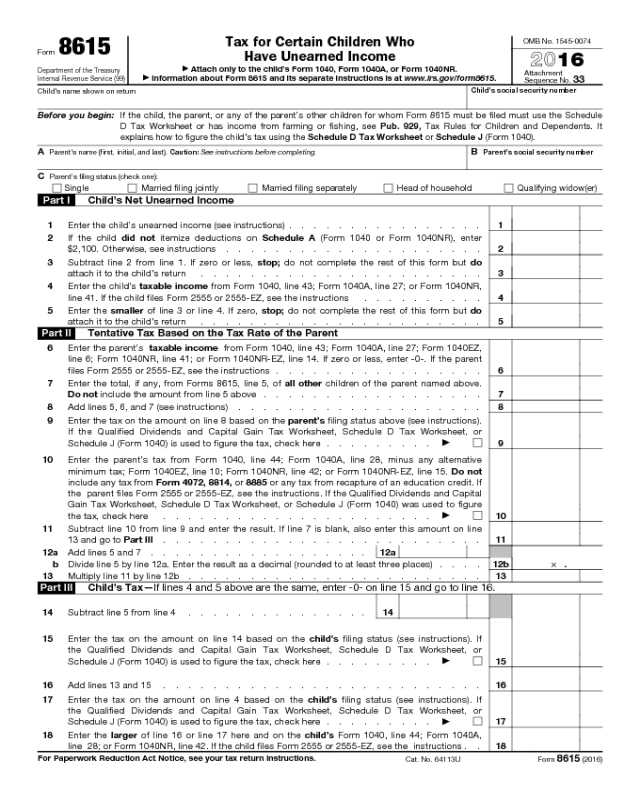

8615 Tax Form

8615 Tax Form - For details, see form 6251, alternative minimum tax—individuals, and its instructions. The child is required to file a tax return. You are required to file a tax return. Do not sign this form unless all applicable lines have. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. Web this tax is calculated on form 8615, tax for certain children who have unearned income. Web water bills can be paid online or in person at city hall (414 e. Web form 8615 must be filed for any child who meets all of the following conditions. Web for form 8615, “unearned income” includes all taxable income other than earned income. See who must file, later.

Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The child had more than $2,300 of unearned income. Web for form 8615, “unearned income” includes all taxable income other than earned income. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Do not sign this form unless all applicable lines have. Attach the completed form to the. 63rd st.) using cash, check or credit card. 12th st.) or at the water services department (4800 e. Complete, edit or print tax forms instantly. For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's.

Web per irs instructions for form 8615: For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. Web form 8615 must be filed with the child’s tax return if all of the following apply: Net investment income tax a child whose tax is figured on form. You are required to file a tax return. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income attach only to the child's form 1040, form. The child had more than $2,000 of unearned income. Web if the parent doesn't or can't choose to include the child's income on the parent's return, use form 8615 to figure the child's tax. The child had more than $2,300 of unearned income. The child is required to file a tax return.

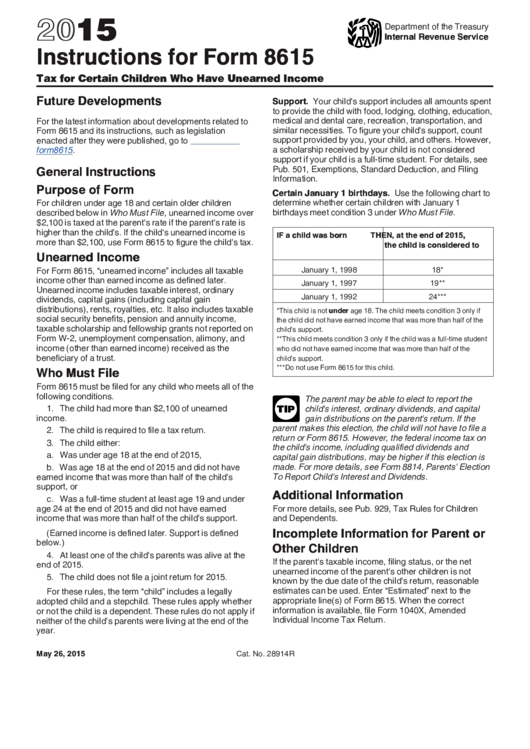

Form 8615 Instructions (2015) printable pdf download

Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. You had more than $2,300 of unearned income. Do not sign this form unless all applicable lines have. As opposed to earned income, which is received for work actually performed, unearned. For children.

