A Portfolio Manager Generates A 5 Return In Year 1

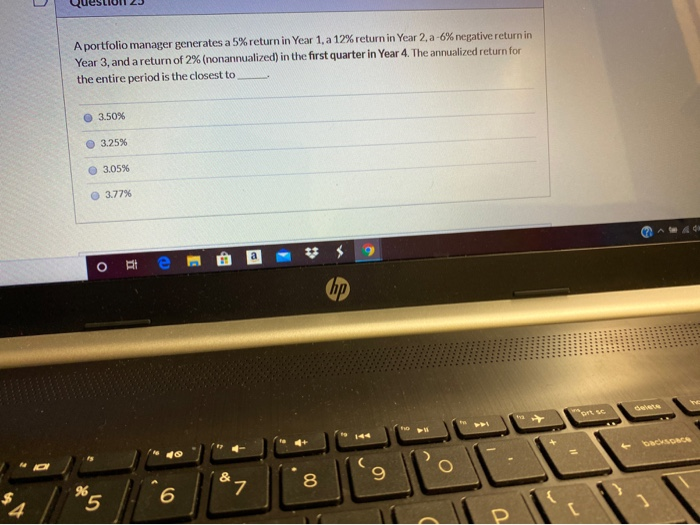

A Portfolio Manager Generates A 5 Return In Year 1 - To calculate the annualized return for the entire period, we need to consider the returns for each year and the return in the first. Adrian chase, a portfolio manager, generates a return of 14% when the benchmark returns 11.5%. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. The annualized return of approximately 3.75% is calculated by considering the varying returns over four periods, accounting for both positive and. Compound the returns by summing them,. To calculate this, apply the geometric mean to evaluate the total return over the entire period of time. The expected return of the benchmark. There’s just one step to solve this.

To calculate this, apply the geometric mean to evaluate the total return over the entire period of time. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. The expected return of the benchmark. Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. Adrian chase, a portfolio manager, generates a return of 14% when the benchmark returns 11.5%. The annualized return of approximately 3.75% is calculated by considering the varying returns over four periods, accounting for both positive and. To calculate the annualized return for the entire period, we need to consider the returns for each year and the return in the first. Compound the returns by summing them,. There’s just one step to solve this.

The expected return of the benchmark. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. To calculate this, apply the geometric mean to evaluate the total return over the entire period of time. Adrian chase, a portfolio manager, generates a return of 14% when the benchmark returns 11.5%. Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. The annualized return of approximately 3.75% is calculated by considering the varying returns over four periods, accounting for both positive and. Compound the returns by summing them,. There’s just one step to solve this. To calculate the annualized return for the entire period, we need to consider the returns for each year and the return in the first.

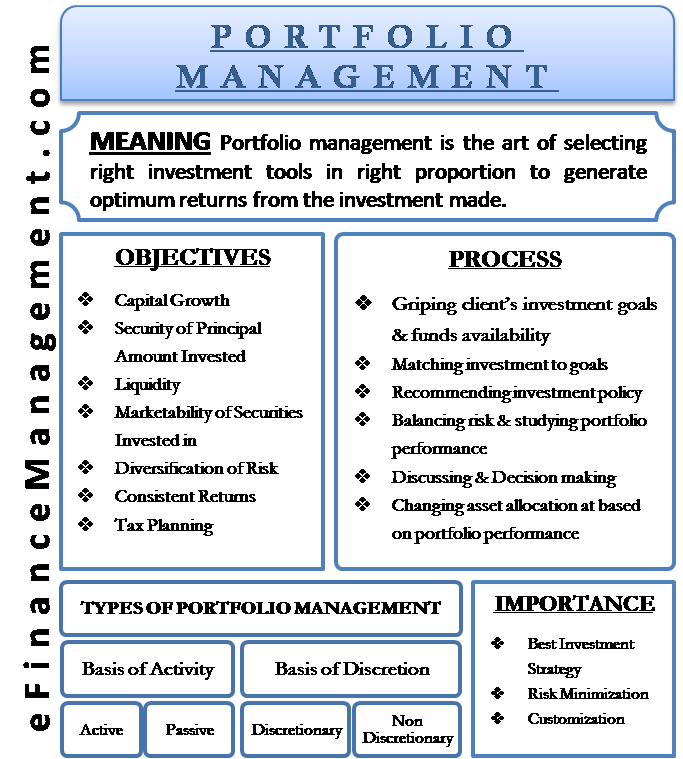

Portfolio Management Definition, Objectives, Importance, Process, Types

Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. To calculate this, apply the geometric mean to evaluate the total return over the entire period of.

