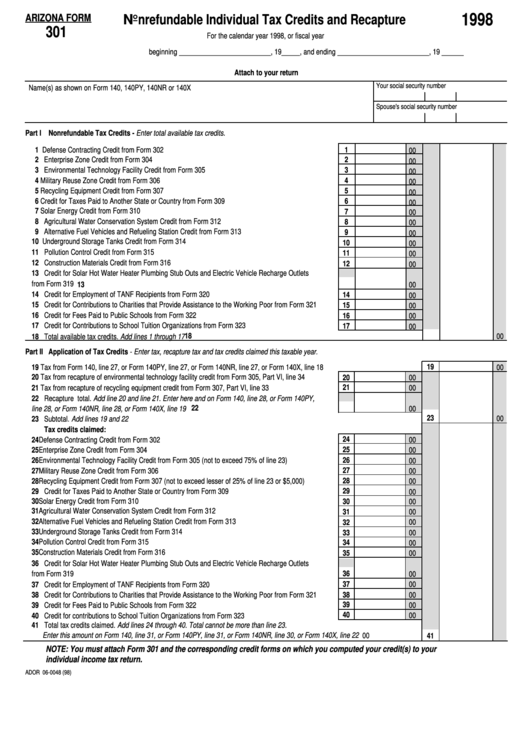

Arizona Tax Form 301

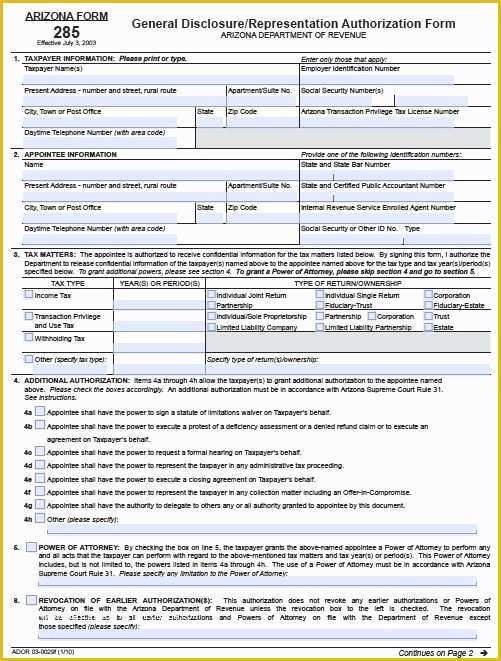

Arizona Tax Form 301 - Edit, sign and print tax forms on any device with pdffiller. Web arizona form 301 author: Web 26 rows tax credits forms : Arizona department of revenue subject: Nonrefundable individual tax credits and. Web for 2020, mary is allowed a maximum credit of $400. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Form 335 is used in claiming the corporate tax. Edit your arizona 301 tax online type text, add images, blackout confidential details, add comments, highlights and more. Web arizona form 301 is the initial document that needs to be prepared by taxpayers in arizona who intend to claim one or multiple tax credits.

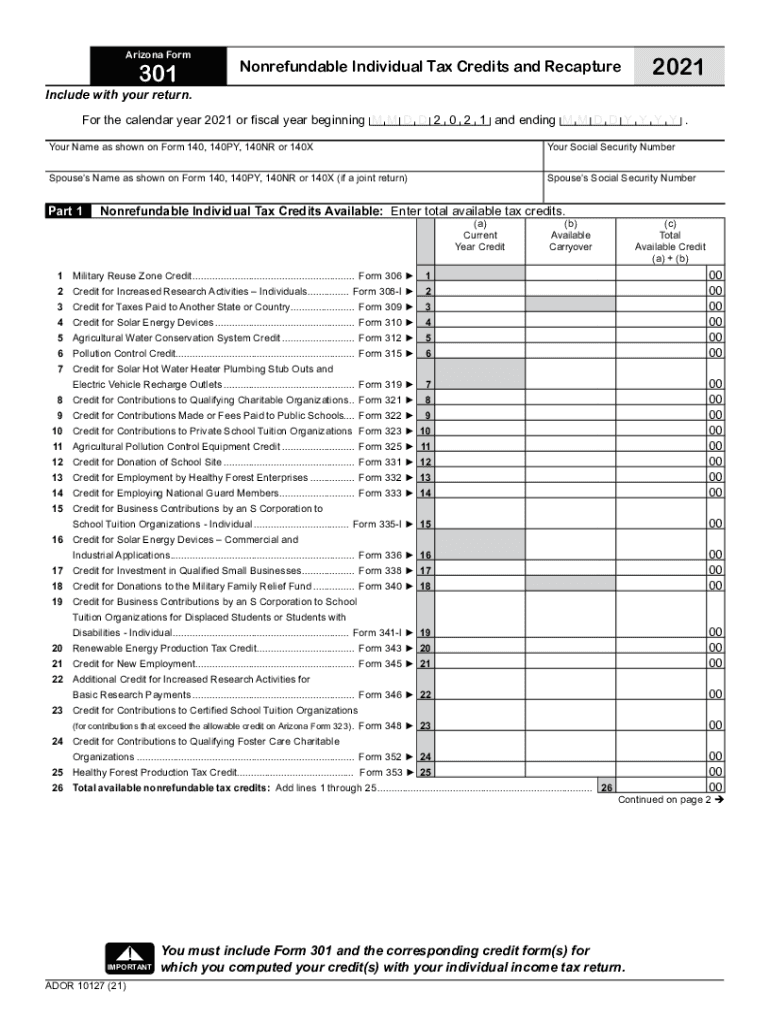

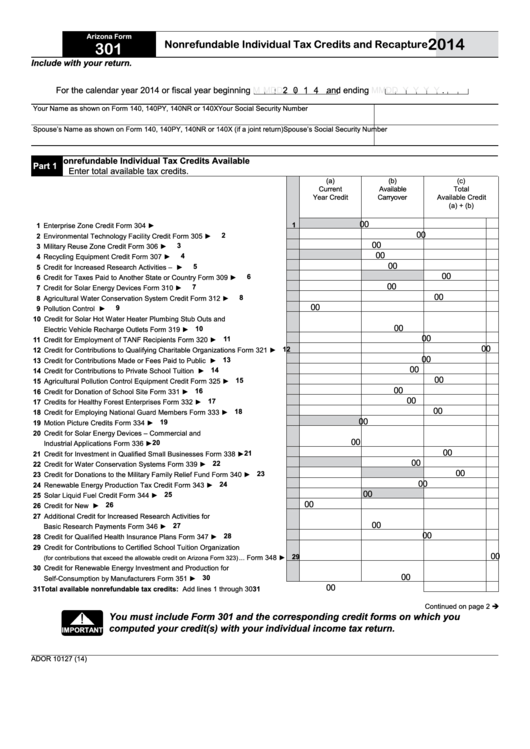

Web arizona form 301 is the initial document that needs to be prepared by taxpayers in arizona who intend to claim one or multiple tax credits. Edit, sign and print tax forms on any device with signnow. For each credit, part 1 displays in three columns:. Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return.! It acts as a summary to include all the. Edit your arizona 301 tax online type text, add images, blackout confidential details, add comments, highlights and more. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Form 335 is used in claiming the corporate tax. Arizona department of revenue subject: Sign it in a few clicks draw your signature, type it,.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000 per. For each credit, part 1 displays in three columns:. Edit, sign and print tax forms on any device with pdffiller. Web arizona form 301 author: Form 335 is used in claiming the corporate tax. Web 26 rows arizona corporate or partnership income tax payment voucher: Web for 2020, mary is allowed a maximum credit of $400. Mary can apply $250 of the credit to her 2020 tax liability and carryover $150 of the unused $400. Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits.

Download Instructions for Arizona Form 120 Arizona Corporation

Edit, sign and print tax forms on any device with signnow. Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless. Sign it in a few clicks draw your signature, type it,. Edit your arizona 301 tax online type text, add images, blackout confidential.

2021 AZ DoR Form 301 Fill Online, Printable, Fillable, Blank pdfFiller

Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return.! Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with.

Arizona Form 301 Nonrefundable Individual Tax Credits And Recapture

Mary’s 2020 tax is $250. Mary can apply $250 of the credit to her 2020 tax liability and carryover $150 of the unused $400. Web arizona form 301 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax. Edit your arizona 301 tax online type text,.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

This form is for income earned in tax year 2022, with tax returns due in. Nonrefundable individual tax credits and recapture keywords: Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income.

Free Will Template Arizona Of Free Tax Power Of attorney Arizona form

Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web arizona form 301 author: Edit, sign and print tax forms on any device with signnow. Arizona department of revenue subject:

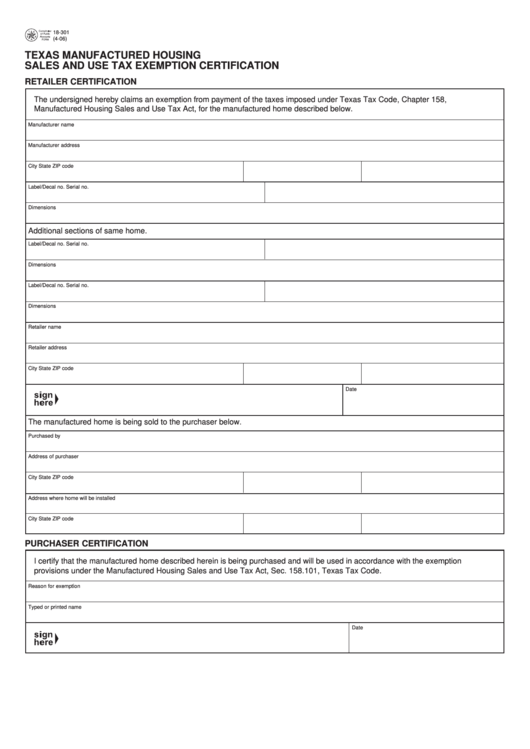

Fillable Form 18301 Texas Manufactured Housing Sales And Use Tax

Nonrefundable individual tax credits and recapture keywords: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Web arizona form 301 is the.

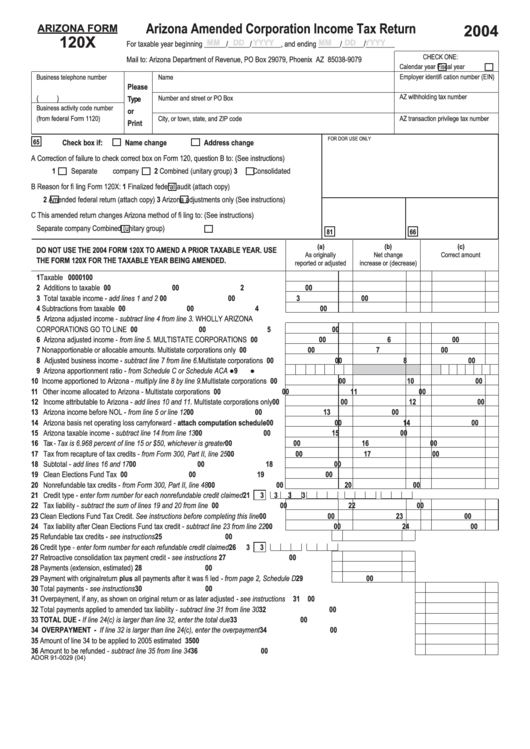

Arizona Form 120x Arizona Amended Corporation Tax Return

Nonrefundable individual tax credits and. Web arizona form 301 author: Mary’s 2020 tax is $250. This form is for income earned in tax year 2022, with tax returns due in. Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000.

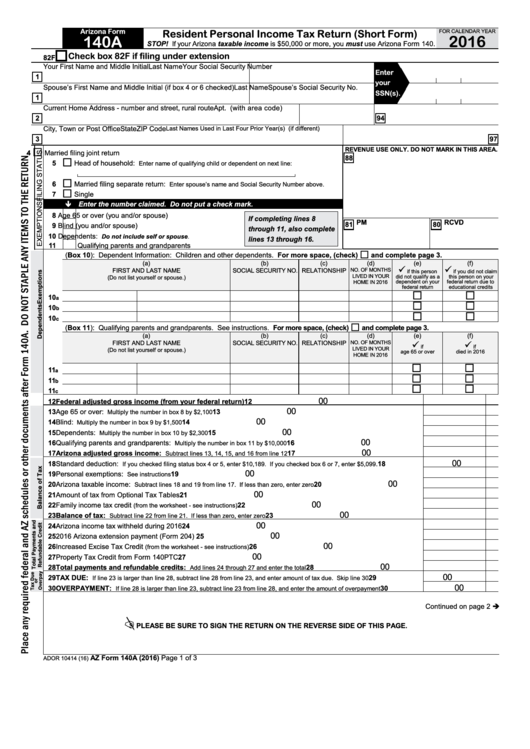

Arizona Form 140a Resident Personal Tax Return 2016

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Form 335 is used in claiming the corporate tax. Web for 2020, mary.

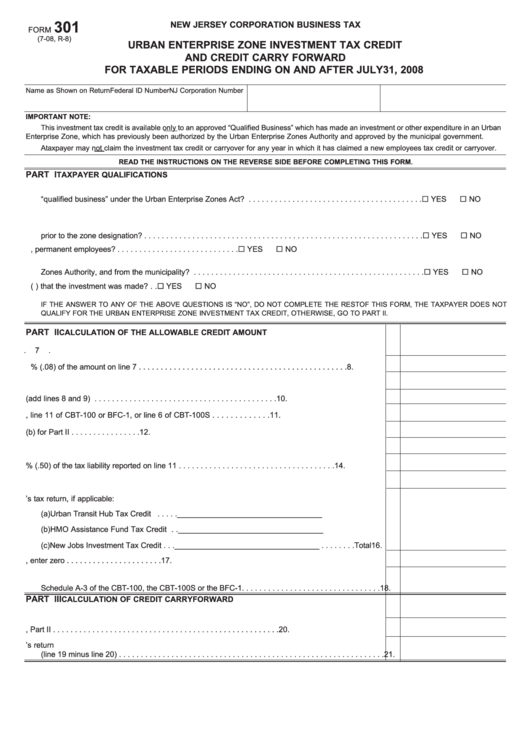

Fillable Form 301 Urban Enterprise Zone Investment Tax Credit And

This form is for income earned in tax year 2022, with tax returns due in. Edit, sign and print tax forms on any device with pdffiller. Web general instructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless. Web generalinstructions you must complete and include.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Nonrefundable individual tax credits and recapture keywords: This form is for income earned in tax year 2022, with tax returns due in. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web 26 rows tax credits forms : Web.

Nonrefundable Individual Tax Credits And.

Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Sign it in a few clicks draw your signature, type it,. Ad register and subscribe now to work on your az dor form 301 & more fillable forms. Edit, sign and print tax forms on any device with pdffiller.

Mary’s 2020 Tax Is $250.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web 26 rows arizona corporate or partnership income tax payment voucher: Web 26 rows tax credits forms : Web you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax return.!

Ad Register And Subscribe Now To Work On Your Az Dor Form 301 & More Fillable Forms.

For each credit, part 1 displays in three columns:. It acts as a summary to include all the. Mary can apply $250 of the credit to her 2020 tax liability and carryover $150 of the unused $400. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the.

Web You Must Complete And Include Arizona Form 301 And The Credit Form(S) With Your Arizona Income Tax Return To Claim Nonrefundable Tax Credits Unless You Meet One Of The.

Edit your arizona 301 tax online type text, add images, blackout confidential details, add comments, highlights and more. Web the az form 301 is a summary form for all the arizona credits on your return, and the form 310 is the solar energy credit, which cannot exceed $1,000 per. This form is for income earned in tax year 2022, with tax returns due in. Web generalinstructions you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless.