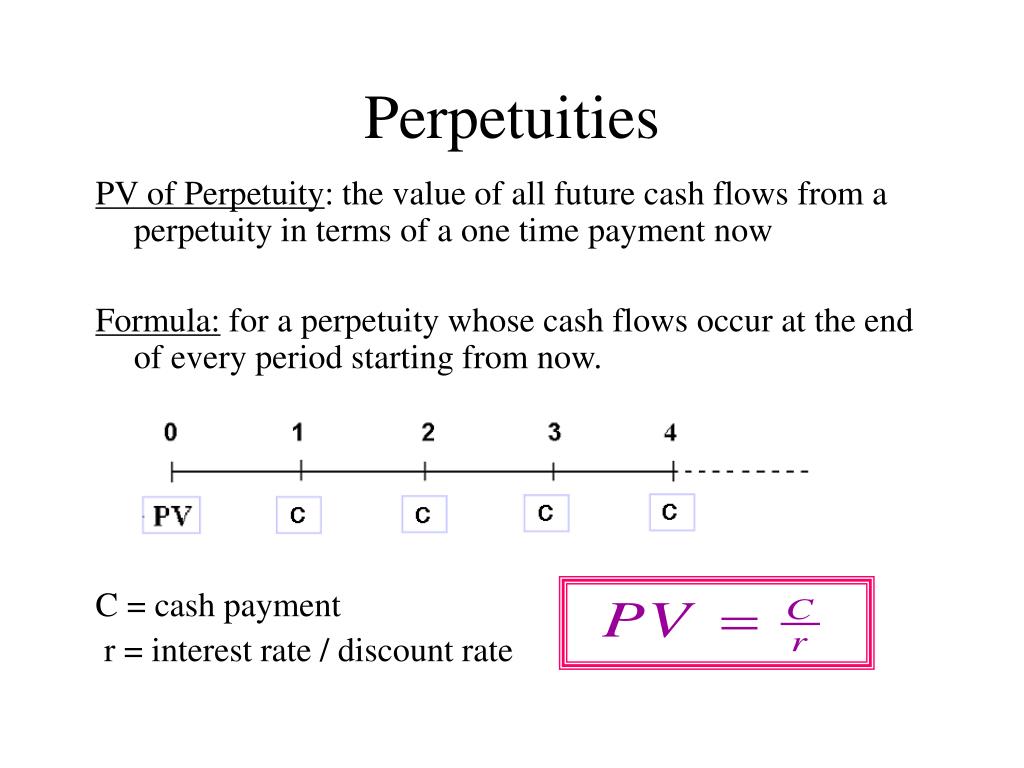

A Perpetuity A Special Form Of Annuity Pays Cash Flows

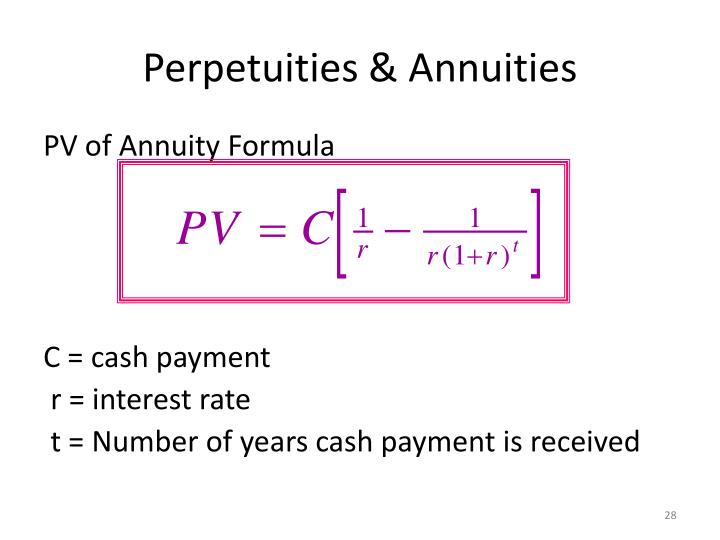

A Perpetuity A Special Form Of Annuity Pays Cash Flows - P = present value of an annuity stream pmt = dollar amount of each annuity payment r = interest rate (also known as. An annuity is also known as a perpetuity. Many people who want to start investing for their future want to start today, which implies an annuity. A series of cash outflows which goes on forever is. Web the future value of an annuity is the total value of payments at a specific point in time. An annuity that provides perpetual cash flows with no end date. For example, bonds generally pay. Web the bottom line. Web a perpetuity, a special form of annuity, pays cash flows. And is not effected by interest rate changes.

Web the perpetuity rule is one sort of annuity that pays forever. And is not effected by interest rate changes. What other factor also has this effect? To reiterate, perpetuities are cash flows are expected to continue forever with no ending date. An annuity is also known as a perpetuity. That do not have time value of money implications. Web any sequence of equally spaced, level cash flows is called an annuity. Compound interest to calculate future values b. It is always built around an expiration. Web with an annuity, the money will eventually run out because there is a scheduled end to the payment schedule.

An annuity that provides perpetual cash flows with no end date. For example, bonds generally pay. P = present value of an annuity stream pmt = dollar amount of each annuity payment r = interest rate (also known as. And is not effected by interest rate changes. An annuity is a financial asset, not an investment security, that makes payments at regular intervals over time. A chain of regular cash flows up to a certain period of time is known as annuity. A mortgage loan is an example of an amortizing loan. Web a perpetuity generates payments or cash flows indefinitely and a perpetuity calculation can be used to determine either a present value for an investment or its. Discounted cash flows to calculate. An annuity is also known as a perpetuity.

Solved 7. Present value of annuities and annuity payments

Web with an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. Payments at the end of each period. Examples of financial instruments that grant perpetual cash flows to its holder are. Web the future value of an annuity is the total value of payments at a specific point in time. Web.

Difference Between Annuity and Perpetuity Difference Between

Web the future value of an annuity is the total value of payments at a specific point in time. Payments at the end of each period. Web the perpetuity rule is one sort of annuity that pays forever. A chain of regular cash flows up to a certain period of time is known as annuity. Web an annuity is a.

Difference Between Annuity and Perpetuity Difference Between

Payments at the end of each period. The process of paying off a loan by making regular principal reductions is called. Web future value when moving from the left to the right of a time line, we are using a. Web the perpetuity rule is one sort of annuity that pays forever. That do not have time value of money.

Is an Annuity a Perpetuity?

Many people who want to start investing for their future want to start today, which implies an annuity. And is not effected by interest rate changes. Payments at the end of each period. A series of cash outflows which goes on forever is. An annuity is also known as a perpetuity.

PPT Present value, annuity, perpetuity PowerPoint Presentation ID

The length of time of the annuity is very important in accumulating wealth within an annuity. Many people who want to start investing for their future want to start today, which implies an annuity. An annuity that provides perpetual cash flows with no end date. Web the bottom line. What other factor also has this effect?

PPT Chapter 4 Time Value of Money (cont.) PowerPoint Presentation

A chain of regular cash flows up to a certain period of time is known as annuity. What other factor also has this effect? A mortgage loan is an example of an amortizing loan. Web with an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. The process of paying off a.

Difference Between Annuity and Perpetuity Difference Between

These cash flows are characterized by regular payments that may. Payments at the end of each period. The process of paying off a loan by making regular principal reductions is called. P = present value of an annuity stream pmt = dollar amount of each annuity payment r = interest rate (also known as. Web a perpetuity, a special form.

Suppose an annuity pays 4 annual interest, compounded annually. If you

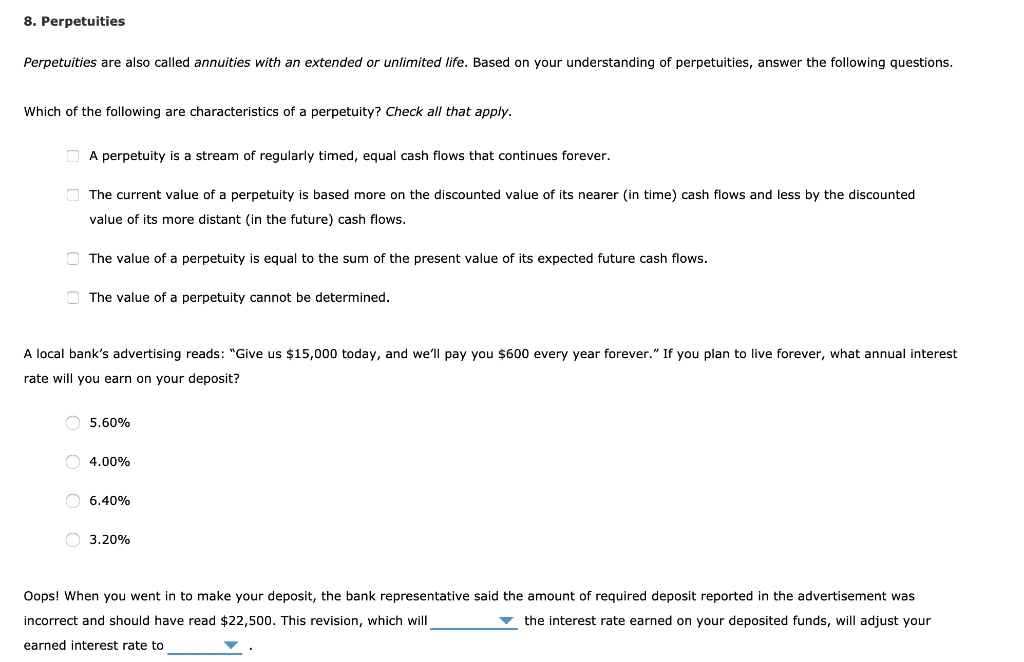

Web the perpetuity rule is one sort of annuity that pays forever. For example, bonds generally pay. With a perpetuity, the payments continue on. These cash flows are characterized by regular payments that may. Web finance finance questions and answers what is the present value of a $300 annuity payment over 5 years if interest rates are 8 percent?

A certain perpetuity pays the holder 200 per month. If the money is

Perpetuities are set payments received forever—or into perpetuity. The process of paying off a loan by making regular principal reductions is called. It is always built around an expiration. Web a perpetuity generates payments or cash flows indefinitely and a perpetuity calculation can be used to determine either a present value for an investment or its. Web the bottom line.

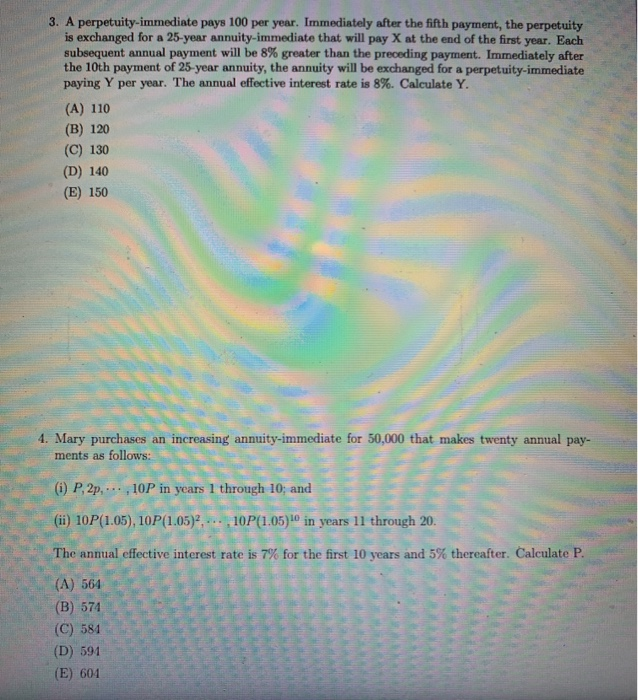

Solved 3. A perpetuityimmediate pays 100 per year.

Web a perpetuity, a special form of annuity, pays cash flows. Web with an annuity, the money will eventually run out because there is a scheduled end to the payment schedule. Examples of financial instruments that grant perpetual cash flows to its holder are. A perpetuity, a special form of. Discounted cash flows to calculate.

Web A Perpetuity, A Special Form Of Annuity, Pays Cash Flows:

Examples of financial instruments that grant perpetual cash flows to its holder are. It is always built around an expiration. Many people who want to start investing for their future want to start today, which implies an annuity. With a perpetuity, the payments continue on.

Web The Future Value Of An Annuity Is The Total Value Of Payments At A Specific Point In Time.

A chain of regular cash flows up to a certain period of time is known as annuity. And is not effected by interest rate changes. Web any sequence of equally spaced, level cash flows is called an annuity. Web a perpetuity, a special form of annuity, pays cash flows:

Discounted Cash Flows To Calculate.

Web a perpetuity, a special form of annuity, pays cash flows. Web p = pmt × 1 − ( 1 ( 1 + r ) n ) r where: An annuity that provides perpetual cash flows with no end date. A mortgage loan is an example of an amortizing loan.

These Cash Flows Are Characterized By Regular Payments That May.

Web a perpetuity, a special form of annuity, pays cash flows multiple choice continuously for one year. Web a perpetuity generates payments or cash flows indefinitely and a perpetuity calculation can be used to determine either a present value for an investment or its. A perpetuity, a special form of. Payments at the end of each period.

/GettyImages-1184024463-25daaf33978646399d600cf6b8274fe5.jpg)