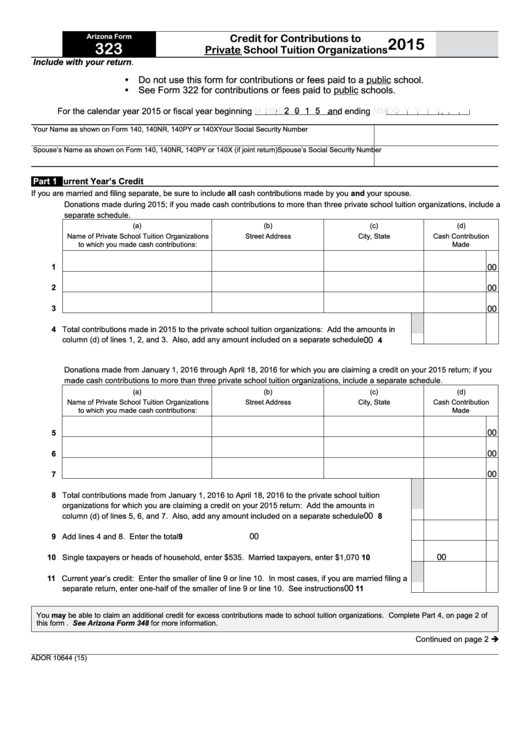

Arizona Tax Form 323

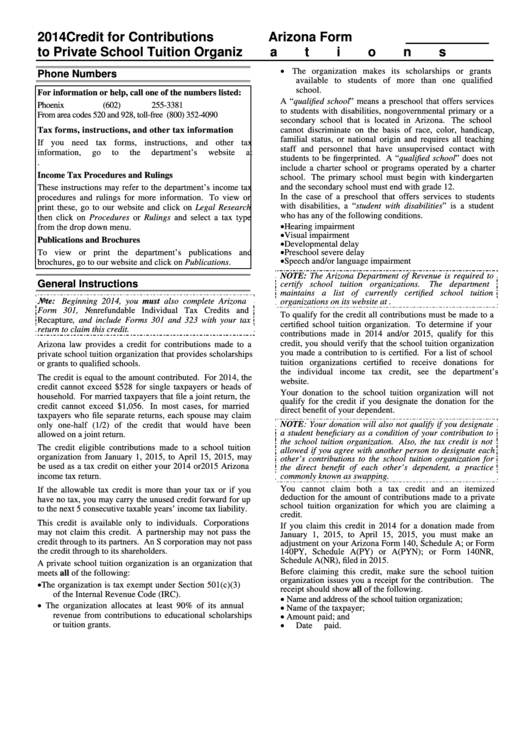

Arizona Tax Form 323 - Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation credits) and az form 348 (to claim plus. Web 323 credit for contributions toprivate school tuition organizations 2021 include with your return. Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to the switcher (overflow/plus) tax credit can be. Are eligible and elect to pay tax based on the optional tax tables pursuant to section 43. Web arizona form 323 for calendar year filers: The amount of credit you must. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web arizona form 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. Do not use this form for cash contributions or fees paid to a.

Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the numbers listed: Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to the switcher (overflow/plus) tax credit can be. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Are eligible and elect to pay tax based on the optional tax tables pursuant to section 43. Web credit for contributions to private school tuition organizations (original individual income tax credit) this tax credit is claimed on form 323. Web the maximum for the 2023 tax year is $1,307 filing single, and $2,609 filing married jointly. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Do not use this form for cash contributions or fees paid to a public school. Web arizona form 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year.

Do not use this form for cash contributions or fees paid to a. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. Web the maximum for the 2023 tax year is $1,307 filing single, and $2,609 filing married jointly. Do not use this form for cash contributions or fees paid to a public school. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the numbers listed: Web arizona form 323 for calendar year filers:

Form 323 Download Printable PDF or Fill Online Residential Economic

Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations. Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to.

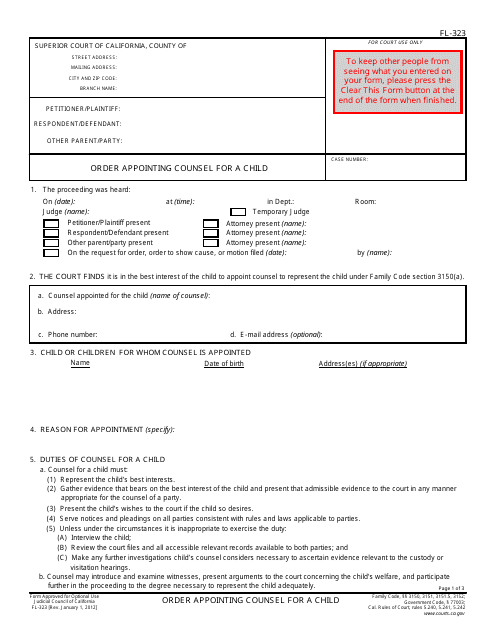

Form FL323 Download Fillable PDF or Fill Online Order Appointing

Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations. Do not use this form for cash contributions or fees paid to a. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web arizona form.

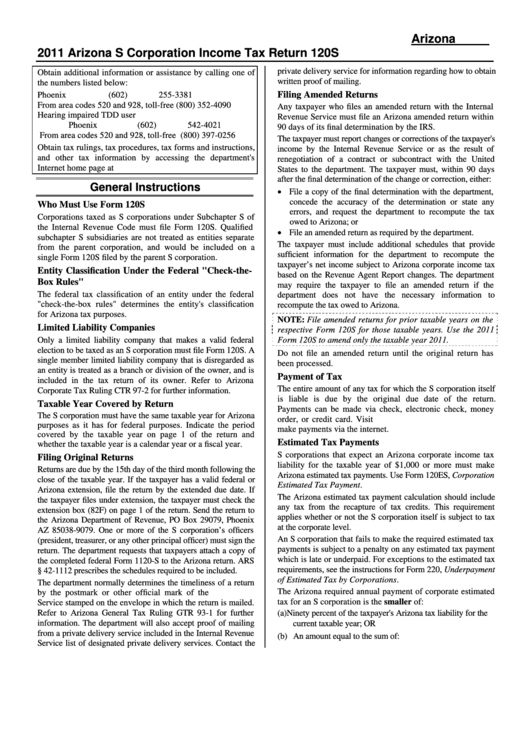

Instructions For Arizona Form 120s Arizona S Corporation Tax

Web credit for contributions to private school tuition organizations (original individual income tax credit) this tax credit is claimed on form 323. Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Web arizona tax form 323 is created by turbotax when you indicate that you have.

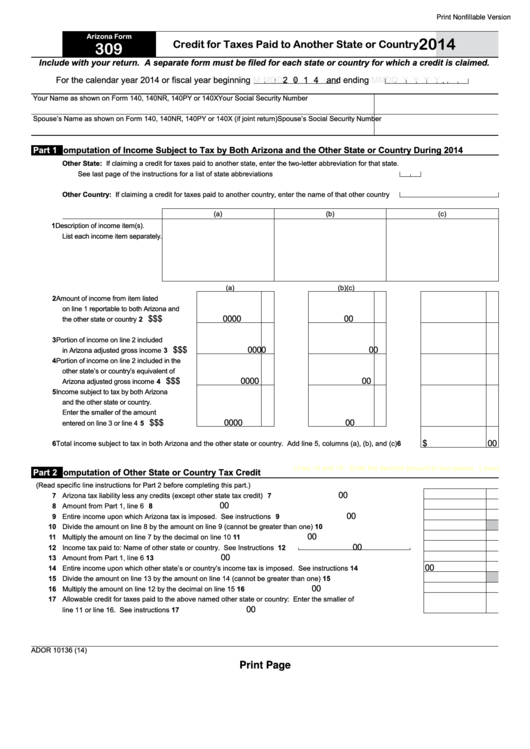

Fillable Arizona Form 309 Credit For Taxes Paid To Another State Or

Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Do not use this form for cash contributions or fees paid to a. Web a nonrefundable individual tax credit for cash contributions to a school tuition organization that exceed the original private school tuition organization. Web credit.

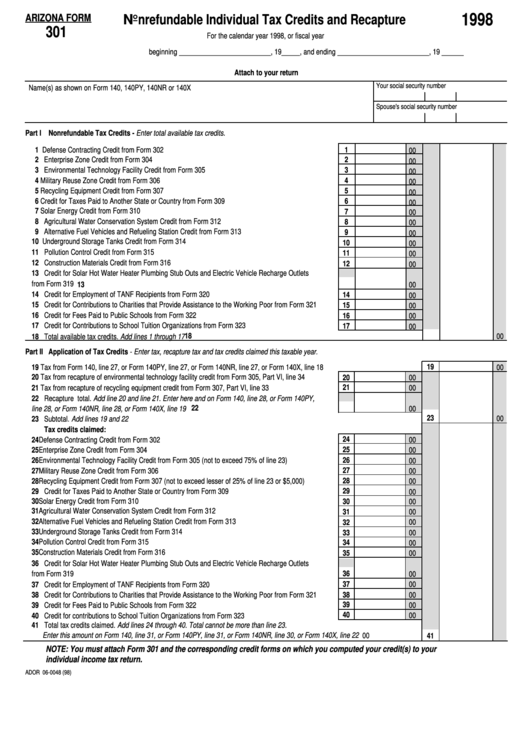

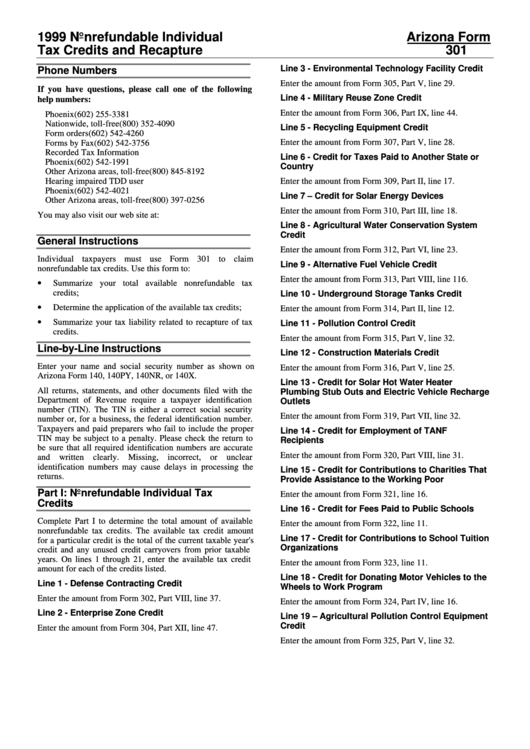

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return. If married taxpayers file separate returns, each spouse may claim only 1/2 of the credit that. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web when filing, you can claim.

PPT Arizona State Tax Return 2012 PowerPoint Presentation, free

Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web arizona form 323 for calendar year filers: The amount of credit you must. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the numbers listed: If.

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

Credit eligible cash contributions made to a private sto from january 1, 2021, to april 15, 2021, may be used as a tax. Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to the switcher (overflow/plus) tax credit can be. Web arizona form 323 for calendar.

Instructions For Form 323 Arizona Credit For Contributions To Private

Do not use this form for cash contributions or fees paid to a. Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to a private school tuition organization that provides scholarships or grants. Are eligible and elect to pay tax based on the optional tax tables pursuant to section 43. If.

Fillable Arizona Form 323 Credit For Contributions To Private School

Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations. Web 26 rows bingo forms. Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation credits) and az form 348 (to claim plus..

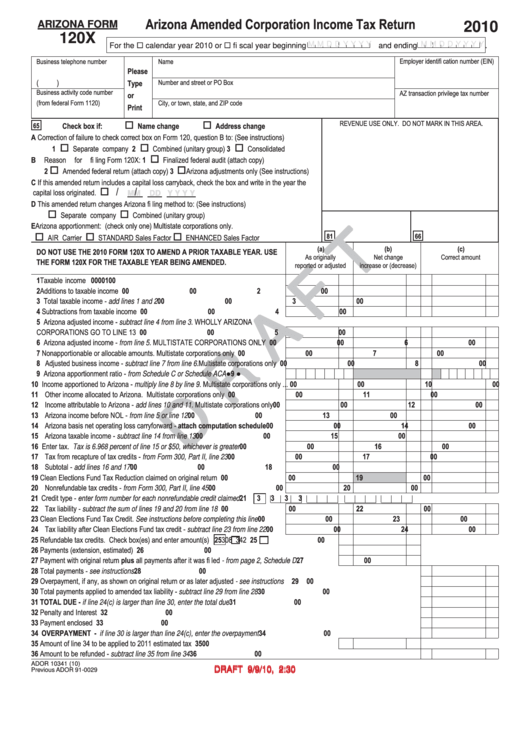

Arizona Form 120x Draft Arizona Amended Corporation Tax Return

The department may provide a simplified return form for individual taxpayers who: Do not use this form for cash contributions or fees paid to a. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax. Web a nonrefundable individual tax credit for cash contributions to a school.

Do Not Use This Form For Cash Contributions Or Fees Paid To A.

Web the forms needed to claim the credit are az form 301 (used for any arizona state tax credit), az form 323 (to claim original donation credits) and az form 348 (to claim plus. Web arizona tax form 323 is created by turbotax when you indicate that you have made cash contributions to a private school tuition organization that provides scholarships or grants. Do not use this form for cash contributions or fees paid to a public school. Web arizona form credit for contributions to 323private school tuition organizations2020 include with your return.

Web Arizona Form 323 For Calendar Year Filers:

Web arizona form 323 either the current or preceding taxable year and is considered to have been made on the last day of that taxable year. Web credit for contributions to private school tuition organizations (original individual income tax credit) this tax credit is claimed on form 323. The department may provide a simplified return form for individual taxpayers who: Are eligible and elect to pay tax based on the optional tax tables pursuant to section 43.

Arizona Has A State Income Tax That Ranges Between 2.59% And 4.5% , Which Is Administered By The Arizona Department Of Revenue.

Web when filing, you can claim your credit for donations made to the original tax credit by using arizona form 323, donations made to the switcher (overflow/plus) tax credit can be. Web 2019 credit for contributions arizona form to private school tuition organizations 323 for information or help, call one of the numbers listed: Web arizona form 323 for calendar year filers: Web first claim the maximum current year’s credit allowed on arizona form 323, credit for contributions to private school tuition organizations.

Credit Eligible Cash Contributions Made To A Private Sto From January 1, 2021, To April 15, 2021, May Be Used As A Tax.

Web individual income tax forms the arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing. If married taxpayers file separate returns, each spouse may claim only 1/2 of the credit that. Application for bingo license packet. Credit eligible cash contributions made to a private sto from january 1, 2022, to april 18, 2022, may be used as a tax.