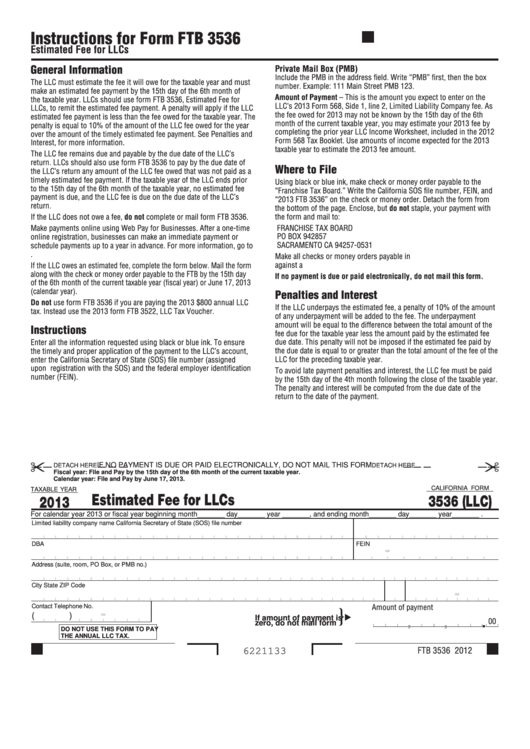

Ca Form 3536

Ca Form 3536 - Web file form ftb 3536. Llcs must file form 3536 within six months after formation. Web your annual llc tax will be due on september 15, 2020 (15th day of the 4th month) your subsequent annual tax payments will continue to be due on the 15th day of the 4th month of your taxable year. Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Form 3536 only needs to be filed if your income is $250,000 or more. To ensure the timely and proper application of the payment to the llc’s account, enter the 16, 2023, to file and pay taxes. Amounts will carry to the ca 568, line 6 and produce a detailed statement. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Use form ftb 3536 if you are paying the 2022 $800 annual llc tax.

Exempt organizations forms and payments. Web look for form 3536 and click the link to download; Enter all the information requested using black or blue ink. Instead use the 2022 form ftb 3522, llc tax voucher. This form is due by the “15th day of the 6th month” after your llc is approved. Form 3536 only needs to be filed if your income is $250,000 or more. Afterward, llcs will need to file form 3536 by june 15 every year. Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income. Llcs must file form 3536 within six months after formation. 16, 2023, to file and pay taxes.

Use form ftb 3536 if you are paying the 2022 $800 annual llc tax. Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income. Llcs must file form 3536 within six months after formation. Form 3536 only needs to be filed if your income is $250,000 or more. Ftb 3536, estimated fee for llcs. Enter all the information requested using black or blue ink. Web file form ftb 3536. It summarizes your california llc’s financial activity during a taxable year. Web your california llc will need to file form 3536 if your llcs make more than $250,000 in annual gross receipts. In this form, you’ll report the:

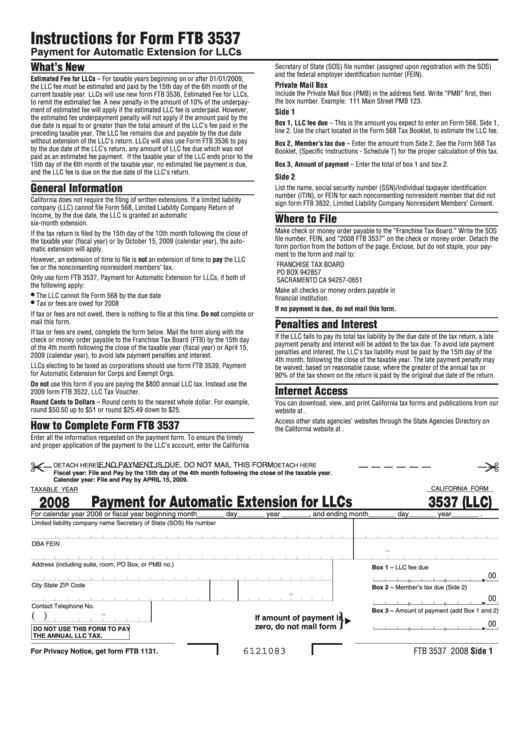

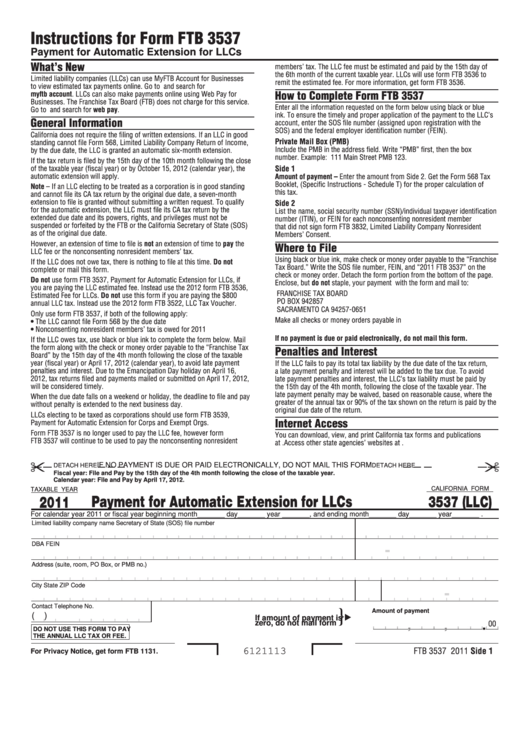

Form 3537 California Fill Out and Sign Printable PDF Template signNow

Exempt organizations forms and payments. Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year. Web corporation tax return and payments. It summarizes your california llc’s financial activity during a taxable year. Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income.

2017 Form 3536 Estimated Fee For Ll Cs Edit, Fill, Sign Online Handypdf

This form is due by the “15th day of the 6th month” after your llc is approved. Afterward, llcs will need to file form 3536 by june 15 every year. 16, 2023, to file and pay taxes. Llcs use ftb 3536 to. It summarizes your california llc’s financial activity during a taxable year.

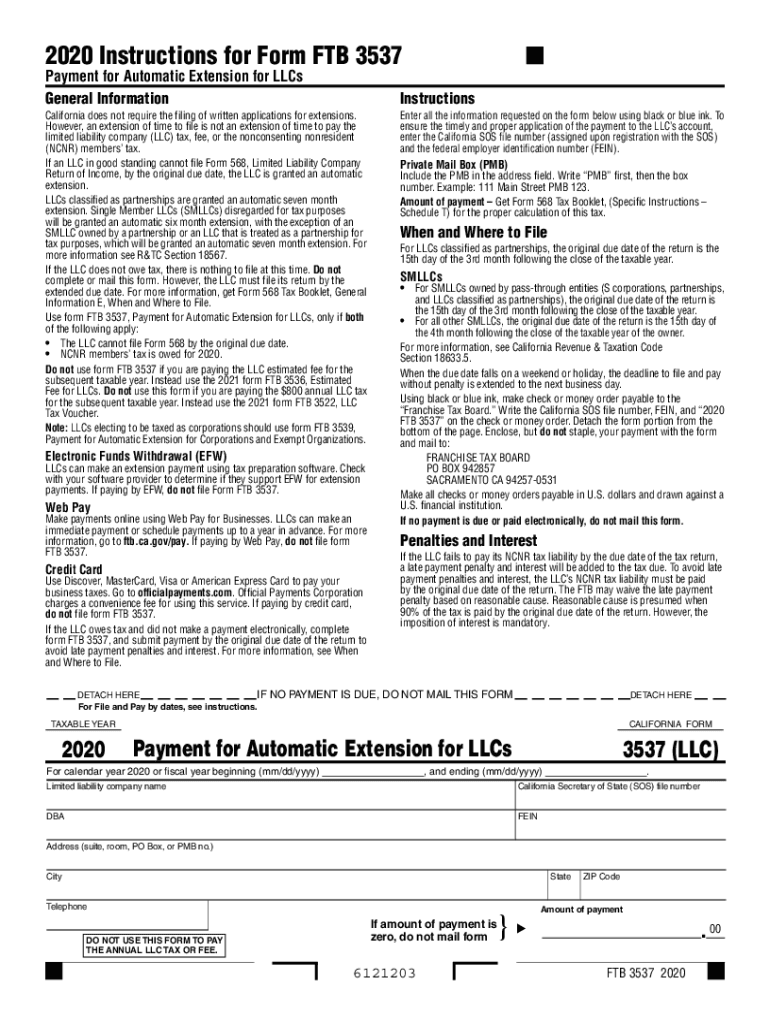

Fillable California Form 3537 (Llc) Payment For Automatic Extension

Llcs use ftb 3536 to. Web file form ftb 3536. For tax years that begin on or after january 1, 2009, llcs must estimate and pay their applicable fee by the 15th day of the 6th month of the current tax year. Instead use the 2022 form ftb 3522, llc tax voucher. Exempt organizations forms and payments.

Fillable California Form 3537 (Llc) Payment For Automatic Extension

Afterward, llcs will need to file form 3536 by june 15 every year. This form is due by the “15th day of the 6th month” after your llc is approved. For tax years that begin on or after january 1, 2009, llcs must estimate and pay their applicable fee by the 15th day of the 6th month of the current.

