943 Form 2021

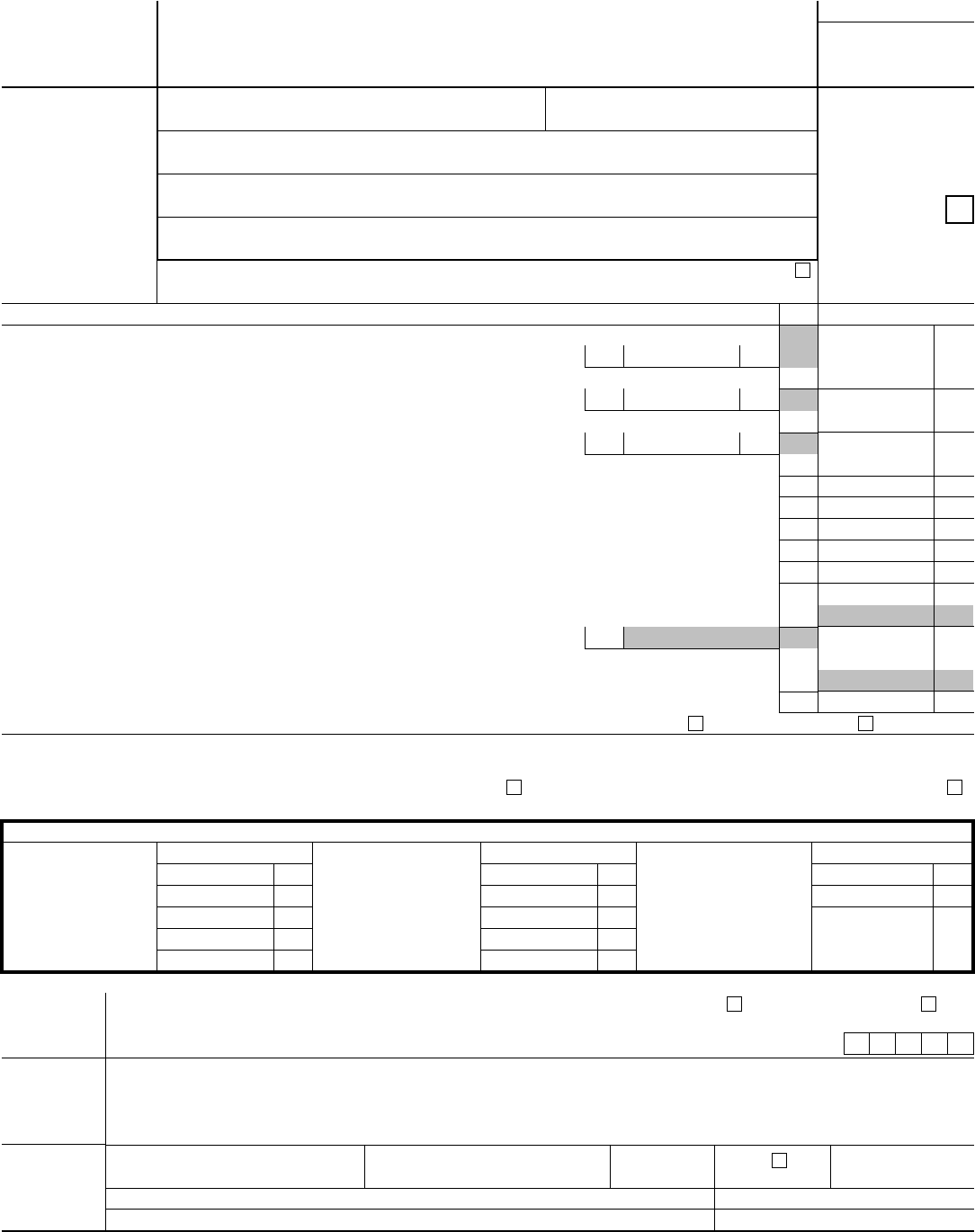

943 Form 2021 - Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Save or instantly send your ready documents. Complete, edit or print tax forms instantly. Web create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Web irs form 943:

Ad upload, modify or create forms. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Line by line instruction for 2022. Some businesses may be required to file both a 943 and. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Save or instantly send your ready documents. Web create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. You’ll file this form with the irs annually. Web for 2022 tax year, file form 943 by january 31, 2023.

Form 943 (employer’s annual federal tax. You’ll file this form with the irs annually. Choose the correct version of the editable pdf form from the list and. 1 2 wages subject to social security tax*. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. It is used to record. Web for 2022 tax year, file form 943 by january 31, 2023. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified. Line by line instruction for 2022. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to.

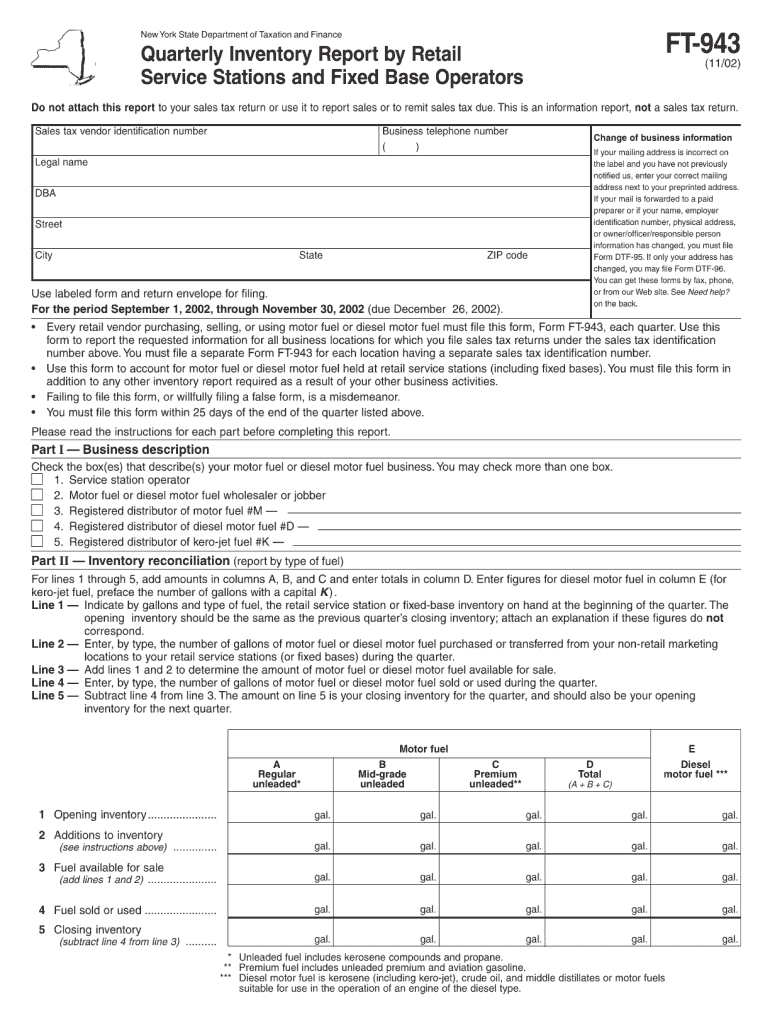

Ft 943 Form Fill Out and Sign Printable PDF Template signNow

Web create my document form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Try it for free now! Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a.

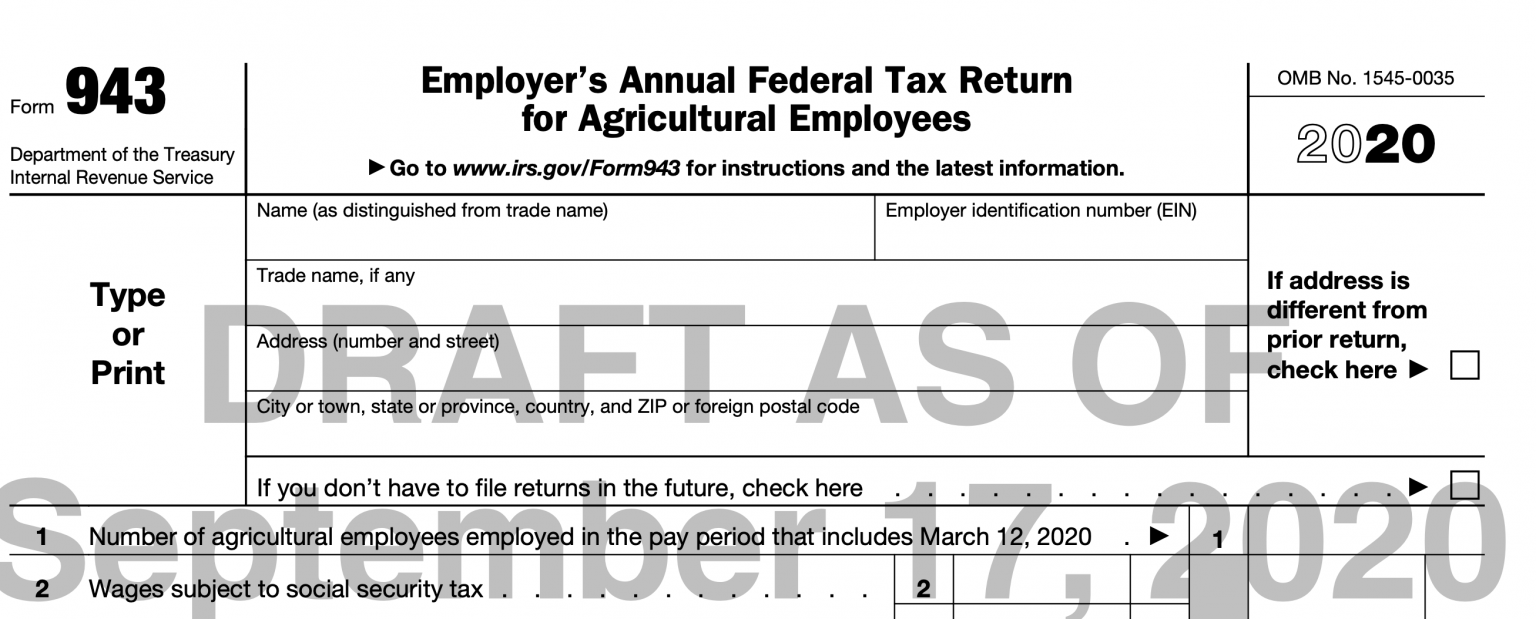

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Form 943 (employer’s annual federal tax. 1 2 wages subject to social security tax*. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Try it for free now! Easily fill out pdf blank, edit, and sign them.

Form 943 Joins The TaxBandits Lineup Blog TaxBandits

Web form 943, is the employer’s annual federal tax return for agricultural employees. Web remember the erc when you file your form 943 by paul neiffer december 27, 2021 we have discussed several times the opportunity for farmers to. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. Choose the correct version of.

943 Form 2021 IRS Forms Zrivo

You’ll file this form with the irs annually. Save or instantly send your ready documents. The instructions include five worksheets similar to those. Form 943 (employer’s annual federal tax. For this, you must purchase tax software.

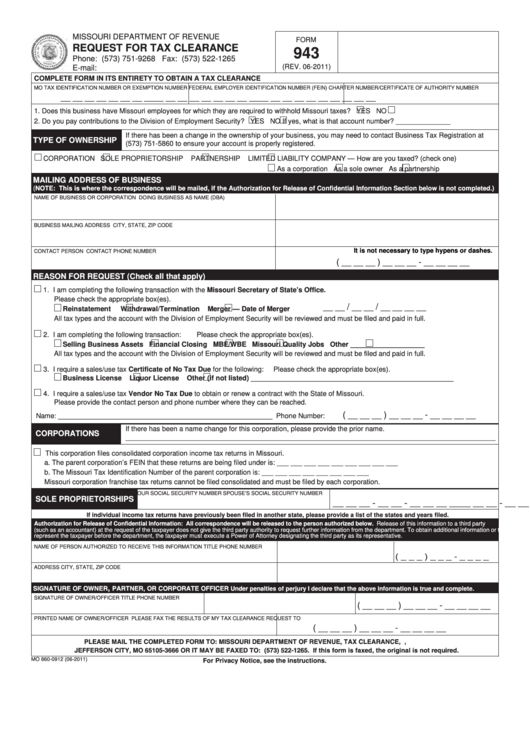

Fillable Form 943 Request For Tax Clearance printable pdf download

Web for 2022 tax year, file form 943 by january 31, 2023. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. It is used to record. Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. The instructions.

2021 Form MO DoR 943 Fill Online, Printable, Fillable, Blank pdfFiller

It is used to record. Web form 943 is required for agricultural businesses with farmworkers. In other words, it is a tax form used to report federal income tax, social. Web for 2022 tax year, file form 943 by january 31, 2023. Web irs form 943:

Form 943 Edit, Fill, Sign Online Handypdf

Web find and fill out the correct irs 943 form. Easily fill out pdf blank, edit, and sign them. For this, you must purchase tax software. Save or instantly send your ready documents. Web form 943 is required for agricultural businesses with farmworkers.

Form 943 Edit, Fill, Sign Online Handypdf

Ad get ready for tax season deadlines by completing any required tax forms today. Easily fill out pdf blank, edit, and sign them. For this, you must purchase tax software. Line by line instruction for 2022. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified.

943 Form Fill Out and Sign Printable PDF Template signNow

However, if you made deposits on time in full payment of the taxes due for the year, you may file the. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. Save or instantly send your ready documents. Web filing 2021 form 943 form 943, just.

What Is Form 943 Santos Czerwinski's Template

Choose the correct version of the editable pdf form from the list and. For this, you must purchase tax software. Web 1 number of agricultural employees employed in the pay period that includes march 12, 2022. You’ll file this form with the irs annually. Try it for free now!

Web Irs Form 943:

Line by line instruction for 2022. Web for 2022 tax year, file form 943 by january 31, 2023. In other words, it is a tax form used to report federal income tax, social. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022.

Web Remember The Erc When You File Your Form 943 By Paul Neiffer December 27, 2021 We Have Discussed Several Times The Opportunity For Farmers To.

Web irs form 943, ( employer's annual federal tax return for agricultural employees) is used by employers to report employment taxes for wages paid to. Web however, employers that pay qualified sick and family leave wages in 2022 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit on form. For this, you must purchase tax software. Web find and fill out the correct irs 943 form.

Web Filing 2021 Form 943 Form 943, Just Like Any Other Tax Return Can Be Filed Electronically.

Easily fill out pdf blank, edit, and sign them. However, if you made deposits on time in full payment of the taxes due for the year, you may file the. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified. 1 2 wages subject to social security tax*.

It Is Used To Record.

Web form 943 is required for agricultural businesses with farmworkers. Choose the correct version of the editable pdf form from the list and. Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today.