990 Extension Form

990 Extension Form - So, if your institution’s year end is. Web what does it mean to file for an extension? Edit, sign and save org exempt tax retn short form. Organization details such as name, address, ein/tax id, tax year. For organizations on a calendar year, the form 990 is due. Batch extensions while this article explains how to create extensions for individual clients, you have the. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. To use the table, you. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due.

For organizations on a calendar year, the form 990 is due. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. So, if your institution’s year end is. Batch extensions while this article explains how to create extensions for individual clients, you have the. To use the table, you. Web what does it mean to file for an extension? If you need more time to file your nonprofit tax. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Organization details such as name, address, ein/tax id, tax year. Be formed and operating as a charity or nonprofit check your nonprofit filing requirements file your tax return and pay your balance due.

Batch extensions while this article explains how to create extensions for individual clients, you have the. If you need more time to file your nonprofit tax. For organizations on a calendar year, the form 990 is due. Thus, for a calendar year. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Be formed and operating as a charity or nonprofit check your nonprofit filing requirements file your tax return and pay your balance due. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Organization details such as name, address, ein/tax id, tax year. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc.

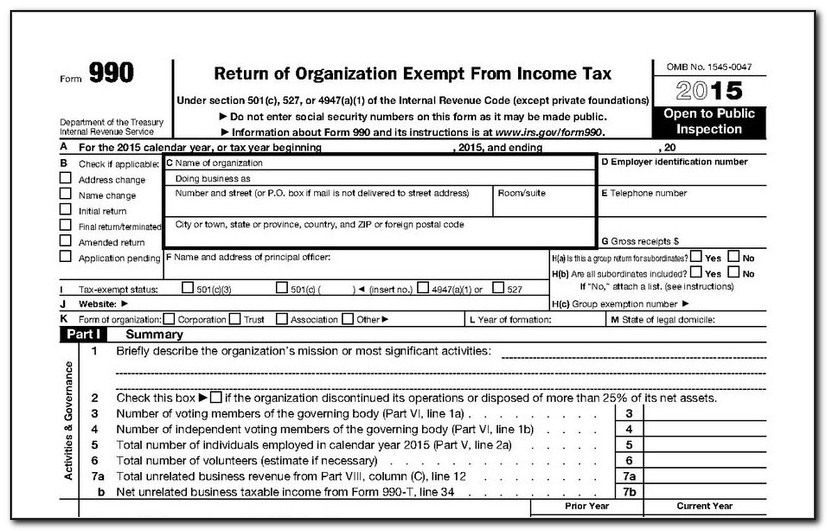

Download Form 990 for Free FormTemplate

Be formed and operating as a charity or nonprofit check your nonprofit filing requirements file your tax return and pay your balance due. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. So, if your institution’s year end is. To use the table, you. If you need.

How to Keep Your TaxExempt Status by Filing IRS Form 990

Web is there an extension for 990 forms? Organization details such as name, address, ein/tax id, tax year. Tax liability and payment for 2022. If you need more time to file your nonprofit tax. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Irs Fillable Extension Form Printable Forms Free Online

Web is there an extension for 990 forms? Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. Be formed and operating as a charity or nonprofit check your nonprofit filing requirements file your tax return and pay your balance due. To use.

Form 990 Filing Extension Form Resume Examples GEOG2LE5Vr

Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. For organizations on a calendar year, the form 990 is due. Thus, for a calendar year. Web what does it mean to file for an extension? Securities and exchange commission, office of foia.

Instructions to file your Form 990PF A Complete Guide

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. So, if your institution’s year end is. Edit, sign and save org exempt tax.

990 Form For Non Profits Irs Universal Network

Edit, sign and save org exempt tax retn short form. Upon written request, copies available from: Batch extensions while this article explains how to create extensions for individual clients, you have the. Web is there an extension for 990 forms? Web what does it mean to file for an extension?

form 990 extension due date 2020 Fill Online, Printable, Fillable

Upon written request, copies available from: So, if your institution’s year end is. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc. For organizations on a calendar year, the form 990 is due. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

How to File A LastMinute 990 Extension With Form 8868

Batch extensions while this article explains how to create extensions for individual clients, you have the. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Uslegalforms allows users to edit, sign, fill & share all type of documents online. For organizations on a calendar year, the form.

How To Never Mistake IRS Form 990 and Form 990N Again

For organizations on a calendar year, the form 990 is due. Uslegalforms allows users to edit, sign, fill & share all type of documents online. To use the table, you. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on. Web accordingly, nonprofits operating on a.

Form 990 Filing Extension Form Resume Examples GEOG2LE5Vr

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Upon written request, copies available from: For organizations on a calendar year, the form 990 is due. If you need more time to file your nonprofit tax. Web.

If You Need More Time To File Your Nonprofit Tax.

For organizations on a calendar year, the form 990 is due. Organization details such as name, address, ein/tax id, tax year. Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Securities and exchange commission, office of foia services, 100 f street ne, washington, dc.

Web What Does It Mean To File For An Extension?

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Upon written request, copies available from: To use the table, you. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or.

Web Information About Form 8868, Application For Extension Of Time To File An Exempt Organization Return, Including Recent Updates, Related Forms, And Instructions On.

Web is there an extension for 990 forms? Web accordingly, nonprofits operating on a calendar year that typically involves them submitting a form 8868 to extend their may 15, 2020 form 990 filing deadline for. Web form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Be formed and operating as a charity or nonprofit check your nonprofit filing requirements file your tax return and pay your balance due.

Edit, Sign And Save Org Exempt Tax Retn Short Form.

Tax liability and payment for 2022. So, if your institution’s year end is. Batch extensions while this article explains how to create extensions for individual clients, you have the. Thus, for a calendar year.