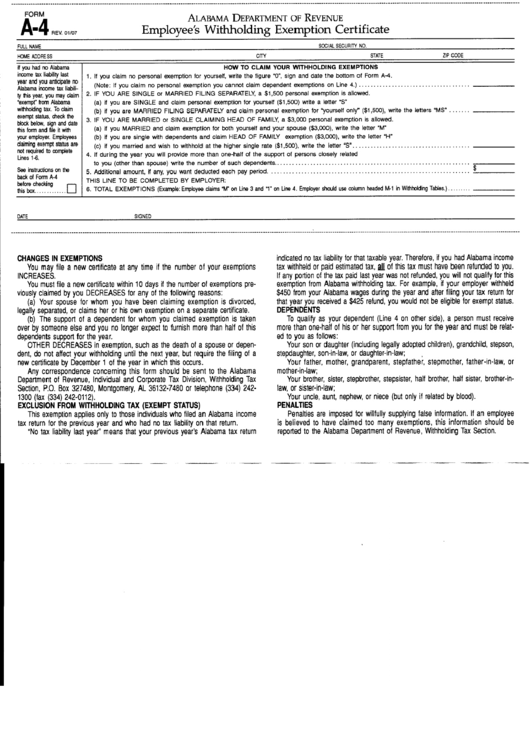

Alabama Tax Withholding Form

Alabama Tax Withholding Form - Section 40 18 73, code of alabama 1975. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. If you are computing alabama withholding tax using the formula method and an employee claims ''h'' (head of family), the deduction allowed in item ''a'' of the formula is 20% limited to $2,000. Annual reconciliation of alabama income tax withheld. Employer’s quarterly return of income tax withheld. Please include contact information with your correspondence. Persons claiming single or zero exemption: Only use the print form button if the form you are printing does not have a green print button. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all over $3,000. Mat is an online filing system developed to allow taxpayers to file and pay their withholding tax electronically.

Only use the print form button if the form you are printing does not have a green print button. Please include contact information with your correspondence. Web any correspondence concerning this form should be sent to the al dept of rev enue, withholdingtax section, po box 327480, montgomery, al 36132 7480 or by fax to 334 242 0112. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Section 40 18 73, code of alabama 1975. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Employer’s quarterly return of income tax withheld. 2% on first $1,000 of taxable wages, 4% on next. Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. Annual reconciliation of alabama income tax withheld.

Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. 2% on first $1,000 of taxable wages, 4% on next. Only use the print form button if the form you are printing does not have a green print button. Employer’s quarterly return of income tax withheld. Please include contact information with your correspondence. Persons claiming single or zero exemption: Web any correspondence concerning this form should be sent to the al dept of rev enue, withholdingtax section, po box 327480, montgomery, al 36132 7480 or by fax to 334 242 0112. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Annual reconciliation of alabama income tax withheld. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all over $3,000.

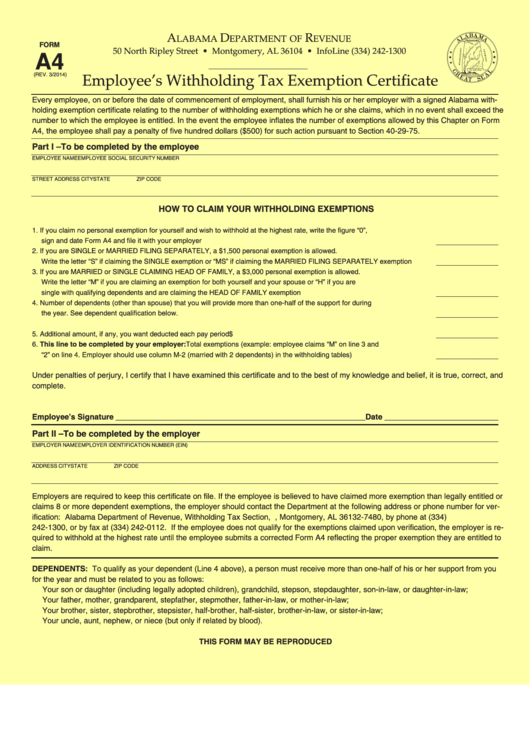

Form A4 Employee'S Withholding Exemption Certificate Alabama

Section 40 18 73, code of alabama 1975. Employer’s quarterly return of income tax withheld. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. Only use the print form button if the form you are printing does not.

Fillable Form A4 Alabama Employee'S Withholding Tax Exemption

Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. Persons claiming single or zero exemption: Employer’s quarterly return of income tax withheld. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all over $3,000. If you are computing alabama withholding tax using the.

Estimated Tax Form Alabama Free Download

Persons claiming single or zero exemption: In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Employer’s quarterly return of income tax withheld. Web any correspondence concerning this form should be sent to the al dept of rev enue, withholdingtax section, po box 327480, montgomery, al 36132 7480 or by fax to.

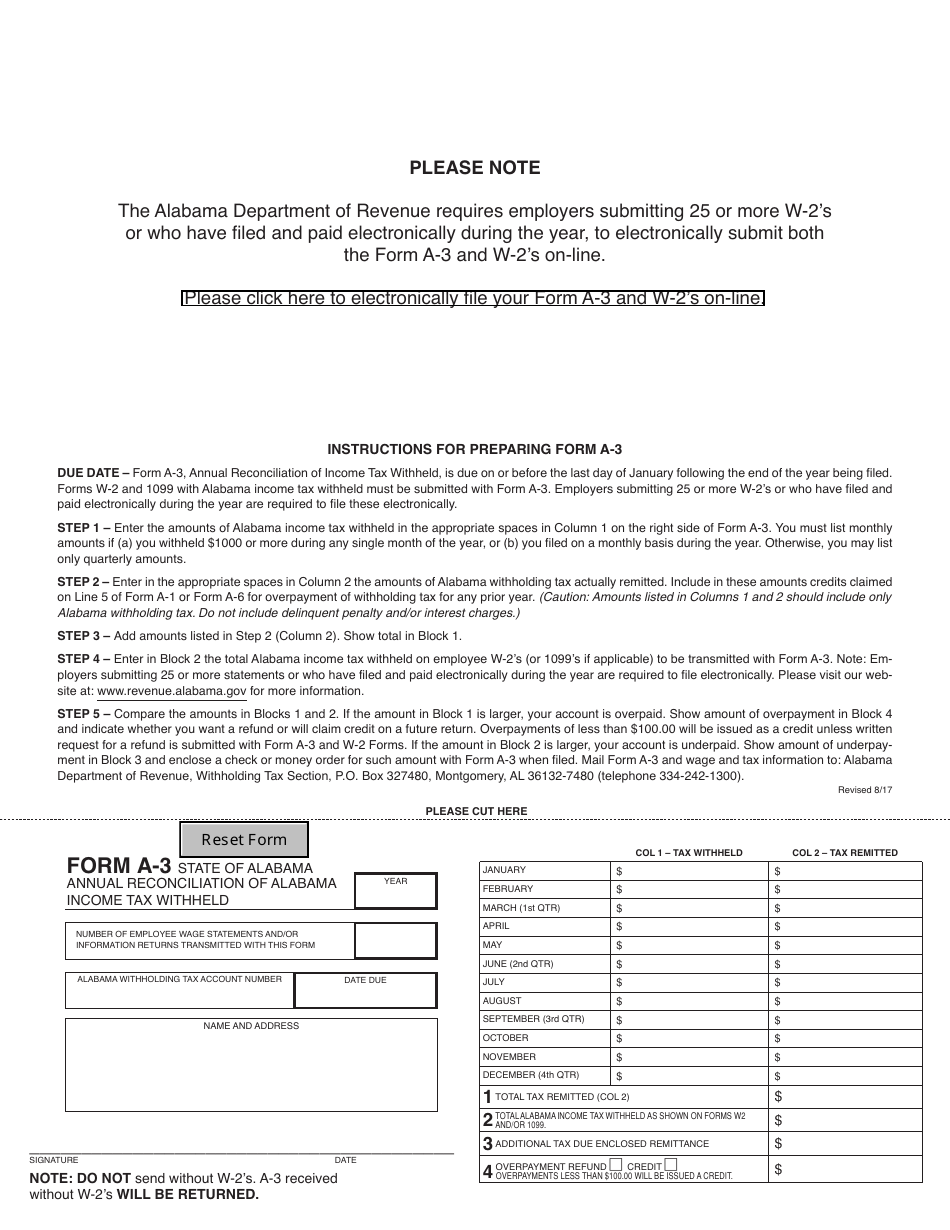

Form A3 Download Fillable PDF or Fill Online Annual Reconciliation of

Mat is an online filing system developed to allow taxpayers to file and pay their withholding tax electronically. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Only use the print form button if the form you are printing does not have a green print button. Web tax policy to get.

State Of Alabama Employee Tax Withholding Form 2023

Web the alabama department of revenue offers a free electronic service, my alabama taxes (mat), for filing and remitting withholding tax. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all over $3,000. If you are computing alabama withholding tax using the formula method and an employee claims ''h'' (head of family), the deduction allowed.

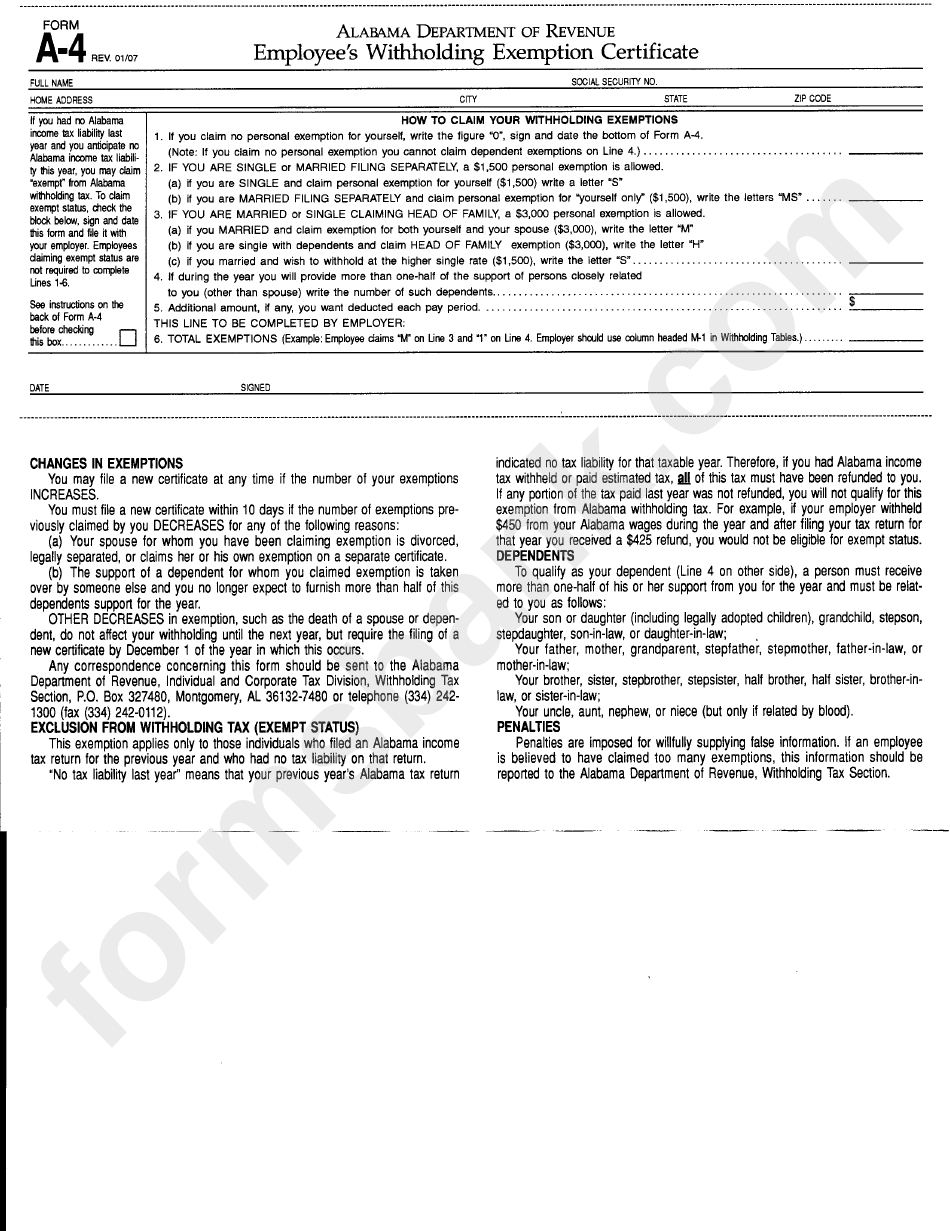

Form A4 Employee'S Withholding Exemption Certificate Alabama

In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. If you are computing alabama withholding tax using the formula method and an employee claims ''h'' (head of family), the deduction allowed in item ''a'' of the formula is 20% limited to $2,000. Section 40 18 73, code of alabama 1975. Only.

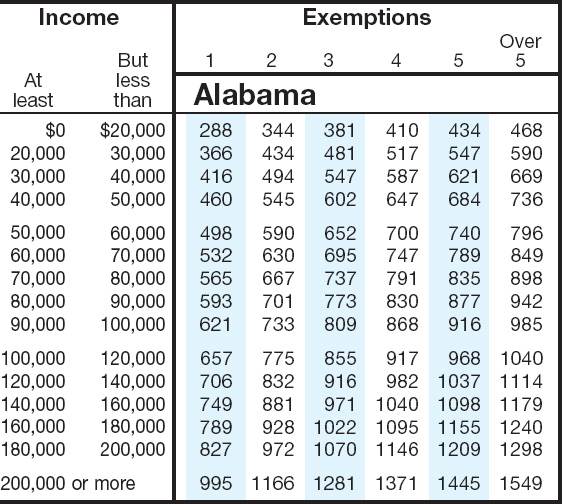

State Of Alabama Withholding Tax Tables 2021 Federal Withholding

Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. If you are computing alabama withholding tax using the formula method and an employee claims ''h'' (head of family), the deduction allowed in item ''a'' of the formula is.

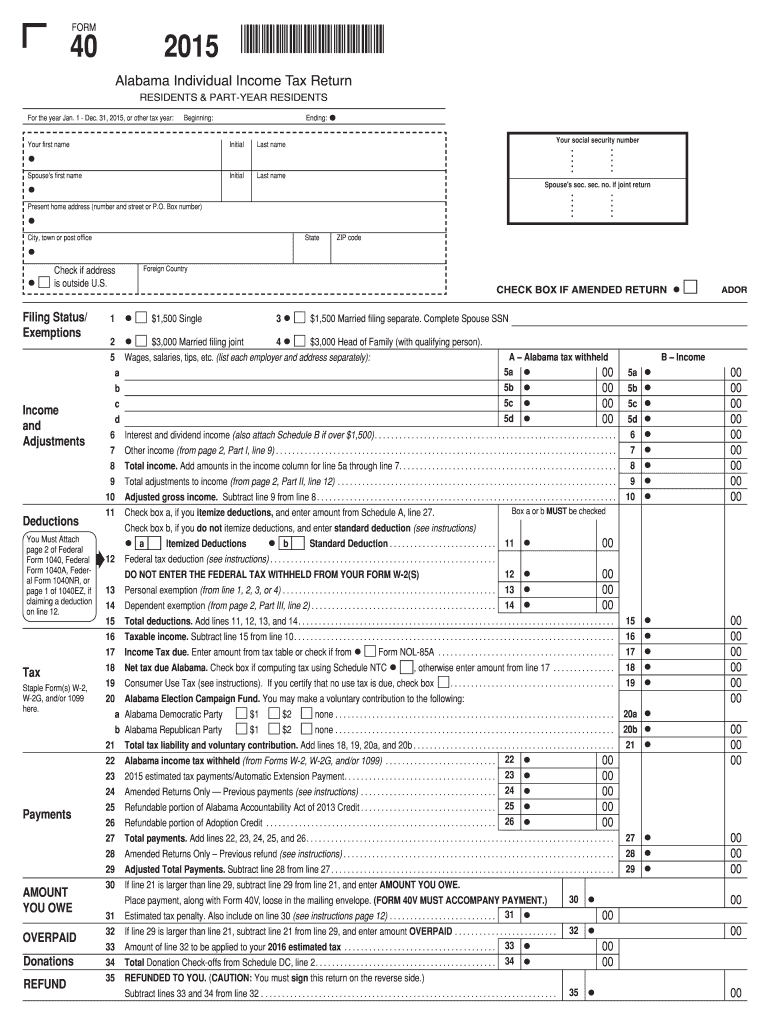

Alabama Form 40 Fill Out and Sign Printable PDF Template signNow

2% on first $1,000 of taxable wages, 4% on next. Only use the print form button if the form you are printing does not have a green print button. Please include contact information with your correspondence. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button,.

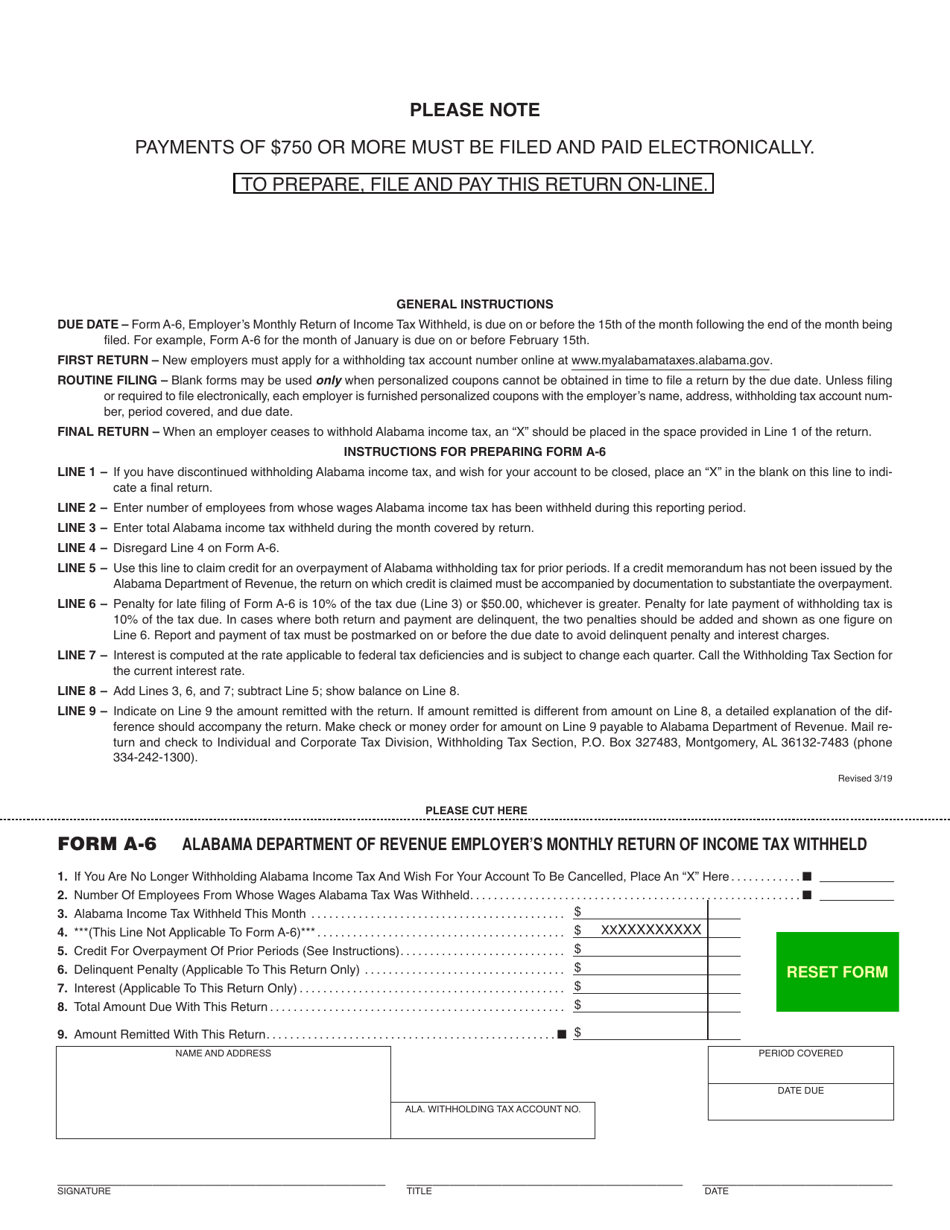

Form A6 Download Fillable PDF or Fill Online Alabama Department of

Persons claiming single or zero exemption: Mat is an online filing system developed to allow taxpayers to file and pay their withholding tax electronically. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. 2% on first $1,000 of taxable wages, 4% on next. Section 40 18 73, code of alabama 1975.

What Is Alabama Withholding Tax QATAX

Persons claiming single or zero exemption: Annual reconciliation of alabama income tax withheld. Only use the print form button if the form you are printing does not have a green print button. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Web any correspondence concerning this form should be sent to.

Only Use The Print Form Button If The Form You Are Printing Does Not Have A Green Print Button.

Persons claiming single or zero exemption: Mat is an online filing system developed to allow taxpayers to file and pay their withholding tax electronically. Web tax policy to get started, open the tax forms(eg, alabama form 40) or your saved tax forms (the html file) using this button, or drag it to the area below. 2% on first $1,000 of taxable wages, 4% on next.

Section 40 18 73, Code Of Alabama 1975.

In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Annual reconciliation of alabama income tax withheld. If you are computing alabama withholding tax using the formula method and an employee claims ''h'' (head of family), the deduction allowed in item ''a'' of the formula is 20% limited to $2,000. Please include contact information with your correspondence.

Web The Alabama Department Of Revenue Offers A Free Electronic Service, My Alabama Taxes (Mat), For Filing And Remitting Withholding Tax.

Employer’s quarterly return of income tax withheld. 2% on first $500 of taxable wages, 4% on next $2,500, and 5% on all over $3,000. Web any correspondence concerning this form should be sent to the al dept of rev enue, withholdingtax section, po box 327480, montgomery, al 36132 7480 or by fax to 334 242 0112.