California Form 100S

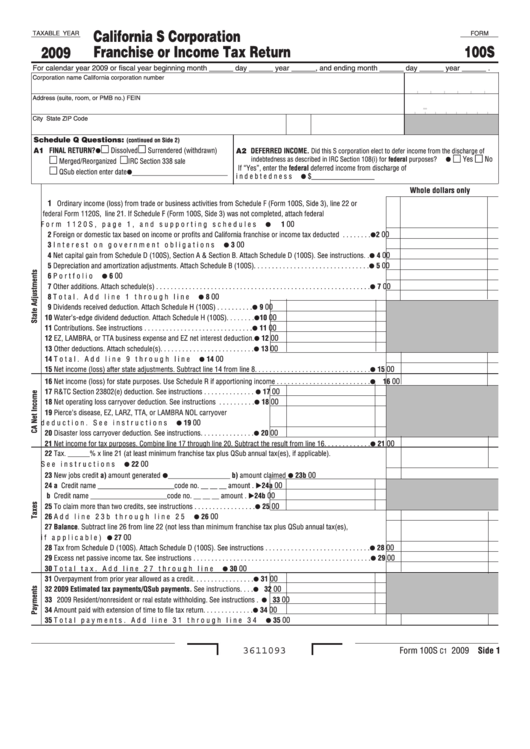

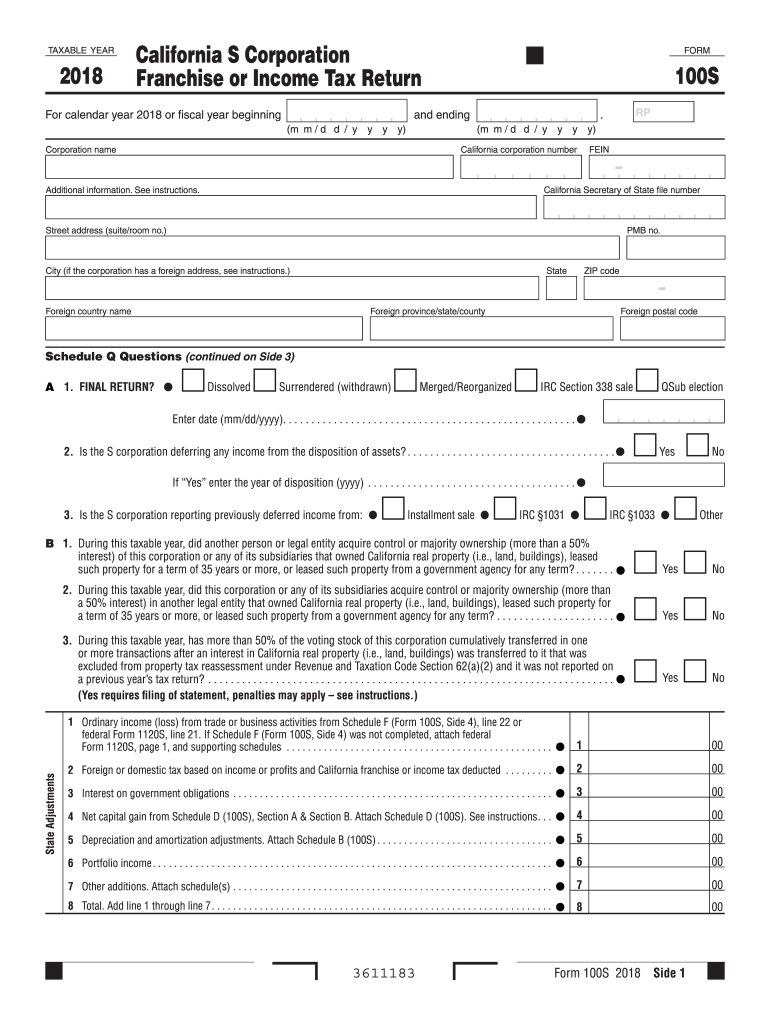

California Form 100S - See the links below for the california ftb form. All federal s corporations subject to california laws must file form 100s. Web ca form 100s, california s corporation franchise or income tax return. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Web here are the california form 100s instructions to fill it out online: Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Web marking s corporate form 100s as an initial return in proconnect. Upload, modify or create forms. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax.

Find and select form 100s california s corporation franchise or income tax return. Web marking s corporate form 100s as an initial return in proconnect. Upload, modify or create forms. See the links below for the california ftb form. • dissolved surrendered (withdrawn) merged/reorganized irc section 338. All federal s corporations subject to california laws must file form 100s. Web included in the form 100s, s corporation tax booklet. Try it for free now! Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Ad download or email ca 100s & more fillable forms, register and subscribe now!

Web ca form 100s, california s corporation franchise or income tax return. References in these instructions are to the internal revenue code (irc) as of. Corporations that incorporated or qualified. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web california s corporation franchise or income tax return form 100s a 1. Try it for free now! • form 100s, california s corporation franchise or income. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. All federal s corporations subject to california laws must file form 100s. • dissolved surrendered (withdrawn) merged/reorganized irc section 338.

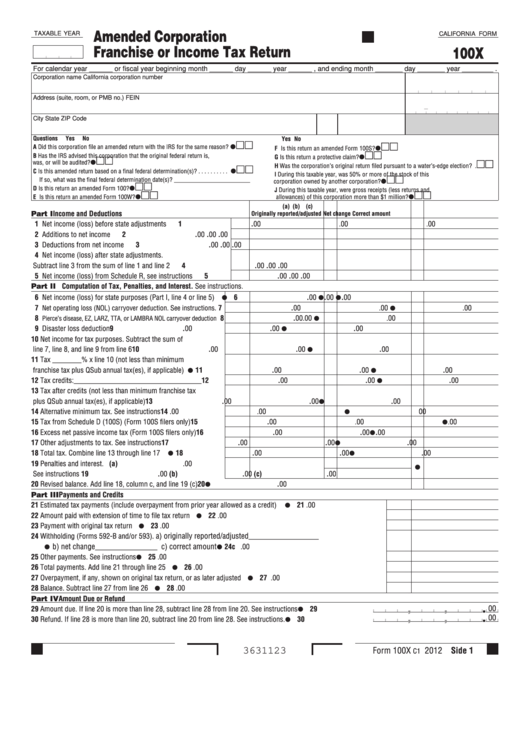

Fillable California Form 100x Amended Corporation Franchise Or

References in these instructions are to the internal revenue code (irc) as of. Try it for free now! Web ca form 100s, california s corporation franchise or income tax return. Ad download or email ca 100s & more fillable forms, register and subscribe now! Solved • by intuit • 2 • updated march 21, 2023.

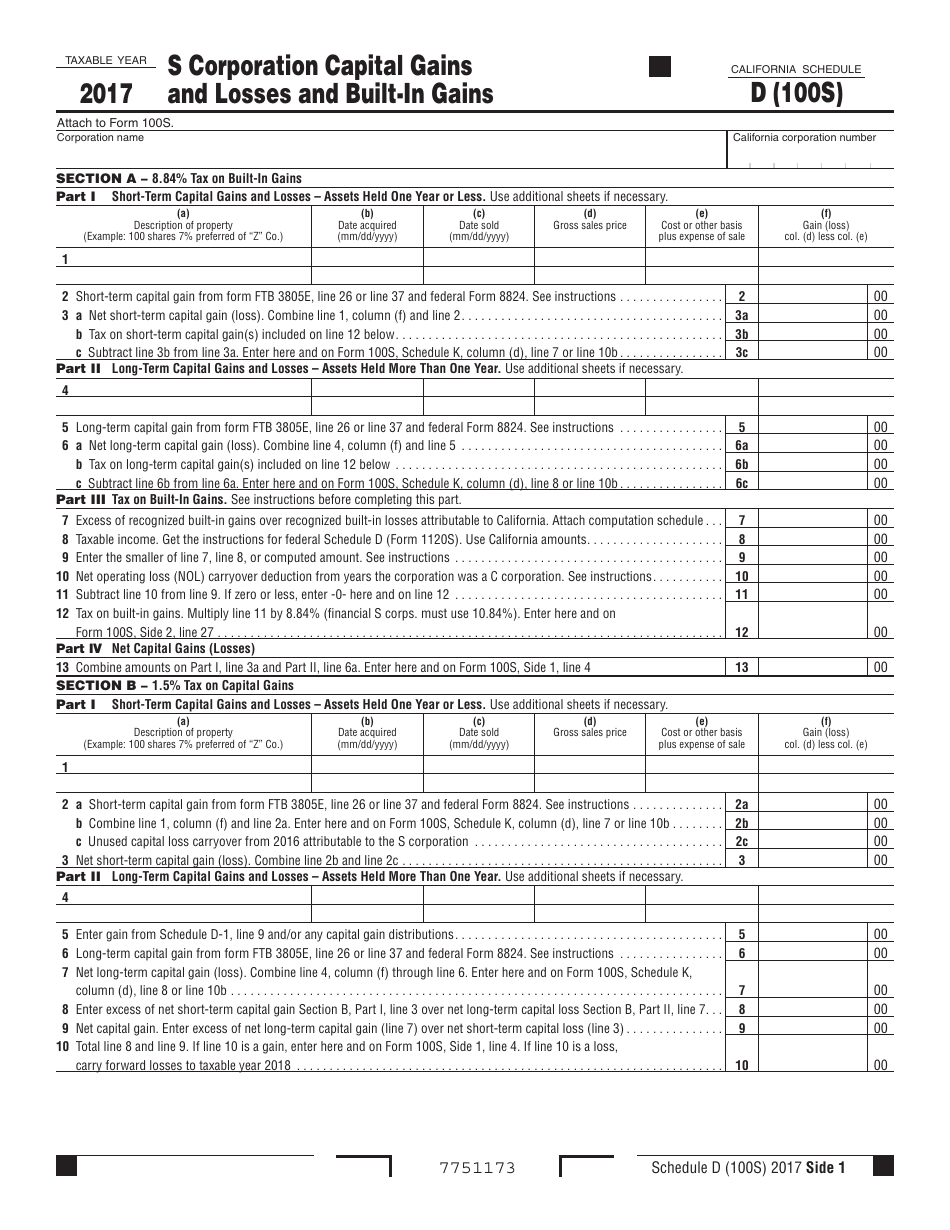

Form 100S Schedule D Download Printable PDF or Fill Online S

Upload, modify or create forms. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. • dissolved surrendered (withdrawn) merged/reorganized irc section 338. Updated 5 months ago by greg hatfield. Ad download or email ca 100s & more fillable forms, register.

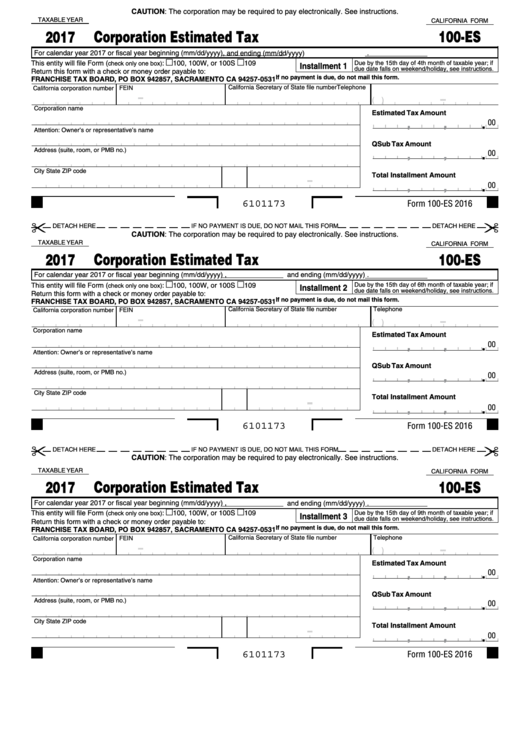

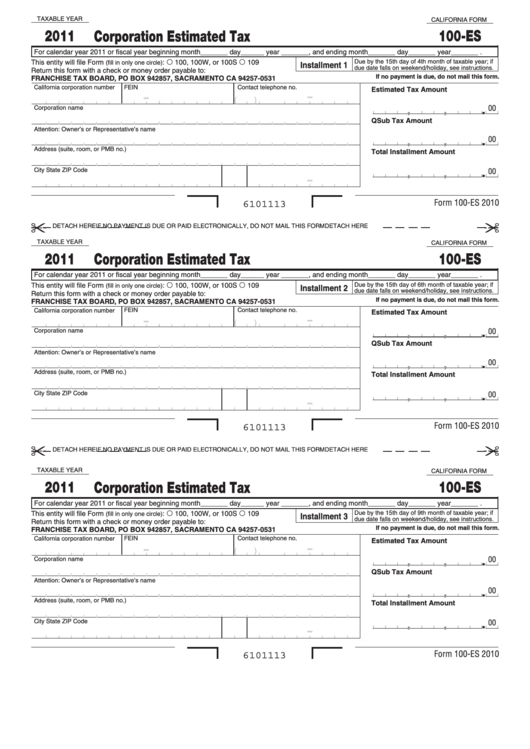

Fillable California Form 100 Es Corporate Esitimated Tax Franchise

Web 100s form (pdf) | 100s booklet (instructions included) federal: See the links below for the california ftb form. Upload, modify or create forms. California s corporation franchise or income tax return. Updated 5 months ago by greg hatfield.

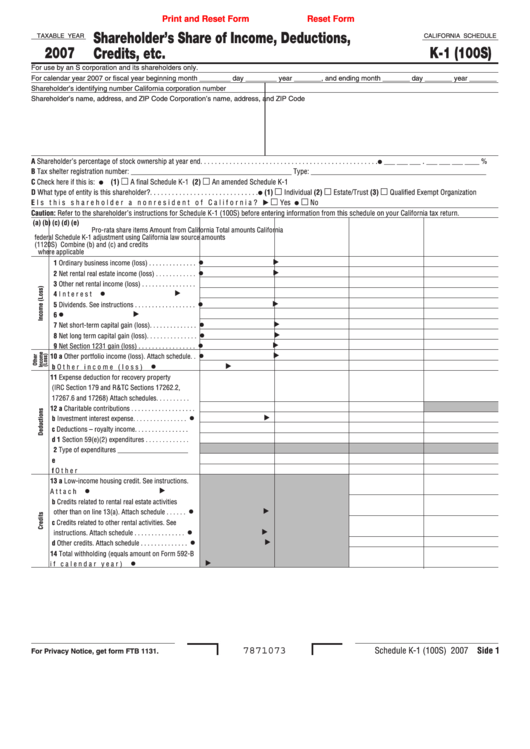

Fillable California Schedule K1 (Form 100s) Shareholder'S Share Of

Upload, modify or create forms. Web included in the form 100s, s corporation tax booklet. Ad download or email ca 100s & more fillable forms, register and subscribe now! Try it for free now! Web marking s corporate form 100s as an initial return in proconnect.

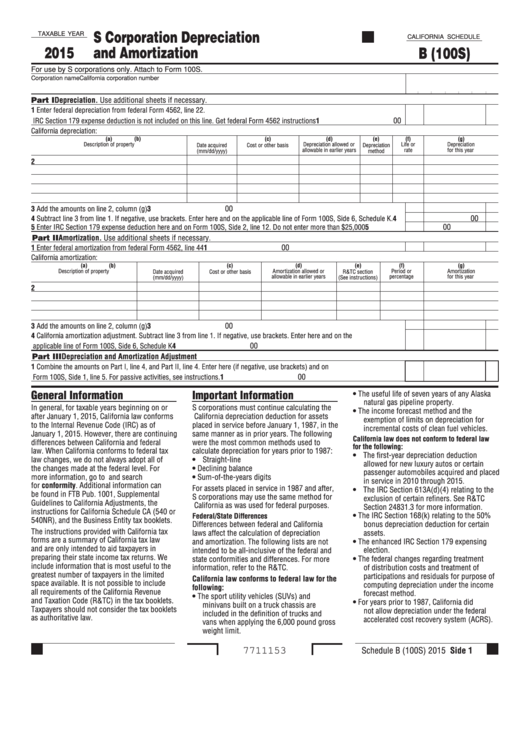

Fillable Schedule B (100s) California S Corporation Depreciation And

Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Find and select form 100s california s corporation franchise or income tax return. All federal s corporations subject to california laws must file form 100s. Web we last updated.

FL100 Form Completion Tutorial California Divorce Tutor Online

See the links below for the california ftb form. Web marking s corporate form 100s as an initial return in proconnect. Try it for free now! Upload, modify or create forms. Find and select form 100s california s corporation franchise or income tax return.

Fillable Form 100s California S Corporation Franchise Or Tax

Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Web you must file california s corporation franchise or income tax.

California Form 100s Instructions PDF Fill Out and Sign Printable PDF

Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Web 100s form (pdf) | 100s booklet (instructions included) federal: California s corporation franchise or income tax return. Ad download or email ca 100s & more fillable forms, register and subscribe now! Web ca form 100s, california s corporation franchise or income.

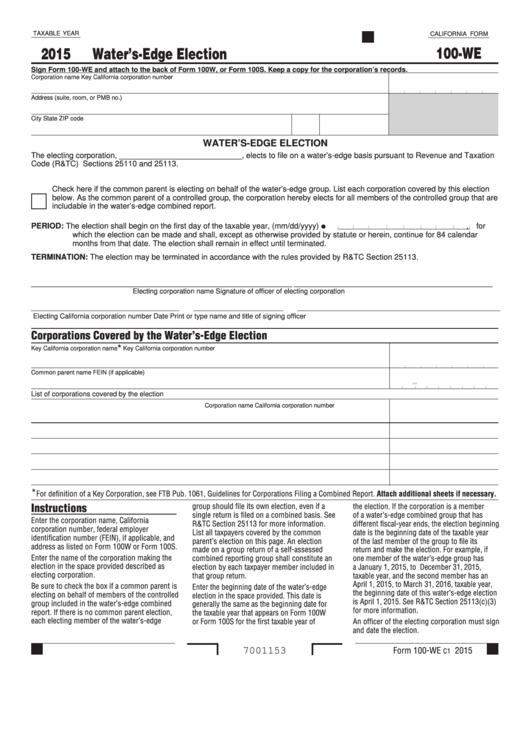

Fillable Form 100We California Water'SEdge Election 2015

Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Find and select form 100s california s corporation franchise or income tax return. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax..

Fillable California Form 100Es Corporation Estimated Tax 2011

Ad download or email ca 100s & more fillable forms, register and subscribe now! See the links below for the california ftb form. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Web all federal s corporations subject to.

Try It For Free Now!

Updated 5 months ago by greg hatfield. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). A corporation with a valid federal s corporation election is considered an s corporation for california. All federal s corporations subject to california laws must file form 100s.

Original Due Date Is The 15Th Day Of The 3Rd Month After The Close Of The Taxable Year And Extended Due Date Is The 15Th Day Of The 9Th Month After The Close Of The Taxable.

Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to. Corporations that incorporated or qualified. Solved • by intuit • 2 • updated march 21, 2023. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022.

Web Ca Form 100S, California S Corporation Franchise Or Income Tax Return.

Web 100s form (pdf) | 100s booklet (instructions included) federal: Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: See the links below for the california ftb form. Ad download or email ca 100s & more fillable forms, register and subscribe now!

Upload, Modify Or Create Forms.

Web included in the form 100s, s corporation tax booklet. References in these instructions are to the internal revenue code (irc) as of. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. Web here are the california form 100s instructions to fill it out online: