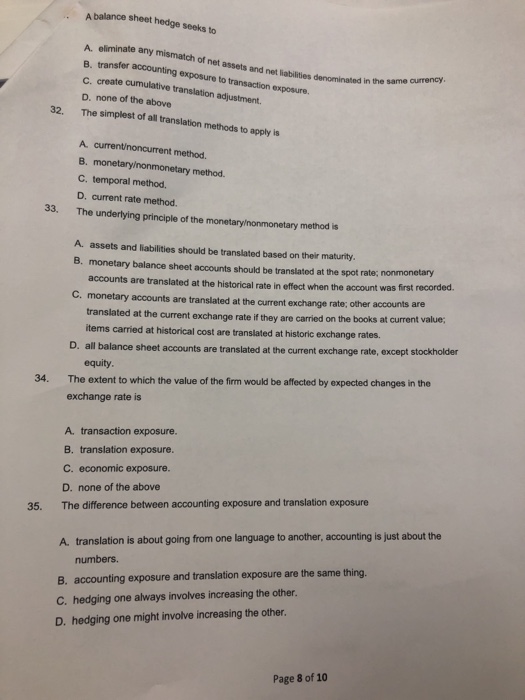

Balance Sheet Hedge

Balance Sheet Hedge - Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect costs are worth discussing: It can be an interest rate. The opportunity cost of holding margin capital and lost upside.

It can be an interest rate. The opportunity cost of holding margin capital and lost upside. Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate.

Foreign exchange risk online presentation

Web two kinds of indirect costs are worth discussing: It can be an interest rate. The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

Technical Balance sheet Hedge Fund Telemetry

Web two kinds of indirect costs are worth discussing: It can be an interest rate. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The opportunity cost of holding margin capital and lost upside.

Solved A balance sheet hedge seeks to nate any mismatch of

It can be an interest rate. Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

Mutual Funds Accounting ( Simplified ) Accounting Education

It can be an interest rate. The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect costs are worth discussing:

4 Steps to Analyse a Balance Sheet Like a Hedge Fund Manager YouTube

It can be an interest rate. The opportunity cost of holding margin capital and lost upside. Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

PPT Module III AssetLiability Management PowerPoint Presentation

It can be an interest rate. Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

How to Show Cash Flow Hedge in Financial Statements Accounting Education

The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate. Web two kinds of indirect costs are worth discussing:

Balance Sheet for Cash Flow Hedge Example PayFixed/ReceiveLIBOR Swap

Web two kinds of indirect costs are worth discussing: It can be an interest rate. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The opportunity cost of holding margin capital and lost upside.

Balance Sheet for Fair Value Hedge Example ReceiveFixed/PayLIBOR

It can be an interest rate. The opportunity cost of holding margin capital and lost upside. Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

Here's What a Hedge Fund ProfitAndLoss Statement Looks Like

Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The opportunity cost of holding margin capital and lost upside. It can be an interest rate. Web two kinds of indirect costs are worth discussing:

It Can Be An Interest Rate.

Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside.