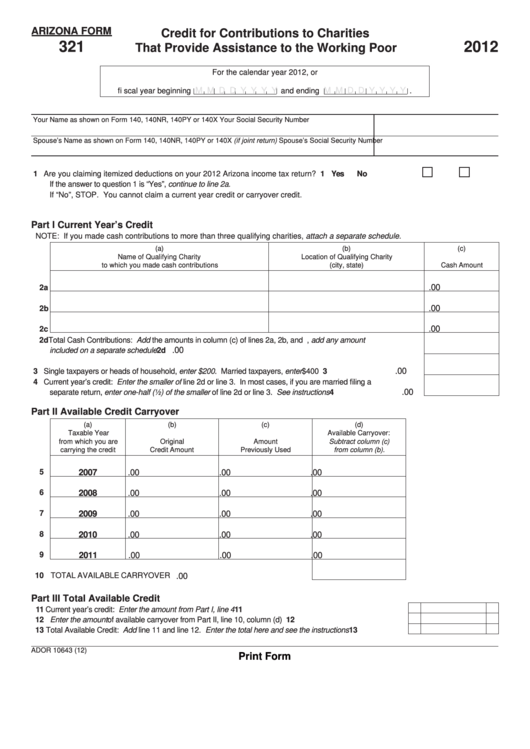

Az Tax Form 321

Az Tax Form 321 - Web complete az form 321 and include it when you file your 2022 state taxes. Save or instantly send your ready documents. Web 2022 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web arizona form credit for contributions 321to qualifying charitable organizations2019 include with your return. Web arizona tax form 321. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed: Web 26 rows tax credits forms : Web more about the arizona form 131. Complete, edit or print tax forms instantly. Web 20 votes how to fill out and sign taxable online?

Web to qualifying charitable organizations 321. The maximum qco credit donation amount for 2022: Web credit for contributions 321to qualifying charitable organizations2022 include with your return. Web we last updated arizona form 321 in february 2023 from the arizona department of revenue. Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Save or instantly send your ready documents. Part 1 current year’s credit a. Web arizona's credits under form 321 and 352 are 100% refundable so contributions may only be claimed if as federal itemized deduction if they are taken as a state tax payment on. When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on. Web more about the arizona form 131.

Get everything done in minutes. Part 1 current year’s credit a. Complete, edit or print tax forms instantly. When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on. Web more about the arizona form 131. Web arizona's credits under form 321 and 352 are 100% refundable so contributions may only be claimed if as federal itemized deduction if they are taken as a state tax payment on. We last updated arizona form 131 in february 2023 from the arizona department of revenue. This form is for income earned in tax year. Web tax forms, instructions, and other tax information if you need tax forms, instructions, and other tax information, go to the department’s website at www.azdor.gov. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or help, call one of the numbers listed:

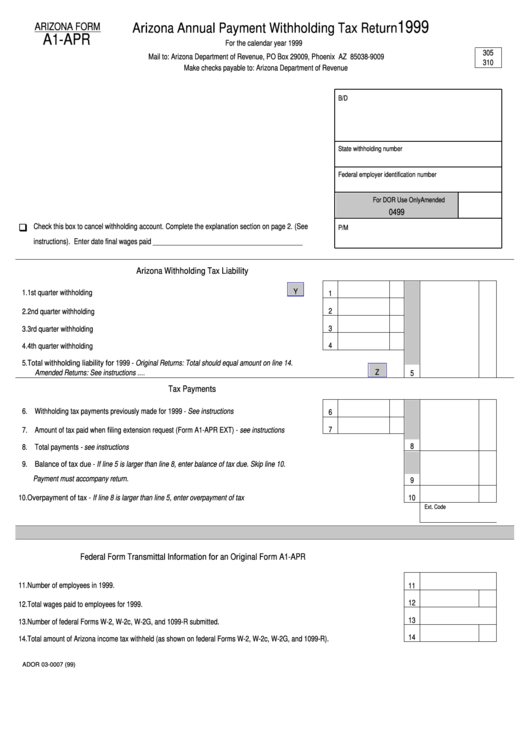

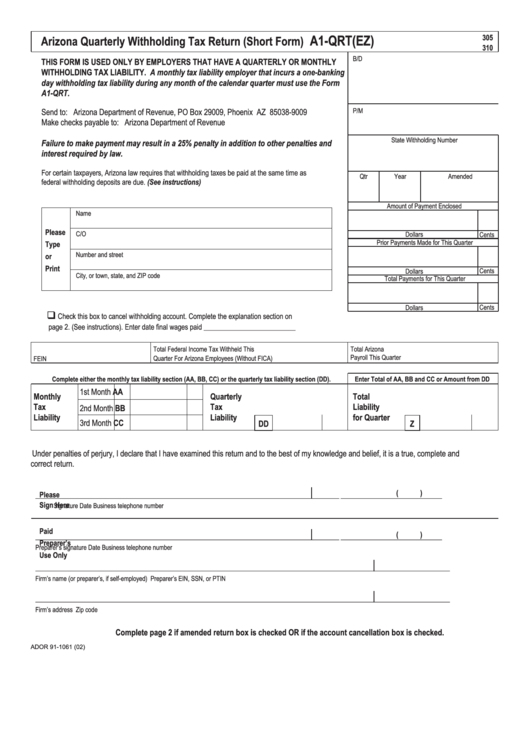

Arizona Form A1Apr Arizona Annual Payment Withholding Tax Return

Web to qualifying charitable organizations 321. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web complete az form 321 and include it when you file your 2022 state taxes. Part 1 current year’s credit a. Web arizona tax form 321.

AZ DoR JT1/UC001 20192021 Fill out Tax Template Online US Legal

Enjoy smart fillable fields and interactivity. Web complete az form 321 and include it when you file your 2022 state taxes. Web donate for 2022 today! Web arizona form credit for contributions 321to qualifying charitable organizations2019 include with your return. Easily fill out pdf blank, edit, and sign them.

