Beginning Capital Account Form 1065

Beginning Capital Account Form 1065 - Web each year you should begin with the beginning of year capital account amount and then add or subtract the appropriate transactions noted above. Web form 1065 2022 u.s. Beginning in 2020 form 1065, we’ve got a new reporting requirement. Web on form 1065, the beginning balance amount should normally match the amount entered as the beginning balance on schedule l, line 21. Web in the amounts to allocatelist, select capital account (sch. The reporting requirements for certain partnerships regarding partners' capital accounts have been clarified. Web if a partner's ending percentage of ownership was zero, you'll need to specially allocate the correct amount of beginning capital. Computing tax basis capital accounts. Form 8949, sales and other dispositions of capital. Web to review or modify entries made in the taxact program relating to partner capital accounts:

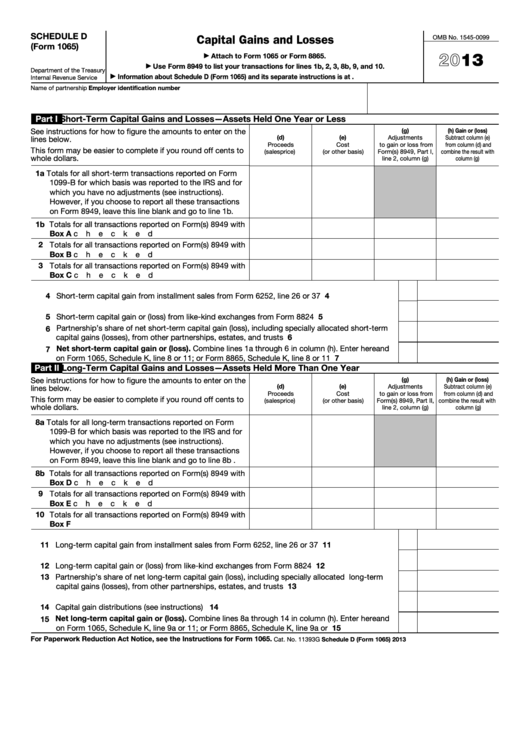

Web schedule d (form 1065), capital gains and losses (if required). Web as per the form 1065 revised instructions, if a partnership calculated the partner’s capital account for last year using the tax basis method, the partner’s ending capital account. Computing tax basis capital accounts. Return of partnership income department of the treasury internal revenue service. Web each year you should begin with the beginning of year capital account amount and then add or subtract the appropriate transactions noted above. Web form 1065 2022 u.s. Beginning in 2020 form 1065, we’ve got a new reporting requirement. For calendar year 2022, or tax year beginning. The reporting requirements for certain partnerships regarding partners' capital accounts have been clarified. Web new method provided for tax basis capital reporting.

For many taxpayers, this may. For calendar year 2022, or tax year beginning. Web new method provided for tax basis capital reporting. Web on form 1065, the beginning balance amount should normally match the amount entered as the beginning balance on schedule l, line 21. Web as per the form 1065 revised instructions, if a partnership calculated the partner’s capital account for last year using the tax basis method, the partner’s ending capital account. Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web on october 22, the irs released a draft of form 1065, u.s. Choose the amount you'd like to allocate first, such as beginning capital. Web in the amounts to allocatelist, select capital account (sch. Web partner’s capital account analysis.

Llc Capital Account Spreadsheet within How To Fill Out An Llc 1065 Irs

Web on october 22, the irs released a draft of form 1065, u.s. Return of partnership income department of the treasury internal revenue service. For many taxpayers, this may. Web new form 1065 requirement: If the return was completed the the.

Schedule Of Real Estate Owned Spreadsheet Spreadsheet Downloa schedule

Return of partnership income instructions for the 2020 tax year, which contain the irs’s. Form 4797, sales of business property (if required). Return of partnership income department of the treasury internal revenue service. Web on october 22, the irs released a draft of form 1065, u.s. Click the ptr alloc button, and allocate this amount by absolute.

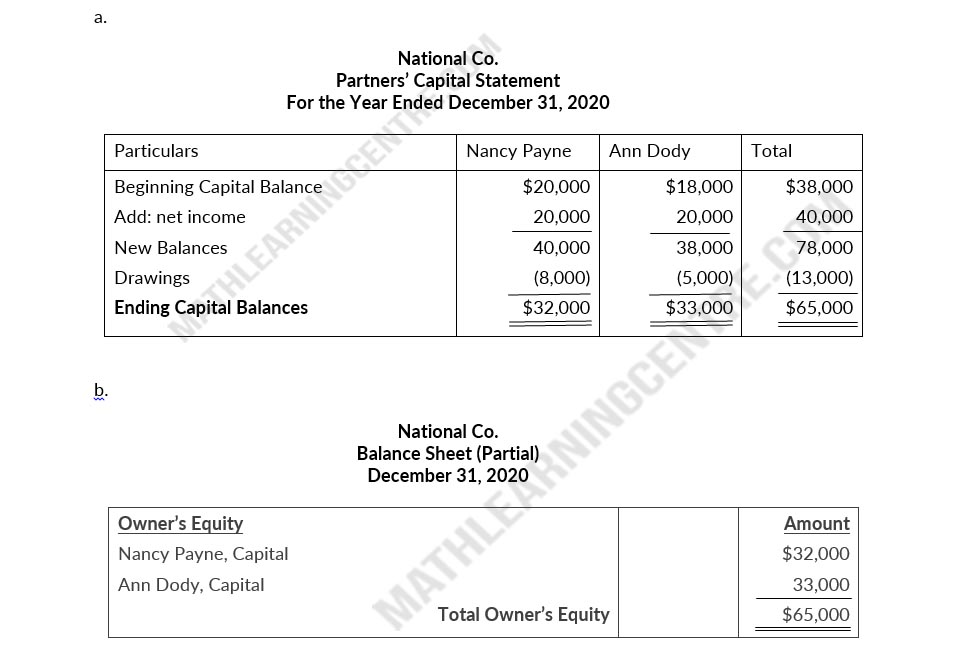

For National Co., beginning capital balances on January 1, 2019, are

Return of partnership income instructions for the 2020 tax year, which contain the irs’s. If the return was completed the the. Web to review or modify entries made in the taxact program relating to partner capital accounts: Form 4797, sales of business property (if required). Web on october 22, the irs released a draft of form 1065, u.s.

Form 1065 Tax Software Universal Network

The irs has released an early draft of the instructions to form 1065, “u.s. For calendar year 2022, or tax year beginning. Beginning in 2020 form 1065, we’ve got a new reporting requirement. Choose the amount you'd like to allocate first, such as beginning capital. Web to review or modify entries made in the taxact program relating to partner capital.

Form 8865 (Schedule K1) Partner's Share of Deductions and

If the return was completed the the. Web new form 1065 requirement: Click the ptr alloc button, and allocate this amount by absolute. The irs has released an early draft of the instructions to form 1065, “u.s. For calendar year 2022, or tax year beginning.

Fillable Schedule D (Form 1065) Capital Gains And Losses 2013

Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web if a partner's ending percentage of ownership was zero, you'll need to specially allocate the correct amount of beginning capital. Web in the amounts to allocatelist, select capital account (sch. The reporting requirements for certain partnerships regarding partners' capital accounts have been.

How to Fill Out Form 1065 for Partnership Tax Return YouTube

Web form 1065 2022 u.s. Web partner’s capital account analysis. Web washington — the irs released today an early draft of the instructions to form 1065, u.s. You then will reach the end of. Web on october 22, the irs released a draft of form 1065, u.s.

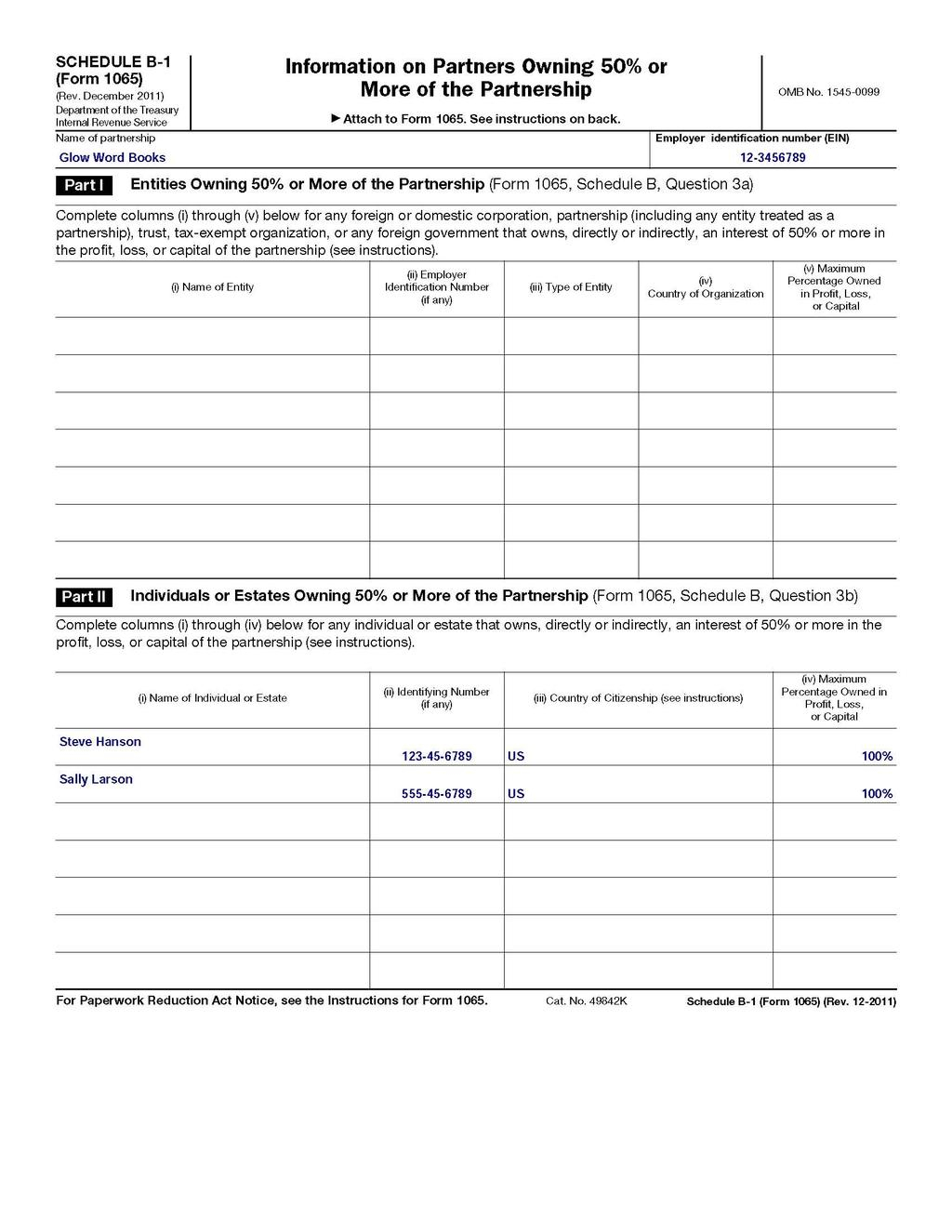

Form 1065 (Schedule B1) Information on Partners Owning 50 or More

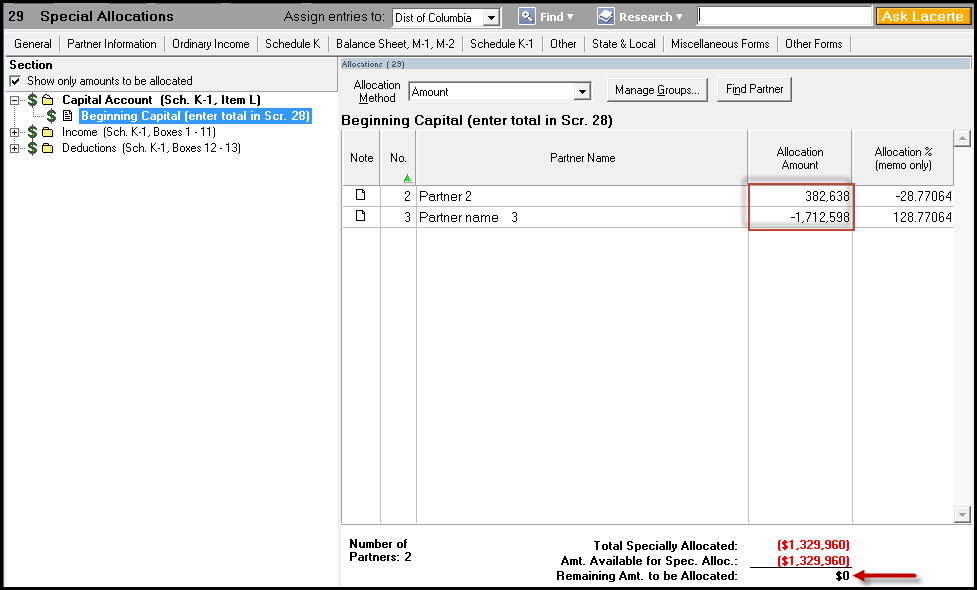

Web if a partner's ending percentage of ownership was zero, you'll need to specially allocate the correct amount of beginning capital. Web to review or modify entries made in the taxact program relating to partner capital accounts: For calendar year 2022, or tax year beginning. Web on form 1065, the beginning balance amount should normally match the amount entered as.

Llc Capital Account Spreadsheet —

Return of partnership income instructions for the 2020 tax year, which contain the irs’s. Web form 1065 2022 u.s. Web on october 22, the irs released a draft of form 1065, u.s. Web if a partner's ending percentage of ownership was zero, you'll need to specially allocate the correct amount of beginning capital. The reporting requirements for certain partnerships regarding.

Beginning Capital Account Showing Zero on Item L of Schedule K1 for a

Click the ptr alloc button, and allocate this amount by absolute. Web on october 22, the irs released a draft of form 1065, u.s. To learn more, refer to. Web new form 1065 requirement: Return of partnership income instructions for the 2020 tax year, which contain the irs’s.

Click The Ptr Alloc Button, And Allocate This Amount By Absolute.

Web to review or modify entries made in the taxact program relating to partner capital accounts: The reporting requirements for certain partnerships regarding partners' capital accounts have been clarified. Web new form 1065 requirement: Web form 1065 2022 u.s.

Web Schedule D (Form 1065), Capital Gains And Losses (If Required).

Web on october 22, the irs released a draft of form 1065, u.s. Web in the amounts to allocatelist, select capital account (sch. Web washington — the irs released today an early draft of the instructions to form 1065, u.s. Web new method provided for tax basis capital reporting.

For Calendar Year 2022, Or Tax Year Beginning.

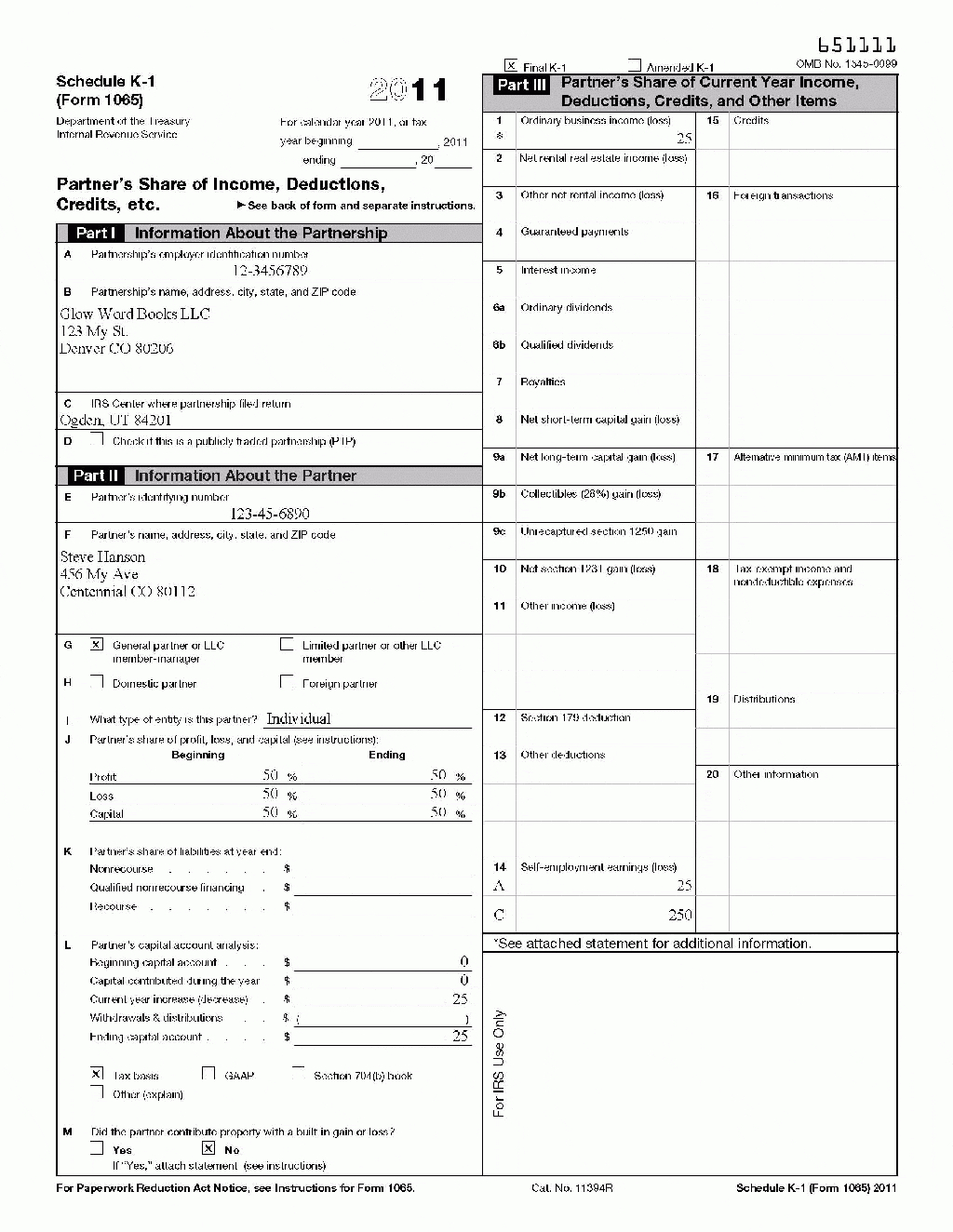

Web partner’s capital account analysis. Web if a partner's ending percentage of ownership was zero, you'll need to specially allocate the correct amount of beginning capital. The irs has released an early draft of the instructions to form 1065, “u.s. Web for tax years beginning in 2020, the irs is requiring partnerships filing form 1065 to report partners' capital accounts on the tax basis (which is what the irs refers to as the.

To Learn More, Refer To.

Computing tax basis capital accounts. Beginning in 2020 form 1065, we’ve got a new reporting requirement. Web as per the form 1065 revised instructions, if a partnership calculated the partner’s capital account for last year using the tax basis method, the partner’s ending capital account. You then will reach the end of.