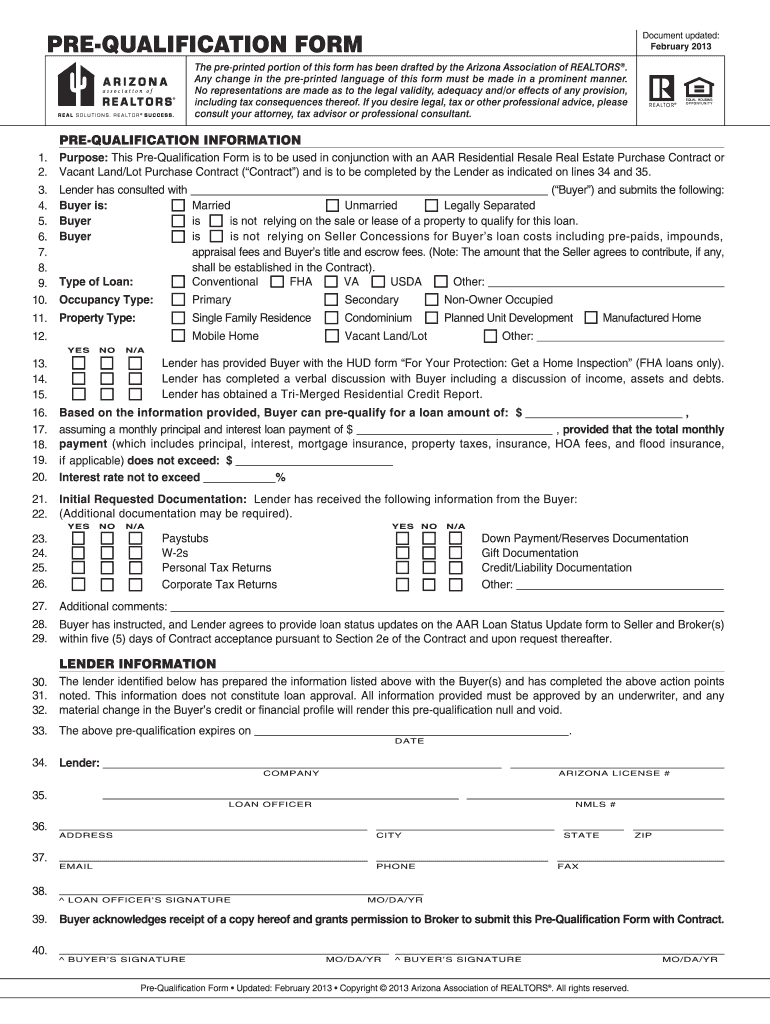

Az Tax Form 352

Az Tax Form 352 - For the calendar year 2020 or fiscal year. Web a nonrefundable individual tax credit for voluntary cash contributions to a qualifying foster care charitable organization (qfco). Web the 2021 maximum limit for this category of donations is $400 for an individual or $800 for a couple filing jointly. Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. (a) contribution date mm/dd/2022 (b) qualifying foster care charity code (c) name of qualifying foster care charity. Web specifically, arizona form 321 is used for donations to qualifying charitable organizations and the arizona form 352 is used for gifts to qualifying foster care charitable. For the calendar year 2022 or fiscal year. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 352. Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. For the calendar year 2021 or fiscal year beginning m m d d 2 0 2 1 and ending m m d d y y y y.

Approved tax software vendors booklet. Web general instructions note: Web arizona form 352 include with your return. Web arizona form credit for contributions 352to qualifying foster care charitable organizations2020 include with your return. For the calendar year 2022 or fiscal year. Web a nonrefundable individual tax credit for voluntary cash contributions to a qualifying foster care charitable organization (qfco). Web forms your responsibilities as a tax preparer penalty abatement request: Web 26 rows tax credits forms : After completing arizona form 352, taxpayers will summarize all the tax credits they are claiming (foster care tax credit, private &. For the calendar year 2021 or fiscal year beginning m m d d 2 0 2 1 and ending m m d d y y y y.

Web a nonrefundable individual tax credit for voluntary cash contributions to a qualifying foster care charitable organization (qfco). Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. Web arizona form 352 include with your return. Your name as shown on. For the calendar year 2022 or fiscal year. Web 2022 credit for contributions arizona form to qualifying foster care charitable organizations 352 for information or help, call one of the numbers listed: Write up to $1,051 personal check to catholic. (a) contribution date mm/dd/2022 (b) qualifying foster care charity code (c) name of qualifying foster care charity. Web forms your responsibilities as a tax preparer penalty abatement request: Web the 2021 maximum limit for this category of donations is $400 for an individual or $800 for a couple filing jointly.

AZ ADEQ Out of State Exemption Form 20172022 Fill and Sign Printable

Web forms your responsibilities as a tax preparer penalty abatement request: Web general instructions note: Web arizona form 352 include with your return. Web sheet on page 3 and include it with the credit form. Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning.

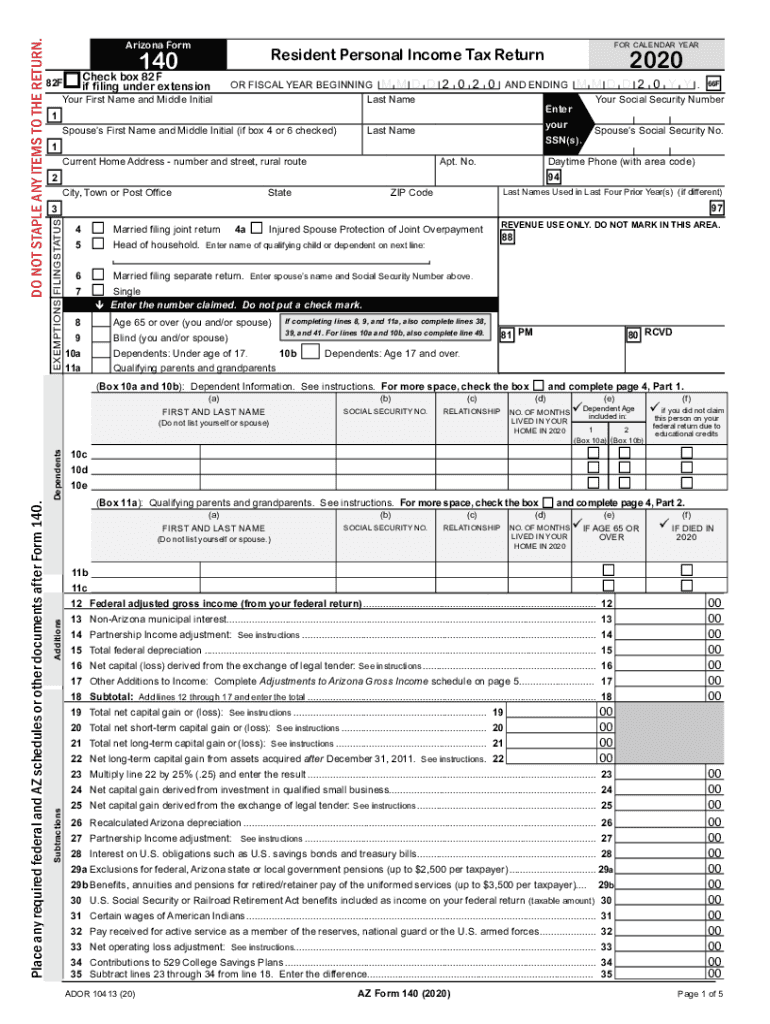

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

For the calendar year 2020 or fiscal year. Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022. Use your credit card to charge $526 (single filer) or $1,051 (joint filer). After completing.

AZ Privilege (Sales) Tax Return Glendale 20102022 Fill out Tax

Web arizona's credits under form 321 and 352 are 100% refundable so contributions may only be claimed if as federal itemized deduction if they are taken as a state tax payment on. Web 2022 credit for contributions arizona form to qualifying foster care charitable organizations 352 for information or help, call one of the numbers listed: Web arizona form 352.

Arizona Instructions Tax Form Fill Out and Sign Printable PDF

Web 26 rows individual income tax forms. Web forms your responsibilities as a tax preparer penalty abatement request: Get your tax credit now: Write up to $1,051 personal check to catholic. Web specifically, arizona form 321 is used for donations to qualifying charitable organizations and the arizona form 352 is used for gifts to qualifying foster care charitable.

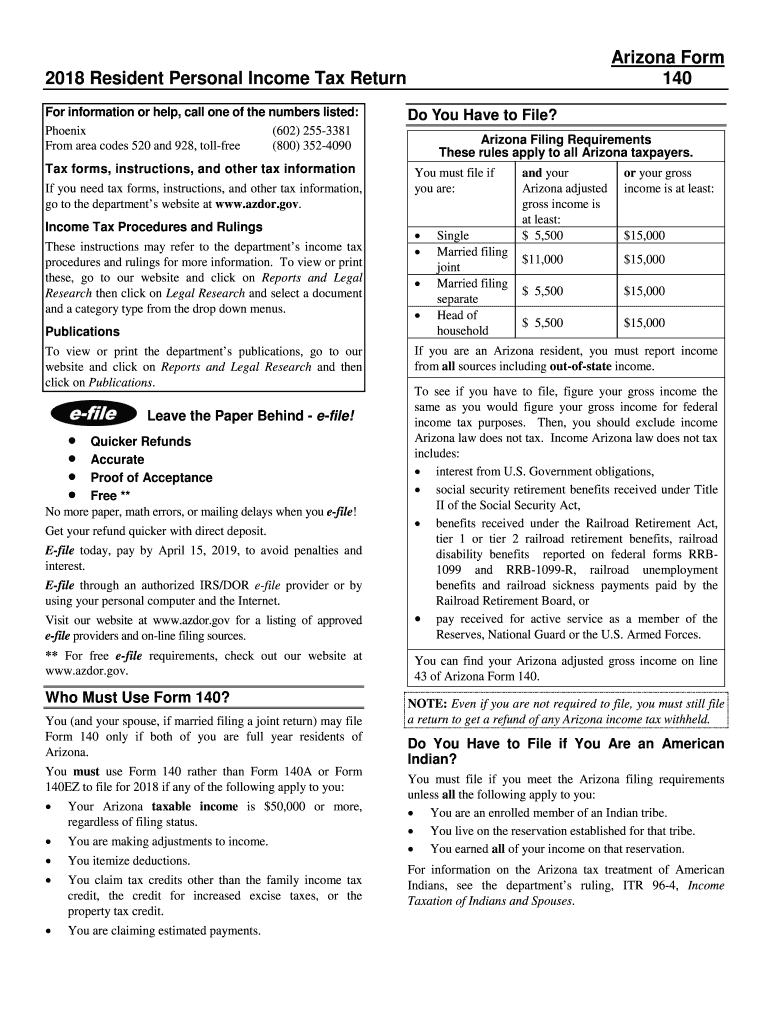

Instructions For Arizona Form 306 Military Reuse Zone Credit 2014

You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301 and 352. Web forms your responsibilities as a tax preparer penalty abatement request: The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022. Web 2022 credit for contributions arizona form to qualifying foster care.

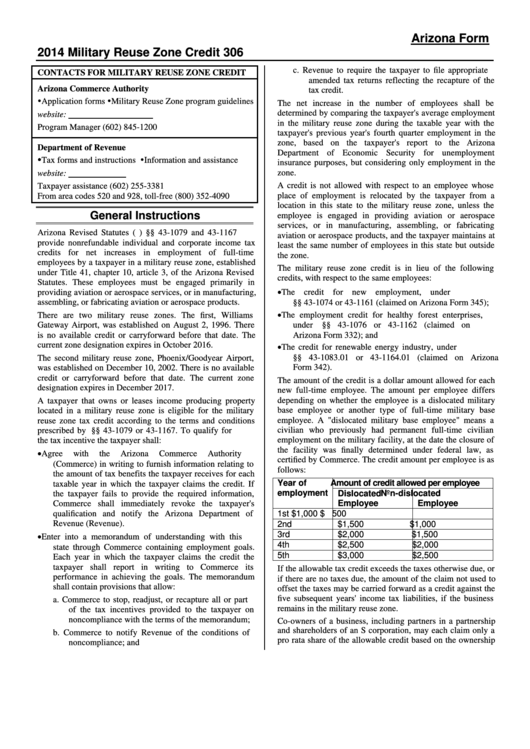

Arizona Prequalification Form 20202022 Fill and Sign Printable

(a) contribution date mm/dd/2022 (b) qualifying foster care charity code (c) name of qualifying foster care charity. Web arizona form 352 11 (1) include with your return. Web 26 rows tax credits forms : Write up to $1,051 personal check to catholic. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the.

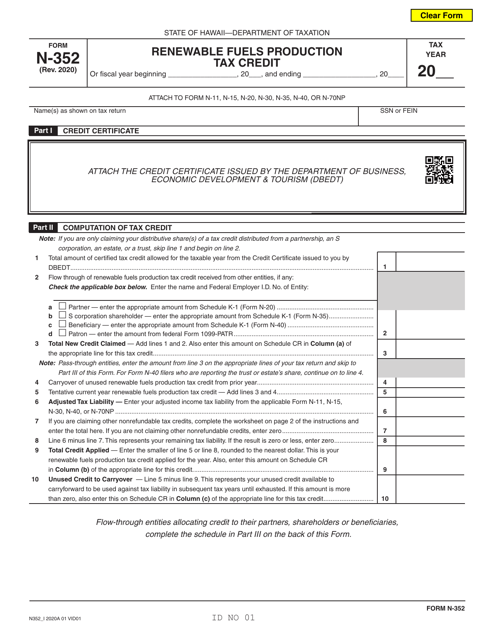

Form N352 Download Fillable PDF or Fill Online Renewable Fuels

Web specifically, arizona form 321 is used for donations to qualifying charitable organizations and the arizona form 352 is used for gifts to qualifying foster care charitable. Web arizona form credit for contributions 352to qualifying foster care charitable organizations2020 include with your return. You must also complete arizona form 301, nonrefundable individual tax credits and recapture, and include forms 301.

AZ AZNG 3352R 1992 Fill and Sign Printable Template Online US

Web 26 rows individual income tax forms. Approved tax software vendors booklet. Web arizona form credit for contributions 352to qualifying foster care charitable organizations2020 include with your return. For the calendar year 2021 or fiscal year beginning m m d d 2 0 2 1 and ending m m d d y y y y. For contributions made to non.

AZ TPT2 2016 Fill out Tax Template Online US Legal Forms

For the calendar year 2021 or fiscal year beginning m m d d 2 0 2 1 and ending m m d d y y y y. Web forms your responsibilities as a tax preparer penalty abatement request: Credit for contributions to qualifying foster care charitable organizations2019 for the calendar year 2019 or fiscal year beginning. Web arizona's credits under.

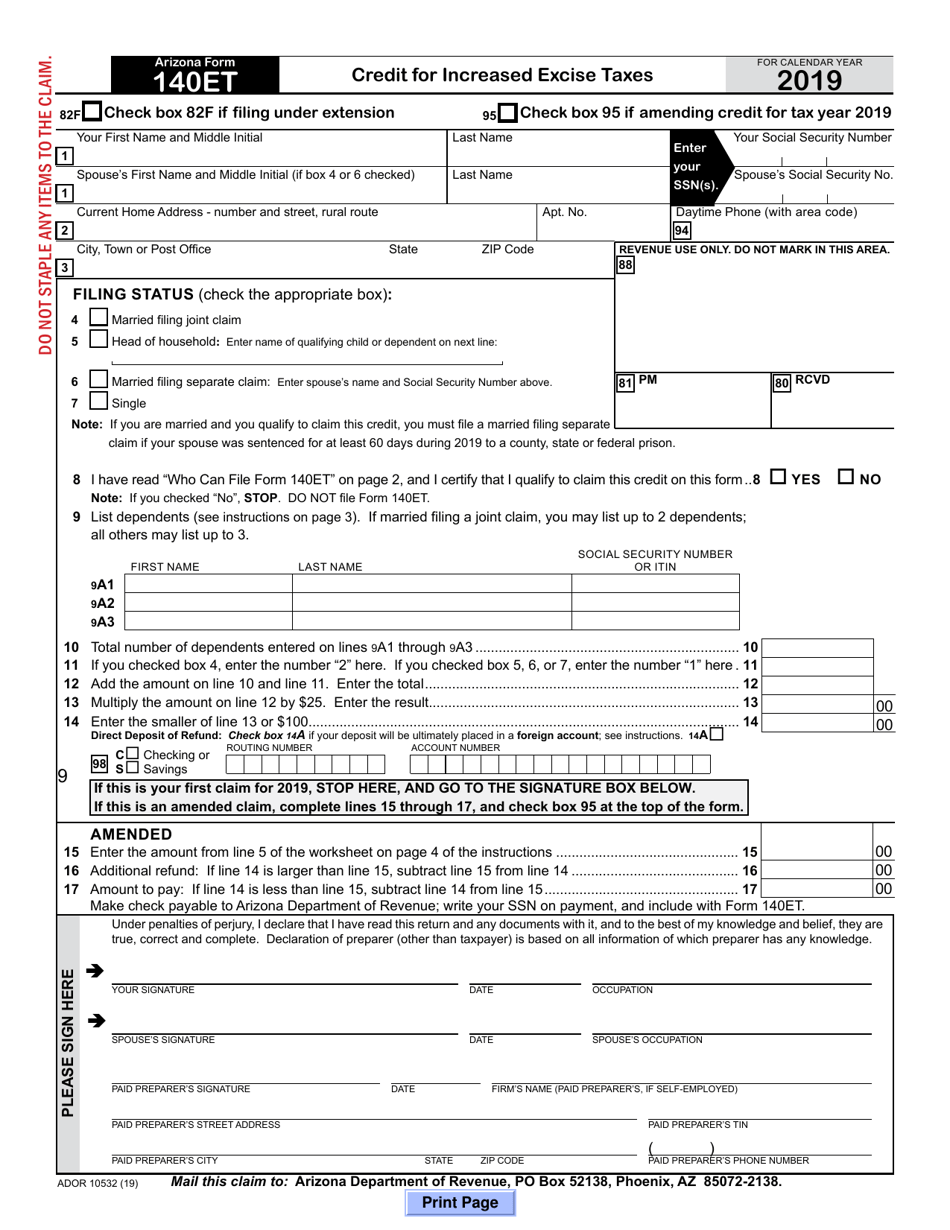

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Web 26 rows tax credits forms : For the calendar year 2022 or fiscal year. Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. For contributions made to non. Web sheet on page 3 and include it with the credit form.

After Completing Arizona Form 352, Taxpayers Will Summarize All The Tax Credits They Are Claiming (Foster Care Tax Credit, Private &.

Web general instructions note: Web forms your responsibilities as a tax preparer penalty abatement request: For the calendar year 2022 or fiscal year. For the calendar year 2021 or fiscal year beginning m m d d 2 0 2 1 and ending m m d d y y y y.

You Must Also Complete Arizona Form 301, Nonrefundable Individual Tax Credits And Recapture, And Include Forms 301 And 352.

Web the 2021 maximum limit for this category of donations is $400 for an individual or $800 for a couple filing jointly. Use your credit card to charge $526 (single filer) or $1,051 (joint filer). Your name as shown on. Web click here for form 352 and instructions.

Web A Nonrefundable Individual Tax Credit For Voluntary Cash Contributions To A Qualifying Foster Care Charitable Organization (Qfco).

Web sheet on page 3 and include it with the credit form. Web specifically, arizona form 321 is used for donations to qualifying charitable organizations and the arizona form 352 is used for gifts to qualifying foster care charitable. Web 26 rows tax credits forms : Get your tax credit now:

Write Up To $1,051 Personal Check To Catholic.

Web arizona form credit for contributions 352to qualifying foster care charitable organizations include with your return. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022. Web 26 rows individual income tax forms. (a) contribution date mm/dd/2022 (b) qualifying foster care charity code (c) name of qualifying foster care charity.