990 Ez Form Schedule A

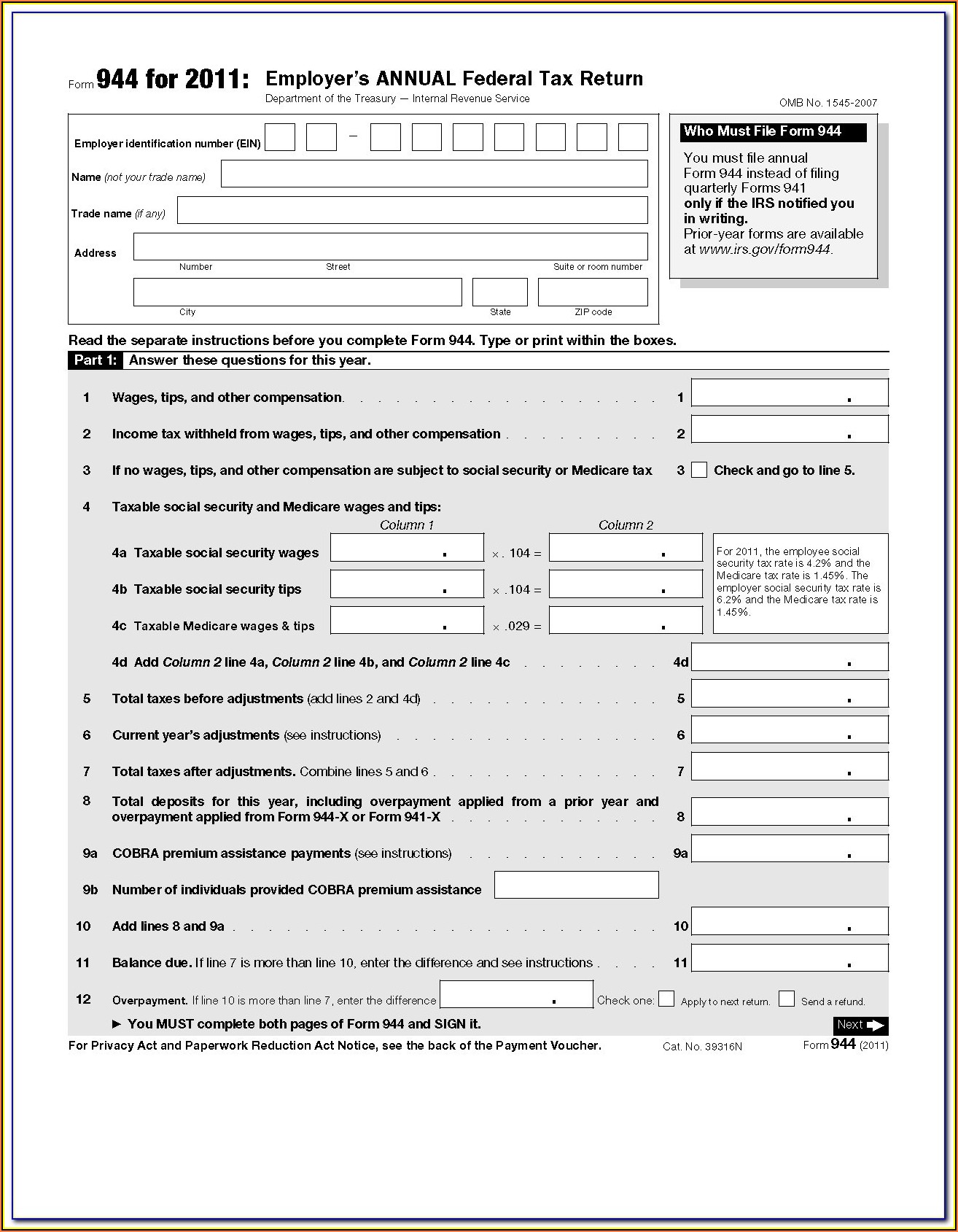

990 Ez Form Schedule A - Web schedule o (form 990) 2022 omb no. This form is used for tax filing purposes, and it will be sent to the united. For an organization described in section 501(c)(7), (8), or (10) filing form. If you checked 12d of part i, complete sections a and d, and complete part v.). Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Optional for others.) balance sheets(see the instructions for part. Web organizations use this schedule to provide information on contributions they reported on: Complete, edit or print tax forms instantly. Each of the other schedules includes a separate part for supplemental information. Get ready for tax season deadlines by completing any required tax forms today.

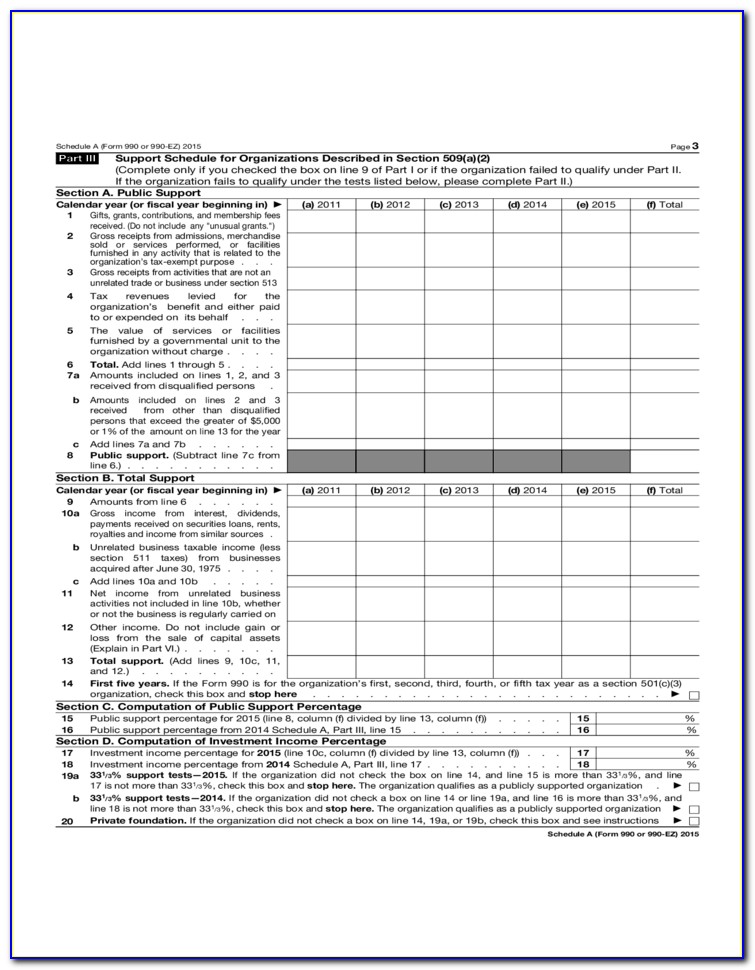

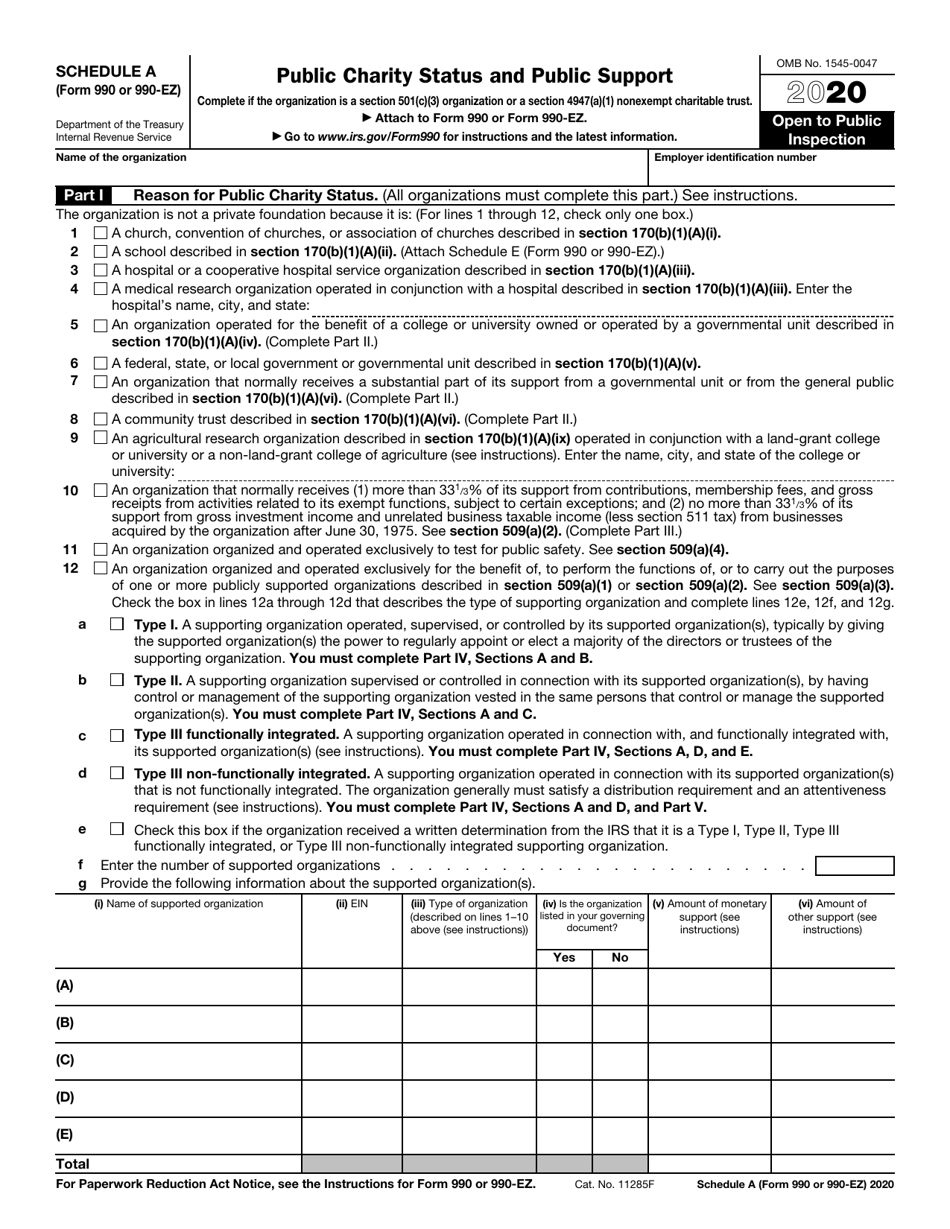

Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of. Web go to www.irs.gov/form990ez for instructions and the latest information. Instructions for these schedules are. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). If you checked 12d of part i, complete sections a and d, and complete part v.). Web 2% of the amount on (i) form 990, part viii, line 1h; Form 990, return of organization exempt. Optional for others.) balance sheets(see the instructions for part. This form is used for tax filing purposes, and it will be sent to the united. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Ad access irs tax forms. This means the organization checked the box on schedule a. Instructions for these schedules are. Web go to www.irs.gov/form990ez for instructions and the latest information. Web the irs has received a number of questions about how to report public support and public charity classification on schedule a, form 990, return of. Who must file all organizations that file form 990 and certain. Optional for others.) balance sheets(see the instructions for part. Get ready for tax season deadlines by completing any required tax forms today. Complete parts i and ii.

Irs Form 990 Ez 2015 Schedule O Form Resume Examples qQ5M9wJ5Xg

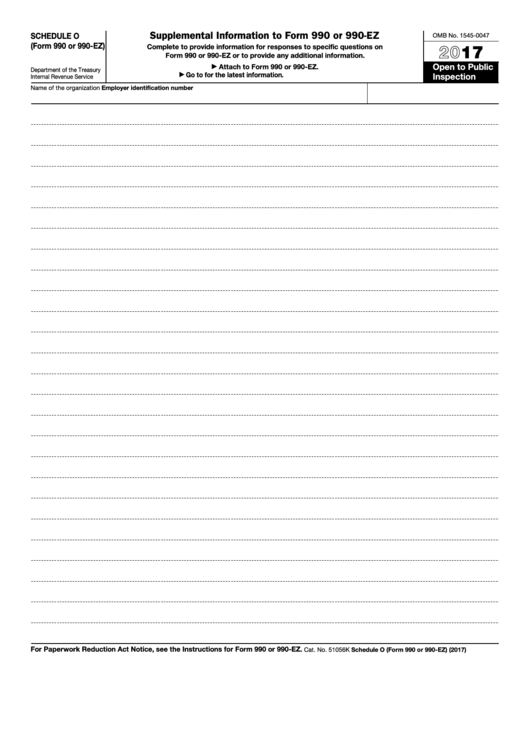

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. For an organization described in section 501(c)(7), (8), or (10) filing form. Web organizations use this schedule to provide information on contributions they reported on: Optional for others.) balance sheets(see the instructions for part. Web schedule o (form 990) 2022 omb.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Form 990, return of organization exempt. Complete parts i and ii. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Web go to www.irs.gov/form990ez for instructions and the latest information. If you checked 12d of part i, complete sections a and d, and complete part v.).

IRS Form 990 (990EZ) Schedule A Download Fillable PDF or Fill Online

Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). Web the following schedules to.

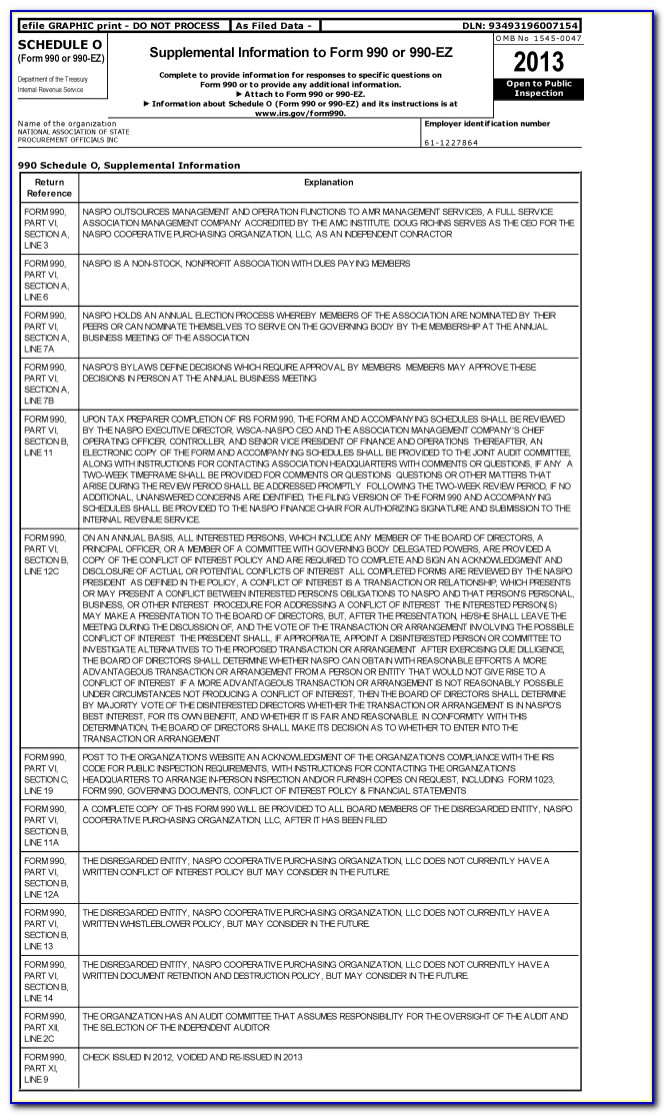

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Web organizations use this schedule to provide information on contributions they reported on: Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Ad access irs tax forms. Web go to www.irs.gov/form990ez for instructions and the latest information. Optional for others.) balance sheets(see the instructions for part.

Irs Forms 990 Ez Form Resume Examples emVKvWnYrX

Complete parts i and ii. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Each of the other schedules includes a separate part for supplemental information. Web schedule o (form 990) 2022 omb no. Optional for others.) balance sheets(see the.

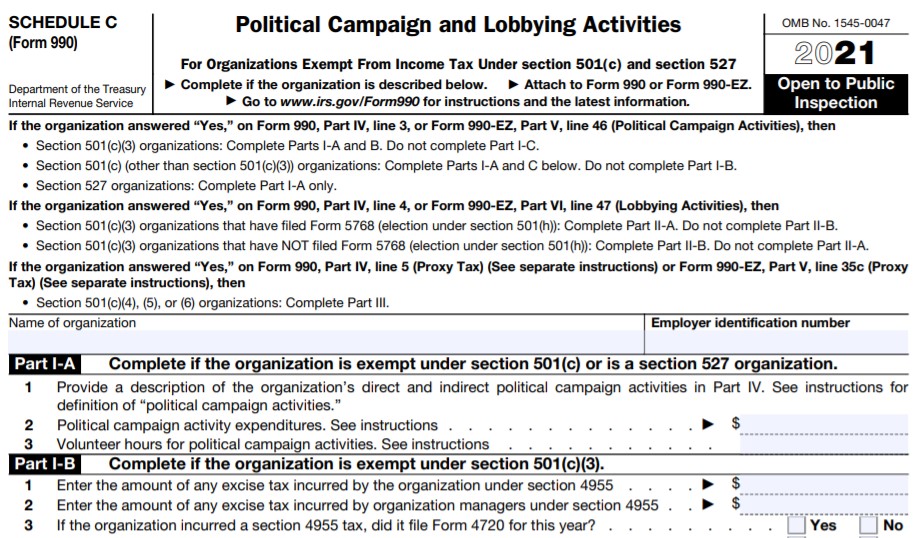

IRS Form 990/990EZ Schedule C Instructions Political Campaign and

For an organization described in section 501(c)(7), (8), or (10) filing form. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w. Optional for others.) balance sheets(see the instructions for part. A supporting organization described in section 509 (a) (3) is.

Form 990 Ez 2013 Schedule O Form Resume Examples B8DVlAnOmb

Web 2% of the amount on (i) form 990, part viii, line 1h; A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web schedule o (form 990) 2022 omb no. Complete, edit or print tax forms instantly. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance.

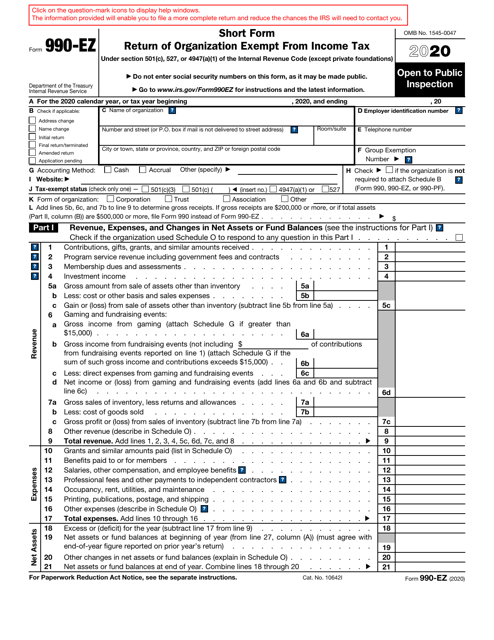

IRS Form 990EZ Download Fillable PDF or Fill Online Short Form Return

Web schedule o (form 990) 2022 omb no. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). Get ready for tax season deadlines by completing any required tax forms today. This means the organization checked the box on schedule a. Optional for others.).

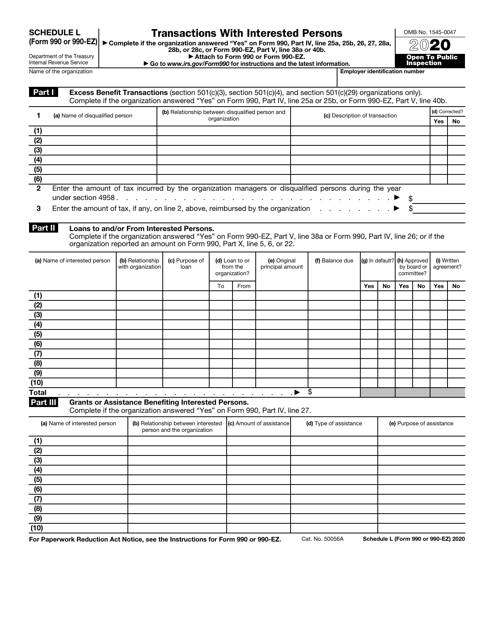

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Web 2% of the amount on (i) form 990, part viii, line 1h; Instructions for these schedules are. If you checked 12d of part i, complete sections a and d, and complete part v.). Complete parts i and ii. Ad access irs tax forms.

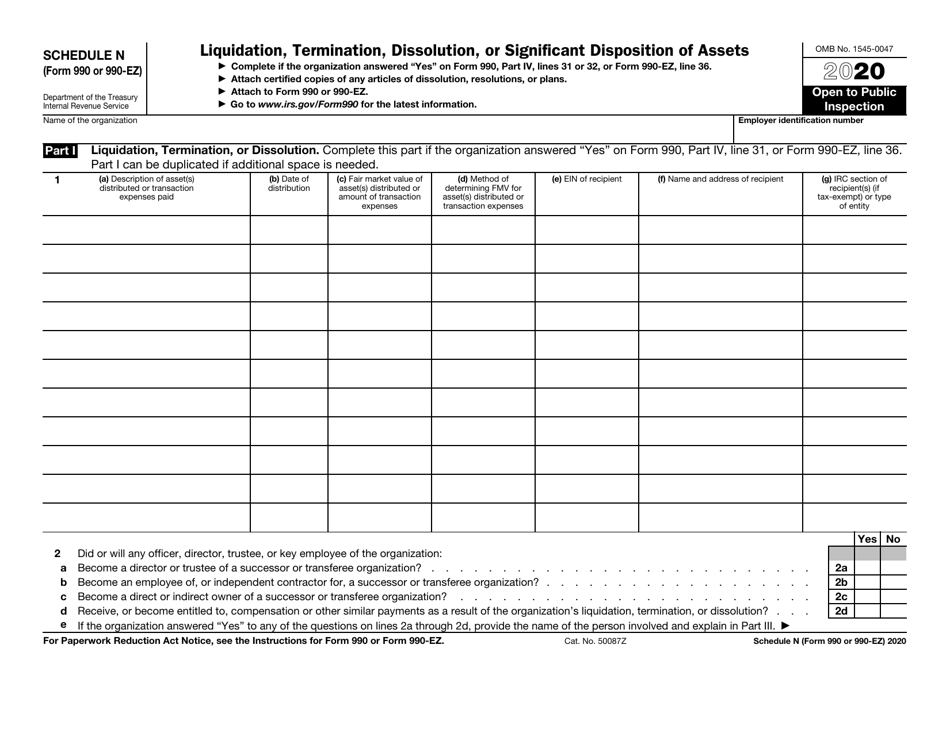

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Each of the other schedules includes a separate part for supplemental information. Web schedule o (form 990) 2022 omb no. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. If you checked 12d of part i, complete sections a and d, and complete part v.). Get ready for tax season deadlines by completing.

Web The Irs Has Received A Number Of Questions About How To Report Public Support And Public Charity Classification On Schedule A, Form 990, Return Of.

Get ready for tax season deadlines by completing any required tax forms today. This form is used for tax filing purposes, and it will be sent to the united. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Form 990, Return Of Organization Exempt.

This means the organization checked the box on schedule a. Each of the other schedules includes a separate part for supplemental information. If you checked 12d of part i, complete sections a and d, and complete part v.). Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

Complete Parts I And Ii.

At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Optional for others.) balance sheets(see the instructions for part. Instructions for these schedules are. Ad access irs tax forms.

Web Go To Www.irs.gov/Form990Ez For Instructions And The Latest Information.

Schedule a (form 990) 2022 (all organizations must complete this part.) see. Who must file all organizations that file form 990 and certain. Ad access irs tax forms. Web form 990 (2022) page 5 part v statements regarding other irs filings and tax compliance (continued) yes no 2a enter the number of employees reported on form w.