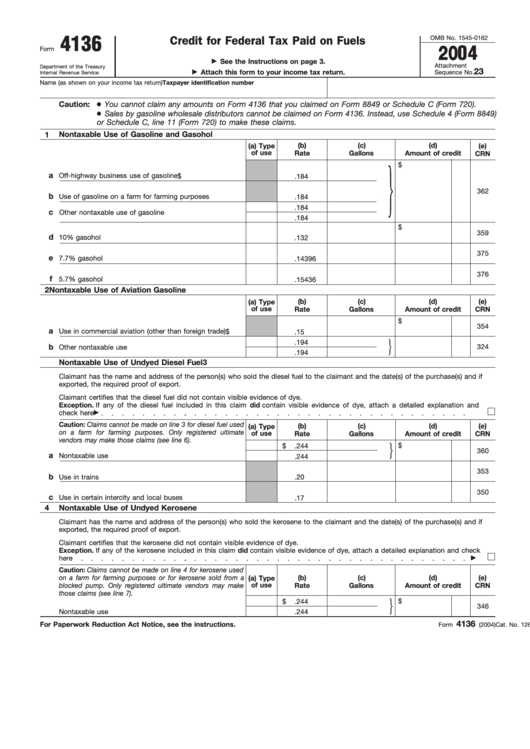

4136 Tax Form

4136 Tax Form - Web show sources > form 4136 is a federal other form. 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. Web what is the form 4136 used for? Web correction to form 4136 for tax year 2022 current year prior year accessible ebooks browser friendly post release changes to forms order forms and. Complete, edit or print tax forms instantly. The credits available on form 4136 are: Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Type form 4136 in search in the upper right click jump to form 4136 say yes on credit for nontaxable fuel usage on how you.

Web show sources > form 4136 is a federal other form. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Request for copy of tax return. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels see the separate instructions. However, the federal government allows people who use certain fuels in certain ways to. Attach this form to your income tax return. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Web to get form 4136 to populate correctly: Do not sign this form unless all applicable lines have. Download or email irs 4136 & more fillable forms, register and subscribe now!

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels see the separate instructions. Request for copy of tax return. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest. Web show sources > form 4136 is a federal other form. Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Type form 4136 in search in the upper right click jump to form 4136 say yes on credit for nontaxable fuel usage on how you. Download or email irs 4136 & more fillable forms, register and subscribe now! 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed diesel fuel registration no. The credits available on form 4136 are:

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Ad sovos combines tax automation with a human touch. Download or email irs 4136 & more fillable forms, register and subscribe now!.

Form 4136 Credit For Federal Tax Paid On Fuels 2002 printable pdf

Web credit for federal tax paid on fuels 4136 caution: Web what is the form 4136 used for? Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. Everyone pays tax when purchasing most types of fuels. Attach this form to your income tax return.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Everyone pays tax when purchasing most types of fuels. Reach out to learn how we can help you! Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Web what is the form 4136 used.

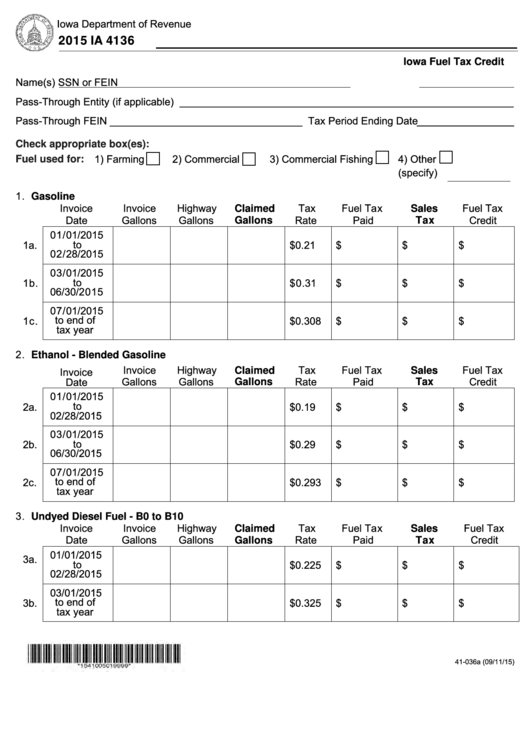

Fillable Form Ia 4136 Iowa Fuel Tax Credit 2015 printable pdf download

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Claimant has the name and address of the person who sold the fuel to the claimant and the dates of purchase. Web show sources > form 4136 is a federal other form..

