401K Loan Chapter 13 Without Permission

401K Loan Chapter 13 Without Permission - Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. Web there isn't any exception for 401(k) loans. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that.

Web fact that payroll deduction for 401(k) loan repayment in chapter 13 would result in $0 for unsecured creditors is not a special. Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that. Web you may be able to take a 401k loan but you will need to request permission from your chapter 13 trustee. The court can certainly dismiss your chapter 13 plan because you failed to. Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. Web there isn't any exception for 401(k) loans.

Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. The court can certainly dismiss your chapter 13 plan because you failed to. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission. Web there isn't any exception for 401(k) loans. Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. Web fact that payroll deduction for 401(k) loan repayment in chapter 13 would result in $0 for unsecured creditors is not a special. Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission.

Should I Take a 401k Loan for a Down Payment on a House? ⋆ Freedom Jar FIRE

Web you may be able to take a 401k loan but you will need to request permission from your chapter 13 trustee. Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals.

What You Should Know Before You Borrow from your 401k Digest Your

Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. The court can certainly dismiss your chapter 13 plan because you failed to. Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. Web according to vanguard’s.

Can I Stop Making 401k Loan Payments? Finstream.TV

Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission. Web withdrawing from a 401k in a chapter 13 would have to be approved by the court because the debtor must commit all. Web however, one exception to this rule is that 401k loans can continue to be repaid.

Is student loan assistance the next 401k? Bizwomen

Web there isn't any exception for 401(k) loans. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. The court can certainly dismiss your chapter 13 plan because you failed to. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission. Web.

Can You Loan Money From 401k TESATEW

Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission. Web your plan's rules will also set a maximum number of loans you may have outstanding.

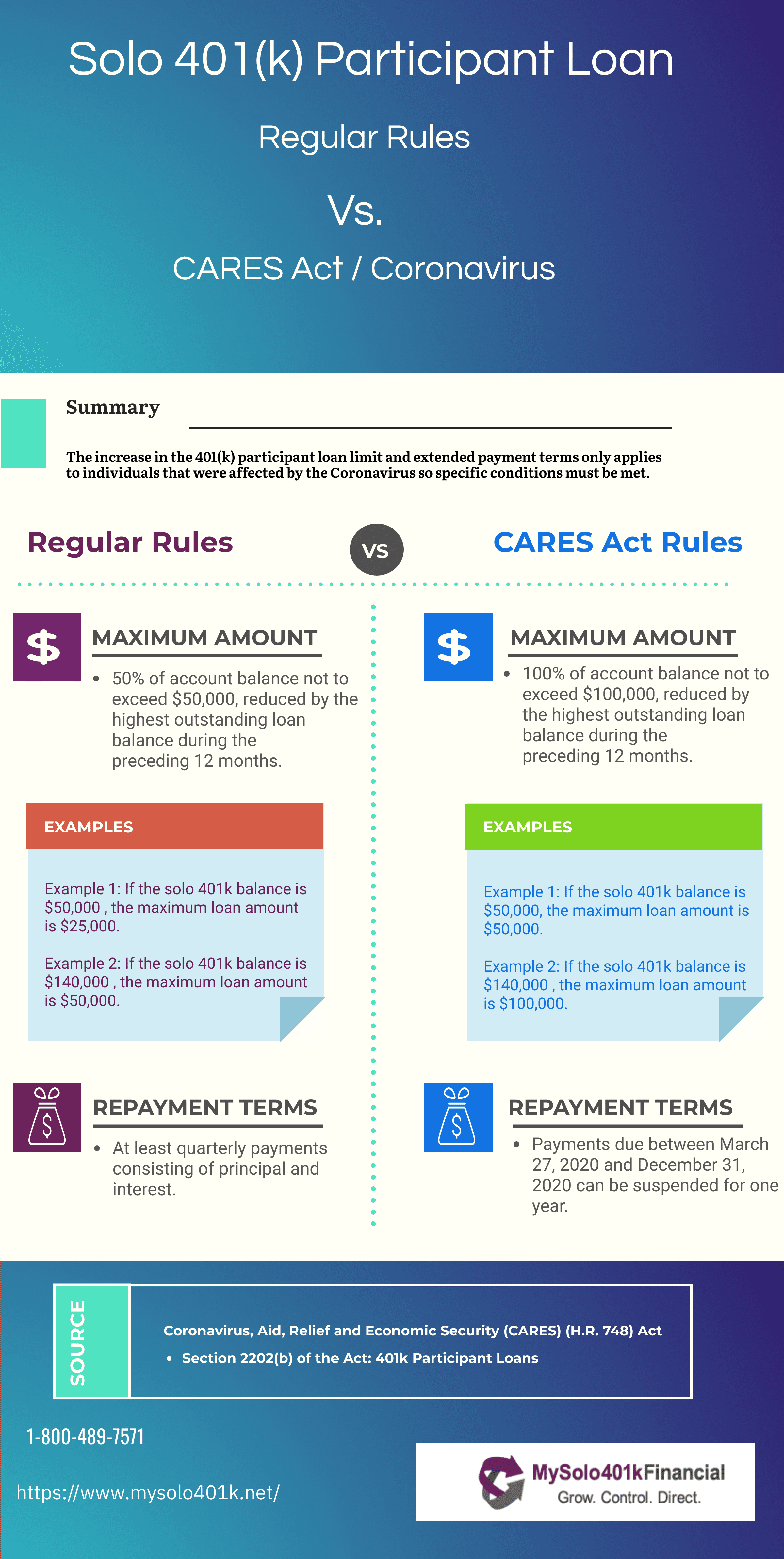

Solo 401k Loan Rules and Regulations My Solo 401k Financial

Web you can take loans out in chapter 13 without court approval, so long as it is under $1,000. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web i took out.

How My 401k Loan Cost Me 1 Million Dollars Is a 401k loan a good idea?

The court can certainly dismiss your chapter 13 plan because you failed to. Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web continuing to repay the loan during bankruptcy allows you to.

401k Loans Explained YouTube

Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web i took out a 401k loan while in chapter13 without permission because i did not know you.

How to Pay Off a 401K Loan Early 401k loan, How to get money, Paying

Web there isn't any exception for 401(k) loans. Web however, one exception to this rule is that 401k loans can continue to be repaid during their bankruptcy, even. Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. If the loan is over. Web withdrawing from a 401k.

Loans, withdrawal, 401k, retirement fund, finances, financial

Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. Web continuing to repay the loan during bankruptcy allows you to keep from falling.

The Court Can Certainly Dismiss Your Chapter 13 Plan Because You Failed To.

Web there isn't any exception for 401(k) loans. Web according to vanguard’s 401(k) loan calculator, borrowing $10,000 from a 401(k) plan over five years means. Web i took out a 401k loan while in chapter13 without permission because i did not know you had to get permission. Web to obtain a loan from your 401 (k) while in a chapter 13 bankruptcy you must get the court’s permission.

Web However, One Exception To This Rule Is That 401K Loans Can Continue To Be Repaid During Their Bankruptcy, Even.

Web continuing to repay the loan during bankruptcy allows you to keep from falling behind on your end goals for. Web there is no income cap on who can file for chapter 13 bankruptcy and it can help alleviate some of the problems that. Web i took out a 401k loan while i am in chapter 13 bankruptcy without the court's permission because i thought i. If the loan is over.

Web You Can Take Loans Out In Chapter 13 Without Court Approval, So Long As It Is Under $1,000.

Web 401 (k) loans can usually be borrowed in the amount of $50,000 or 50% of your account balance, whichever is less. Web fact that payroll deduction for 401(k) loan repayment in chapter 13 would result in $0 for unsecured creditors is not a special. Web you may be able to take a 401k loan but you will need to request permission from your chapter 13 trustee. Web your plan's rules will also set a maximum number of loans you may have outstanding from your plan.