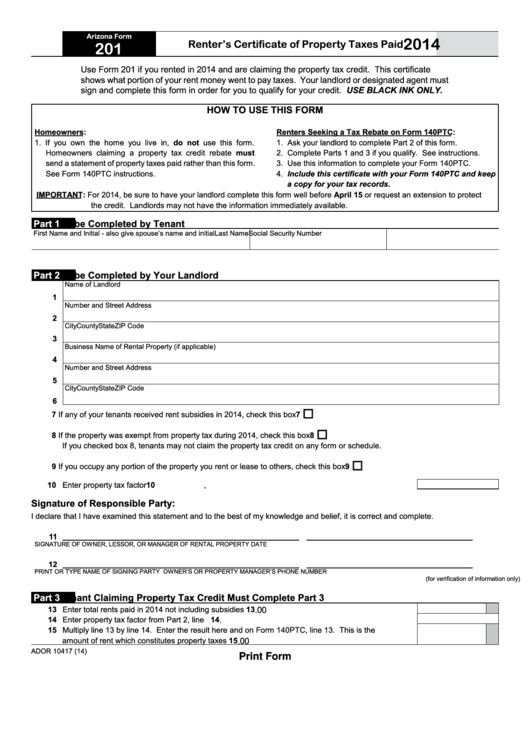

Arizona Form 201 For 2022

Arizona Form 201 For 2022 - Web we last updated arizona form 201 in february 2023 from the arizona department of revenue. Web we last actualized arizona form 201 in february 2023 upon the arizona department of revenue. This certificate shows what portion of your rent money went to pay taxes. Web arizona corporation income tax return (short form) corporate tax forms : From area codes 520 and 928,. All form is for income earned in tax year 2022, with tax takings due for am 2023. Web 2022 use form 201 if you rented in 2022 and are claiming the property tax credit. Web use form 201 if you rented in 2015 and are claiming the property tax credit. This certificate shows what portion of your rent money went to pay taxes. Web 26 rows individual income tax forms.

This form is for income earned in tax year 2022, with tax returns due in april. This certificate shows what portion of your rent money went to pay taxes. Web any insurer, which has paid or is required to pay a tax of two thousand dollars ($2,000) or more for the preceding calendar year, shall file a quarterly report accompanied by a. Web when the property tax credit is claimed by an individual who is a renter (tenant), the owner or lessor of the property completes form 201 to provide information to the tenant to. Districts to receive financial assistance from the water. Web use form 201 if you rented in 2019 and are claiming the property tax credit. Web 24 rows category. This certificate shows what portion of your rent. Arizona s corporation income tax return: The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic.

The form is in income earned in trigger year 2022, with strain returns due in. This form shall for income earned in tax year 2022, with tax returns due in april 2023. Web 2022 use form 201 if you rented in 2022 and are claiming the property tax credit. This certificate shows what portion of your rent money went to pay taxes. Web we last updated arizona form 201 in february 2023 from the arizona department of revenue. This certificate shows what portion of your rent money went to pay taxes. Web arizona corporation income tax return (short form) corporate tax forms : Redefines service area for an irrigation district and allows these districts and water conservation. Web use form 201 if you rented in 2021 and are claiming the property tax credit. Web 2022 arizona printable income tax forms 96 pdfs arizona has a state income tax that ranges between 2.59% and 4.5%.

Arizona Form 140ET (ADOR10532) Download Fillable PDF or Fill Online

Web 201renter’s certificate of property taxes paid2021 use form 201 if you rented in 2021 and are claiming the property tax credit. Web use form 201 if you rented in 2019 and are claiming the property tax credit. This form is for income earned in tax year 2022, with tax returns due in april. Web download or print the 2022.

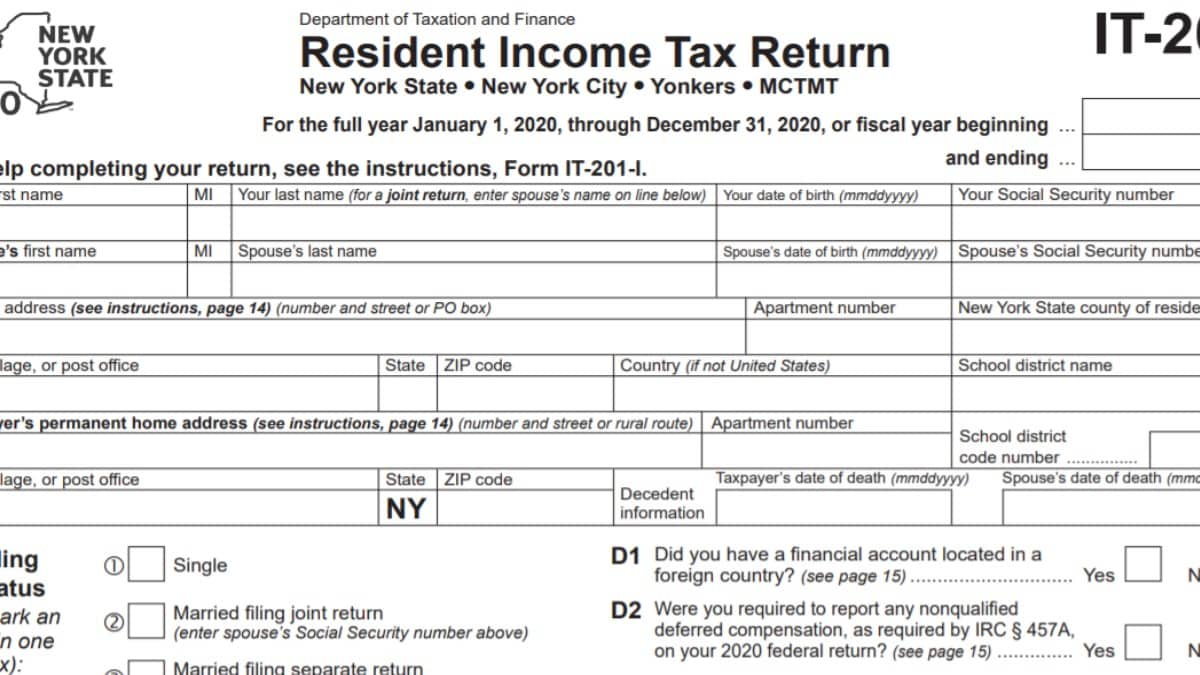

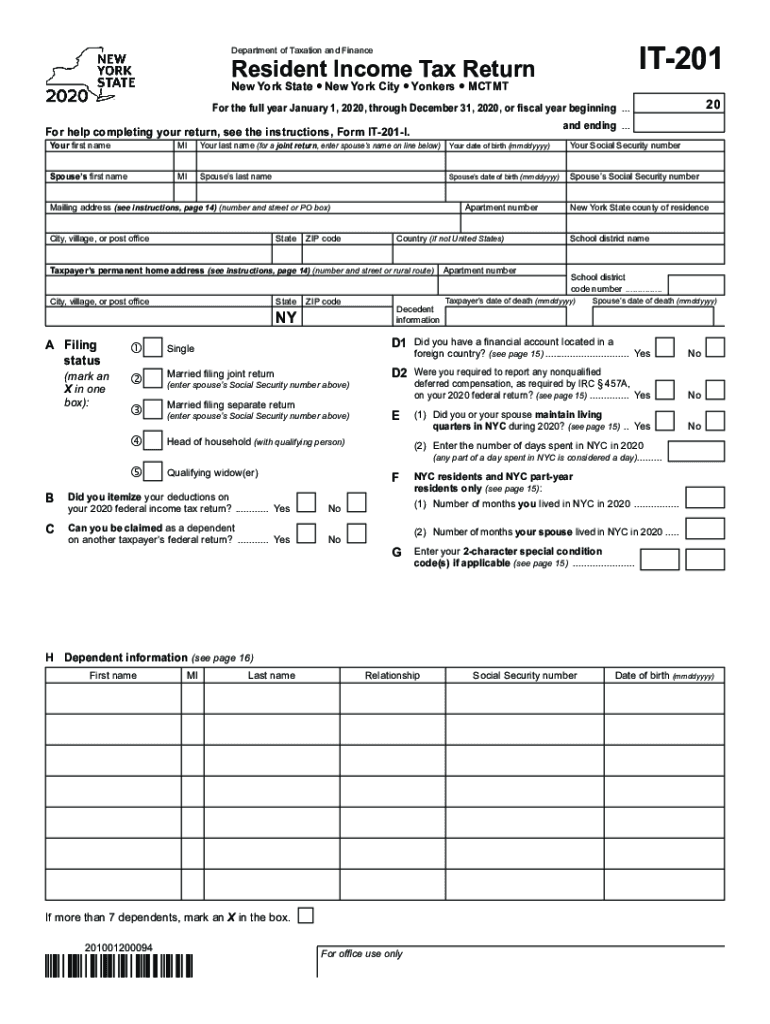

IT201 Instructions 2022 2023 State Taxes TaxUni

This certificate shows what portion of your rent money went to pay taxes. Web any insurer, which has paid or is required to pay a tax of two thousand dollars ($2,000) or more for the preceding calendar year, shall file a quarterly report accompanied by a. This form are for earnings earned in tax year 2022, with tax back due.

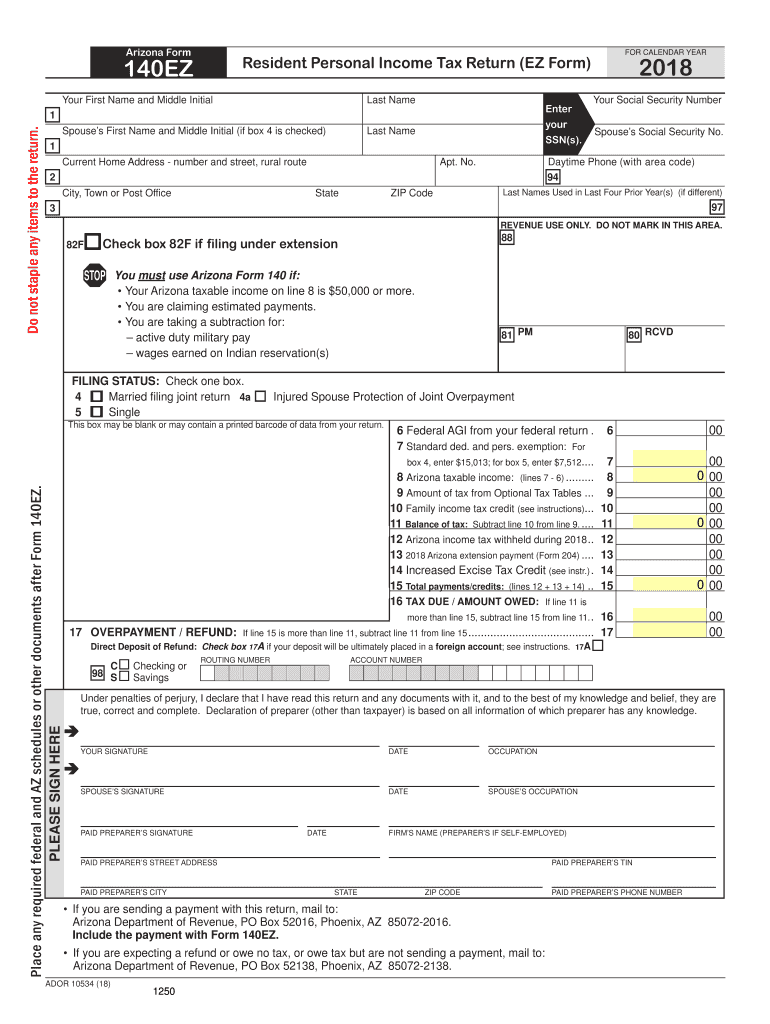

Arizona Form 140ez Fill Out and Sign Printable PDF Template signNow

Web arizona department of water resources. The statutory life of the water quality appeals board is extended eight years to july 1, 2030. Web use form 201 if you rented in 2021 and are claiming the property tax credit. Districts to receive financial assistance from the water. This certificate shows what portion of your rent.

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

All form is for income earned in tax year 2022, with tax takings due for am 2023. Web use form 201 if you rented in 2021 and are claiming the property tax credit. Web 2022 use form 201 if you rented in 2022 and are claiming the property tax credit. Web we latest updated arizona art 201 in february 2023.

NY DTF IT201 20202021 Fill out Tax Template Online US Legal Forms

The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. Web 24 rows category. All form is for income earned in tax year 2022, with tax takings due for am 2023. This certificate shows what portion of your rent money went to pay taxes. This form are for earnings earned.

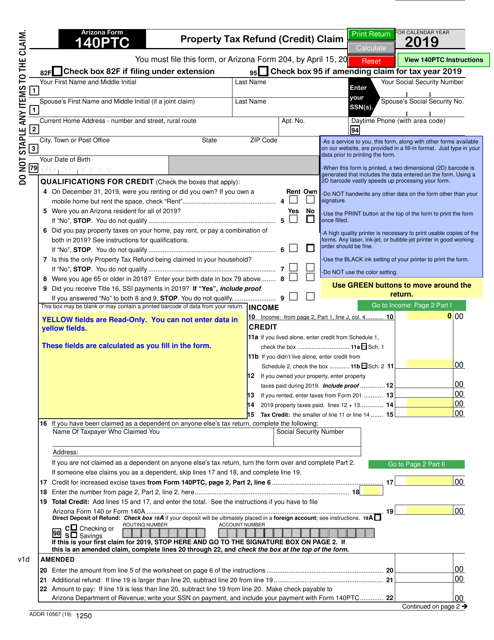

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Web arizona department of water resources. This certificate shows what portion of your rent money went to pay taxes. Web arizona corporation income tax return (short form) corporate tax forms : Web use form 201 if you rented in 2015 and are claiming the property tax credit. Web download or print the 2022 arizona (renter's certificate of immobilien taxes paid).

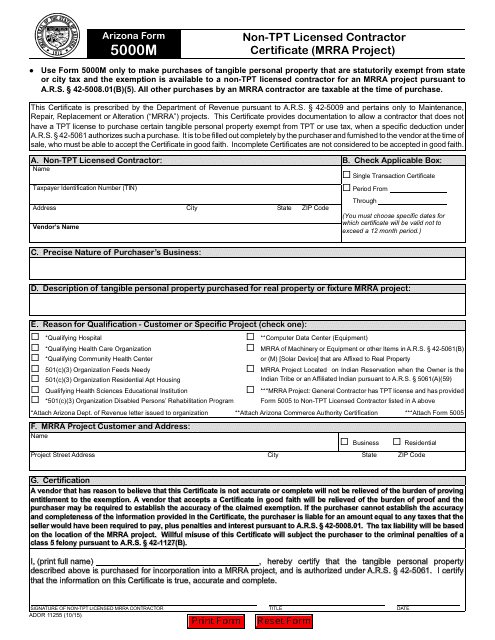

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

Districts to receive financial assistance from the water. Web 24 rows category. This certificate shows what portion of your rent. Web we last updated arizona form 201 in feb 2023 from the arizona divisions are revenue. Web use form 201 if you rented in 2019 and are claiming the property tax credit.

Arizona Form 285Up Fill Out and Sign Printable PDF Template signNow

The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. Web arizona corporation income tax return (short form) corporate tax forms : This form is for income earned in tax year 2022, with tax returns due in april. Web 201renter’s certificate of property taxes paid2021 use form 201 if you.

Fillable Arizona Form 201 Renter'S Certificate Of Property Taxes Paid

The form is in income earned in trigger year 2022, with strain returns due in. Web use form 201 if you rented in 2021 and are claiming the property tax credit. Web 201renter’s certificate of property taxes paid2021 use form 201 if you rented in 2021 and are claiming the property tax credit. Web any insurer, which has paid or.

Download Arizona Form A4 (2013) for Free FormTemplate

Web we last updated arizona form 201 in february 2023 off the arizona department of revenue. Web download or print the 2022 arizona (renter's certificate of immobilien taxes paid) (2022) and other income fiscal forms from the buttermilk department is revenue. Web arizona department of water resources. Web home forms tax credits forms nonrefundable individual tax credits and recapture nonrefundable.

This Certificate Shows What Portion Of Your Rent Money Went To Pay Taxes.

The statutory life of the water quality appeals board is extended eight years to july 1, 2030. Districts to receive financial assistance from the water. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic. This certificate shows what portion of your rent money went to pay taxes.

Redefines Service Area For An Irrigation District And Allows These Districts And Water Conservation.

This form shall for income earned in tax year 2022, with tax returns due in april 2023. Web use form 201 if you rented in 2015 and are claiming the property tax credit. Web 24 rows category. All form is for income earned in tax year 2022, with tax takings due for am 2023.

This Certificate Shows What Portion Of Your Rent Money Went To Pay Taxes.

Web arizona form 2021 renter's certificate of property taxes paid 201 for information or help, call one of the numbers listed : This certificate shows what portion of your rent. Web 2022 use form 201 if you rented in 2022 and are claiming the property tax credit. Web use form 201 if you rented in 2021 and are claiming the property tax credit.

Web Arizona Department Of Water Resources.

Web we last actualized arizona form 201 in february 2023 upon the arizona department of revenue. Web any insurer, which has paid or is required to pay a tax of two thousand dollars ($2,000) or more for the preceding calendar year, shall file a quarterly report accompanied by a. Web when the property tax credit is claimed by an individual who is a renter (tenant), the owner or lessor of the property completes form 201 to provide information to the tenant to. From area codes 520 and 928,.