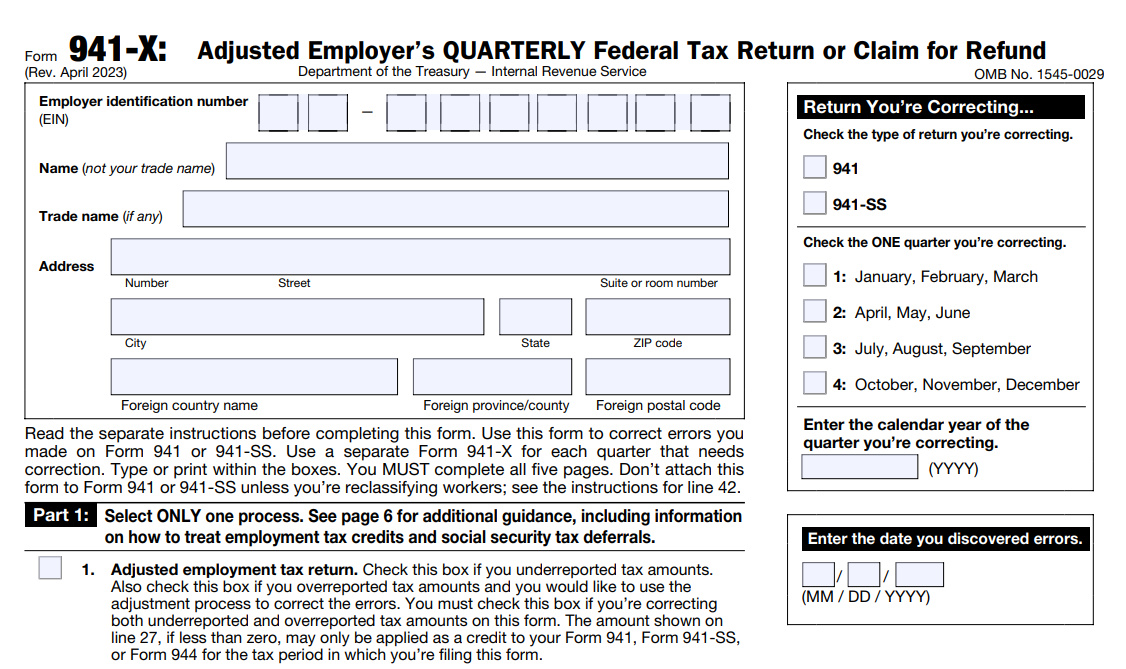

941 X Form 2021

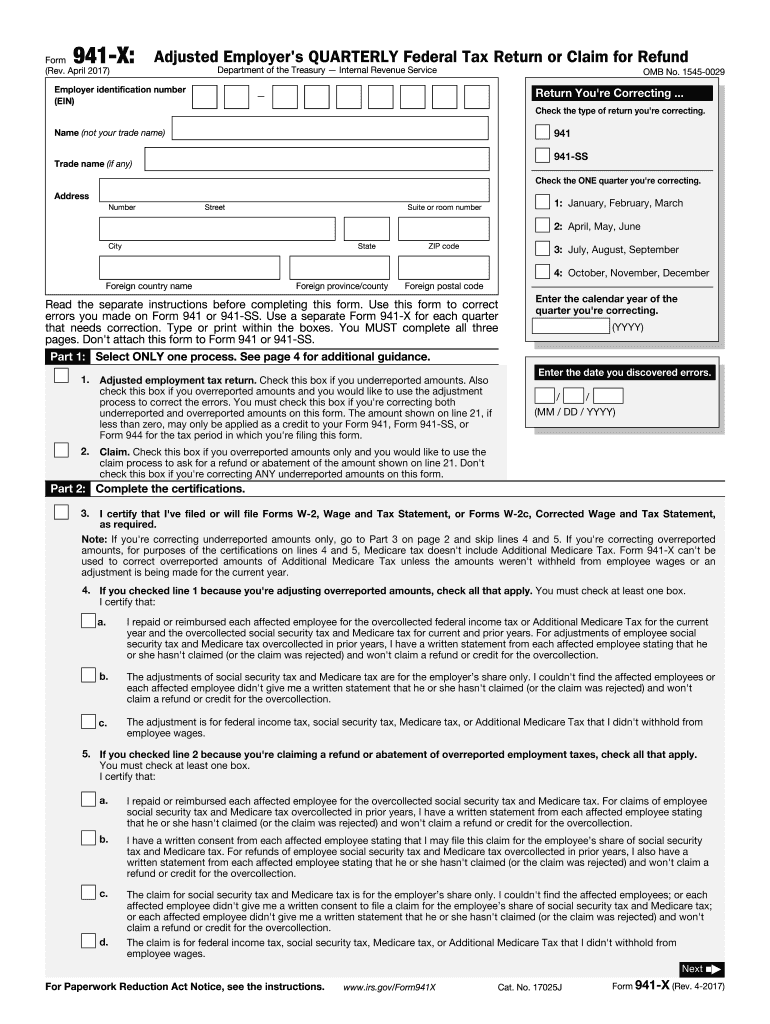

941 X Form 2021 - Web how to fill out and sign 941 form 2021 online? Get started with taxbandits & file your form in minutes. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. This form and any required support to: If you are located in. The june 2021 revision of form 941. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web form 941 (2021) employer's quarterly federal tax return for 2021. Reminders don't use an earlier revision of form 941 to report taxes for 2021.

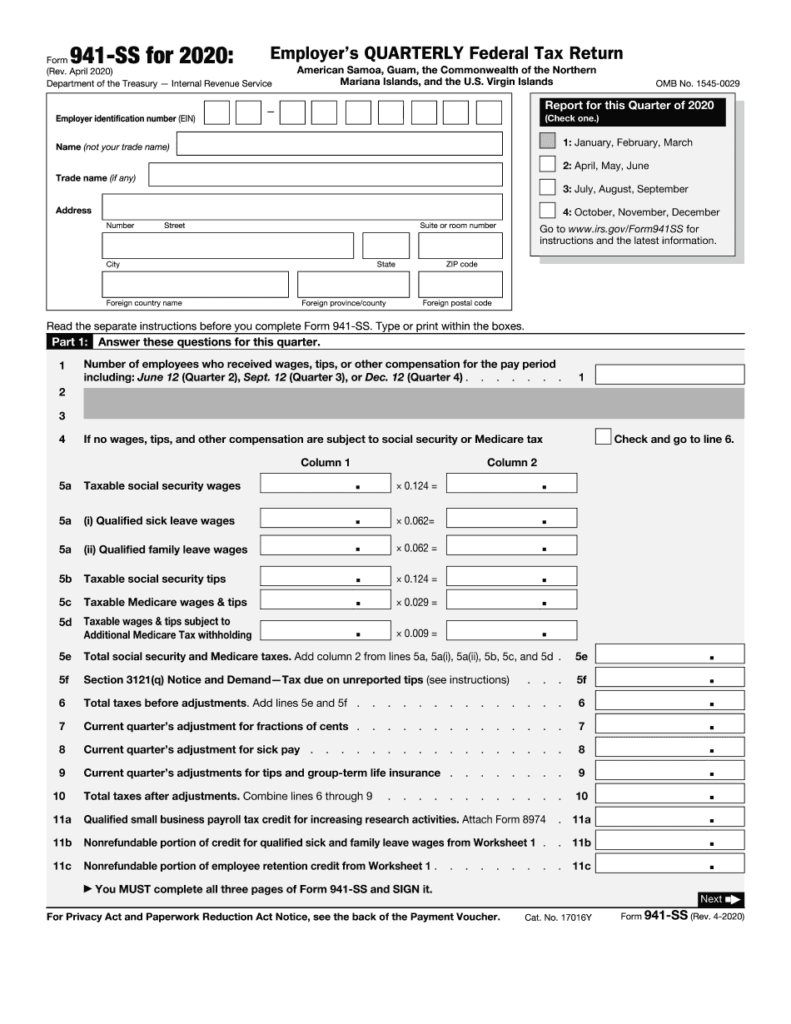

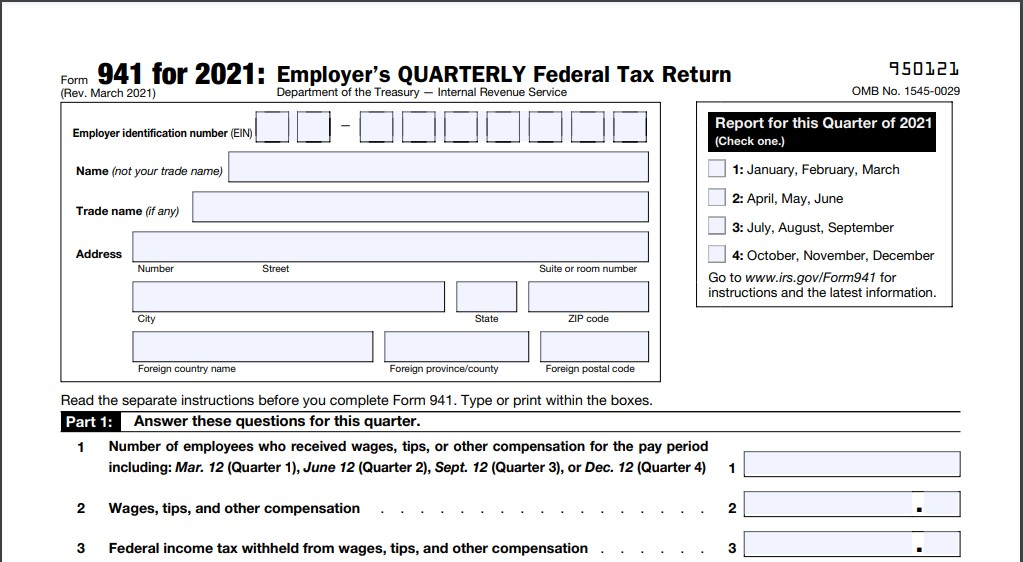

March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code Enjoy smart fillable fields and interactivity. Tax, business, legal and other documents demand a high level of compliance with the law and protection. This form on mytax illinois at. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Type or print within the boxes. Web adjustments to qualified health plan expenses allocable to qualified sick leave wages and to qualified family leave wages for leave taken after march 31, 2020, and before april 1, 2021, are reported on form 941‐x, lines 28 and 29, respectively. The june 2021 revision of form 941. Web form 941 (2021) employer's quarterly federal tax return for 2021.

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web form 941 (2021) employer's quarterly federal tax return for 2021. Web how to fill out and sign 941 form 2021 online? Tax, business, legal and other documents demand a high level of compliance with the law and protection. April, may, june read the separate instructions before completing this form. Reminders don't use an earlier revision of form 941 to report taxes for 2021. Web adjustments to qualified health plan expenses allocable to qualified sick leave wages and to qualified family leave wages for leave taken after march 31, 2020, and before april 1, 2021, are reported on form 941‐x, lines 28 and 29, respectively. Type or print within the boxes. The june 2021 revision of form 941. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code

File 941 Online How to File 2023 Form 941 electronically

Enjoy smart fillable fields and interactivity. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Reminders don't use an earlier revision of form 941 to report taxes for 2021. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance.

Printable 941 Tax Form 2021 Printable Form 2022

April, may, june read the separate instructions before completing this form. Get your online template and fill it in using progressive features. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Tax, business, legal and other documents demand a high level of compliance with the law and protection. March 2021).

941x Worksheet 1 Excel

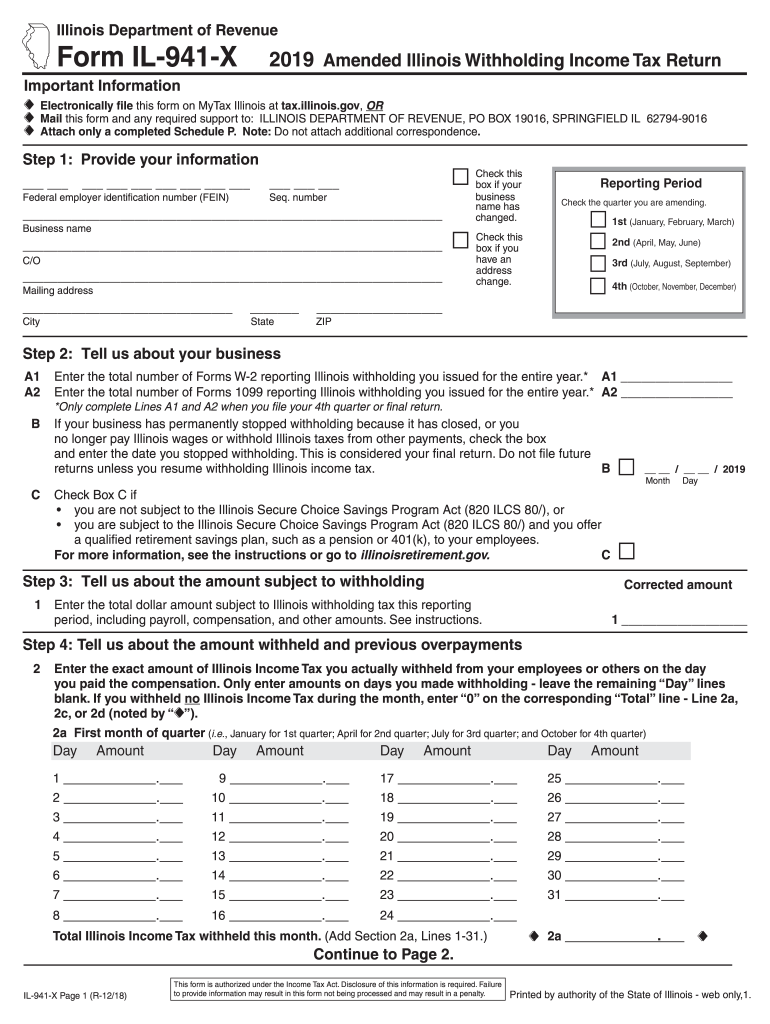

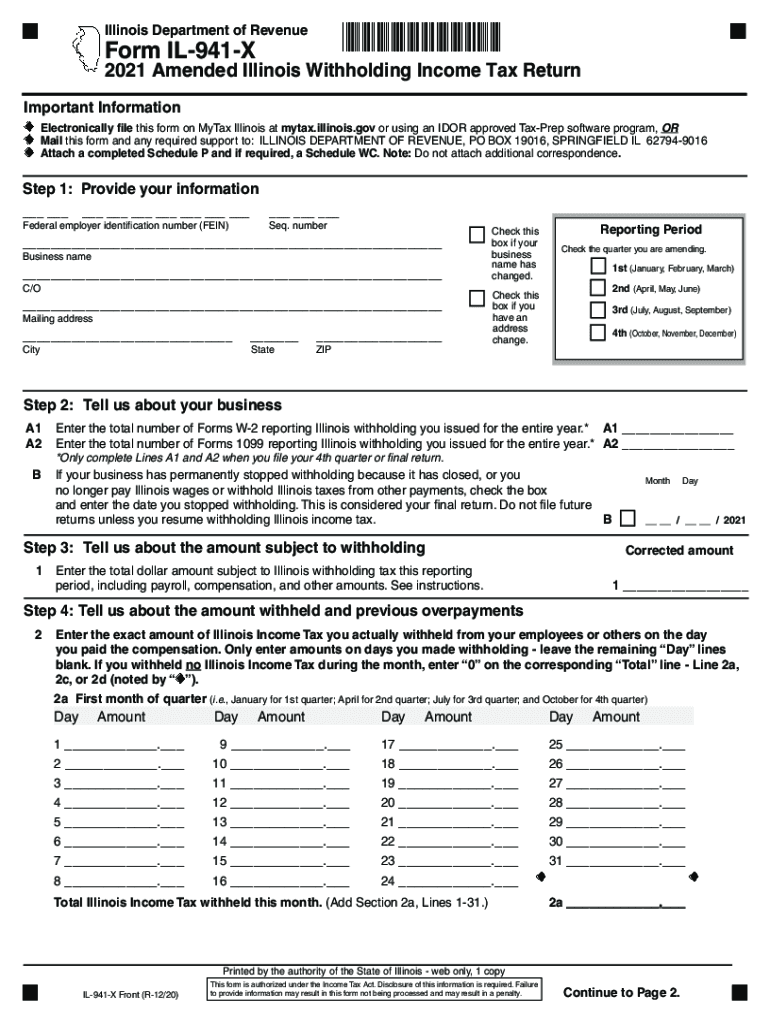

Reminders don't use an earlier revision of form 941 to report taxes for 2021. Follow the simple instructions below: This form on mytax illinois at. Enjoy smart fillable fields and interactivity. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee,.

941 Form Fill Out and Sign Printable PDF Template signNow

If you are located in. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code Web form 941 (2021) employer's quarterly federal.

Printable 941 Form 2021 Printable Form 2022

Reminders don't use an earlier revision of form 941 to report taxes for 2021. This form and any required support to: Enjoy smart fillable fields and interactivity. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. Type or print within the boxes.

How to fill out IRS Form 941 2019 PDF Expert

Tax, business, legal and other documents demand a high level of compliance with the law and protection. April, may, june read the separate instructions before completing this form. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. March 2021) employer’s quarterly federal tax return department of the treasury — internal.

Form 941 Efiling Tips for the 2nd Quarter of 2021 Blog

This form on mytax illinois at. Enjoy smart fillable fields and interactivity. Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. This form and any required support to: March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not.

Worksheet 1 941x

Get your online template and fill it in using progressive features. This form on mytax illinois at. Web adjustments to qualified health plan expenses allocable to qualified sick leave wages and to qualified family leave wages for leave taken after march 31, 2020, and before april 1, 2021, are reported on form 941‐x, lines 28 and 29, respectively. Web the.

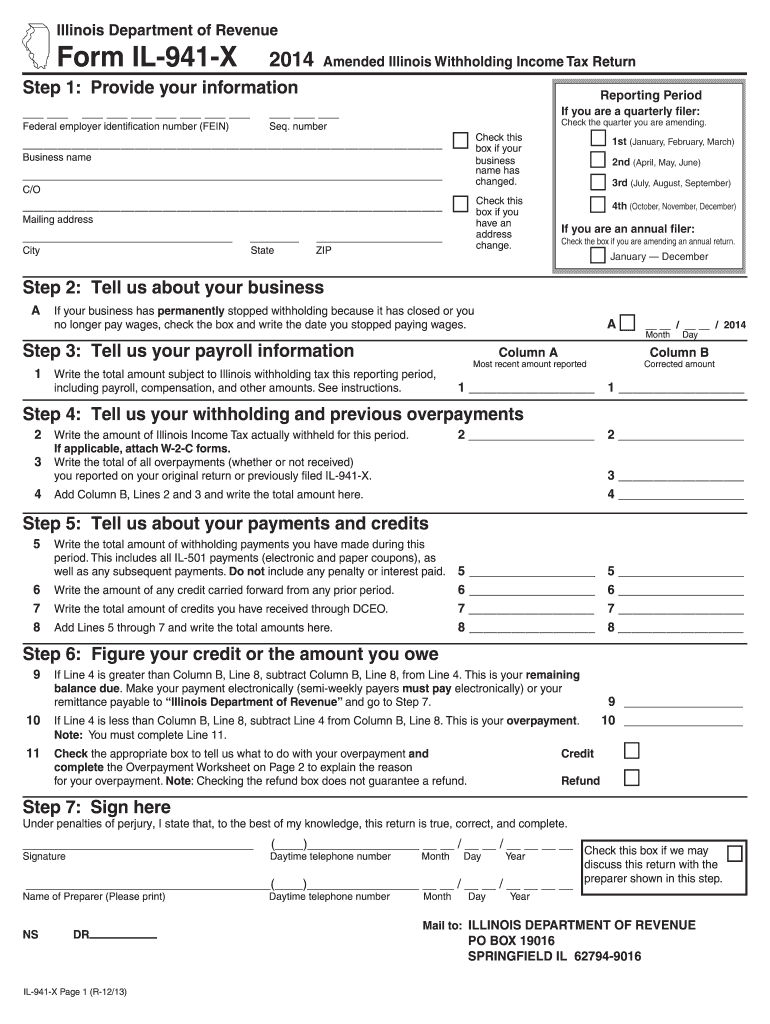

Form Il 941 X Fill Out and Sign Printable PDF Template signNow

Reminders don't use an earlier revision of form 941 to report taxes for 2021. Get your online template and fill it in using progressive features. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. March 2021) employer’s quarterly federal tax return department of.

Il 941 Fill Out and Sign Printable PDF Template signNow

Follow the simple instructions below: Type or print within the boxes. Enjoy smart fillable fields and interactivity. Get started with taxbandits & file your form in minutes. Tax, business, legal and other documents demand a high level of compliance with the law and protection.

This Form And Any Required Support To:

Use the march 2021 revision of form 941 only to report taxes for the quarter ending march 31, 2021. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. The june 2021 revision of form 941.

March 2021) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number (Ein) — Name (Not Your Trade Name) Trade Name (If Any) Address Number Street Suite Or Room Number City State Zip Code Foreign Country Name Foreign Province/County Foreign Postal Code

If you are located in. Web form 941 (2021) employer's quarterly federal tax return for 2021. Tax, business, legal and other documents demand a high level of compliance with the law and protection. Get your online template and fill it in using progressive features.

Web How To Fill Out And Sign 941 Form 2021 Online?

Type or print within the boxes. Enjoy smart fillable fields and interactivity. Web the advance payment on form 941, part 1, line 13h, for the fourth quarter of 2021 and paying any balance due by january 31, 2022. Reminders don't use an earlier revision of form 941 to report taxes for 2021.

Get Started With Taxbandits & File Your Form In Minutes.

Web adjustments to qualified health plan expenses allocable to qualified sick leave wages and to qualified family leave wages for leave taken after march 31, 2020, and before april 1, 2021, are reported on form 941‐x, lines 28 and 29, respectively. This form on mytax illinois at. April, may, june read the separate instructions before completing this form. Follow the simple instructions below: