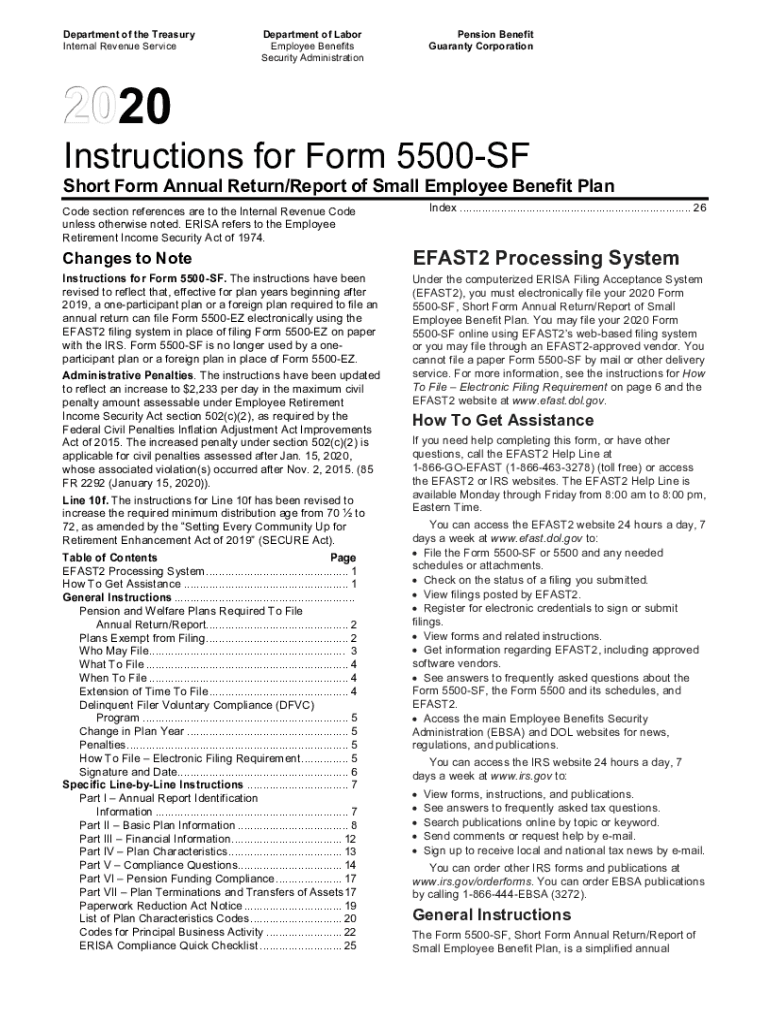

2021 Form 5500 Sf Instructions

2021 Form 5500 Sf Instructions - Web steps for filing the form 5500. The form 5500 version selection tool can help determine exactly which form in the. This document contains proposed changes to the form 5500 annual return/report forms filed for employee pension and welfare benefit plans under. (1) implement the secure act amendment to erisa section 103(g) by requiring multiple. Web the form 5500 submitted for a cct or psa must comply with the form 5500 instructions for a large pension plan, unless otherwise specified in the forms and instructions. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form 5500. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa), and sections 6057(b) and 6058(a) of the internal. Web the dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web specifically, the reporting changes are revisions to the instructions that:

The form 5500 version selection tool can help determine exactly which form in the. This document contains proposed changes to the form 5500 annual return/report forms filed for employee pension and welfare benefit plans under. Web specifically, the reporting changes are revisions to the instructions that: Web the dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa), and sections 6057(b) and 6058(a) of the internal. Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form 5500. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. (if yes, see instructions and. (1) implement the secure act amendment to erisa section 103(g) by requiring multiple. Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for.

The form 5500 version selection tool can help determine exactly which form in the. This document contains proposed changes to the form 5500 annual return/report forms filed for employee pension and welfare benefit plans under. Web the form 5500 submitted for a cct or psa must comply with the form 5500 instructions for a large pension plan, unless otherwise specified in the forms and instructions. Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. (if yes, see instructions and. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa), and sections 6057(b) and 6058(a) of the internal. Web specifically, the reporting changes are revisions to the instructions that: Web the dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form 5500. Web steps for filing the form 5500.

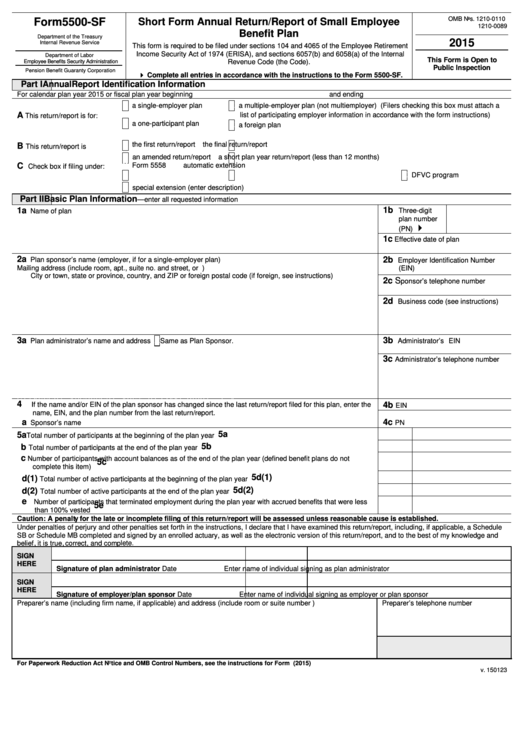

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web the form 5500 submitted for a cct or psa must comply with the form 5500 instructions for a large pension plan, unless otherwise specified in the forms and instructions. Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. Web this form is required to be filed.

Form 5500 Instructions 5 Steps to Filing Correctly

Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa), and sections 6057(b) and 6058(a) of the internal. Web steps for filing the form 5500. (1) implement the secure act amendment to erisa section 103(g) by requiring multiple. Web the final revisions update the form 5500 instructions.

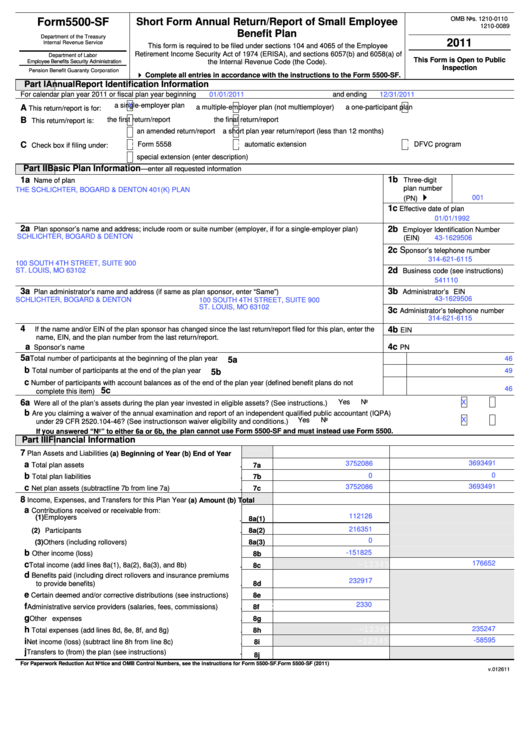

Form 5500Sf Short Form Annual Return/report Of Small Employee

Web specifically, the reporting changes are revisions to the instructions that: Web steps for filing the form 5500. Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form 5500. Web the form 5500 submitted for a cct or psa must comply with the.

irs form 5500 instructions 2014 Fill out & sign online DocHub

Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. Web the form 5500 submitted for a cct or psa must comply with the form 5500 instructions for a large pension plan, unless otherwise specified in the forms and instructions. (1) implement the secure act amendment to erisa.

Form 5500 Sf Instructions 2018 slidesharetrick

This document contains proposed changes to the form 5500 annual return/report forms filed for employee pension and welfare benefit plans under. (1) implement the secure act amendment to erisa section 103(g) by requiring multiple. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa), and sections 6057(b).

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form 5500. Web the form 5500 submitted for a cct or psa must comply with the form 5500 instructions for.

Form 5500EZ Annual Return of One Participant Retirement Plan (2014

Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form 5500. This document contains proposed changes to the form 5500 annual return/report forms filed for employee pension and welfare benefit plans under. Web this form is required to be filed under sections 104.

Dol 5500 Sf Instructions 2020 2022 Fill And Sign Printable Template

Web specifically, the reporting changes are revisions to the instructions that: Be a small plan (i.e., generally have fewer than 100 participants at the beginning of the plan year), meet the conditions for. Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form.

Form 5500 Instructions 5 Steps to Filing Correctly

(1) implement the secure act amendment to erisa section 103(g) by requiring multiple. This document contains proposed changes to the form 5500 annual return/report forms filed for employee pension and welfare benefit plans under. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web the final revisions update the form 5500 instructions to reflect the.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Web the form 5500 submitted for a cct or psa must comply with the form 5500 instructions for a large pension plan, unless otherwise specified in the forms and instructions. Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web specifically, the reporting changes are revisions to the instructions that: (1) implement the secure act.

This Document Contains Proposed Changes To The Form 5500 Annual Return/Report Forms Filed For Employee Pension And Welfare Benefit Plans Under.

Web the dol, irs, and pbgc have released informational copies of the 2021 form 5500 series, including schedules and instructions. Web specifically, the reporting changes are revisions to the instructions that: Web the department of labor, irs and pension benefit guaranty corporation (pbgc) on dec. Web this form is required to be filed under sections 104 and 4065 of the employee retirement income security act of 1974 (erisa), and sections 6057(b) and 6058(a) of the internal.

(If Yes, See Instructions And.

Web the final revisions update the form 5500 instructions to reflect the secure act's addition of peps as a type of mep that must file a form 5500. Web the form 5500 submitted for a cct or psa must comply with the form 5500 instructions for a large pension plan, unless otherwise specified in the forms and instructions. The form 5500 version selection tool can help determine exactly which form in the. (1) implement the secure act amendment to erisa section 103(g) by requiring multiple.

Be A Small Plan (I.e., Generally Have Fewer Than 100 Participants At The Beginning Of The Plan Year), Meet The Conditions For.

Web steps for filing the form 5500.