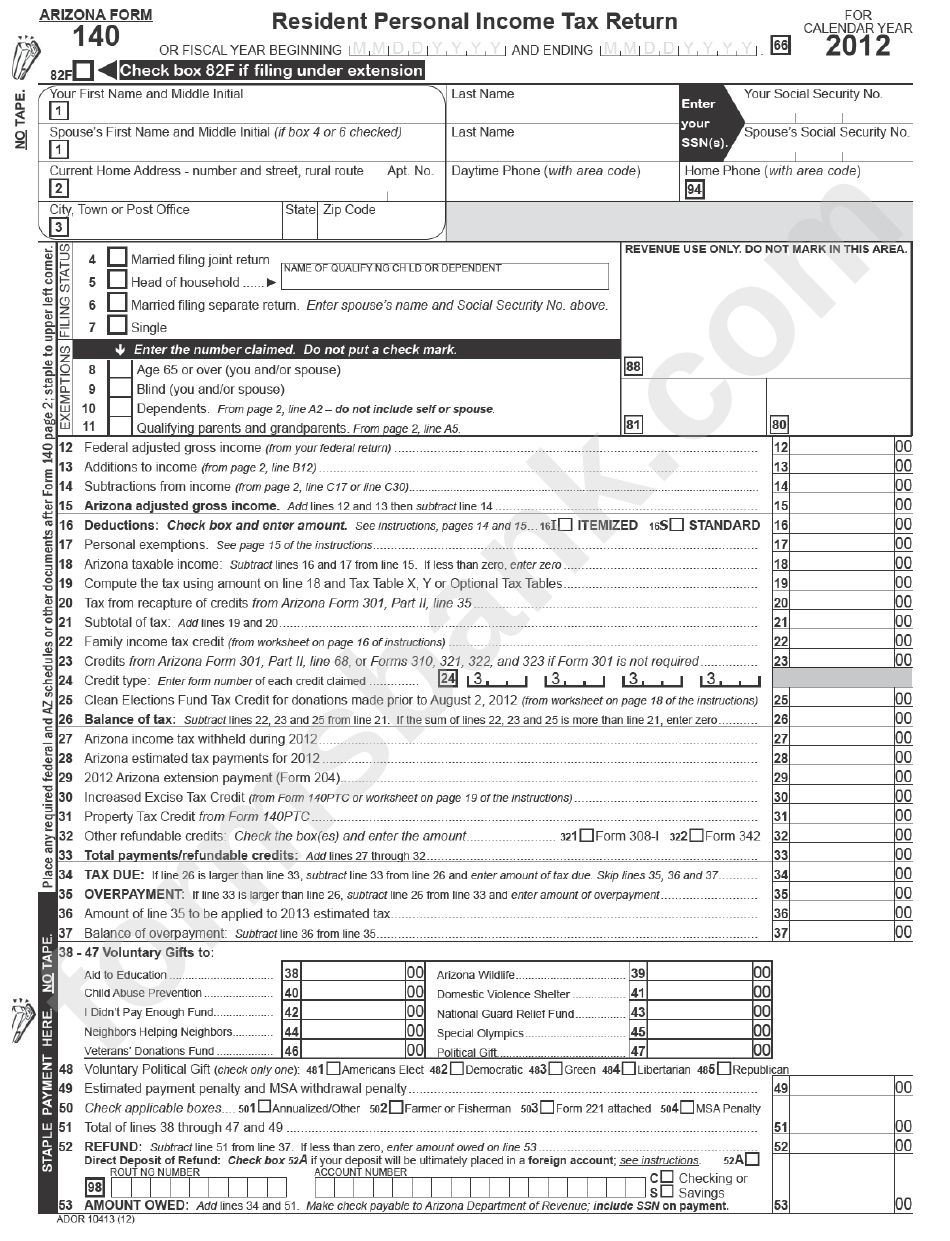

Printable Az 140 Tax Form Printable Form 2022

Web arizona form 321 1 (1) include with your return. $400 single, married filing separate or head of household; Complete, edit or print tax forms instantly. Web 26 rows tax credits forms : Complete, edit or print tax forms instantly.

Fillable Arizona Form 321 Credit For Contributions To Charities That

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Agricultural water conservation system credit: Enjoy smart fillable fields and interactivity. Caring coalition az is a “qualifying charitable organization” for the arizona state tax credit 321. Web arizona's credits under form 321 and 352 are 100% refundable so contributions may only.

