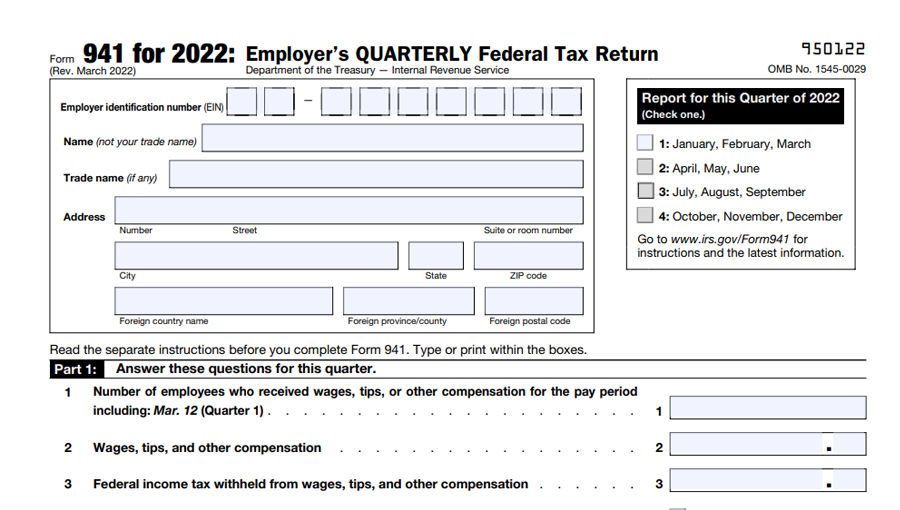

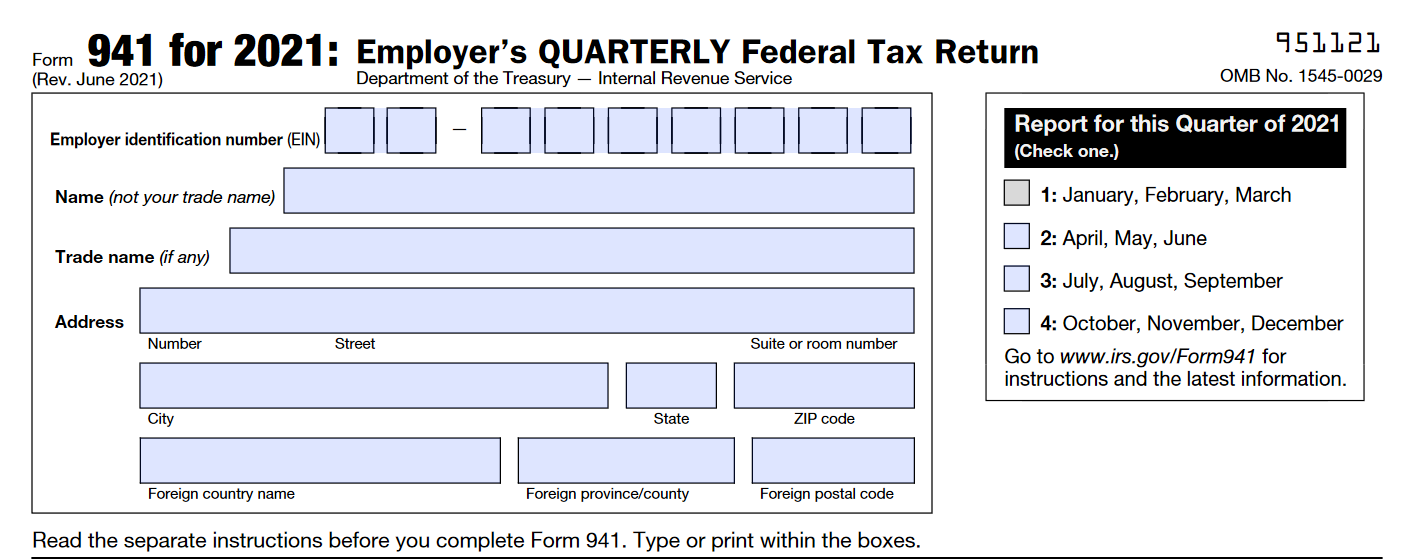

2022 Federal 941 Form

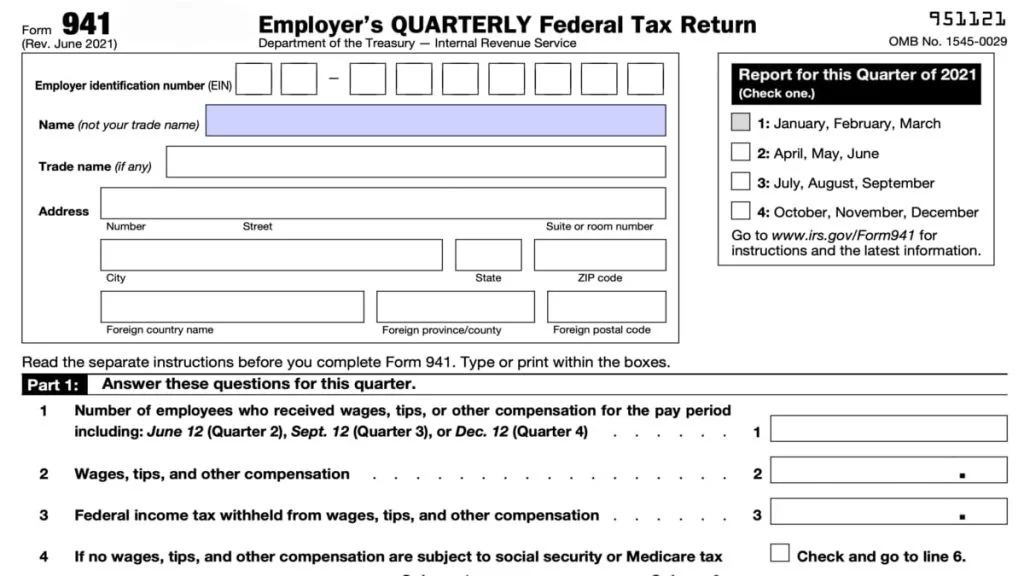

2022 Federal 941 Form - Web yes, there will still be two worksheets for form 941 for the third quarter. Web we last updated federal form 941 in july 2022 from the federal internal revenue service. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. This form is for income earned in tax year 2022, with tax returns due in april 2023. If you reported more than $50,000, you’re a. The deadline is the last day of the month following the end of the quarter. Don't use an earlier revision to report taxes for 2023. The last time form 941 was. Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to. Ad edit, sign and print irs 941 tax form on any device with dochub.

Web report for this quarter of 2022 (check one.) 1: Ad edit, sign and print irs 941 tax form on any device with dochub. If changes in law require additional. Show sources > about the corporate income tax the irs and most states require. Web learn more about patriot payroll what is form 941? Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Don't use an earlier revision to report taxes for 2023. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web you file form 941 quarterly. Ad get ready for tax season deadlines by completing any required tax forms today.

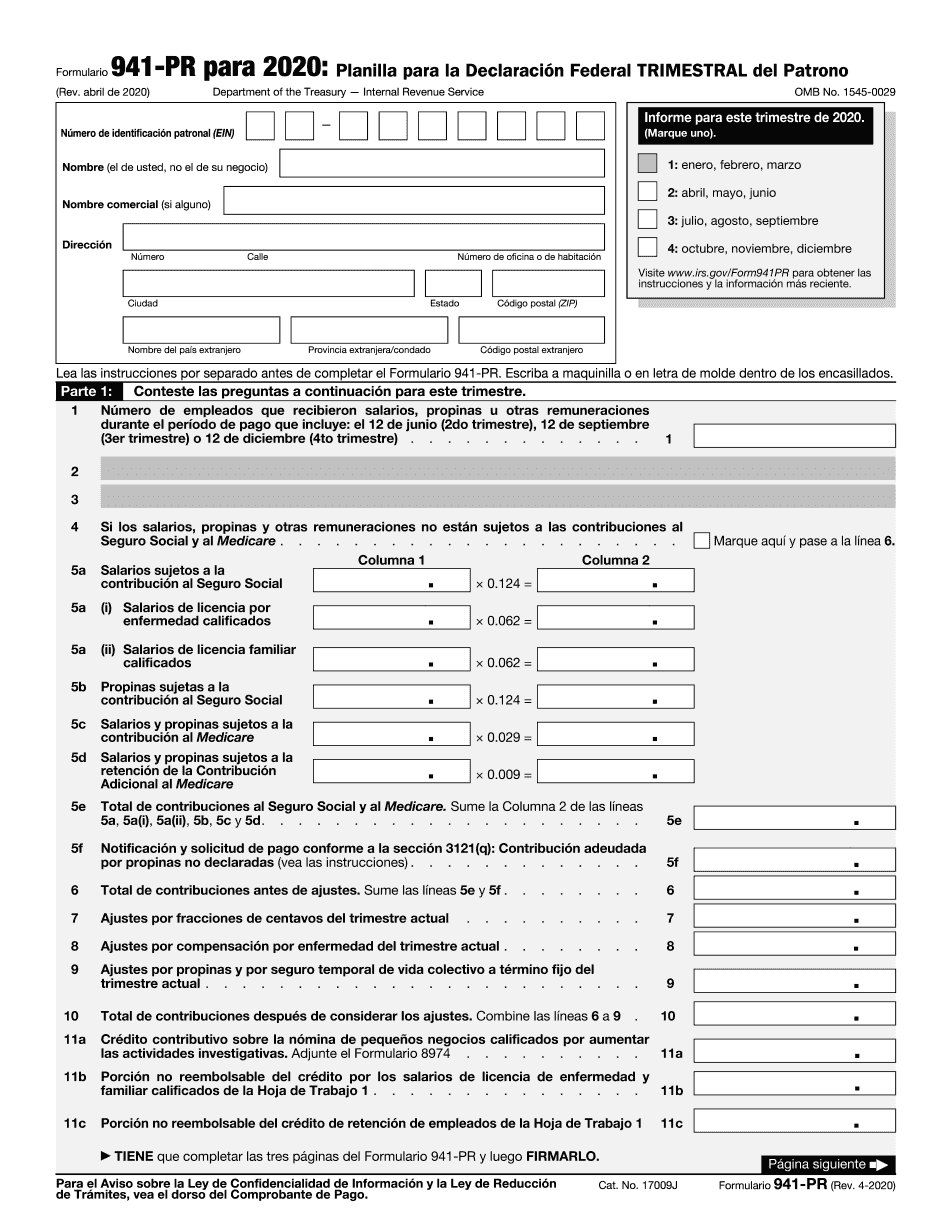

These worksheets should only be used by employers that need to calculate and claim. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. Web you file form 941 quarterly. Web we last updated federal form 941 from the internal revenue service in july 2022. At this time, the irs. If you reported more than $50,000, you’re a. Web learn more about patriot payroll what is form 941? Ad edit, sign and print irs 941 tax form on any device with dochub. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

File Form 941 Online for 2023 Efile 941 at Just 5.95

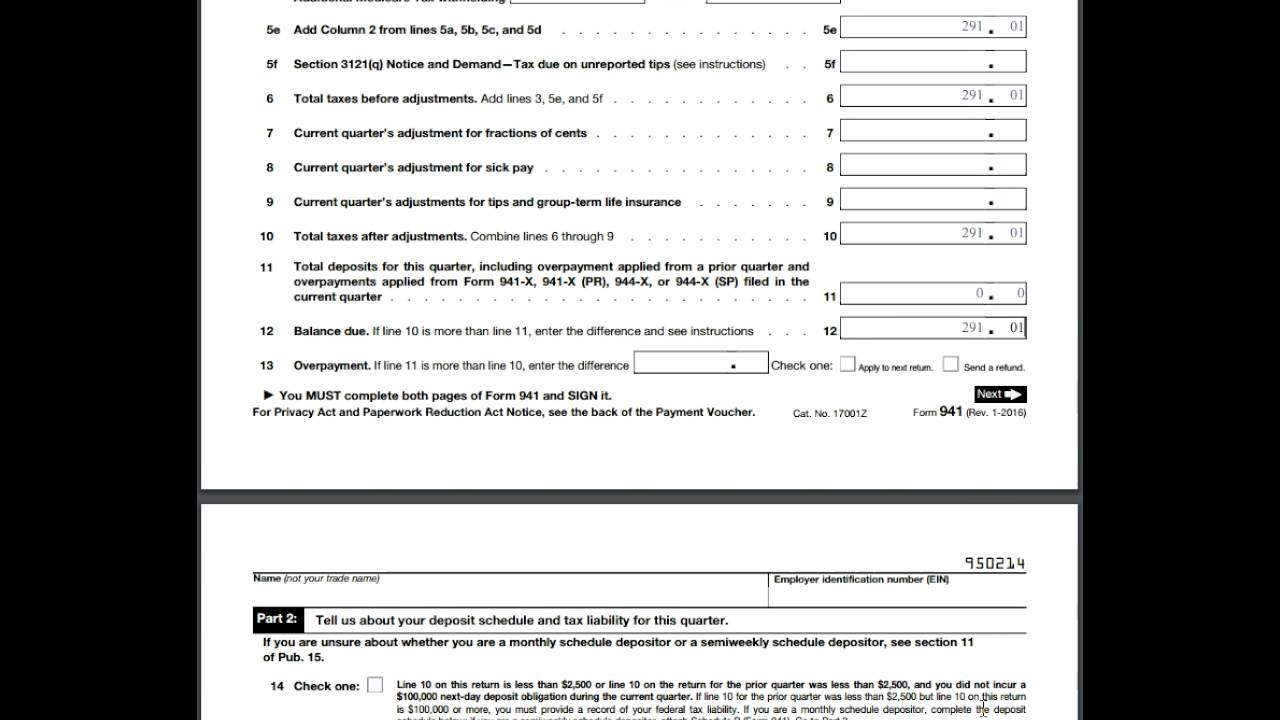

28 by the internal revenue service. Web a draft version of the 2022 form 941, employer’s quarterly federal tax return, was released jan. 26 by the internal revenue service. Ad get ready for tax season deadlines by completing any required tax forms today. The deadline is the last day of the month following the end of the quarter.

Form 941 Employer's Quarterly Federal Tax Return. Normal forms not due

At this time, the irs. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to. Web yes, there will still be two worksheets for form 941 for the third quarter. Web we last updated federal form 941.

Printable 941 Form Printable Form 2021

The irs has officially named this form as quarterly employer’s. The last time form 941 was. Web yes, there will still be two worksheets for form 941 for the third quarter. Web irs form 941, is a quarterly form that any business owner with employees must file it with the irs. These worksheets should only be used by employers that.

941 Form 2023

Web you file form 941 quarterly. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Complete, edit or print tax forms instantly. Show sources > about the corporate income tax the irs and most states require. Web the irs expects the june 2022 revision of form 941 and these instructions to be used for.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; At this time, the irs. Web irs form 941, is a quarterly form that any business owner with employees must file it with the irs. This form is for income earned in tax year 2022, with tax returns due in april 2023..

IRS Form 941 Instructions for 2021 How to fill out Form 941

If you reported more than $50,000, you’re a. If changes in law require additional. Ad edit, sign and print irs 941 tax form on any device with dochub. The deadline is the last day of the month following the end of the quarter. The irs has officially named this form as quarterly employer’s.

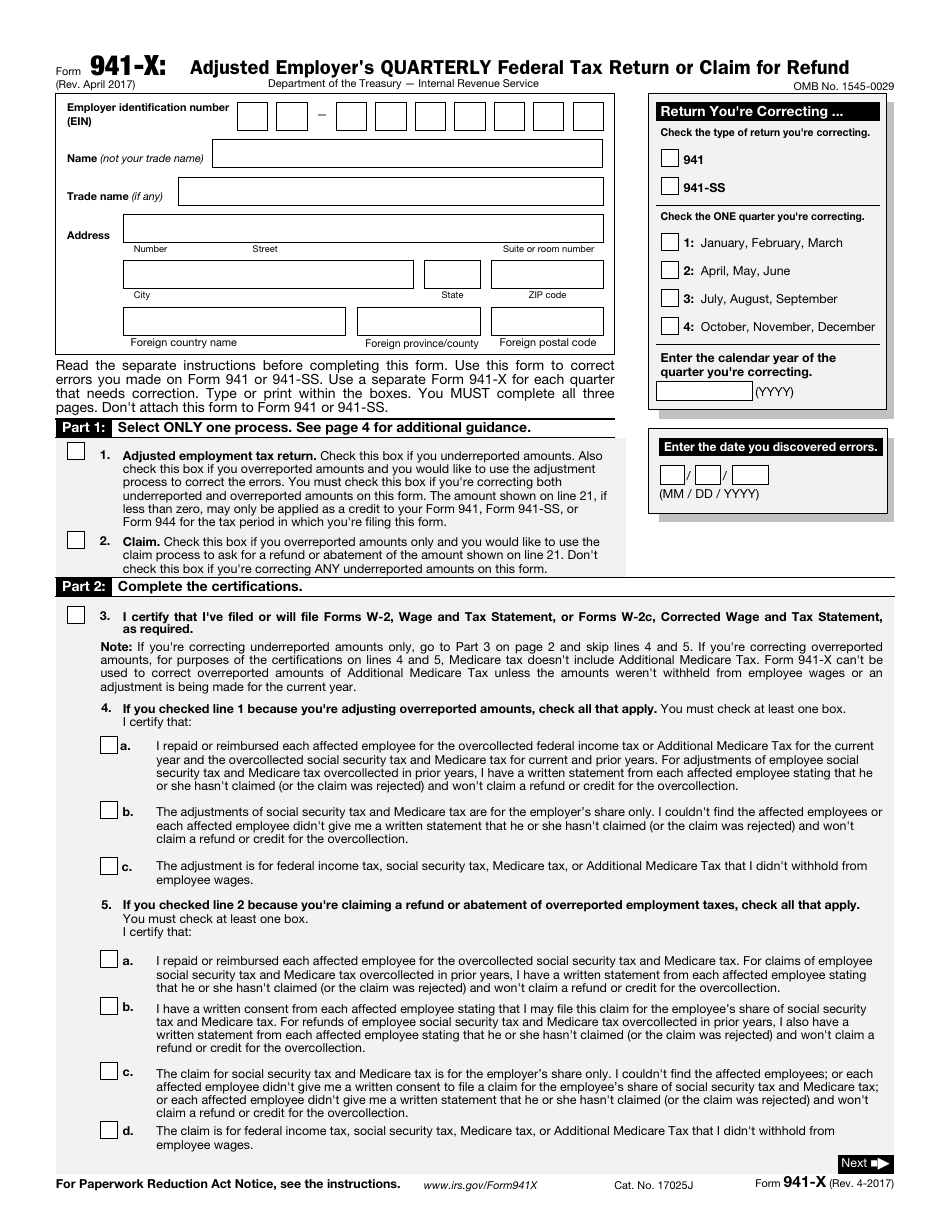

IRS Form 941X Download Fillable PDF or Fill Online Adjusted Employer's

The last time form 941 was. Web the irs expects the june 2022 revision of form 941 and these instructions to be used for the second, third, and fourth quarters of 2022. At this time, the irs. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Ad get ready for tax season deadlines by.

Revised IRS Form 941 Schedule R 2nd quarter 2021

Web yes, there will still be two worksheets for form 941 for the third quarter. Web we last updated federal form 941 from the internal revenue service in july 2022. Web we last updated federal form 941 in july 2022 from the federal internal revenue service. Web learn more about patriot payroll what is form 941? The last time form.

Customers

Form 941 is used by employers. If you reported more than $50,000, you’re a. At this time, the irs. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web february 28, 2022 · 9 minute read.

TX 2022 20112022 Fill and Sign Printable Template Online US Legal

Web form 941, employer’s quarterly federal tax return, is the tax form that reports wages paid to employees, tips they reported, and taxes withheld from their paychecks, including. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; The last time form 941 was. Ad edit, sign and print irs 941 tax.

Complete, Edit Or Print Tax Forms Instantly.

Don't use an earlier revision to report taxes for 2023. Web learn more about patriot payroll what is form 941? Irs form 941, employer’s quarterly federal tax return, reports payroll taxes and employee wages to. Web yes, there will still be two worksheets for form 941 for the third quarter.

The Irs Has Officially Named This Form As Quarterly Employer’s.

Web you file form 941 quarterly. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web finalized versions of the 2022 form 941, its instructions, and schedules were issued feb. Web form 941, which has a revision date of march 2022, must be used only for the first quarter of 2022 as the other quarters are grayed out.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

The deadline is the last day of the month following the end of the quarter. 28 by the internal revenue service. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web february 28, 2022 · 9 minute read.

26 By The Internal Revenue Service.

The last time form 941 was. Web report for this quarter of 2022 (check one.) 1: At this time, the irs. Web form 941 for 2023: