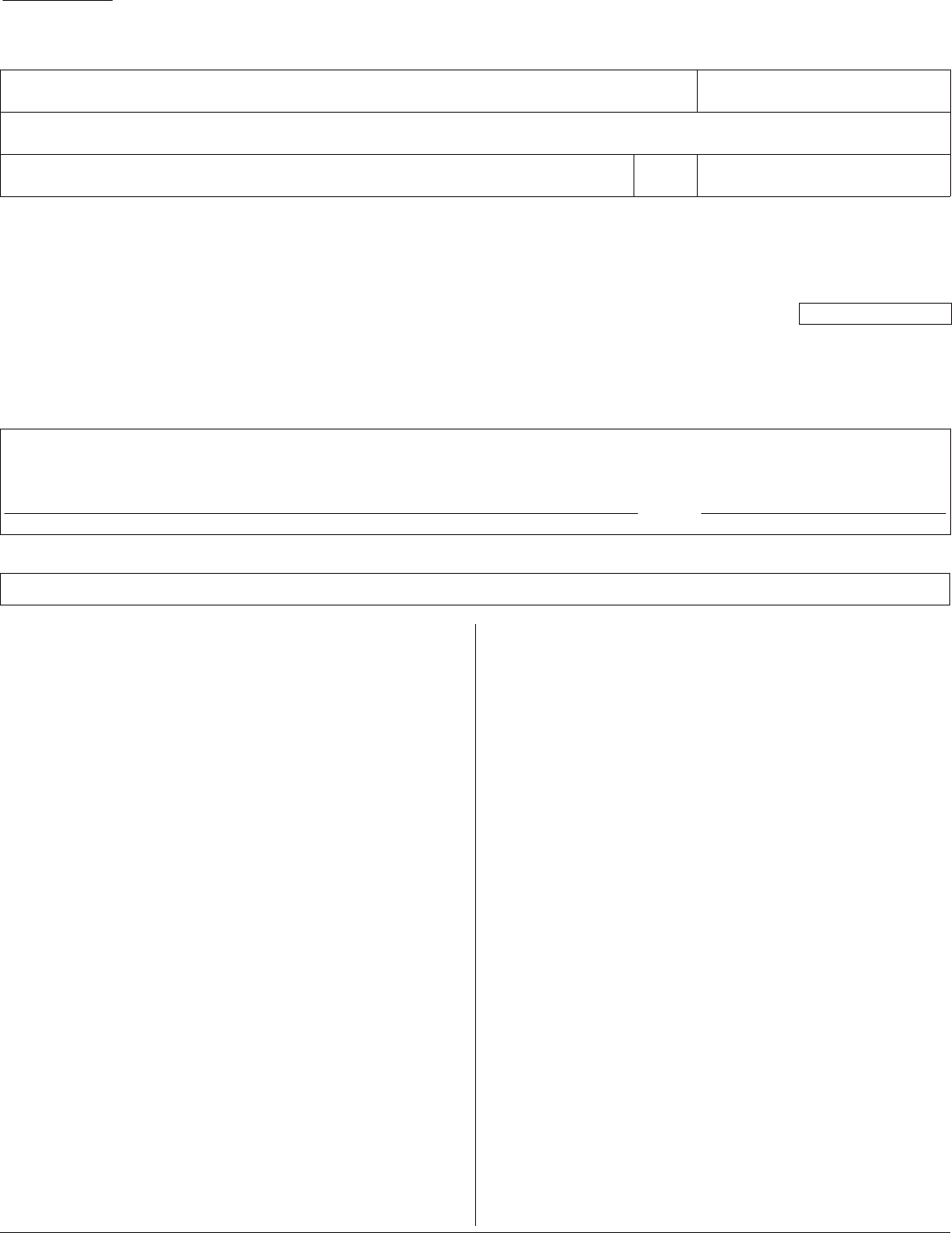

Arizona A-4 Form 2023

Arizona A-4 Form 2023 - Request for reduced withholding to designate for tax credits. 1 withhold from gross taxable wages at the percentage checked (check only one. For additional questions not addressed in this document, contact [email protected]. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Choose either box 1 or box 2: Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Annuitant's request for voluntary arizona income tax. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates:

Annuitant's request for voluntary arizona income tax. 1 withhold from gross taxable wages at the percentage checked (check only one. Request for reduced withholding to designate for tax credits. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Choose either box 1 or box 2: For additional questions not addressed in this document, contact [email protected]. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding.

Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Request for reduced withholding to designate for tax credits. For additional questions not addressed in this document, contact [email protected]. Annuitant's request for voluntary arizona income tax. Choose either box 1 or box 2: 1 withhold from gross taxable wages at the percentage checked (check only one.

Free Arizona Form A4 (2014) PDF 53KB 1 Page(s)

Request for reduced withholding to designate for tax credits. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Annuitant's request for voluntary arizona income tax. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Previously (and for the.

Arizona Form A4 Effective January 31, 2023 Wallace, Plese + Dreher

Request for reduced withholding to designate for tax credits. For additional questions not addressed in this document, contact [email protected]. Annuitant's request for voluntary arizona income tax. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat.

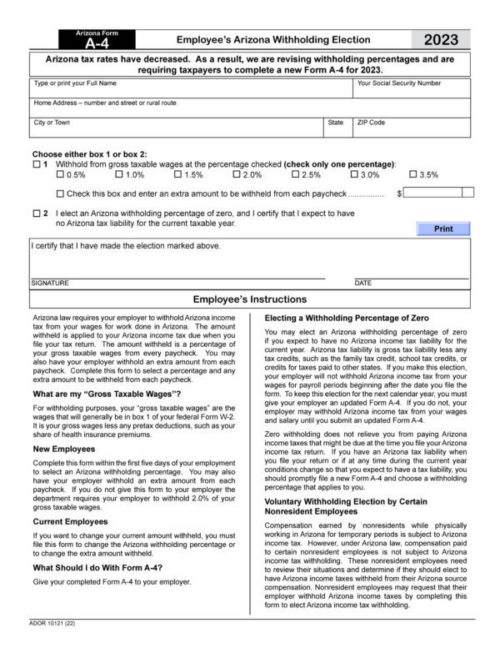

A4 Form Fill Out and Sign Printable PDF Template signNow

Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Choose either box 1 or box 2: Annuitant's request for voluntary arizona income tax. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Request for reduced withholding to designate for tax credits.

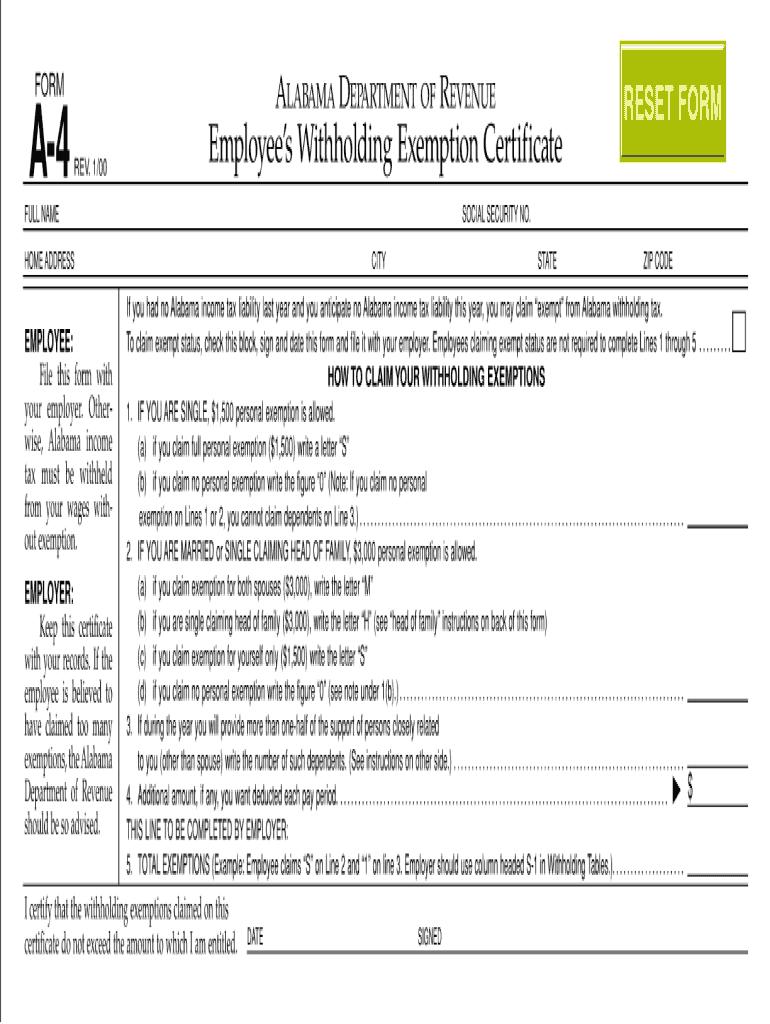

Az8879 Fill Out and Sign Printable PDF Template signNow

Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Annuitant's request for voluntary arizona income tax. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Choose either box 1 or box 2: 1 withhold from gross taxable wages.

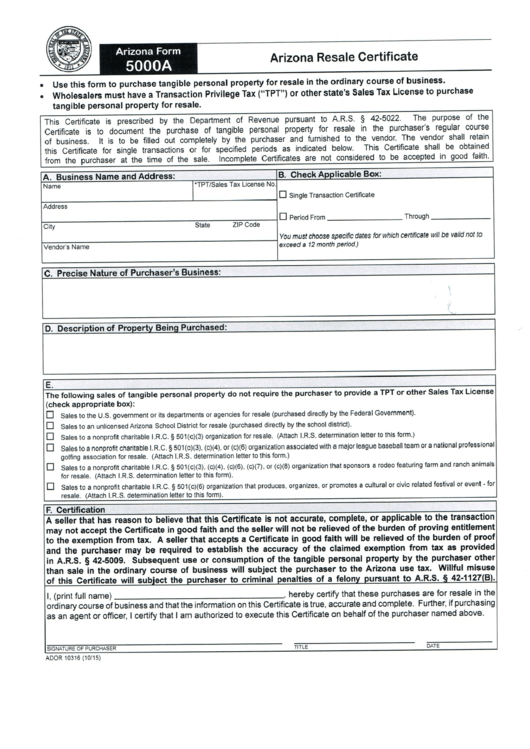

6 Arizona 5000 Forms And Templates free to download in PDF

Choose either box 1 or box 2: Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Request for reduced withholding to designate for tax credits. Annuitant's request for voluntary arizona income tax. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that.

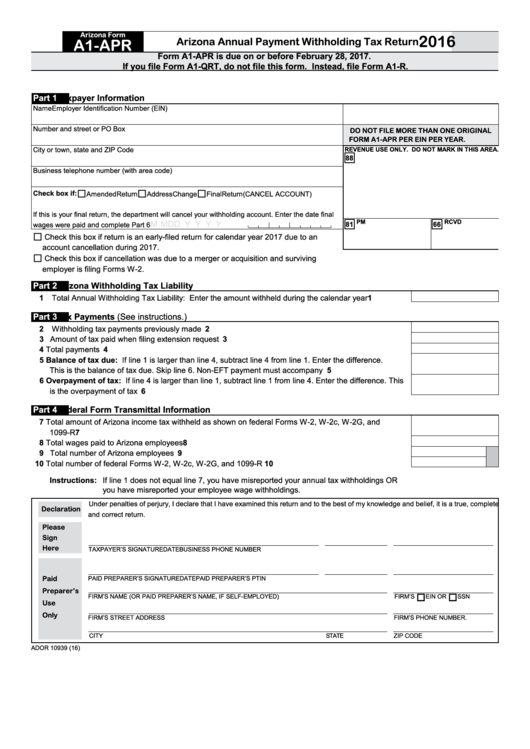

Fillable Arizona Form A1Apr Arizona Annual Payment Withholding Tax

Request for reduced withholding to designate for tax credits. For additional questions not addressed in this document, contact [email protected]. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Annuitant's request for voluntary arizona income tax. 1 withhold from gross taxable wages at the percentage checked (check only one.

StepbyStep Guide to Forming an LLC in Arizona

Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Request for reduced withholding to designate for tax credits. Single filers with a taxable income of up to $28,652 paid a.

Free Printable 2023 W 4 Form IMAGESEE

Request for reduced withholding to designate for tax credits. 1 withhold from gross taxable wages at the percentage checked (check only one. Annuitant's request for voluntary arizona income tax. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Web questions and answers for new arizona form a.

Download Arizona Form A4 (2013) for Free FormTemplate

Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Annuitant's request for voluntary arizona income tax. Choose either box 1 or box 2: 1 withhold from gross taxable wages at the percentage checked (check only one. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat.

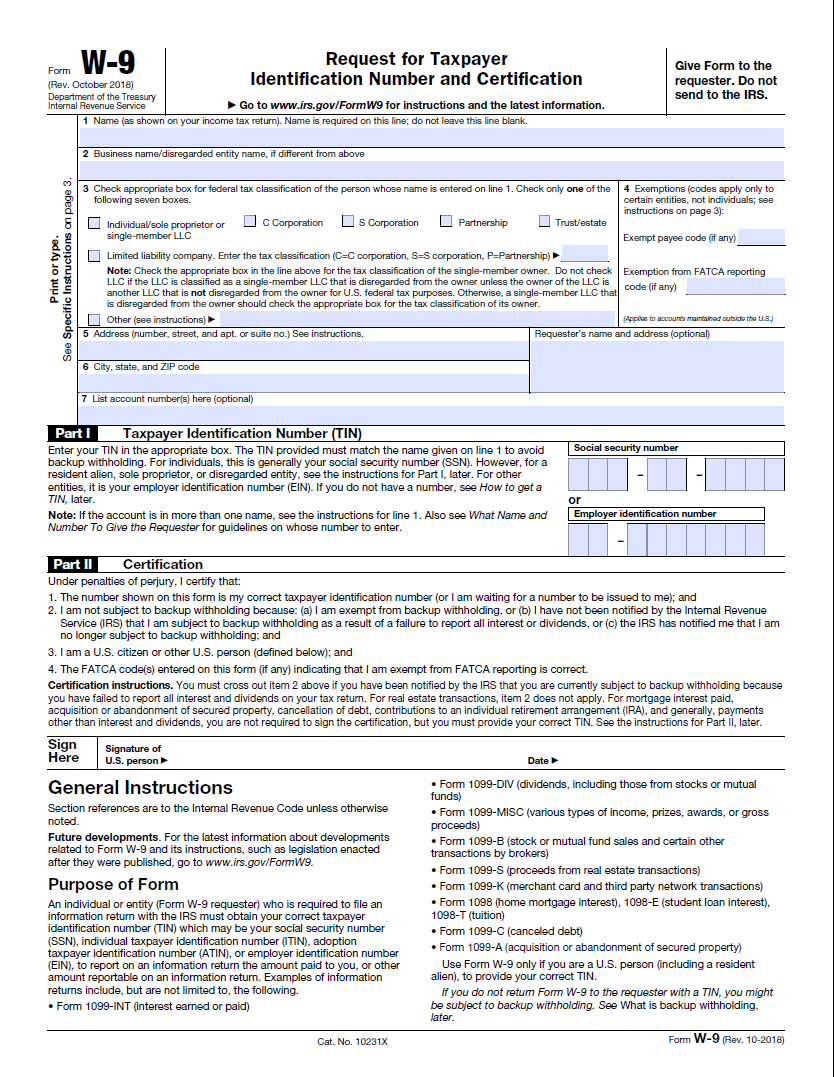

W9 Form 2023 Printable 2023 Payroll Calendar

For additional questions not addressed in this document, contact [email protected]. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web arizona’s income tax for the year 2023 (filed by april 2024) will be a flat rate of 2.5% for all residents. Request for reduced withholding to designate for tax credits. 1.

For Additional Questions Not Addressed In This Document, Contact [Email Protected].

Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Choose either box 1 or box 2: Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%.

Web Arizona’s Income Tax For The Year 2023 (Filed By April 2024) Will Be A Flat Rate Of 2.5% For All Residents.

1 withhold from gross taxable wages at the percentage checked (check only one. Request for reduced withholding to designate for tax credits. Annuitant's request for voluntary arizona income tax.