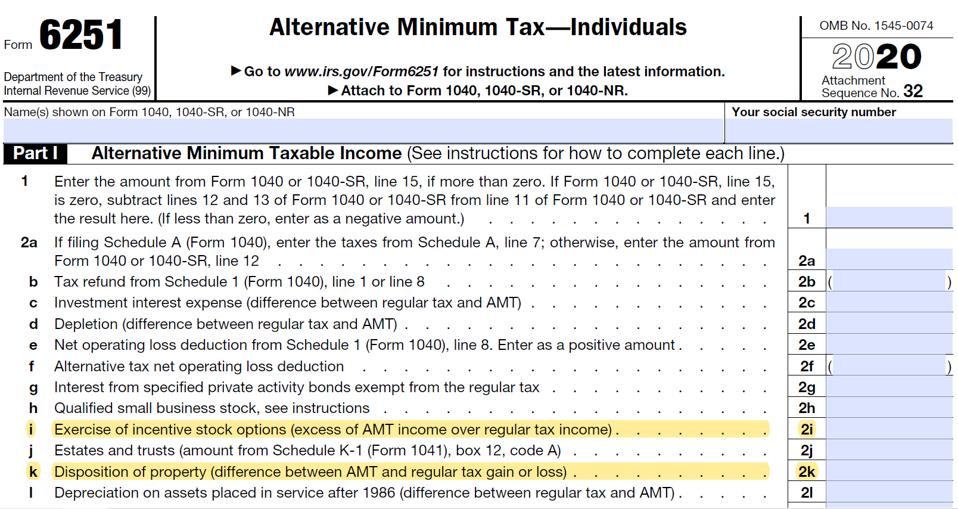

2021 Form 6251

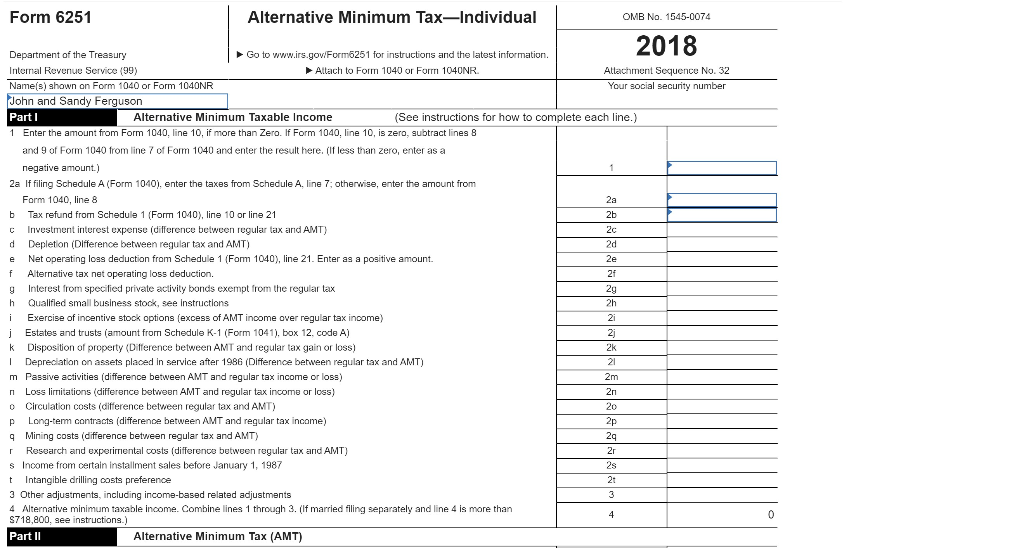

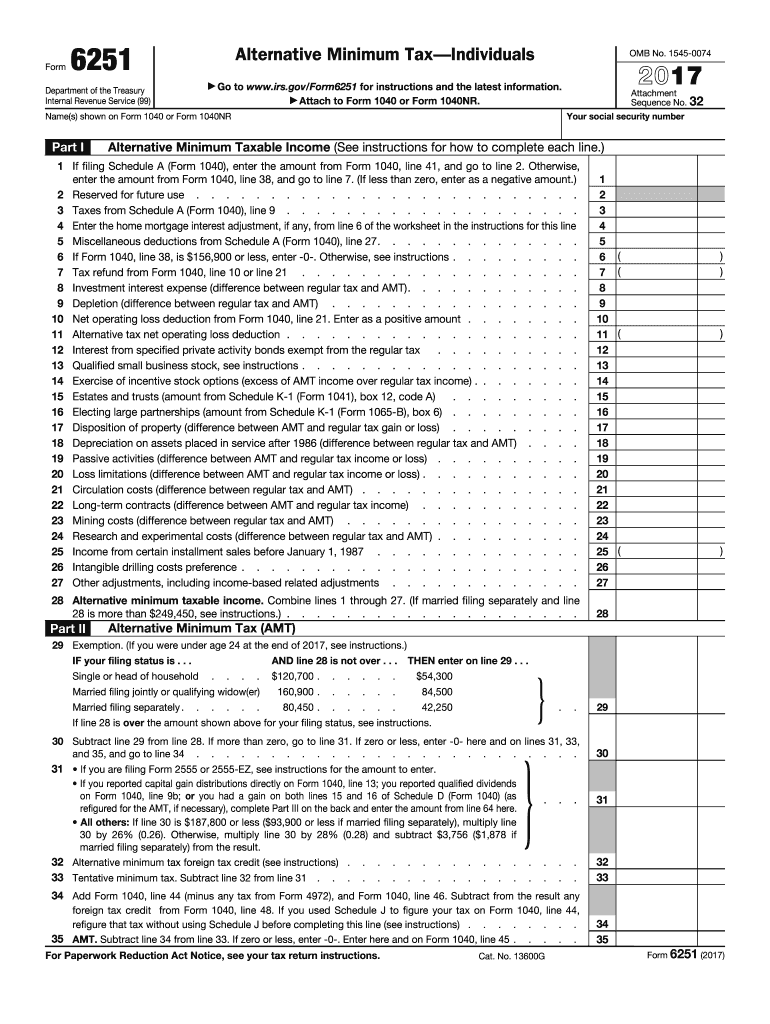

2021 Form 6251 - If you have a net operating loss (nol) amount on line 8 of schedule 1 (form 1040) additional income and adjustments to. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Tax computation using maximum capital gains rates : For tax year 2022 (which you file in. Edit, sign and save irs instruction 6251 form. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web purpose of form use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you. Web if you had tax preference items and adjustments in 2021, see form ia 6251 for further information.

Edit, sign and save irs instruction 6251 form. Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you. Form 6251 is used by individuals. Complete part iii only if you are required to do so by line 31 or by the foreign earned. Web form 6251 2023. Complete, edit or print tax forms instantly. For tax year 2022 (which you file in. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web for tax year 2021 (which you file in 2022), the exemption is $73,000 for single individuals and $114,600 for married couples. The amt is a separate tax that is imposed in addition to your regular tax.

Ad access irs tax forms. Tax computation using maximum capital gains rates : If you have a net operating loss (nol) amount on line 8 of schedule 1 (form 1040) additional income and adjustments to. Web purpose of form use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web form 6251 2023. Web more about the federal form 6251. Alternative minimum tax—individuals department of the treasury internal revenue service. Complete part iii only if you are required to do so by line 31 or by the foreign earned. No form 6251 on 2021 return. Edit, sign and save irs instruction 6251 form.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

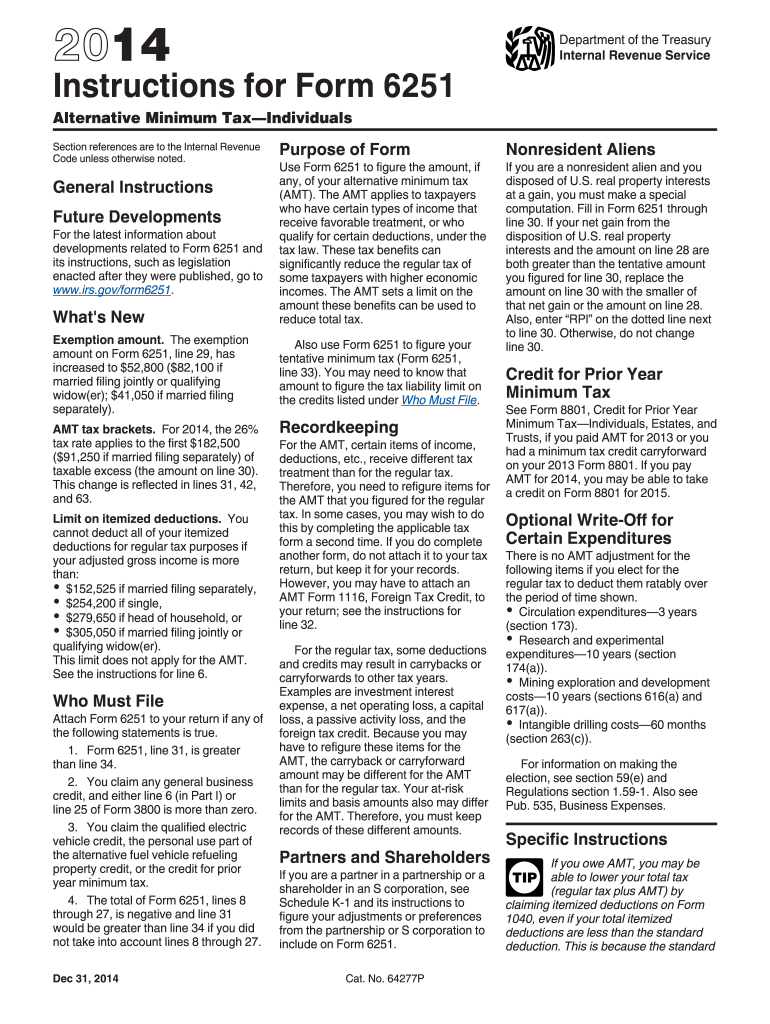

Web more about the federal form 6251. This change is reflected in lines 7, 18, and 39. Complete part iii only if you are required to do so by line 31 or by the foreign earned. Web form 6251 2023. Complete, edit or print tax forms instantly.

Form 6251 Edit, Fill, Sign Online Handypdf

Alternative minimum tax—individuals department of the treasury internal revenue service. Edit, sign and save irs instruction 6251 form. If you have a net operating loss (nol) amount on line 8 of schedule 1 (form 1040) additional income and adjustments to. Web form 6251 is scheduled for availability in turbotax online on 2/18/2021. Web if the calculation on form 6251:

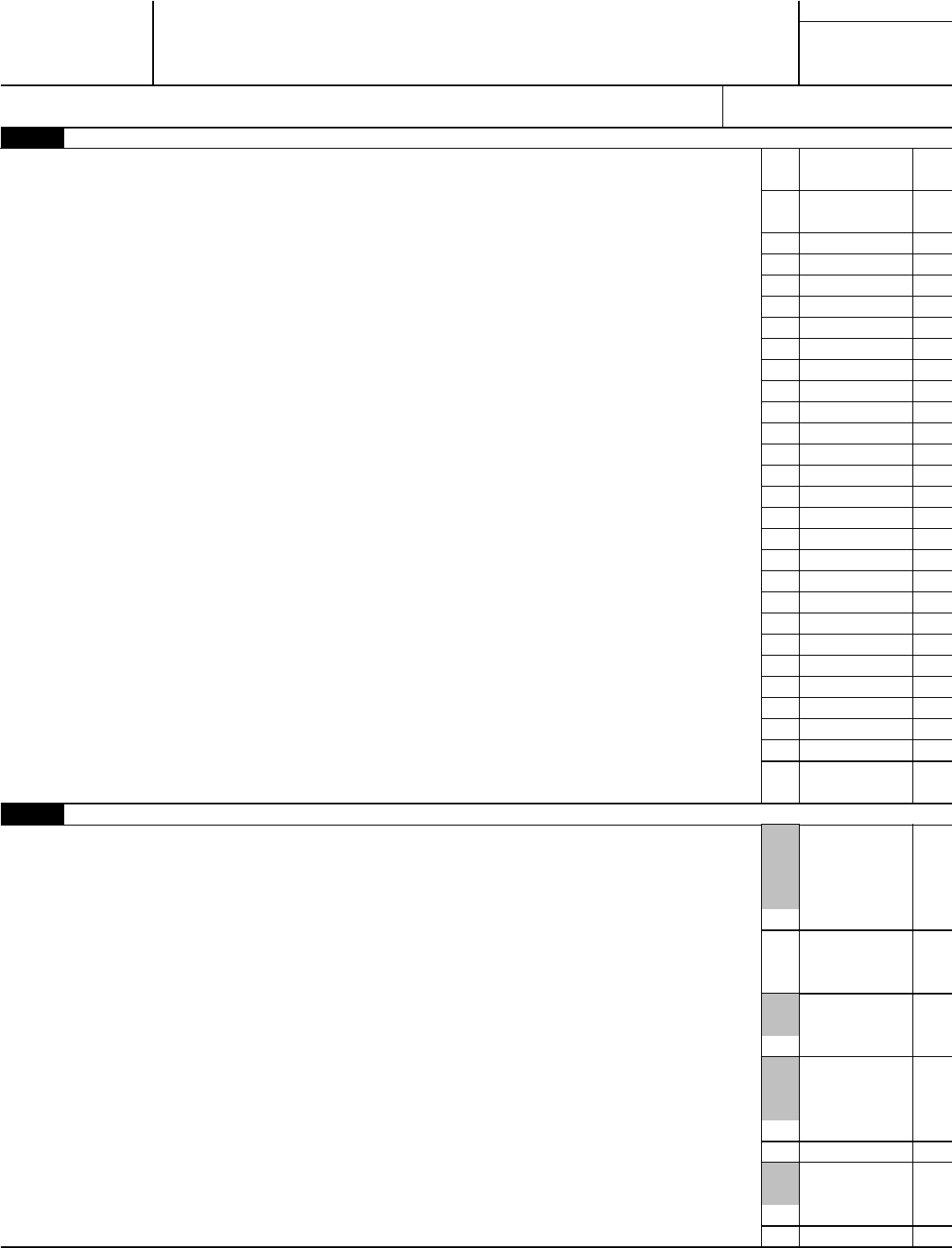

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2004

Form 6251 is used by individuals. Tax computation using maximum capital gains rates : Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you. For tax year 2022 (which you.

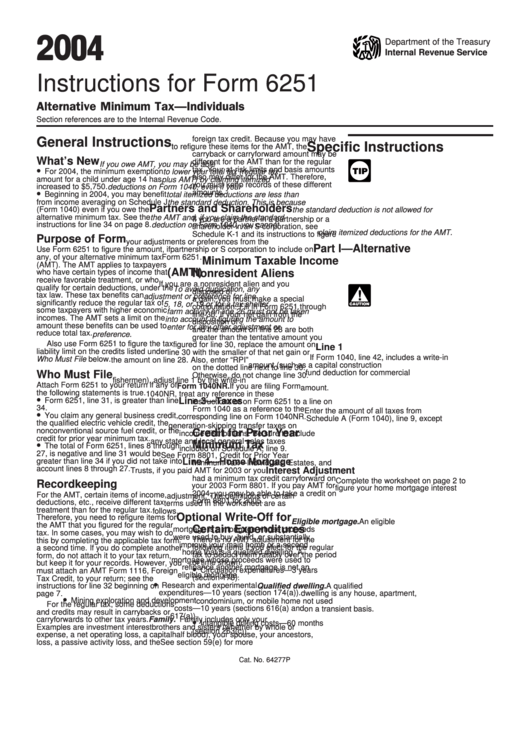

i9 form 2021 sample i9 Form 2021 Printable

Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt, but you. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest. Web for 2021, the 26% tax rate applies to the first $199,900 ($99,950 if married filing.

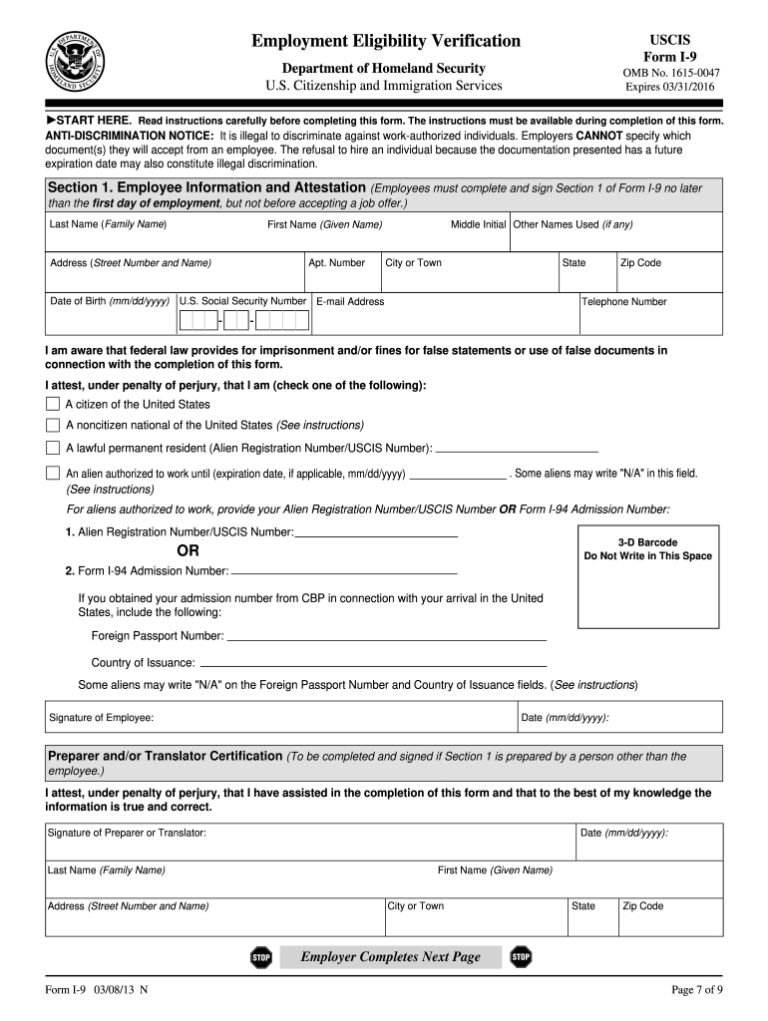

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2011

This form is for income earned in tax year. Web if the calculation on form 6251: How to find/figure the alternative minimum taxable income before exemptions flagged as error. For tax year 2022 (which you file in. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe.

Irs Form 1040 Vs W2 What Is The Difference Between Tax Forms 1040

We last updated federal form 6251 in december 2022 from the federal internal revenue service. Web form 6251 2023. Complete, edit or print tax forms instantly. In order for wealthy individuals to. Web last updated april 13, 2023 3:38 pm.

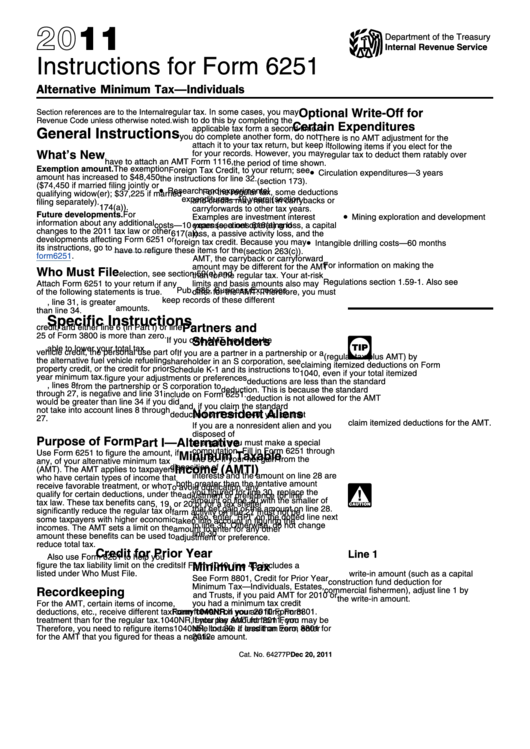

Instructions For Form 6251 Alternative Minimum Tax Individuals

Web form 6251 (2017) page : Web for 2021, the 26% tax rate applies to the first $199,900 ($99,950 if married filing separately) of taxable excess (the amount on line 6). Web more about the federal form 6251. Get ready for tax season deadlines by completing any required tax forms today. Web form 6251 is scheduled for availability in turbotax.

6251 Instructions Form Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest. This change is reflected in lines 7, 18, and 39. In order for wealthy individuals to. Web form 6251 is scheduled for availability in turbotax.

come Tax Return i Help Save & Exit Submit

Web form 6251 2023. Uslegalforms allows users to edit, sign, fill & share all type of documents online. This change is reflected in lines 7, 18, and 39. Web for tax year 2021 (which you file in 2022), the exemption is $73,000 for single individuals and $114,600 for married couples. Edit, sign and save irs instruction 6251 form.

Irs 6251 Form 2017 Fill Out and Sign Printable PDF Template signNow

Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Complete, edit or print tax forms instantly. This form is for income earned in tax year. Form 6251 is used by individuals. Alternative minimum tax shows that your tentative minimum tax is less than your regular tax, you don't owe any amt,.

The Amt Is A Separate Tax That Is Imposed In Addition To Your Regular Tax.

Complete part iii only if you are required to do so by line 31 or by the foreign earned. Web form 6251 (2017) page : Uslegalforms allows users to edit, sign, fill & share all type of documents online. This form is for income earned in tax year.

Alternative Minimum Tax Shows That Your Tentative Minimum Tax Is Less Than Your Regular Tax, You Don't Owe Any Amt, But You.

Get ready for tax season deadlines by completing any required tax forms today. No form 6251 on 2021 return. Web purpose of form use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). For tax year 2022 (which you file in.

We Last Updated Federal Form 6251 In December 2022 From The Federal Internal Revenue Service.

Web form 6251 is scheduled for availability in turbotax online on 2/18/2021. See the forms availability table linked below. Form 6251 is used by individuals. In order for wealthy individuals to.

How To Find/Figure The Alternative Minimum Taxable Income Before Exemptions Flagged As Error.

Web form 6251 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest. Ad access irs tax forms. Web more about the federal form 6251. Web if you had tax preference items and adjustments in 2021, see form ia 6251 for further information.