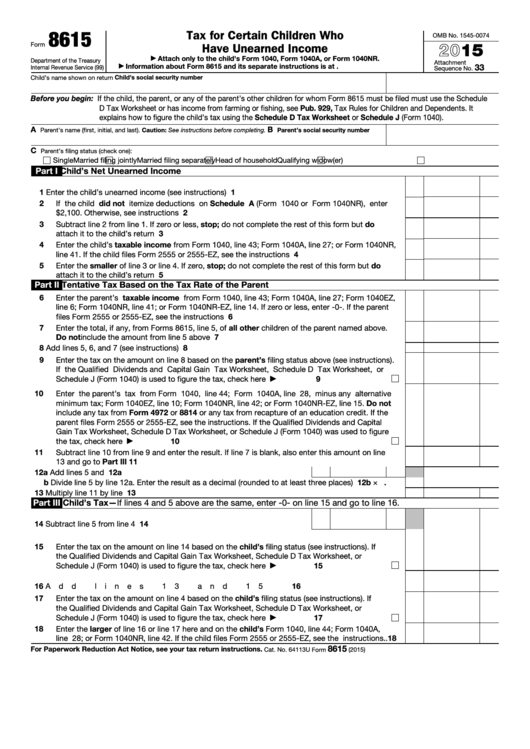

Fillable Form 8615 Tax For Certain Children Who Have Unearned

For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the parent's. As opposed to earned income, which is received for work actually performed, unearned. For details, see form 6251, alternative minimum tax—individuals, and its instructions. Do not sign this form unless all.

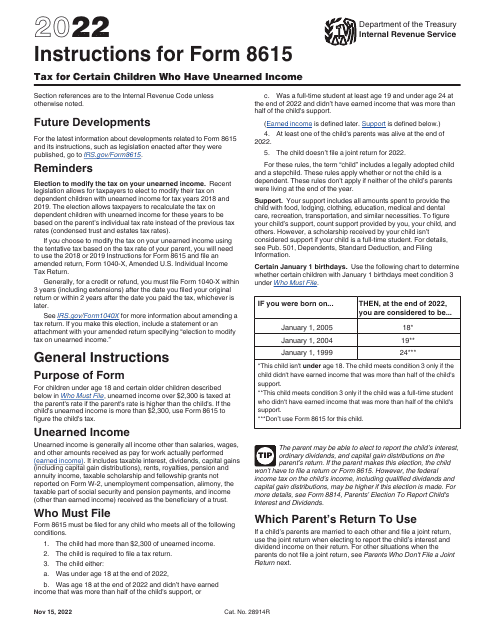

Download Instructions for IRS Form 8615 Tax for Certain Children Who

63rd st.) using cash, check or credit card. You had more than $2,300 of unearned income. The child is required to file a tax return. The child had more than $2,000 of unearned income. Unearned income includes taxable interest, ordinary dividends, capital gains (including.

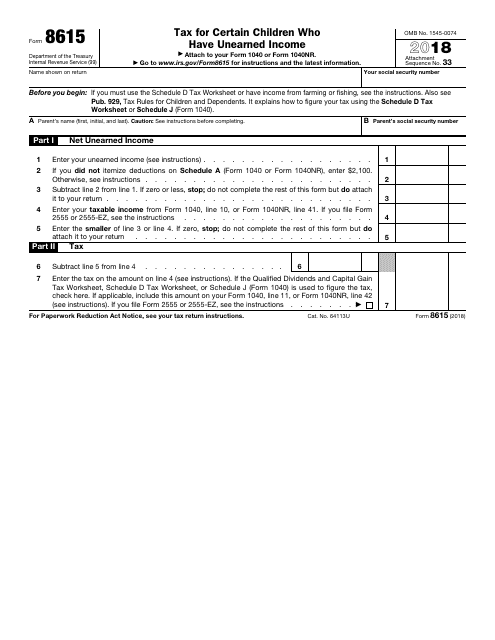

IRS Form 8615 Download Fillable PDF or Fill Online Tax for Certain

Complete, edit or print tax forms instantly. Request for copy of tax return. Register and subscribe now to work on your irs 8615 form & more fillable forms. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income attach only to the child's form 1040, form. For children under age 18.

Form 8615 Edit, Fill, Sign Online Handypdf

12th st.) or at the water services department (4800 e. Net investment income tax a child whose tax is figured on form. You had more than $2,300 of unearned income. Unearned income includes taxable interest, ordinary dividends, capital gains (including. The child had more than $2,300 of unearned income.

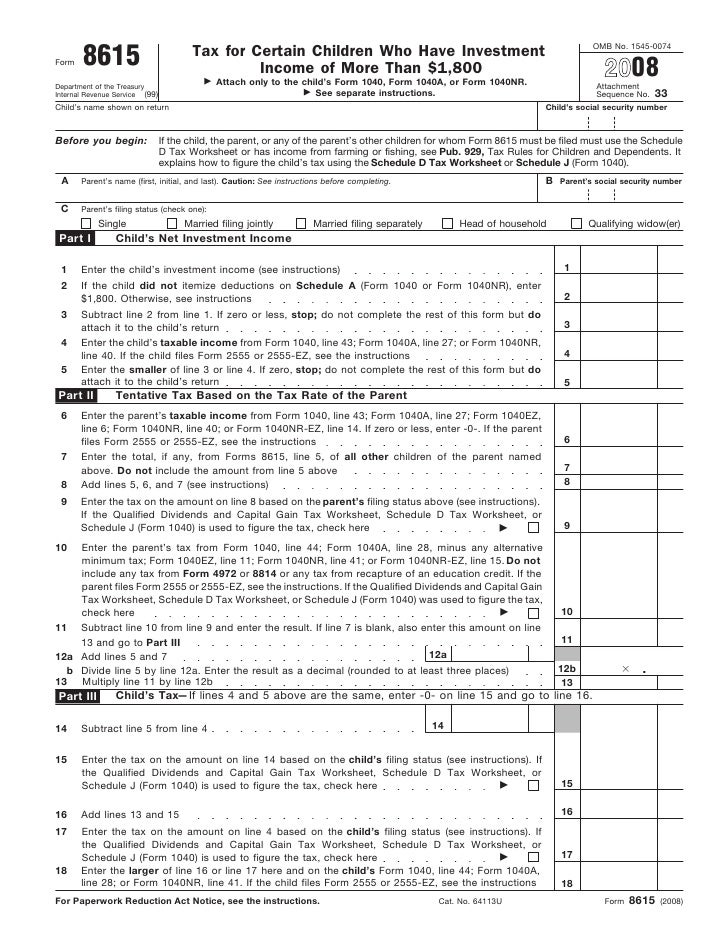

Form 8615Tax for Children Under Age 14 With Investment of Mor…

The child is required to file a tax return. Attach the completed form to the. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income attach only to the child's form 1040, form. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age.

4506 Form 2021 IRS Forms Zrivo

Attach the completed form to the. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Complete, edit or print tax forms instantly. Net investment income tax a child whose tax is figured on form. See who must file, later.

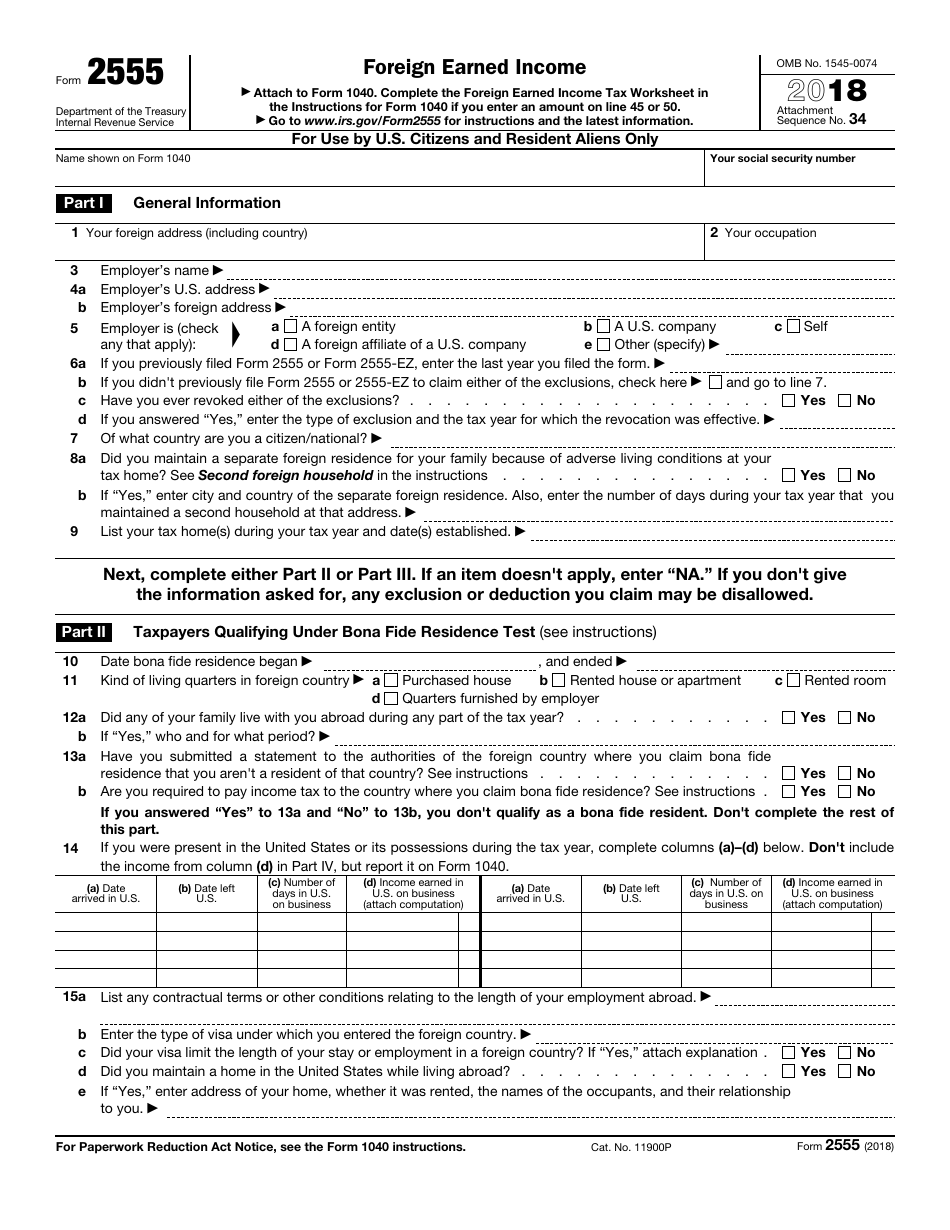

IRS Form 2555 Download Fillable PDF or Fill Online Foreign Earned

Do not sign this form unless all applicable lines have. Register and edit, fill, sign now your irs 8615 form & more fillable forms. Web water bills can be paid online or in person at city hall (414 e. See who must file, later. The child had more than $2,300 of unearned income.

DSC_8615 Gundersons Bookkeeping

Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income attach only to the child's form 1040, form. Unearned income includes taxable interest, ordinary dividends, capital gains (including. Web per irs instructions for form 8615: Web if the parent doesn't or can't choose to include the child's income on the parent's.

Instructions for IRS Form 2555 Foreign Earned Download

Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 must be filed with the child’s tax return if all of the following apply: For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if.

Web For Form 8615, “Unearned Income” Includes All Taxable Income Other Than Earned Income.

Web form 8615 must be filed for any child who meets all of the following conditions. Do not sign this form unless all applicable lines have. See who must file, later. Web water bills can be paid online or in person at city hall (414 e.

For Children Under Age 18 And Certain Older Children Described Below In Who Must File, Unearned Income Over $2,200 Is Taxed.

If using a private delivery service, send your returns to the street. Web form 8615 must be filed for any child who meets all of the following conditions. 12th st.) or at the water services department (4800 e. You had more than $2,300 of unearned income.

Unearned Income Includes Taxable Interest, Ordinary Dividends, Capital Gains (Including.

Complete, edit or print tax forms instantly. Request for copy of tax return. Net investment income tax a child whose tax is figured on form. Complete, edit or print tax forms instantly.

Web Form 8615 Department Of The Treasury Internal Revenue Service (99) Tax For Certain Children Who Have Unearned Income Attach Only To The Child's Form 1040, Form.

Register and subscribe now to work on your irs 8615 form & more fillable forms. The child is required to file a tax return. Web form 8615 must be filed with the child’s tax return if all of the following apply: The child is required to file a tax return.