501-Llc Form California

501-Llc Form California - Web secretary of state (sos) filing requirements who must file use the tables to determine your organization's filing requirement for the following forms: Web lic 501 (3/99) (over) hereby certify under penalty of perjury that the above statements are true and correct. Web 501 (c) (1): I registered my own llc early last year to. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. I give my permission for any necessary verification. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Exemption application (form 3500) download the form; Ensure campaign deadlines are met. Get started on any device!

The llc has articles of organization accepted by the california secretary of state (sos). Declaration of stealing your money by rob weinberg february 21, 2022 19808 last month, 43,090 new businesses were formed in california. Exemption application (form 3500) download the form; Ensure campaign deadlines are met. Web forms, samples and fees. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Ad make your free legal documents. Web for tax years beginning on or after january 1, 2021, and before january 1, 2024, llcs that organize, register, or file with the secretary of state to do business in california are not subject to the annual tax of $800 for their first tax year. Web click to edit settings and logout. Get started on any device!

Go to www.fppc.ca.gov for most campaign disclosure filing schedules or check with your. I registered my own llc early last year to. Go to www.fppc.ca.gov for campaign disclosure filing schedules. The misleading solicitation can be identified from the following characteristics as shown in the sample (pdf) : Ensure campaign deadlines are met. This form is considered filed the date it is postmarked or hand delivered. Choose the initial directors for your corporation. Web click to edit settings and logout. Web for tax years beginning on or after january 1, 2021, and before january 1, 2024, llcs that organize, register, or file with the secretary of state to do business in california are not subject to the annual tax of $800 for their first tax year. Determine your exemption type, complete, print, and mail your application;

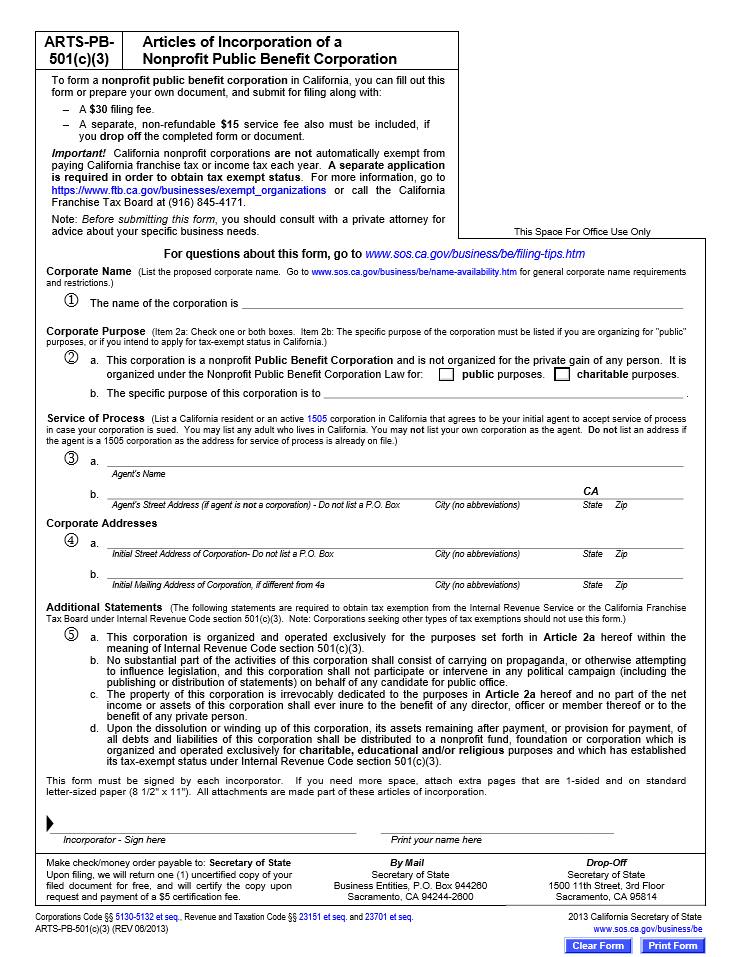

Free California Articles of Incorporation of a Nonprofit Public Benefit

Ad make your free legal documents. Web www.fppc.ca.gov candidate intention statement california 501 form who files: Web forms, samples and fees. Web lic 501 (3/99) (over) hereby certify under penalty of perjury that the above statements are true and correct. Ensure campaign deadlines are met.

Form a California 501(c)(3) nonprofit corporation by following these

I give my permission for any necessary verification. Ensure campaign deadlines are met. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal funds on behalf of your candidacy. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of.

501 Finding Ca Form Fill Online, Printable, Fillable, Blank pdfFiller

Candidates for county central committee that do not raise or spend $2,000 or more in a calendar year. California secretary of state 1500 11th street sacramento, california 95814 office: Go to www.fppc.ca.gov for campaign disclosure filing schedules. Web in california, the statement of information (also known as a biennial report) is a regular filing that your llc must complete every.

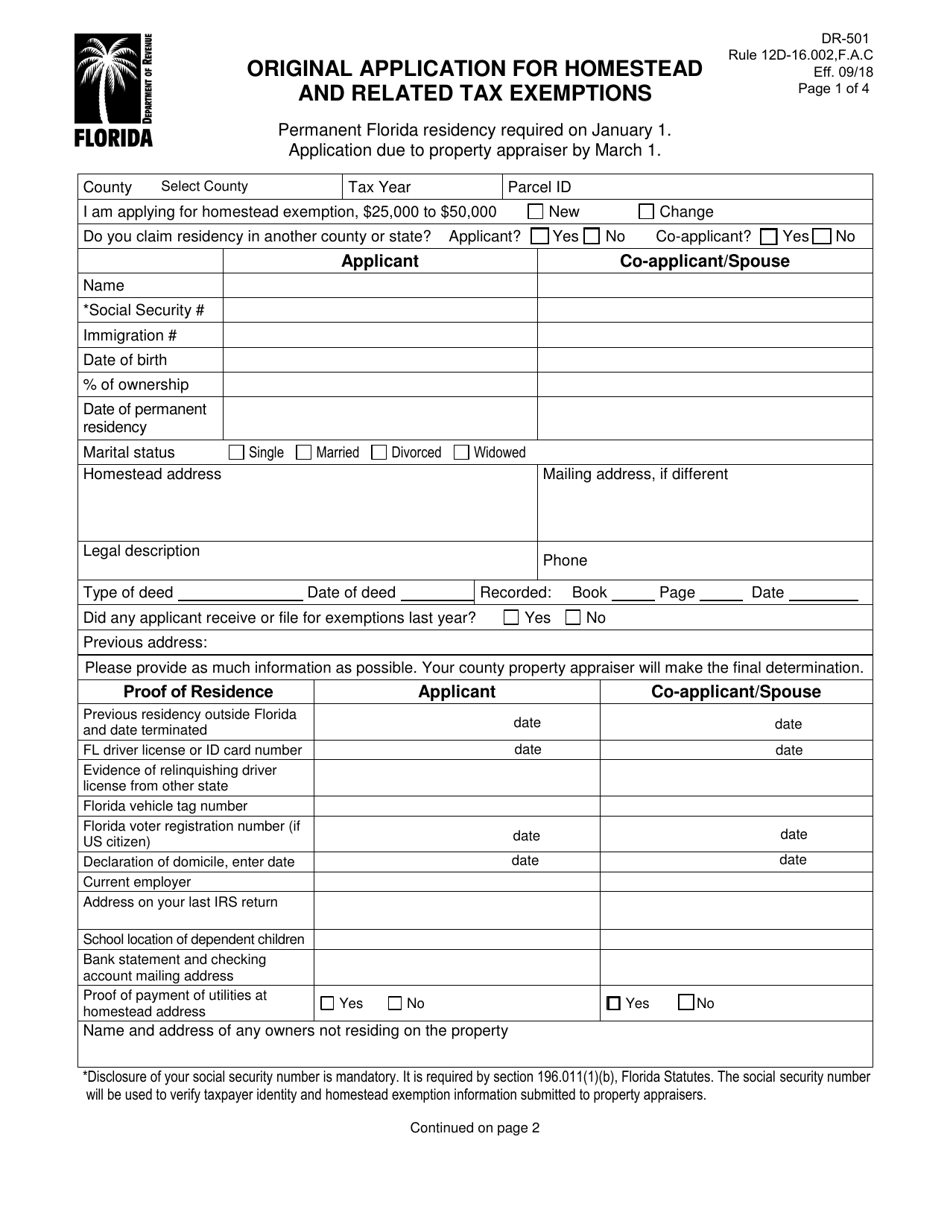

Form DR501 Download Fillable PDF or Fill Online Original Application

Ensure campaign deadlines are met. Limited liability companies may become exempt if owned and operated by an exempt nonprofit and have proof of accepted entity classification election (irs form. This form is considered filed the date it is postmarked or hand delivered. The misleading solicitation can be identified from the following characteristics as shown in the sample (pdf) : Here.

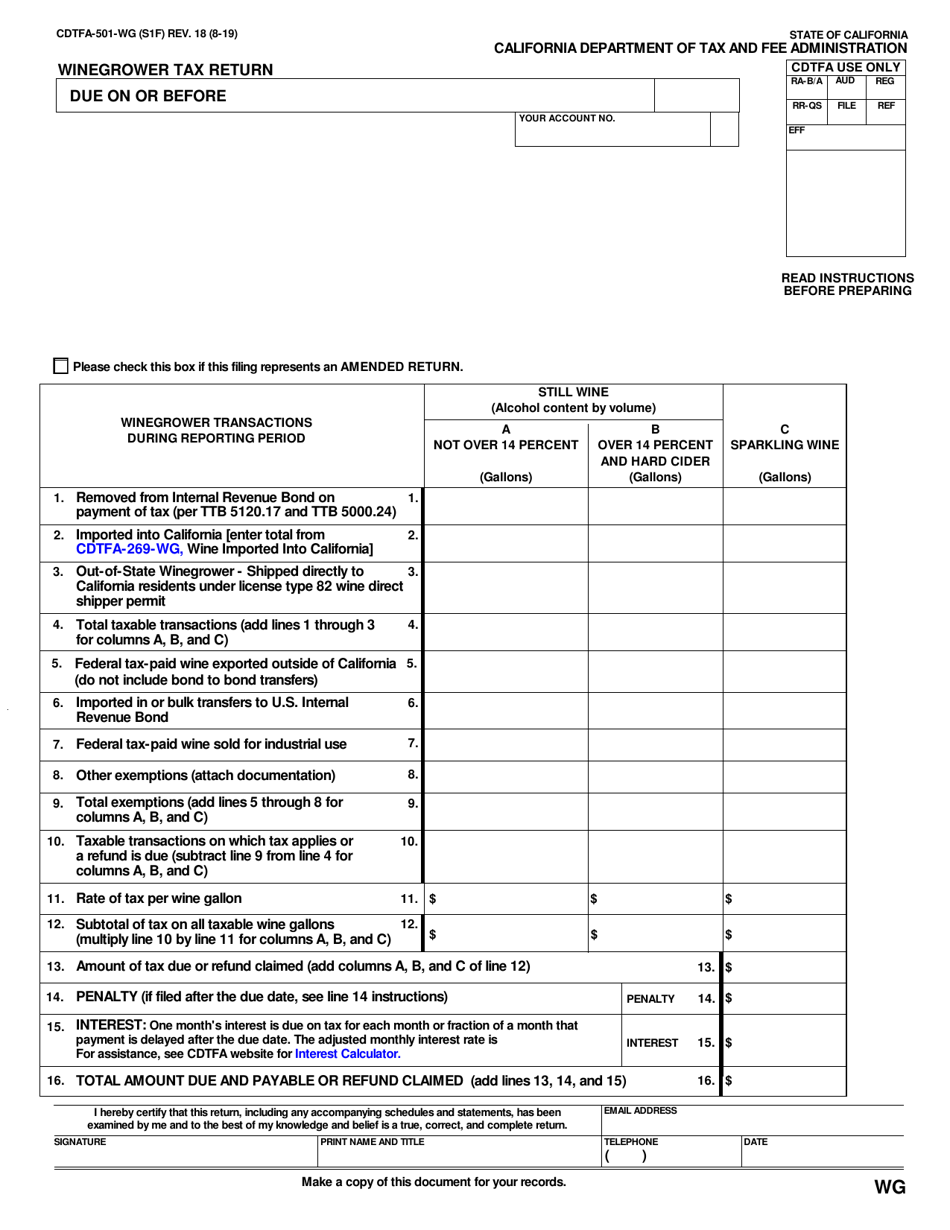

Form CDTFA501WG Download Fillable PDF or Fill Online Winegrower Tax

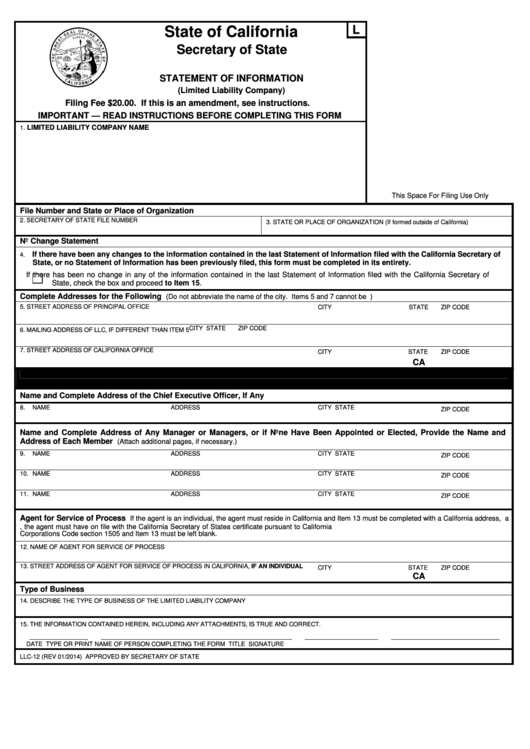

Web in california, the statement of information (also known as a biennial report) is a regular filing that your llc must complete every two years to update your business information, including: Ensure campaign deadlines are met. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available.

Form CDTFA501AU Download Fillable PDF or Fill Online User Use Fuel

Web lic 501 (3/99) (over) hereby certify under penalty of perjury that the above statements are true and correct. Web this solicitation, california corporations annual order form and similar solicitations, are not being sent on behalf of the california secretary of state. Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited.

Fillable Form Llc12 Statement Of Information State Of California

Web the purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the california revised uniform limited liability company act. Any corporation that is organized under an act of congress that is exempt from federal income tax. Determine your exemption type, complete, print, and mail.

501c3 Articles Of Incorporation Template Template 1 Resume Examples

Exemption application (form 3500) download the form; The misleading solicitation can be identified from the following characteristics as shown in the sample (pdf) : Web click to edit settings and logout. Corporations that hold a title of property for exempt organizations. Web file the form 501 before you solicit or receive any contributions or before you make expenditures from personal.

Forming an LLC in California A StepbyStep Guide Gusto

Guidelines for access to public records; I registered my own llc early last year to. An llc should use this voucher if any of the following apply: This form is considered filed the date it is postmarked or hand delivered. Web 501 (c) (1):

Forming A 501c3 In Illinois Form Resume Examples o7Y3z039BN

Candidates for county central committee that do not raise or spend $2,000 or more in a calendar year. Web in california, the statement of information (also known as a biennial report) is a regular filing that your llc must complete every two years to update your business information, including: File the form 501 before. An llc should use this voucher.

Web File The Form 501 Before You Solicit Or Receive Any Contributions Or Before You Make Expenditures From Personal Funds On Behalf Of Your Candidacy.

Web the purpose of the limited liability company is to engage in any lawful act or activity for which a limited liability company may be organized under the california revised uniform limited liability company act. I give my permission for any necessary verification. Web forms, samples and fees. Corporations that hold a title of property for exempt organizations.

Choose The Initial Directors For Your Corporation.

Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. © 2023 ca secretary of state Here are the steps to create a nonprofit in california. California secretary of state 1500 11th street sacramento, california 95814 office:

Web Www.fppc.ca.gov Candidate Intention Statement California 501 Form Who Files:

Web in california, the statement of information (also known as a biennial report) is a regular filing that your llc must complete every two years to update your business information, including: Go to www.fppc.ca.gov for campaign disclosure filing schedules. Ad make your free legal documents. This form is considered filed the date it is postmarked or hand delivered.

Guidelines For Access To Public Records;

Limited liability companies may become exempt if owned and operated by an exempt nonprofit and have proof of accepted entity classification election (irs form. Web secretary of state (sos) filing requirements who must file use the tables to determine your organization's filing requirement for the following forms: Web for tax years beginning on or after january 1, 2021, and before january 1, 2024, llcs that organize, register, or file with the secretary of state to do business in california are not subject to the annual tax of $800 for their first tax year. Reading further, i saw a $243 processing fee, with deadlines, statutes, and penalties mentioned.