501-Llc Form

501-Llc Form - Ensure campaign deadlines are met. The questions that follow will help you determine if an organization is eligible to apply for recognition of exemption from federal income taxation under section 501 (a) of the internal revenue code and, if so, how to proceed. This form is considered filed the date it is postmarked or hand delivered. Llcs with multiple members can file as a. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Secretary of state department of business services limited liability division 501 s. 2023's best llc filing services. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Limited liability companies (llcs) are required to file one of the following forms, depending on how it has chosen to be taxed: The limited liability company gives notice that the series has limited.

If the only member of the llc is a corporation, then the llc’s income and expenses are reported on the corporation’s returns on form 1120 or 1120s. A limited liability company (llc) is a business structure allowed by state statute. 2023's best llc filing services. Ad focus on your business & let professionals handle your paperwork. Secretary of state department of business services limited liability division 501 s. The llc’s income and expenses are reported on the individual’s tax return on form 1040, schedule c, e, or f. August 2018 — 1 — llc 23.14 type or print clearly. $75 series fee, if required: Top services compared & ranked The names of the series must include the full name of the limited liability company and are the following:

Limited liability companies pdf forms. Ad top 5 llc services online (2023). August 2018 — 1 — llc 23.14 type or print clearly. Secretary of state department of business services limited liability division 501 s. A limited liability company (llc) is a business structure allowed by state statute. Due within 90 days of initial registration and every two years thereafter. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Limited liability companies (llcs) are required to file one of the following forms, depending on how it has chosen to be taxed: You can form an llc to run a business or to hold assets. These comments are due february 6, 2022.

2022 certificate of existence request form LLC Bible

The parent corporation of an affiliated group files form 851 with its consolidated income tax return to identify the parent and affiliated members, report allocated amounts of payments, and determine that each subsidiary. Ad protect your personal assets with a $0 llc—just pay state filing fees. Web the irs forms for llc filings vary. Limited liability companies (llcs) are required.

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

Backup withholding is not required on any payments made to the following payees: Web in that state, your business needs at least two members to form an llc. Ensure campaign deadlines are met. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. The.

2011 Form IL LLC50.1 Fill Online, Printable, Fillable, Blank pdfFiller

The llc’s income and expenses are reported on the individual’s tax return on form 1040, schedule c, e, or f. The limited liability company gives notice that the series has limited. Web review information about a limited liability company (llc) and the federal tax classification process. Web complete this form to avoid possible erroneous backup withholding. These comments are due.

Top 501c3 Form Templates free to download in PDF format

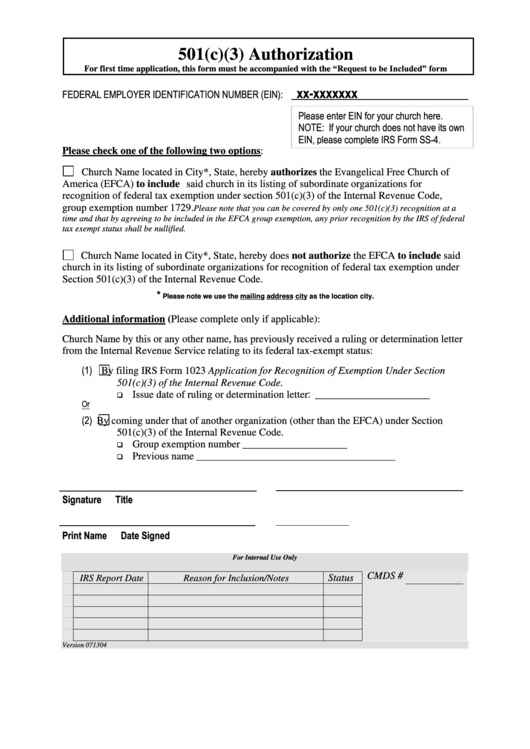

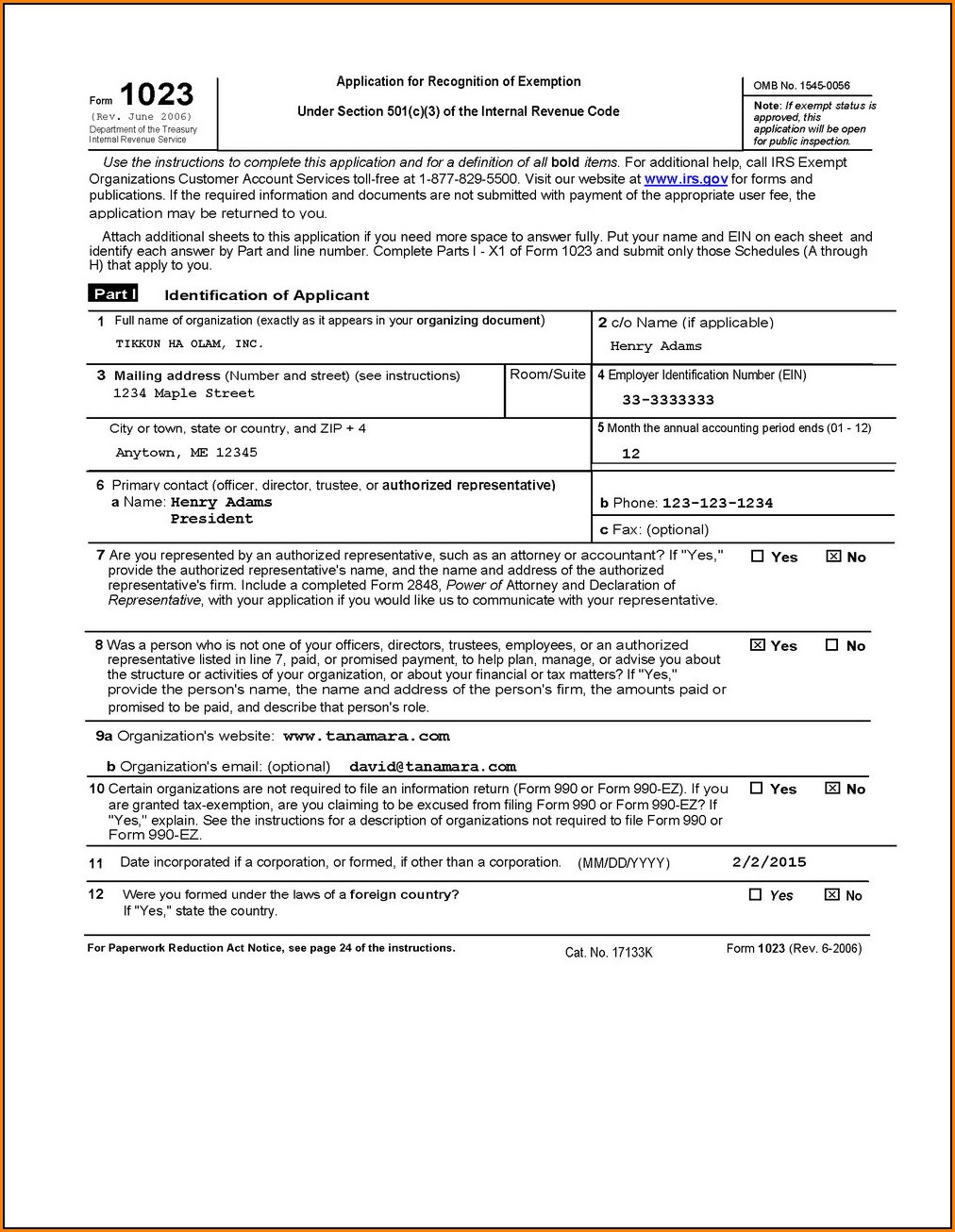

Ensure campaign deadlines are met. These comments are due february 6, 2022. The questions that follow will help you determine if an organization is eligible to apply for recognition of exemption from federal income taxation under section 501 (a) of the internal revenue code and, if so, how to proceed. Web form 1024, application for recognition of exemption under section.

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

Web in that state, your business needs at least two members to form an llc. The limited liability company gives notice that the series has limited. Llcs protects its members against personal liabilities. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Even though.

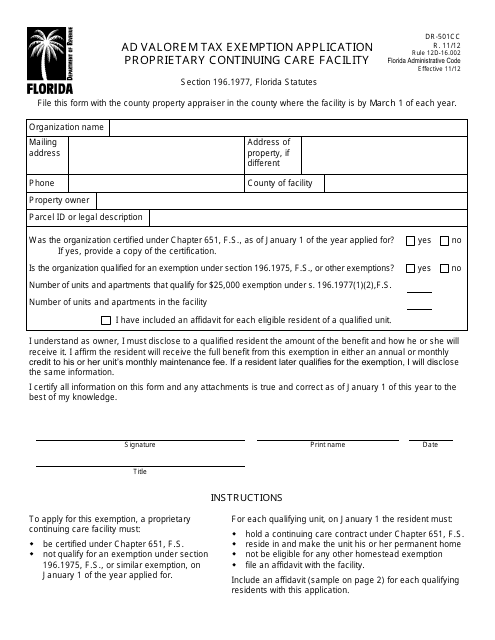

Form DR501CC Download Printable PDF or Fill Online Ad Valorem Tax

Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. 24/7 expert llc formation guidance. These comments are due february 6, 2022. Even though you can have any number of members, most llcs have fewer than five. Obtaining a 501 (c) does not guarantee.

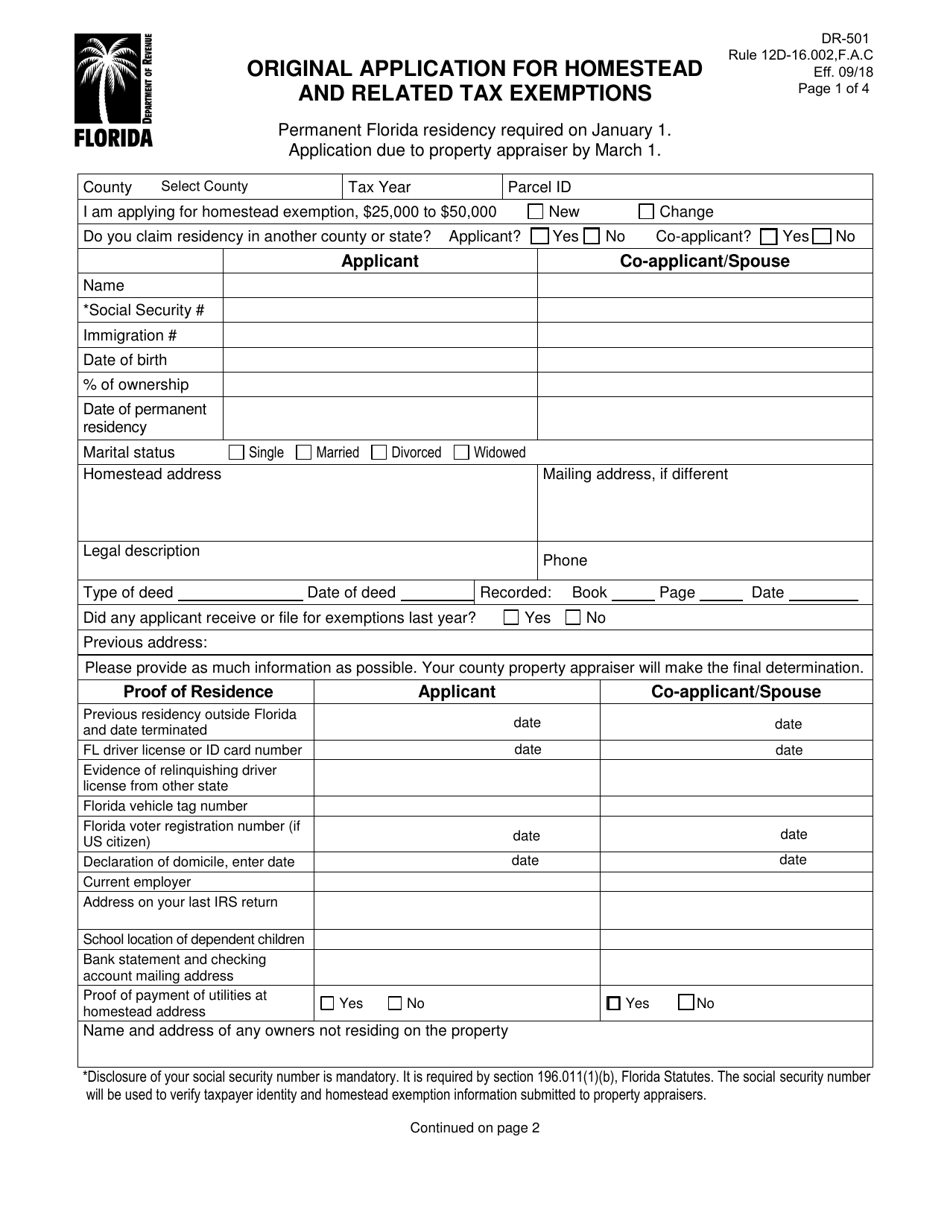

Form DR501 Download Fillable PDF or Fill Online Original Application

Ad focus on your business & let professionals handle your paperwork. August 2018 — 1 — llc 23.14 type or print clearly. Secretary of state department of business services limited liability division 501 s. An organization exempt from tax under section 501(a), any ira, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2),.

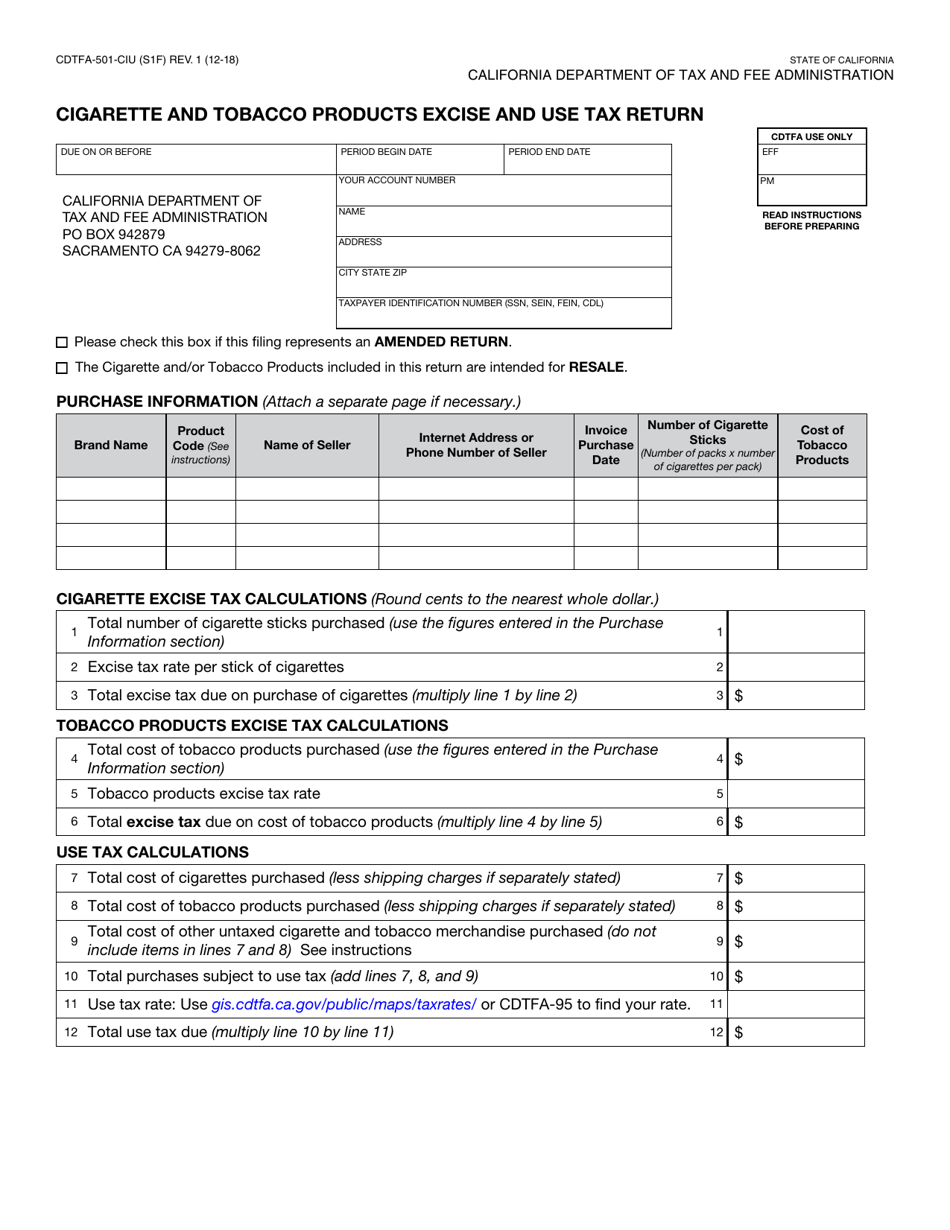

Form CDTFA501CIU Download Fillable PDF or Fill Online Cigarette and

Top services compared & ranked The parent corporation of an affiliated group files form 851 with its consolidated income tax return to identify the parent and affiliated members, report allocated amounts of payments, and determine that each subsidiary. File online for faster response. The names of the series must include the full name of the limited liability company and are.

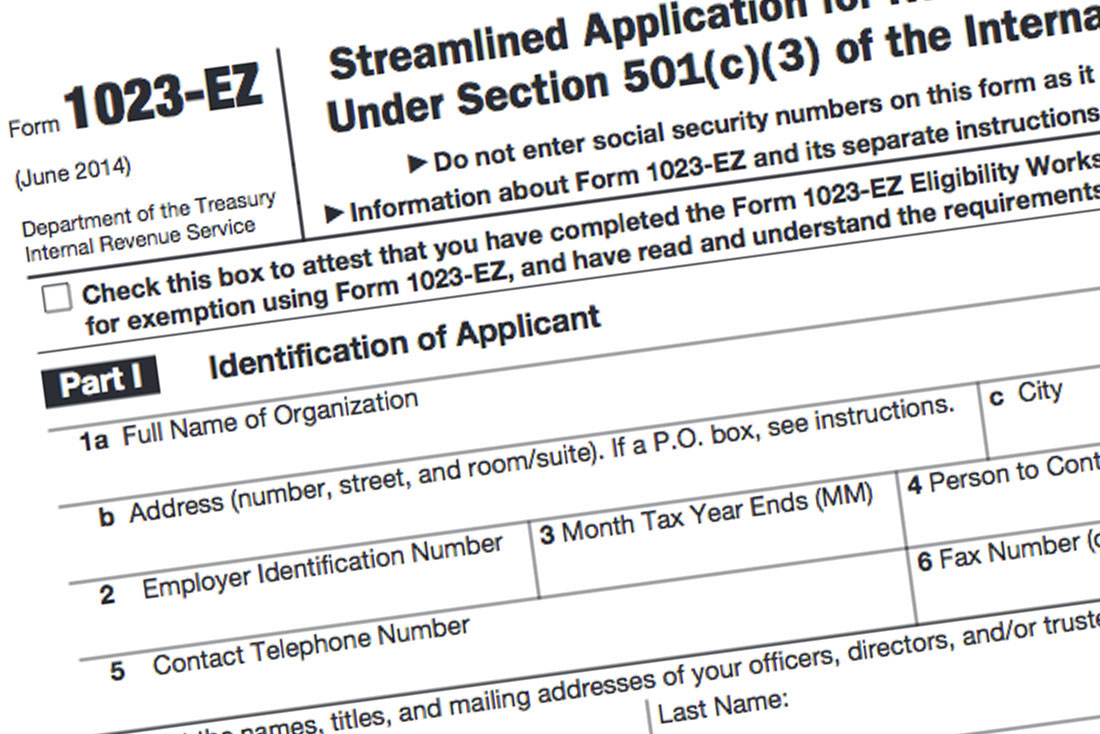

Form 1023EZ The Faster, Easier 501(c)(3) Application for Small

O series llc (optional) pursuant to section 347.186, the limited liability company may establish a designated series in its operating agreement. Ensure campaign deadlines are met. This form is considered filed the date it is postmarked or hand delivered. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on.

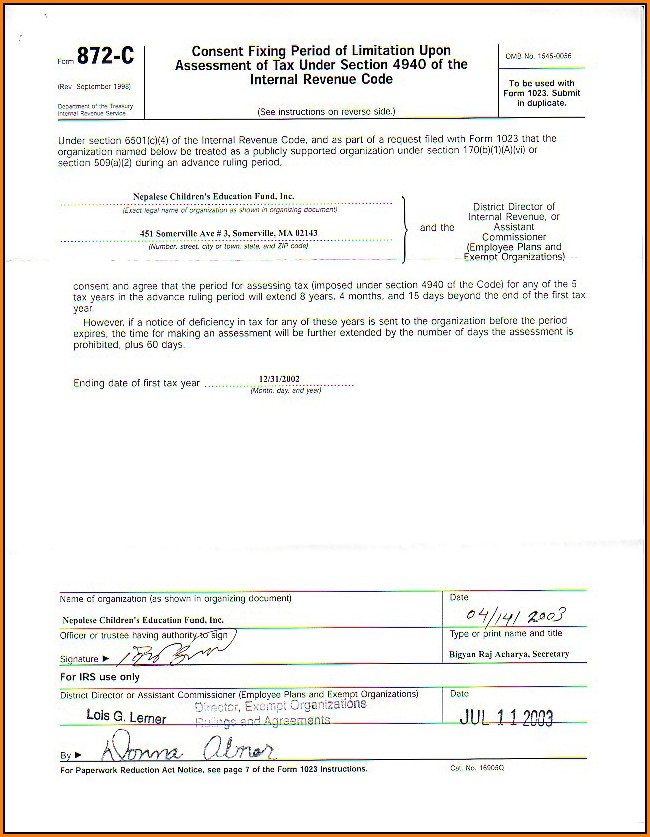

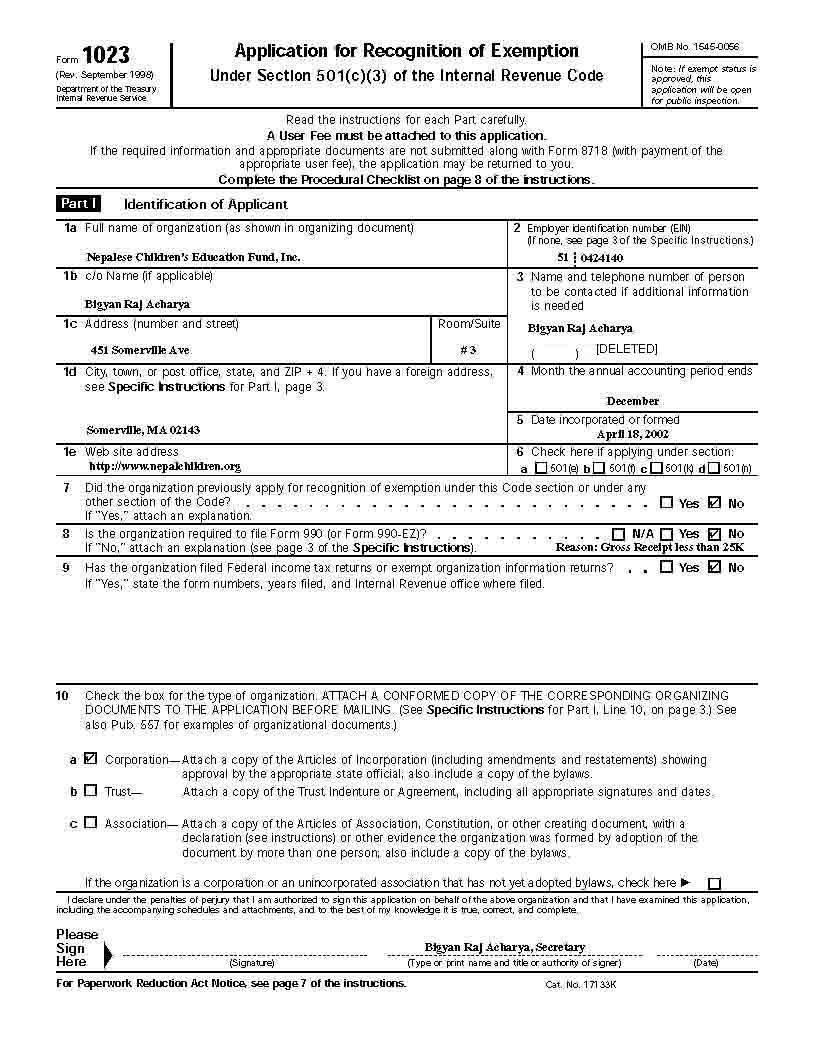

NCEF Nepalese Children's Education Fund

Web information about form 851, affiliations schedule, including recent updates, related forms and instructions on how to file. O series llc (optional) pursuant to section 347.186, the limited liability company may establish a designated series in its operating agreement. An organization exempt from tax under section 501(a), any ira, or a custodial account under section 403(b)(7) if the account satisfies.

These Comments Are Due February 6, 2022.

O series llc (optional) pursuant to section 347.186, the limited liability company may establish a designated series in its operating agreement. $75 series fee, if required: Web information about form 851, affiliations schedule, including recent updates, related forms and instructions on how to file. These are typically called nonprofit limited liability companies. the most common type of nonprofit is a corporation, and it is formed under and regulated by the state in which it is founded.

Web Complete This Form To Avoid Possible Erroneous Backup Withholding.

Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to identify the parent and affiliated members, report allocated amounts of payments, and determine that each subsidiary. Ad protect your personal assets with a $0 llc—just pay state filing fees. The owners of an llc are members.

Make Your Business Official Today In Less Than 10 Minutes.

Top services compared & ranked Keeping the llc small makes it easier for members to work together and come up with a shared vision for the company. We'll do the legwork so you can set aside more time & money for your business. Web form 1024, application for recognition of exemption under section 501(a).

Due Within 90 Days Of Initial Registration And Every Two Years Thereafter.

2023's best llc filing services. Web the llc doesn’t have to pay taxes. Ensure campaign deadlines are met. 24/7 expert llc formation guidance.