Amount Of Money Generated By A Property In A Year

Amount Of Money Generated By A Property In A Year - Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. This cash flow rule helps real. Let’s say i have a $100,000 property i bought last year with a $70,000. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. My annual cash flow last year was $3,000, and it appreciated by.

Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. This cash flow rule helps real. My annual cash flow last year was $3,000, and it appreciated by. Let’s say i have a $100,000 property i bought last year with a $70,000. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate.

Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. This cash flow rule helps real. My annual cash flow last year was $3,000, and it appreciated by. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. Let’s say i have a $100,000 property i bought last year with a $70,000. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,.

Real Estate Investing Tips for Beginners

The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. My annual cash flow last year was $3,000, and it appreciated by. Let’s say i have a $100,000 property i bought last year with a $70,000. Cash flow is the amount of money generated by an investment property after accounting for.

My annual cash flow last year was $3,000, and it appreciated by. Let’s say i have a $100,000 property i bought last year with a $70,000. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. The 2% cash flow rule of thumb calculates the amount of rental income a property.

53 Important Statistics About How Much Data Is Created Every Day in

Let’s say i have a $100,000 property i bought last year with a $70,000. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. My annual cash flow last year was $3,000,.

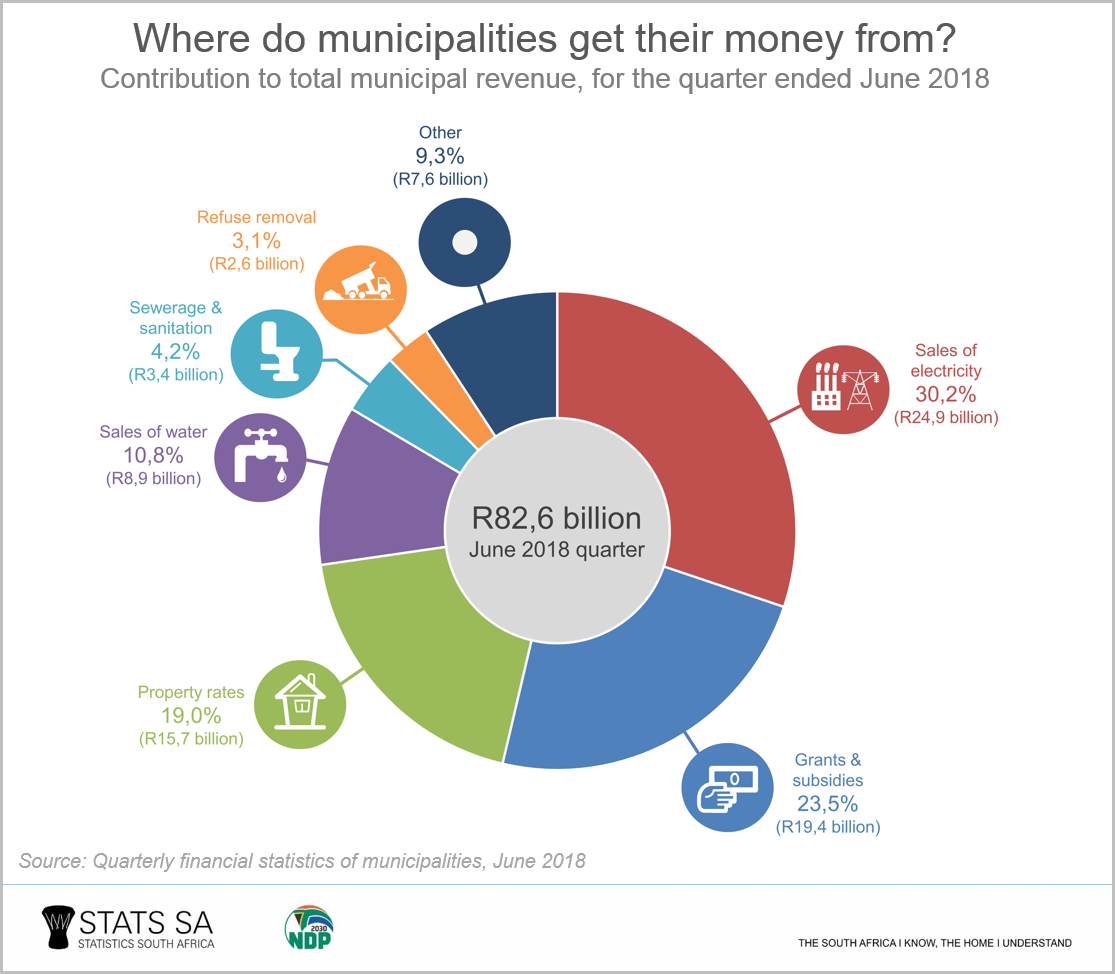

An update to municipal spending and revenue (June 2018) Statistics

This cash flow rule helps real. Let’s say i have a $100,000 property i bought last year with a $70,000. My annual cash flow last year was $3,000, and it appreciated by. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. While rental property offers the potential for generating profits.

How Real Estate Can Generate For the Retirement Years Ed

This cash flow rule helps real. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. Let’s say i have a $100,000 property i bought last year with a $70,000. My annual cash flow last year was $3,000, and it appreciated by. The 2% cash flow rule of thumb calculates the.

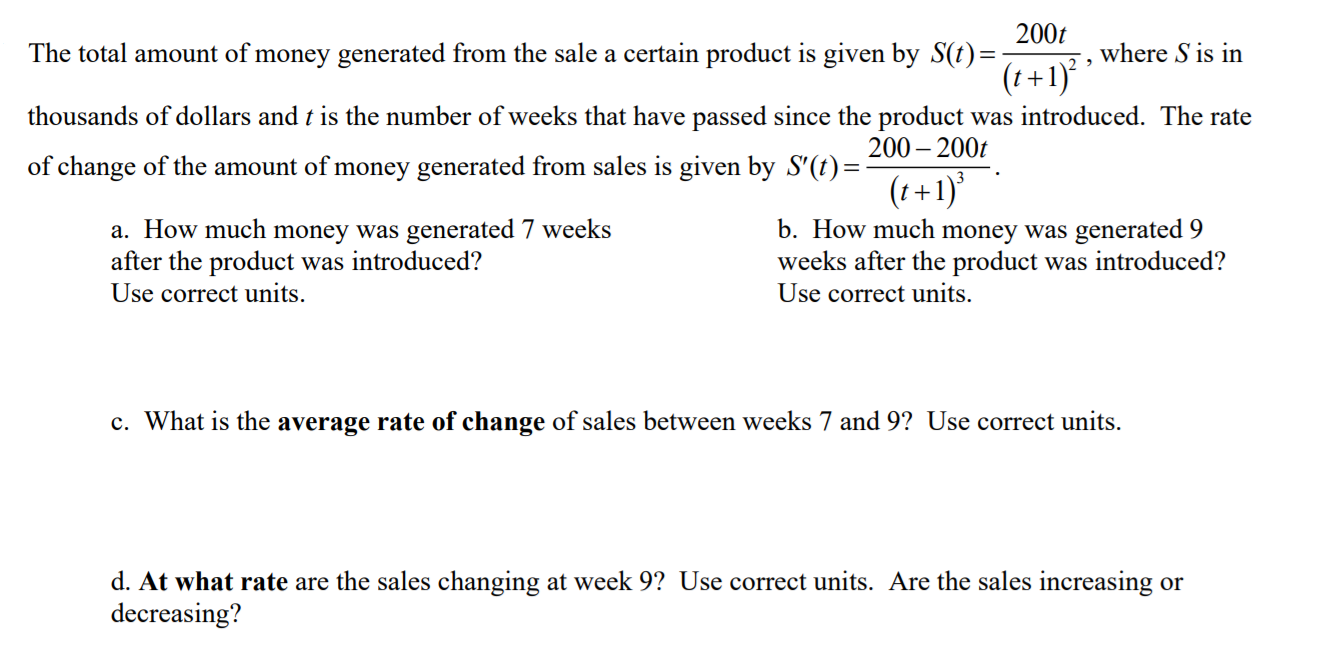

Solved The total amount of money generated from the sale a

My annual cash flow last year was $3,000, and it appreciated by. Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. This cash flow rule helps real. While rental property offers.

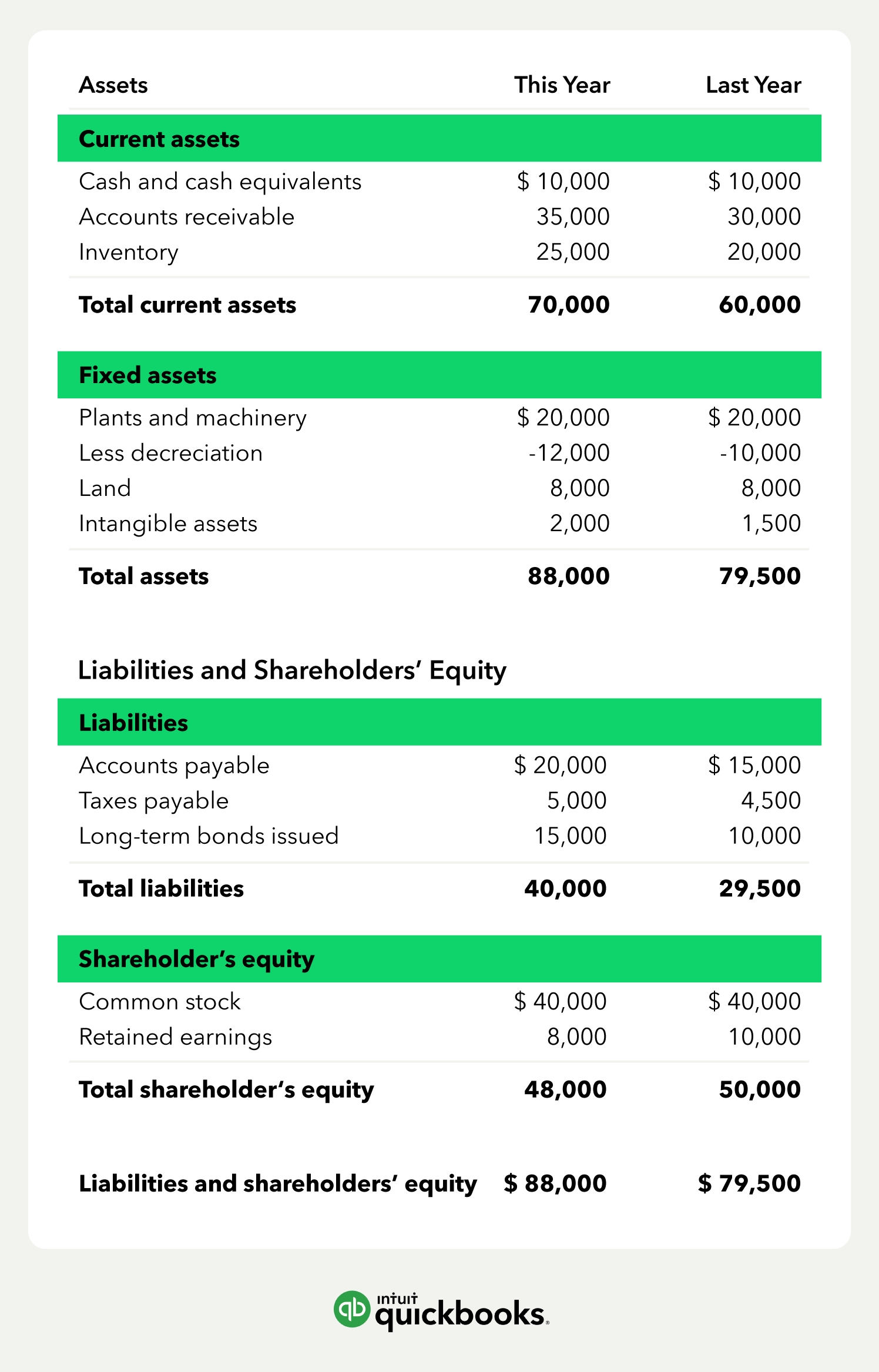

How to Read & Prepare a Balance Sheet QuickBooks

This cash flow rule helps real. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. My annual cash flow last year was $3,000, and it appreciated by. Let’s say i have a $100,000 property i bought last year with a $70,000. While rental property offers the potential for generating profits.

How to Create a Real Estate Investment Model in Excel Financial Edge

While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. This cash flow rule helps real. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. Let’s say i have a $100,000 property i bought last year with a $70,000. My annual.

How to Make Money in Real Estate

This cash flow rule helps real. My annual cash flow last year was $3,000, and it appreciated by. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. Let’s say i have a $100,000 property i bought last year with a $70,000. The 2% cash flow rule of thumb calculates the.

US Tax Revenue Government Revenue in the US Tax Foundation

Let’s say i have a $100,000 property i bought last year with a $70,000. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. This cash flow rule helps real. The 2% cash flow rule of thumb calculates the amount of rental income a property can expected to generate. Cash flow.

Cash Flow Is The Amount Of Money Generated By An Investment Property After Accounting For All Income And Expenses.

Let’s say i have a $100,000 property i bought last year with a $70,000. My annual cash flow last year was $3,000, and it appreciated by. While rental property offers the potential for generating profits through recurring income, appreciation in property value, and tax benefits,. This cash flow rule helps real.

:max_bytes(150000):strip_icc()/real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)

:max_bytes(150000):strip_icc()/HOWMONEYISMADEREALESTATEFINALJPEG-8db8883c13df4233ba2aad6ae392647f.jpg)