2020 Form 1099-Misc

2020 Form 1099-Misc - Fill, edit, sign, download & print. Upload, modify or create forms. Involved parties names, places of residence and phone. Try it for free now! Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. More specifically, the irs has split the form 1099 into two separate forms: Ad get the latest 1099 misc online. These amounts are generally reported on schedule c. If you have not already entered the applicable. Insurance contracts, etc., are reported to.

Try it for free now! Insurance contracts, etc., are reported to. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate. These amounts are generally reported on schedule c. More specifically, the irs has split the form 1099 into two separate forms: Upload, modify or create forms. Involved parties names, places of residence and phone. All you have to do is enter the required details. Fill, edit, sign, download & print. If your business paid at least.

Do not miss the deadline Fill, edit, sign, download & print. Upload, modify or create forms. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate. If you have not already entered the applicable. All you have to do is enter the required details. Web create a 1099 misc 2020 tax form online in minutes. Try it for free now! Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Insurance contracts, etc., are reported to.

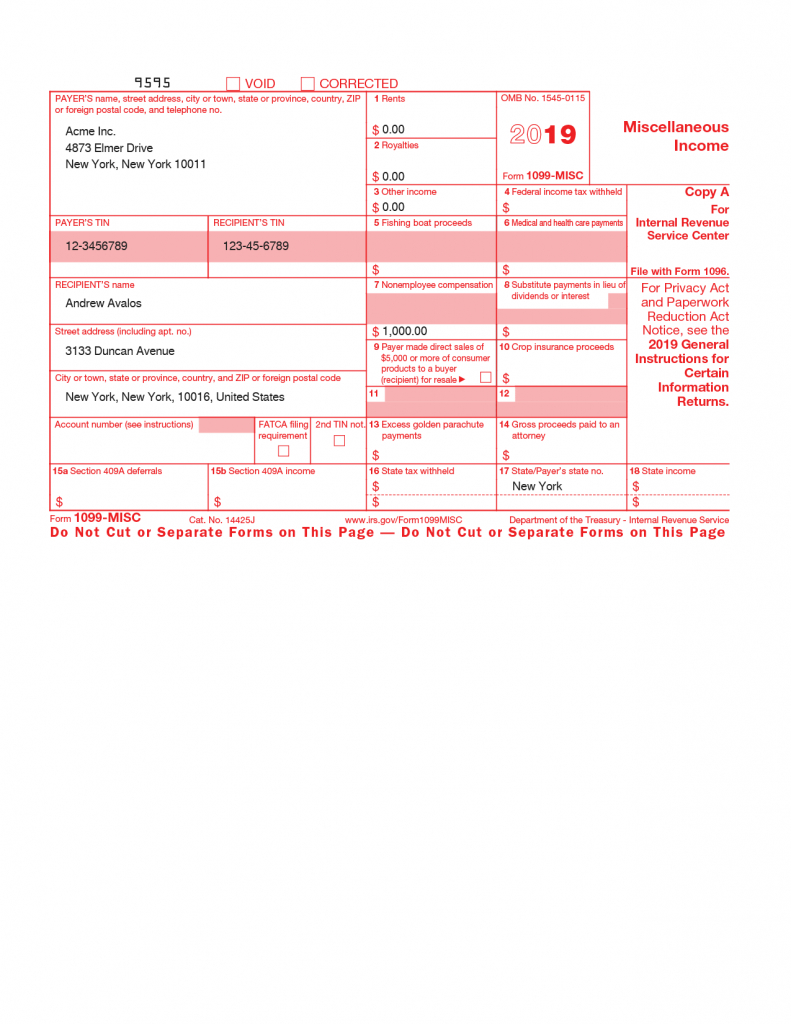

tax documents Archives Delano Sherley & Associates Inc.

These amounts are generally reported on schedule c. If your business paid at least. Insurance contracts, etc., are reported to. Web create a 1099 misc 2020 tax form online in minutes. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines.

There’s A New Tax Form With Some Changes For Freelancers & Gig

Insurance contracts, etc., are reported to. All you have to do is enter the required details. Upload, modify or create forms. Web create a 1099 misc 2020 tax form online in minutes. Ad get the latest 1099 misc online.

Pick W9 Form 2020 Printable Pdf Calendar Printables Free Blank

Do not miss the deadline If you have not already entered the applicable. Fill, edit, sign, download & print. These amounts are generally reported on schedule c. Ad get ready for tax season deadlines by completing any required tax forms today.

2020 Form 1099MISC Create Fillable & Printable 1099MISC for Free

These amounts are generally reported on schedule c. Ad get the latest 1099 misc online. Insurance contracts, etc., are reported to. Web create a 1099 misc 2020 tax form online in minutes. If you have not already entered the applicable.

Form 1099 Overview and FAQ Buildium Help Center

Involved parties names, places of residence and phone. If you have not already entered the applicable. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. More specifically, the irs has split the form 1099.

IRS Makes Major Change to Annual Form 1099MISC Information Return GYF

Insurance contracts, etc., are reported to. If the real estate was not your main home, report the transaction on form 4797, form 6252, and/or the schedule d for the appropriate. Ad get ready for tax season deadlines by completing any required tax forms today. All you have to do is enter the required details. Upload, modify or create forms.

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Do not miss the deadline Web create a 1099 misc 2020 tax form online in minutes. If your business paid at least. Insurance contracts, etc.,.

2020 1099MISC IRS Copy A Form Print Template PDF Fillable Etsy

Ad get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Ad get the latest 1099 misc online. Do not miss the deadline More specifically, the irs has split the form 1099 into two separate forms:

1099MISC Software to Create, Print and EFile Form 1099MISC Irs

Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Upload, modify or create forms. More specifically, the irs has split the form 1099 into two separate forms: If you have not already entered the.

Efile Form 1099 MISC Online How to File 1099 MISC for 2020

More specifically, the irs has split the form 1099 into two separate forms: Involved parties names, places of residence and phone. Web create a 1099 misc 2020 tax form online in minutes. Ad get ready for tax season deadlines by completing any required tax forms today. These amounts are generally reported on schedule c.

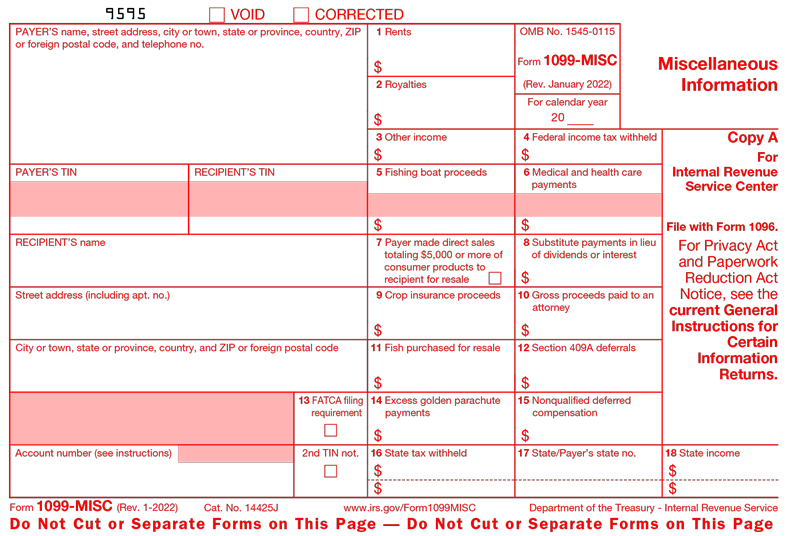

More Specifically, The Irs Has Split The Form 1099 Into Two Separate Forms:

Ad get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Web create a 1099 misc 2020 tax form online in minutes. If your business paid at least.

All You Have To Do Is Enter The Required Details.

These amounts are generally reported on schedule c. Involved parties names, places of residence and phone. Insurance contracts, etc., are reported to. Web if you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported.

Fill In The Empty Areas;

If you have not already entered the applicable. Fill, edit, sign, download & print. Ad get the latest 1099 misc online. Try it for free now!

If The Real Estate Was Not Your Main Home, Report The Transaction On Form 4797, Form 6252, And/Or The Schedule D For The Appropriate.

Do not miss the deadline