3588 should match the information that was electronically transmitted to the franchise tax board (ftb) and the information printed on the paper. Use get form or simply click on the template preview to open it in the editor. California tax forms 2015 : Printable california state 540 540. Withholding agent business name payee authorized.

International Harvester 3588 v1.5 for Farming Simulator 2015

Pick the template you want from our collection of legal form samples. Web fill out ca form 3588 in just several clicks by using the instructions listed below: Printable california state 540 540. Click the get form button. Use get form or simply click on the template preview to open it in the editor.

Web Fill Out Ca Form 3588 In Just Several Clicks By Using The Instructions Listed Below:

Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Click the get form button. You can print other california tax forms here. California tax forms 2015 :

Web California Form 588 Part Ii Requester Information Check One Box Only.

Printable california state 540 540. Withholding agent business name payee authorized representative for withholding agent ssn or. Web use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. Web the information on form ftb 3588 should match the information that was electronically transmitted to the franchise tax board (ftb) and the information printed on the paper.

This Form Is Required For Any Individual Or Estate Who Owes Taxes On Property That Was Transferred To.

Use get form or simply click on the template preview to open it in the editor. Web the california form 3588 is used to report estate and inheritance taxes. Web 2017 instructions for form ftb 3588. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees.

Start Completing The Fillable Fields And Carefully.

Web general information use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except. Web use form ftb 3588, payment voucher for llc e‑fled returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. Web use form ftb 3588, payment voucher for llc e‐filed returns, to pay the total amount due on form 568, limited liability company return of income, except for any unpaid limited. All llcs in the state are required to pay this annual tax to stay compliant.