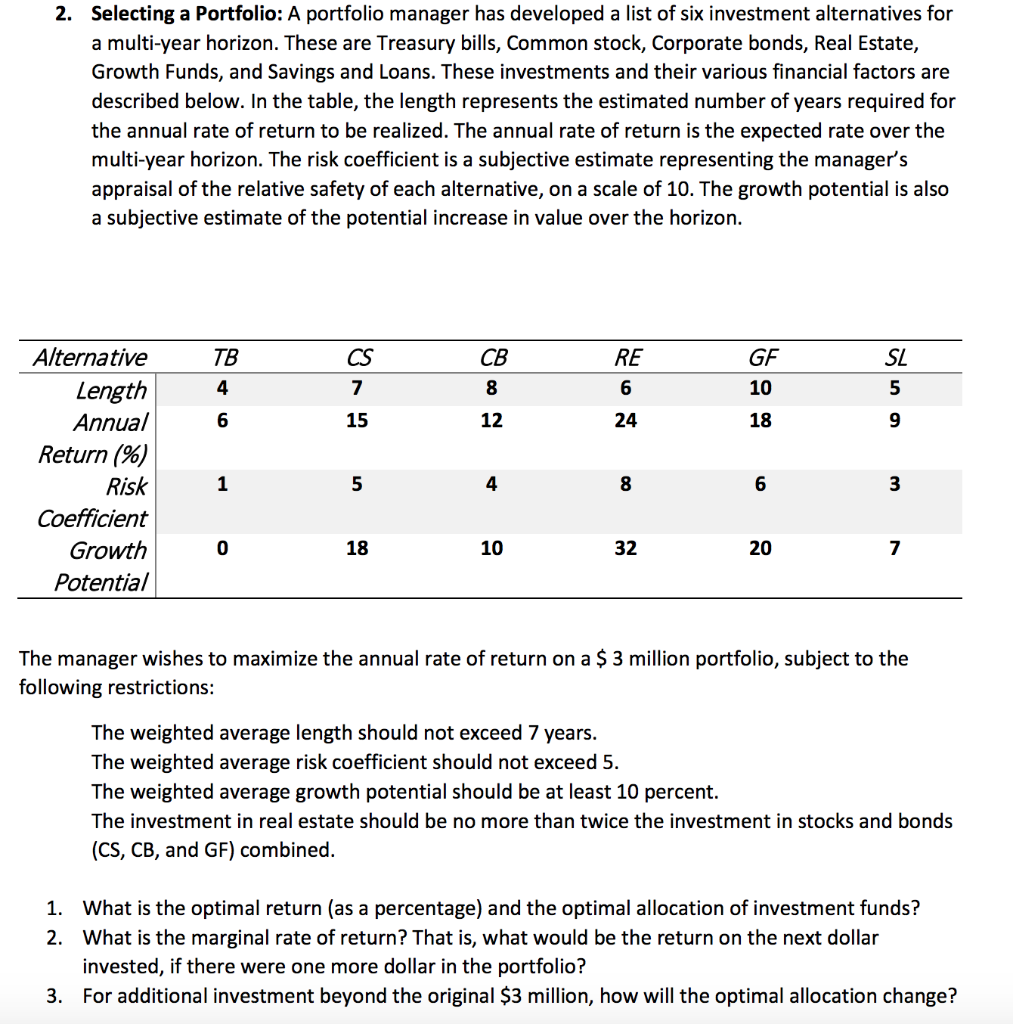

Solved 2. Selecting a Portfolio A portfolio manager has

The annualized return of approximately 3.75% is calculated by considering the varying returns over four periods, accounting for both positive and. To calculate the annualized return for the entire period, we need to consider the returns for each year and the return in the first. The expected return of the benchmark. To calculate this, apply the geometric mean to evaluate.

Solved A portfolio manager generates a 5 return in Year 1,

Compound the returns by summing them,. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. To calculate the annualized return for the entire period, we need to consider the returns for each year and the return in the first. Adrian chase, a portfolio manager, generates a return of 14% when.

What is a portfolio manager? Definition and some relevant example

Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. To calculate this, apply the geometric mean to evaluate the total return over the entire period of time. Compound the returns by summing them,. The annualized return of approximately 3.75% is calculated by considering the varying.

Portfolio Management Maximizing Returns and Managing Risks for Optimal

To calculate the annualized return for the entire period, we need to consider the returns for each year and the return in the first. Compound the returns by summing them,. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. The annualized return of approximately 3.75% is calculated by considering the.

Solved You observe a portfolio for five year and determine

The annualized return of approximately 3.75% is calculated by considering the varying returns over four periods, accounting for both positive and. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. To calculate the annualized return for the entire period, we need to consider the returns for each year and the.

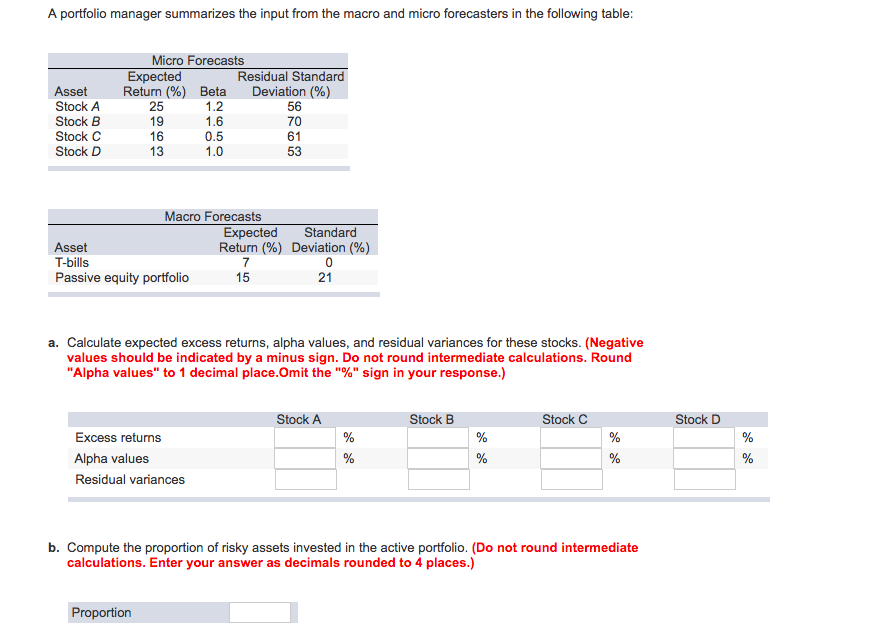

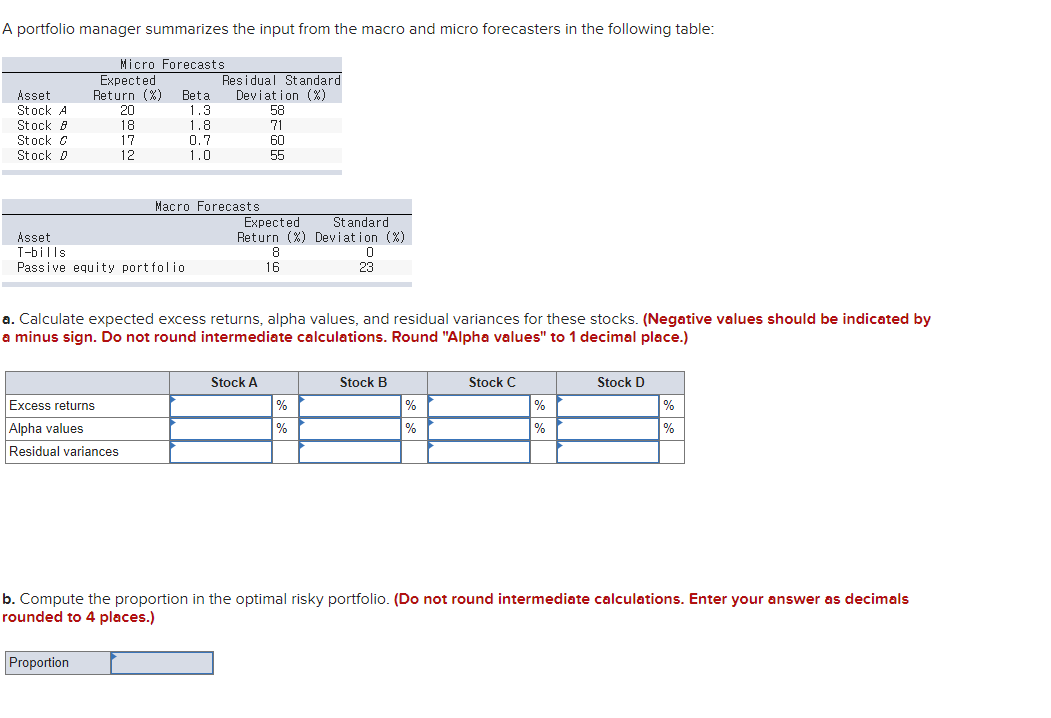

Solved A portfolio manager summarizes the input from the

There’s just one step to solve this. Compound the returns by summing them,. To calculate this, apply the geometric mean to evaluate the total return over the entire period of time. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. The annualized return of approximately 3.75% is calculated by considering.

How to Calculate Portfolio Returns From Scratch (Example Included

Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. To calculate this, apply the geometric mean to evaluate the total return over the entire period of.

Portfolio Diversification Strategies for Maximizing Returns and

The annualized return of approximately 3.75% is calculated by considering the varying returns over four periods, accounting for both positive and. Adrian chase, a portfolio manager, generates a return of 14% when the benchmark returns 11.5%. An active portfolio manager generates a return of 18.80% on her equity portfolio that has a beta of 1.40. To calculate the annualized return.

Solved A portfolio manager summarizes the input from the

Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. To calculate this, apply the geometric mean to evaluate the total return over the entire period of time. The expected return of the benchmark. Compound the returns by summing them,. There’s just one step to solve.

An Active Portfolio Manager Generates A Return Of 18.80% On Her Equity Portfolio That Has A Beta Of 1.40.

Indexing is a form of passive investing in which the investor simply purchases an index of returns using mutual funds or exchange traded funds. To calculate the annualized return for the entire period, we need to consider the returns for each year and the return in the first. To calculate this, apply the geometric mean to evaluate the total return over the entire period of time. There’s just one step to solve this.

The Annualized Return Of Approximately 3.75% Is Calculated By Considering The Varying Returns Over Four Periods, Accounting For Both Positive And.

The expected return of the benchmark. Adrian chase, a portfolio manager, generates a return of 14% when the benchmark returns 11.5%. Compound the returns by summing them,.