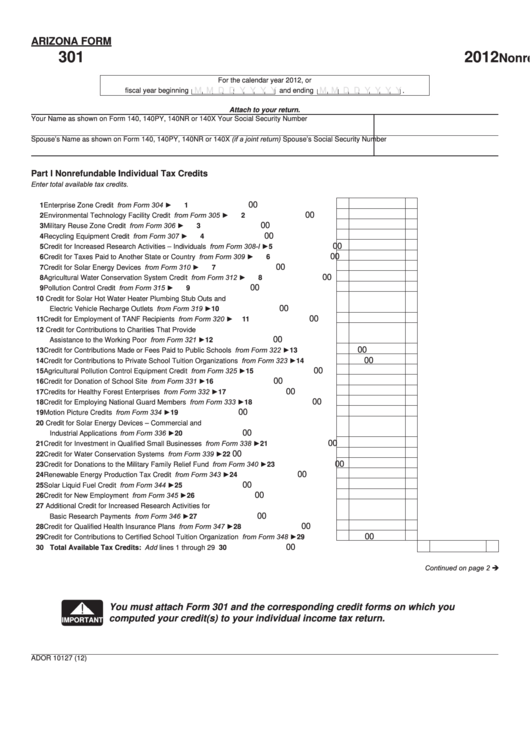

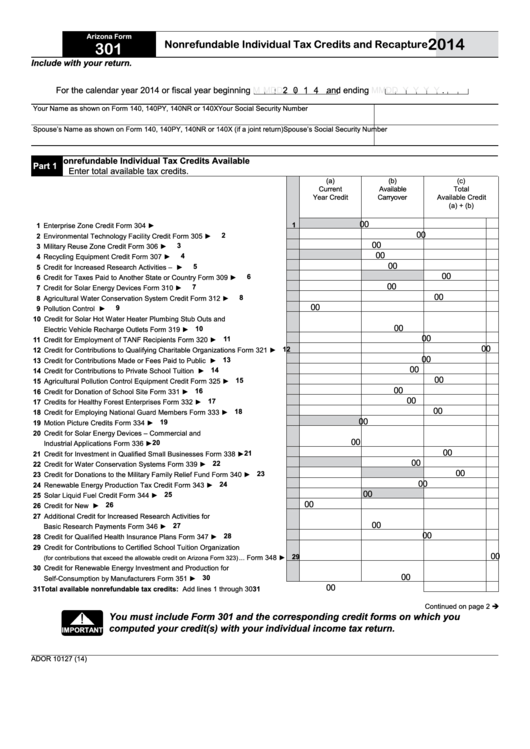

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Get your online template and fill it in using progressive features. Easily fill out pdf blank, edit, and sign them. Web tax forms, instructions, and other tax information if you need tax forms, instructions, and other tax information, go to the department’s website at www.azdor.gov. Web 2021 credit for contributions arizona form to qualifying charitable organizations 321 for information or.

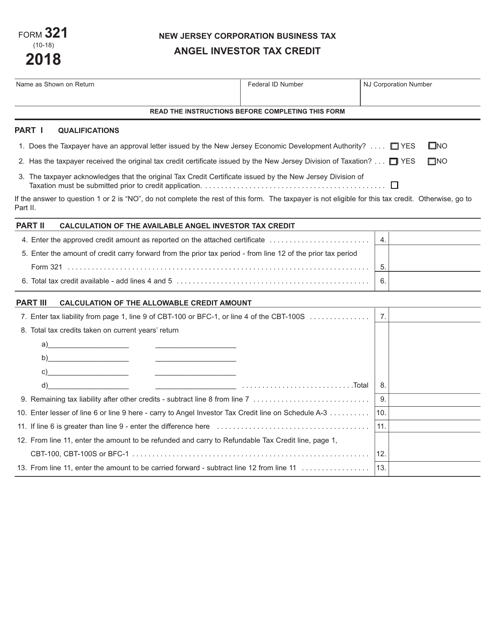

Form 321 Download Fillable PDF or Fill Online Angel Investor Tax Credit

Ad register and subscribe now to work on your az dor form 321 & more fillable forms. Web arizona tax form 321. Get everything done in minutes. Web arizona form 321 1 (1) include with your return. Complete, edit or print tax forms instantly.

AZ Form 301, Nonrefundable Individual Tax Credits and Recapture

We last updated arizona form 131 in february 2023 from the arizona department of revenue. The maximum qco credit donation amount for 2022: Complete, edit or print tax forms instantly. Part 1 current year’s credit a. When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Caring coalition az is a “qualifying charitable organization” for the arizona state tax credit 321. Part 1 current year’s credit a. Web more about the arizona form 131. This form is for income earned in tax year 2022, with tax returns due in. Agricultural water conservation system credit:

Form A1Qrt(Ez) Arizona Quarterly Withholding Tax Return (Short Form

Get everything done in minutes. Web donate for 2022 today! Credit for solar energy devices: This form is for income earned in tax year. Web 20 votes how to fill out and sign taxable online?

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Get everything done in minutes. Web credit for contributions 321to qualifying charitable organizations2022 include with your return. Web donate for 2022 today! Web arizona's credits under form 321 and 352 are 100% refundable so contributions may only be claimed if as federal itemized deduction if they are taken as a state tax payment on. Web arizona tax form 321.

Web Complete Az Form 321 And Include It When You File Your 2022 State Taxes.

Complete, edit or print tax forms instantly. Caring coalition az is a “qualifying charitable organization” for the arizona state tax credit 321. Web 20 votes how to fill out and sign taxable online? For the calendar year 2019 or fiscal year beginning mmdd2019.

Ad Register And Subscribe Now To Work On Your Az Dor Form 321 & More Fillable Forms.

$400 single, married filing separate or head of household; Easily fill out pdf blank, edit, and sign them. Agricultural water conservation system credit: This form is for income earned in tax year 2022, with tax returns due in.

Web Arizona Form Credit For Contributions 321To Qualifying Charitable Organizations2019 Include With Your Return.

Credit for solar energy devices: Web separately on arizona form 321. Get your online template and fill it in using progressive features. Web to qualifying charitable organizations 321.

Get Everything Done In Minutes.

When filing your taxes in 2022, charitable tax credit gifts made between january 1, 2021, and december 31, 2021, are required to be listed on. Web the tax credit is claimed on form 321. Web 26 rows tax credits forms : Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.