California Form 3536 (Llc) Estimated Fee For Llcs 2013 printable

Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income. For tax years that begin on or after january 1, 2009, llcs must estimate and pay their applicable fee by the 15th day of the 6th month of the current tax year. It summarizes your california llc’s financial activity.

CreekBridge Village Apartments Apartments in Salinas, CA

Amounts will carry to the ca 568, line 6 and produce a detailed statement. 16, 2023, to file and pay taxes. Enter all the information requested using black or blue ink. Llcs must file form 3536 within six months after formation. Instead use the 2022 form ftb 3522, llc tax voucher.

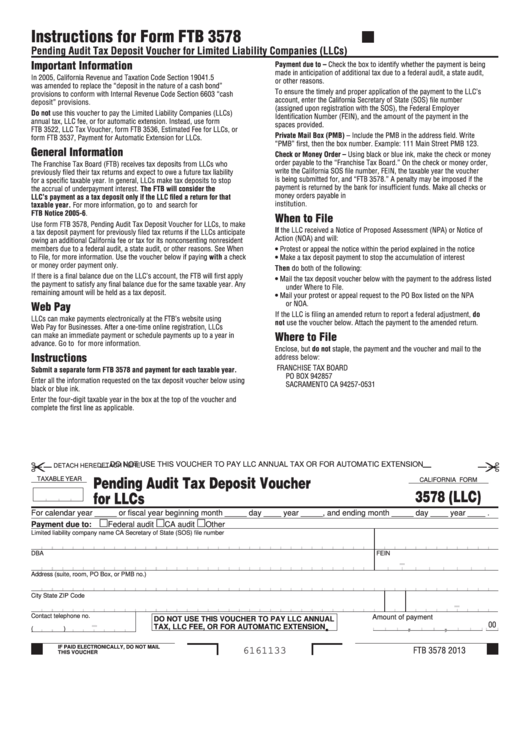

California Form 3578 Pending Audit Tax Deposit Voucher For Llcs

16, 2023, to file and pay taxes. In this form, you’ll report the: Llc return of income (fee varies) each year, all llcs must also file form 568, called the llc return of income. When are my estimate payments due? Web the fee is $900 for llcs that make between $250,000 and $500,000 during the year.

CA Form 1073 20142021 Complete Legal Document Online US Legal Forms

The annual tax payment is due with llc tax voucher (ftb 3522). For tax years that begin on or after january 1, 2009, llcs must estimate and pay their applicable fee by the 15th day of the 6th month of the current tax year. Web your california llc will need to file form 3536 if your llcs make more than.

Ca Form 3536 2022

In this form, you’ll report the: 16, 2023, to file and pay taxes. It summarizes your california llc’s financial activity during a taxable year. Afterward, llcs will need to file form 3536 by june 15 every year. Web corporation tax return and payments.

If he had a physical form I would’ve strangled the brat MassEffectMemes

Instead use the 2022 form ftb 3522, llc tax voucher. Web look for form 3536 and click the link to download; It summarizes your california llc’s financial activity during a taxable year. In this form, you’ll report the: For tax years that begin on or after january 1, 2009, llcs must estimate and pay their applicable fee by the 15th.

Web Your California Llc Will Need To File Form 3536 If Your Llcs Make More Than $250,000 In Annual Gross Receipts.

Web corporation tax return and payments. Form 3536 only needs to be filed if your income is $250,000 or more. Instead use the 2022 form ftb 3522, llc tax voucher. To ensure the timely and proper application of the payment to the llc’s account, enter the

Llc Return Of Income (Fee Varies) Each Year, All Llcs Must Also File Form 568, Called The Llc Return Of Income.

Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Web we last updated the estimated fee for llcs in april 2023, so this is the latest version of form 3536, fully updated for tax year 2022. Llcs must file form 3536 within six months after formation. Amounts will carry to the ca 568, line 6 and produce a detailed statement.

Web File Form Ftb 3536.

Llcs use ftb 3536 to. The annual tax payment is due with llc tax voucher (ftb 3522). The fee is $2,500 for llcs that make between $500,000 and $1,000,000 during the tax year. Afterward, llcs will need to file form 3536 by june 15 every year.

When Are My Estimate Payments Due?

You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. Ftb 3536, estimated fee for llcs. Web look for form 3536 and click the link to download; Use form ftb 3536 if you are paying the 2022 $800 annual llc tax.

.jpg?crop=(0,0,300,200)&cropxunits=300&cropyunits=200&quality=85&scale=both&)