3520 A Form

3520 A Form - Web form 3520 & instructions: Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related. The foreign trust must furnish the required. It does not have to be a “foreign gift.” rather, if a. Decedents) file form 3520 with the irs to report: Owner, is march 15, and the due date for. Owner (under section 6048(b)) department of the treasury internal revenue service go to. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related. Owner, is an example of a tax document that must be filed every year by taxpayers who are the. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Persons (and executors of estates of u.s. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. It does not have to be a “foreign gift.” rather, if a. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web if you are a u.s. Owner (under section 6048(b)) department of the treasury internal revenue service go to. Owner, is march 15, and the due date for.

Web the penalty imposed on a u.s. Get ready for tax season deadlines by completing any required tax forms today. Owner, is an example of a tax document that must be filed every year by taxpayers who are the. It does not have to be a “foreign gift.” rather, if a. Certain transactions with foreign trusts, ownership of foreign trusts under the. The foreign trust must furnish the required. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related. Owner (under section 6048(b)) department of the treasury internal revenue service go to. Web form 3520 & instructions: Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with.

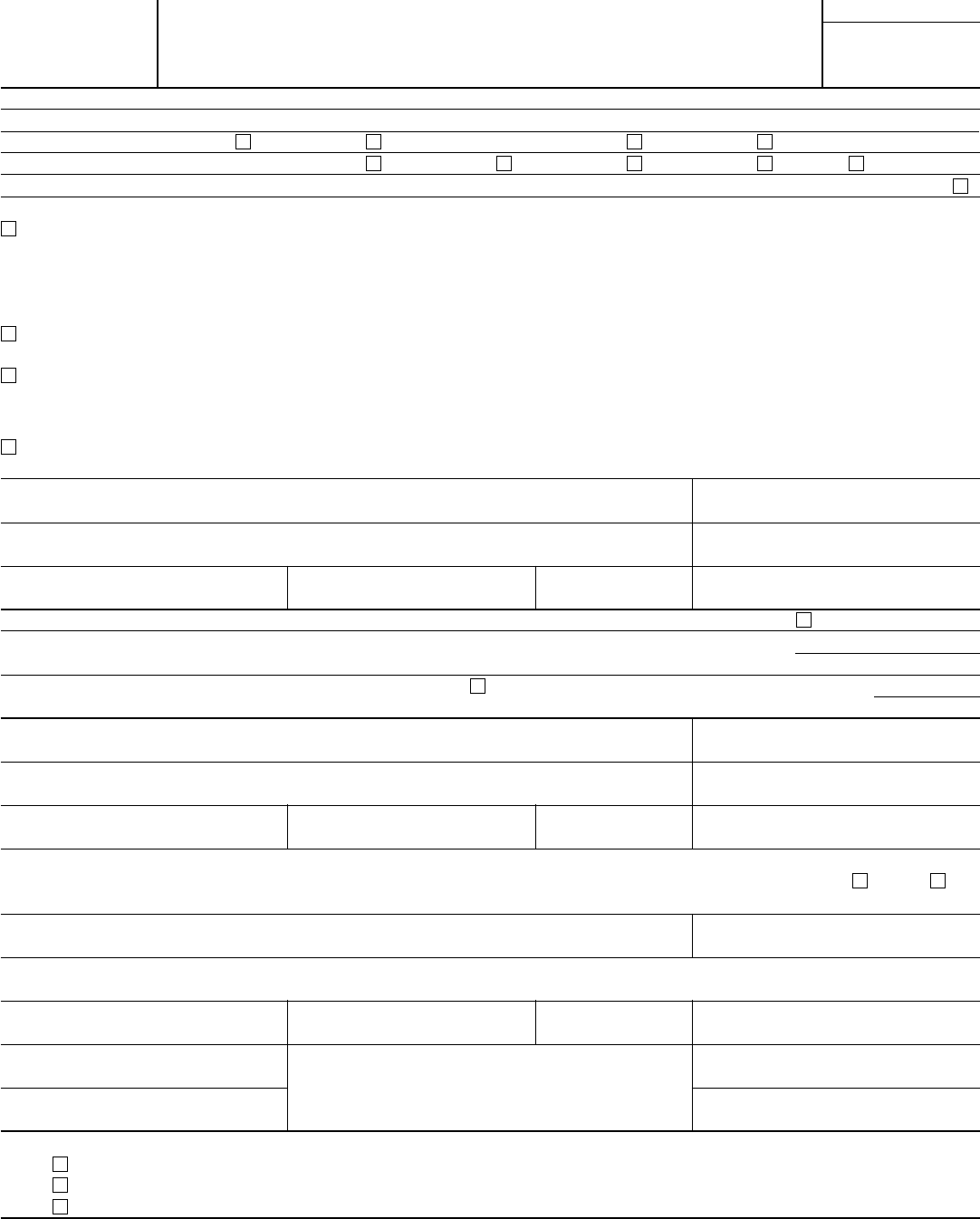

IRS Form 3520A 2018 2019 Fill out and Edit Online PDF Template

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Where should it be filed? Web if you are a u.s. Web form 3520 filing requirements. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Certain transactions with foreign trusts, ownership of foreign trusts under the. Where should it be filed? Persons (and executors of estates of u.s. Web the penalty imposed on a u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

'Victims' Of IRS forms 3520 and 3520A coming forward to protest large

Web the penalty imposed on a u.s. Decedents) file form 3520 with the irs to report: Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web form 3520 filing requirements. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web form 3520 filing requirements. Web the penalty imposed on a u.s..

Form 3520 Edit, Fill, Sign Online Handypdf

Owner (under section 6048(b)) department of the treasury internal revenue service go to. The foreign trust must furnish the required. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from.

Steuererklärung dienstreisen Form 3520

Owner (under section 6048(b)) department of the treasury internal revenue service go to. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related. Decedents) file form 3520 with the irs to report: The foreign trust must furnish the required. Owner, is an example of a tax document.

3.21.19 Foreign Trust System Internal Revenue Service

Certain transactions with foreign trusts, ownership of foreign trusts under the. Talk to our skilled attorneys by scheduling a free consultation today. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Owner, is an example of a tax document that must be filed every year by taxpayers who are the. Where should it be filed?

Fill Free fillable Form 3520A 2019 Annual Information Return of

Owner, is march 15, and the due date for. Owner (under section 6048(b)) department of the treasury internal revenue service go to. Web the penalty imposed on a u.s. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Ad don’t feel alone if you’re dealing with irs.

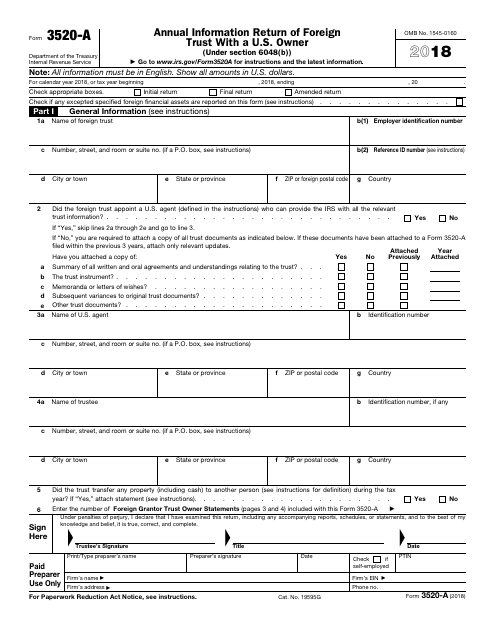

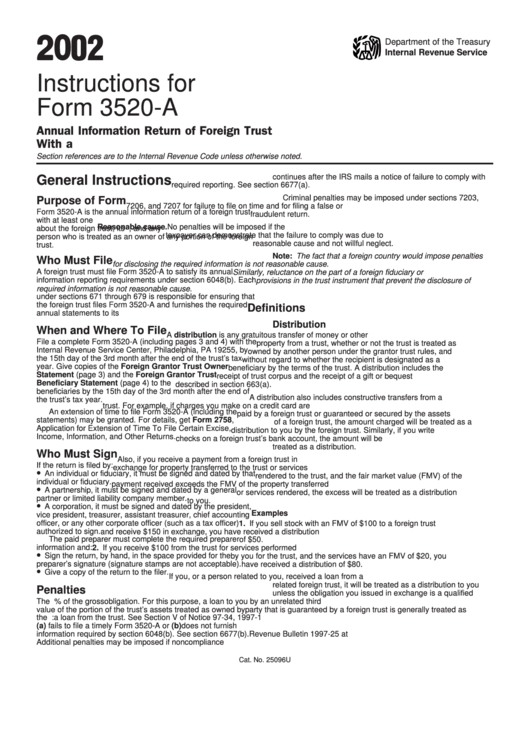

Instructions For Form 3520A Annual Information Return Of Foreign

Owner (under section 6048(b)) department of the treasury internal revenue service go to. Owner, is an example of a tax document that must be filed every year by taxpayers who are the. Web the penalty imposed on a u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner,.

Instructions For Form 3520A Annual Information Return Of Foreign

Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web the penalty imposed on a u.s. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related. Get ready for tax.

Web Form 3520 & Instructions:

Persons (and executors of estates of u.s. Web if you are a u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Certain transactions with foreign trusts, ownership of foreign trusts under the.

Form 3520 Is Technically Referred To As The Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts.

Decedents) file form 3520 with the irs to report: Web the penalty imposed on a u.s. Owner (under section 6048(b)) department of the treasury internal revenue service go to. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related.

Ad Don’t Feel Alone If You’re Dealing With Irs Form 3520 Penalty Abatement Issues.

Owner, is an example of a tax document that must be filed every year by taxpayers who are the. It does not have to be a “foreign gift.” rather, if a. Talk to our skilled attorneys by scheduling a free consultation today. The foreign trust must furnish the required.

Web Form 3520 Filing Requirements.

Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Where should it be filed? Owner, is march 15, and the due date for. Get ready for tax season deadlines by completing any required tax forms today.