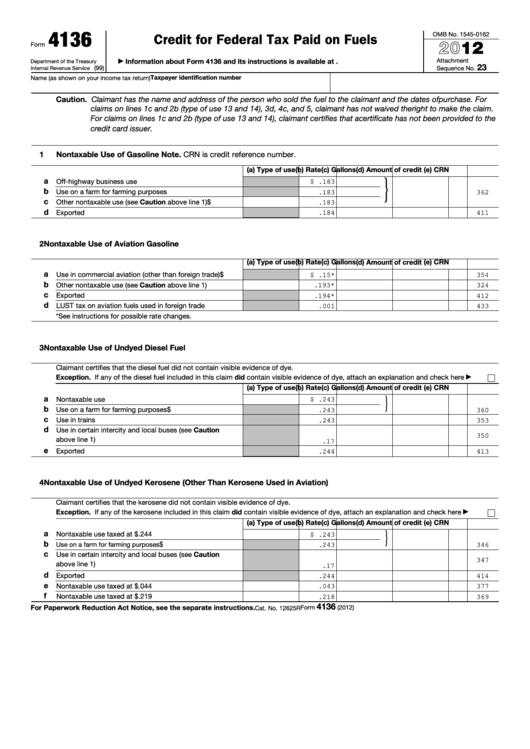

Fillable Form 4136 Credit For Federal Tax Paid On Fuels 2012

Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. Do not sign this form unless all applicable lines have. Complete, edit or print tax forms instantly. Web correction to form 4136 for tax year 2022 current year prior year accessible ebooks browser friendly post release changes.

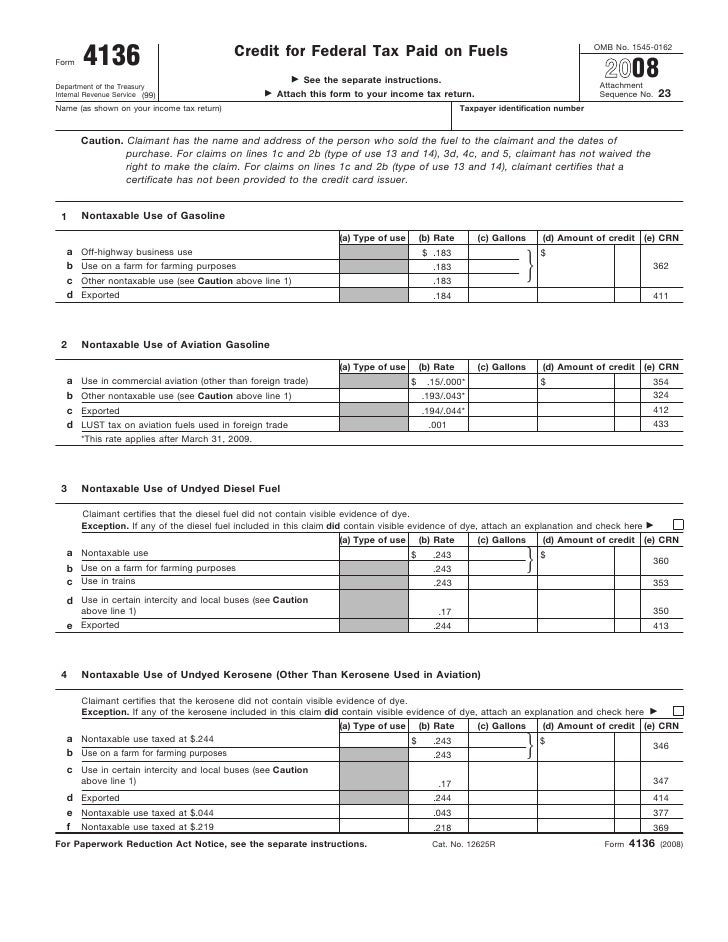

Form 4136Credit for Federal Tax Paid on Fuel

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Ad sovos combines tax automation with a human touch. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

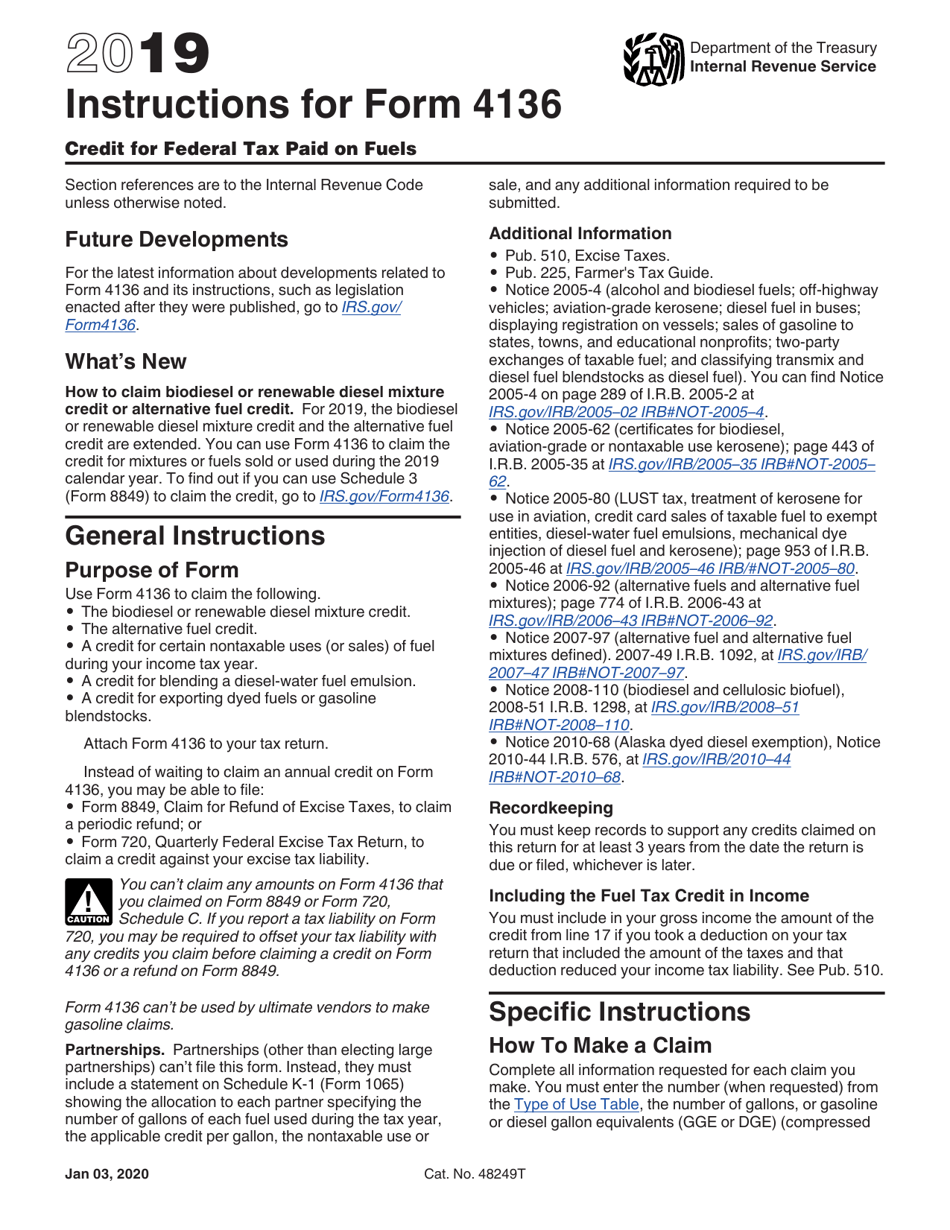

The credits available on form 4136 are: The biodiesel or renewable diesel mixture credit. Reach out to learn how we can help you! Request for copy of tax return. Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis.

Fillable Form 4136 Credit For Federal Tax Paid On Fuels printable pdf

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Ad download or email irs 4136 & more fillable forms, register and subscribe now! 12625rform 4136 5kerosene used in aviation (see caution above line 1) 6sales by registered ultimate vendors of undyed.

Fuel Tax Credit Eligibility, Form 4136 & How to Claim

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web correction to form 4136 for tax year 2022 current year prior year accessible ebooks browser friendly post release changes to forms order forms and. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

The credits available on form 4136 are: Type form 4136 in search in the upper right click jump to form 4136 say yes on credit for nontaxable fuel usage on how you. Web however, if you operate a business that consumes a significant amount of fuel, you may be eligible for a federal fuel tax credit under certain circumstances by.

Web What Is The Form 4136 Used For?

Reach out to learn how we can help you! Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web to get form 4136 to populate correctly: The credits available on form 4136 are:

Web Show Sources > Form 4136 Is A Federal Other Form.

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels see the separate instructions. The biodiesel or renewable diesel mixture credit. Web credit for federal tax paid on fuels 4136 caution:

Do Not Sign This Form Unless All Applicable Lines Have.

Type form 4136 in search in the upper right click jump to form 4136 say yes on credit for nontaxable fuel usage on how you. Web correction to form 4136 for tax year 2022 current year prior year accessible ebooks browser friendly post release changes to forms order forms and. Attach this form to your income tax return. Download or email irs 4136 & more fillable forms, register and subscribe now!

Missouri Receives Fuel Tax On Gallons Of Motor Fuel (Gasoline, Diesel Fuel, Kerosene, And Blended Fuel) From Licensed Suppliers On A Monthly Basis.

Request for copy of tax return. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Ad sovos combines tax automation with a human touch. Everyone pays tax when purchasing most types of fuels.