3520 Form Instructions

3520 Form Instructions - Go to ftb.ca.gov, log in to myftb, and select file a power of. Send form 3520 to the. Transferor who, directly or indirectly, transferred money or other property during the. Provide your name, address, phone number, and social security number. Not everyone who is a us person. Web this form must be submitted to the u.s. Web file a separate form 3520 for each foreign trust. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24. Web form 3520 & instructions:

Web form 3520 & instructions: Web file a separate form 3520 for each foreign trust. Customs and border protection to import passenger vehicles, highway motorcycles and the corresponding engines into the. Web this form must be submitted to the u.s. Not everyone who is a us person. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Provide your name, address, phone number, and social security number. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24. It does not have to be a “foreign gift.” rather,. Web businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for 6 years.

Provide your name, address, phone number, and social security number. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24. Owner files this form annually to provide information. Web form 3520 & instructions: It does not have to be a “foreign gift.” rather,. Send form 3520 to the. Go to ftb.ca.gov, log in to myftb, and select file a power of. Web file a separate form 3520 for each foreign trust. Owner a foreign trust with at least one u.s.

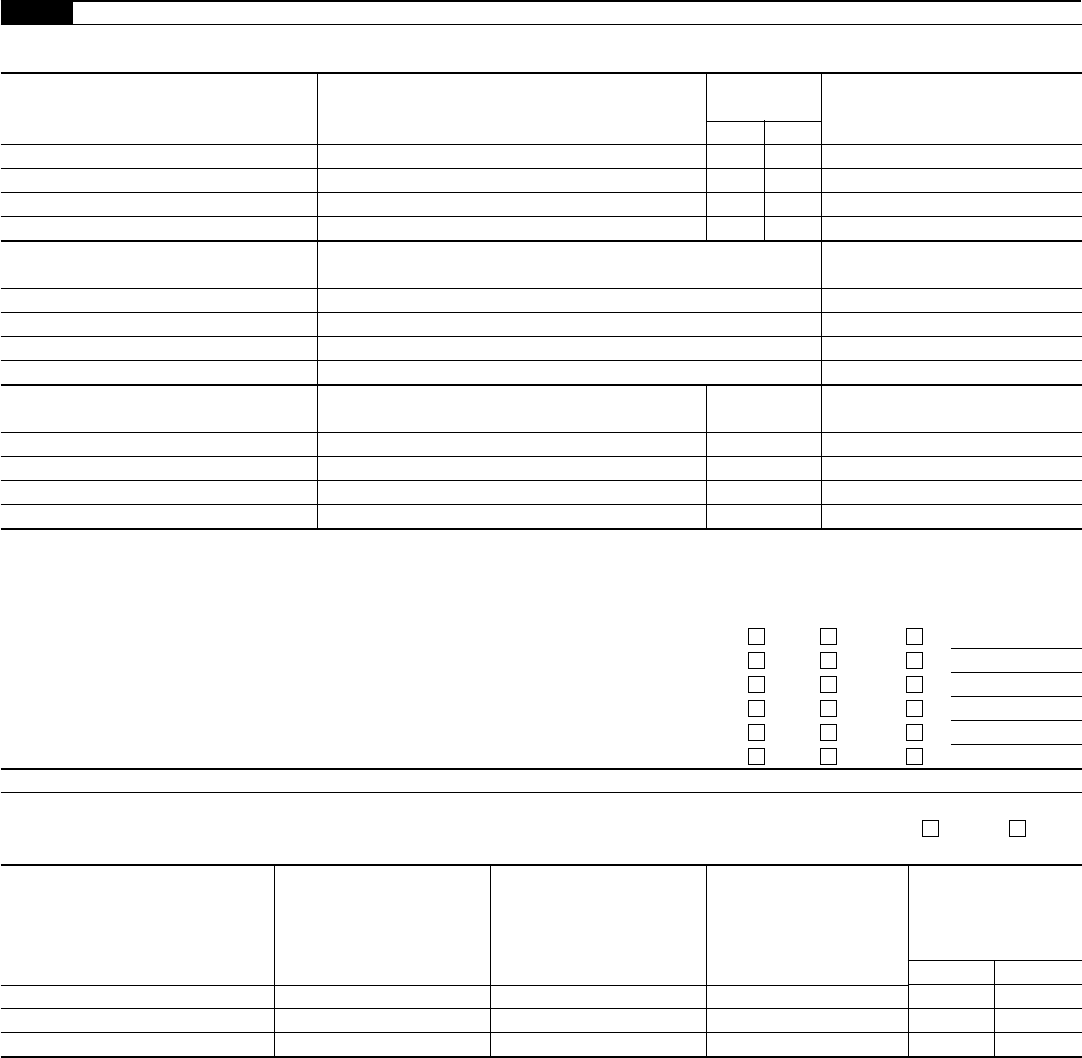

Epa form 3520 21 Instructions Best Of File Biomed Central

It does not have to be a “foreign gift.” rather,. Web businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for 6 years. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated.

Epa form 3520 21 Instructions Brilliant Sl L Eta 11 0271

Owner files this form annually to provide information. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for.

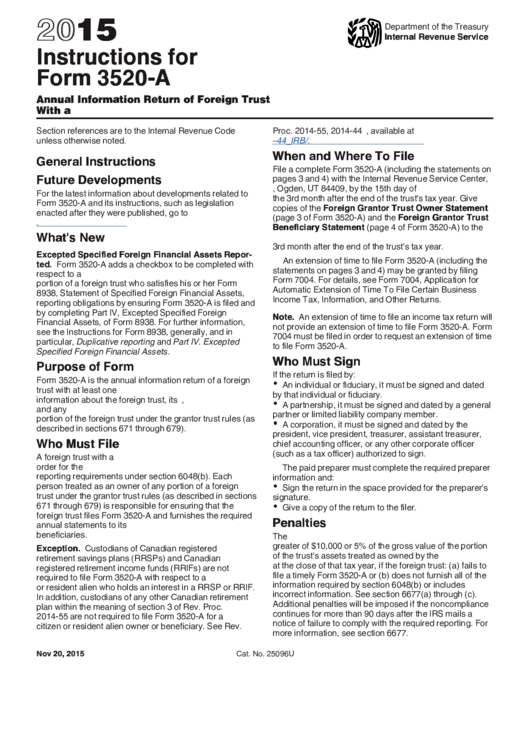

Instructions For Form 3520A Annual Information Return Of Foreign

Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Owner a foreign trust with at least one u.s. Send form 3520 to the. It does not have to be a “foreign gift.” rather,. Owner files this form annually to provide information.

Steuererklärung dienstreisen Form 3520

For faster processing, submit electronically. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24. Web form 3520 & instructions: Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt.

Epa form 3520 21 Instructions Inspirational Fice Of foreign Missions

Owner files this form annually to provide information. Send form 3520 to the. Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. Web businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of.

3520 1 Form Fill Online, Printable, Fillable, Blank pdfFiller

Owner a foreign trust with at least one u.s. Not everyone who is a us person. Web businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for 6 years. Transferor who, directly or indirectly, transferred money or other property during the. The irs f orm 3520 is.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Provide your name, address, phone number, and social security number. It does not have to be a “foreign gift.” rather,. Customs and border protection to import passenger vehicles, highway motorcycles and the corresponding engines into the. Web instructions for completing ftb 3520: Web an income tax return, the due date for filing form 3520 is the 15th day of the.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Transferor who, directly or indirectly, transferred money or other property during the. Owner files this form annually to provide information. For faster processing, submit electronically. Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. Provide your name, address, phone number,.

Epa Form 3520 21 Fillable Fill Out and Sign Printable PDF Template

Owner a foreign trust with at least one u.s. Web file a separate form 3520 for each foreign trust. Send form 3520 to the. Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. Web form 3520 is technically referred to.

Form 3520 Fill out & sign online DocHub

Not everyone who is a us person. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Web businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for 6 years. Web an income tax.

Web File A Separate Form 3520 For Each Foreign Trust.

Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Customs and border protection to import passenger vehicles, highway motorcycles and the corresponding engines into the. Web this form must be submitted to the u.s. Web businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for 6 years.

Transferor Who, Directly Or Indirectly, Transferred Money Or Other Property During The.

Owner files this form annually to provide information. Owner a foreign trust with at least one u.s. Go to ftb.ca.gov, log in to myftb, and select file a power of. Web form 3520 & instructions:

Not Everyone Who Is A Us Person.

Provide your name, address, phone number, and social security number. Web instructions for completing ftb 3520: It does not have to be a “foreign gift.” rather,. Web form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Send Form 3520 To The.

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web the form 3520 instructions say that if you received an amount from a portion of a foreign trust of which you are treated as the owner, please complete lines 24. Web the form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain foreign persons to the. For faster processing, submit electronically.