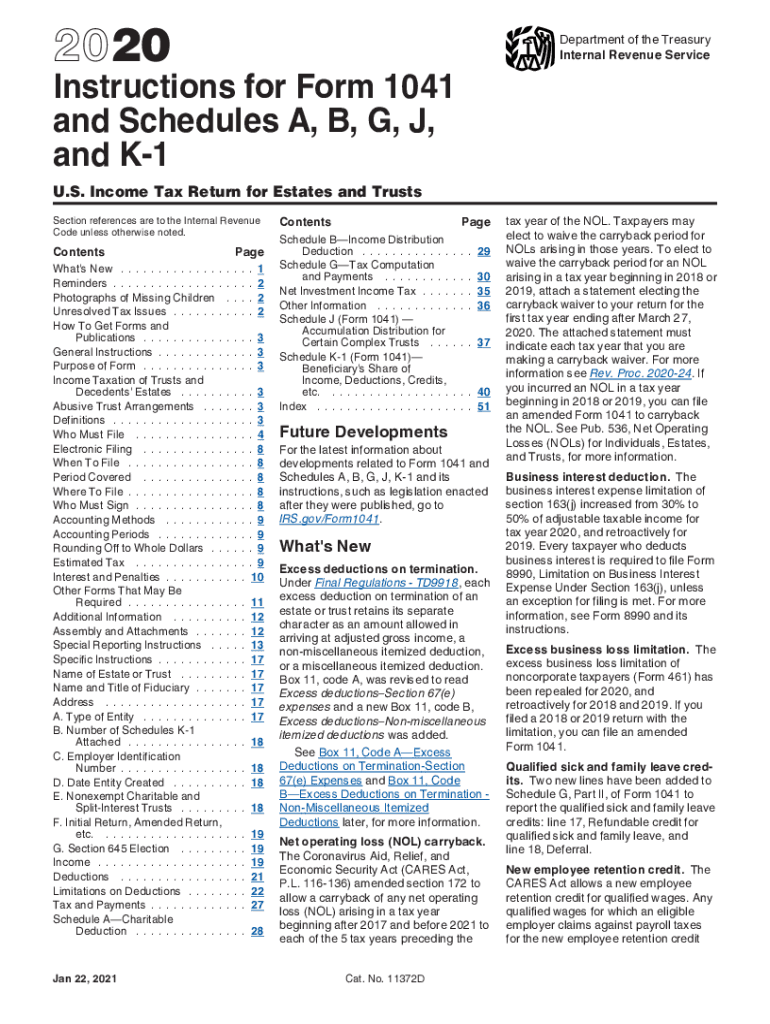

2020 Form 1041 Instructions

2020 Form 1041 Instructions - Web 2020 ia 1041 iowa fiduciary return tax.iowa.gov for calendar year 2020 or fiscal year beginning (mm/dd) ______ / ______ , 2020, and ending (mm/dd) ______ / _____ , 20. Tax is $3,129 + 37% of the amount over 12,950. Web for paperwork reduction act notice, see the separate instructions. Web for paperwork reduction act notice, see the separate instructions. After doing the 1041's first page's step by step. Web how do i file form 1041 for an estate or trust? Web the fiduciary (or one of the joint fiduciaries) must file form 1041 for a domestic trust taxable under section 641 that has: You'll need turbotax business to file form. Estates and trusts with an adjusted gross income of. 1041 (2022) form 1041 (2022) page.

Web for paperwork reduction act notice, see the separate instructions. 1041 (2022) form 1041 (2022) page. Web for paperwork reduction act notice, see the separate instructions. Web the irs directions for schedule g say: 2 schedule a charitable deduction. Every resident estate or trust that is required to file a federal form 1041. Tax is $3,129 + 37% of the amount over 12,950. 2 of 7 do not write in this area; Web the fiduciary (or one of the joint fiduciaries) must file form 1041 for a domestic trust taxable under section 641 that has: (1) is required to file a federal income tax return for the taxable year, or (2) had.

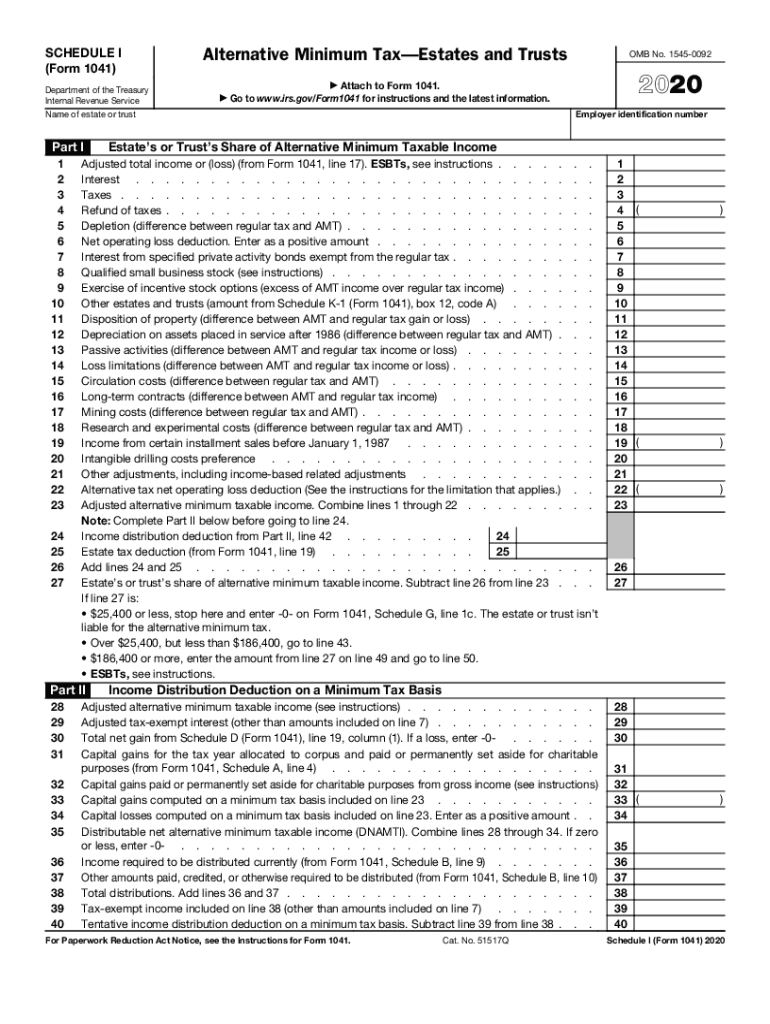

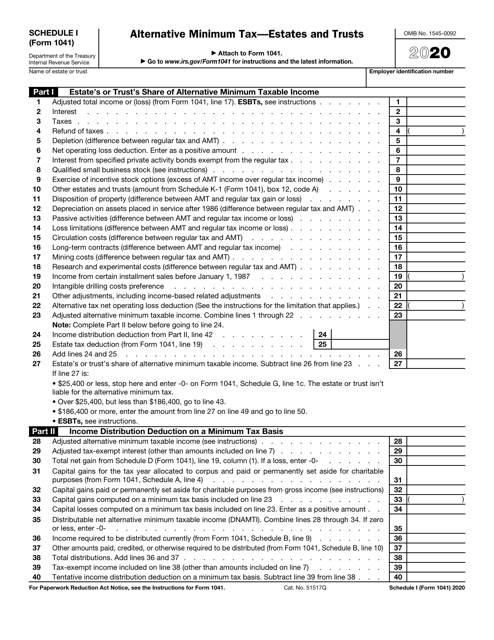

Web 2020 ohio it 1041 rev. Web who must complete schedule i (form 1041) complete parts i and ii if the estate or trust is required to complete form 1041, schedule b, income distribution deduction. Web for paperwork reduction act notice, see the separate instructions. Web the irs directions for schedule g say: Web the fiduciary (or one of the joint fiduciaries) must file form 1041 for a domestic trust taxable under section 641 that has: Web certain estates and trusts cannot base their declaration of estimated tax on 100% of their prior year's tax liability. 2 schedule a charitable deduction. (1) is required to file a federal income tax return for the taxable year, or (2) had. If taxable income is over 12,950: 2 schedule a charitable deduction.

Irs Form 1041 Instructions 2017 Form Resume Examples GM9OOwk9DL

Web certain estates and trusts cannot base their declaration of estimated tax on 100% of their prior year's tax liability. If taxable income is over 12,950: Web 2020 ia 1041 iowa fiduciary return tax.iowa.gov for calendar year 2020 or fiscal year beginning (mm/dd) ______ / ______ , 2020, and ending (mm/dd) ______ / _____ , 20. Web for paperwork reduction.

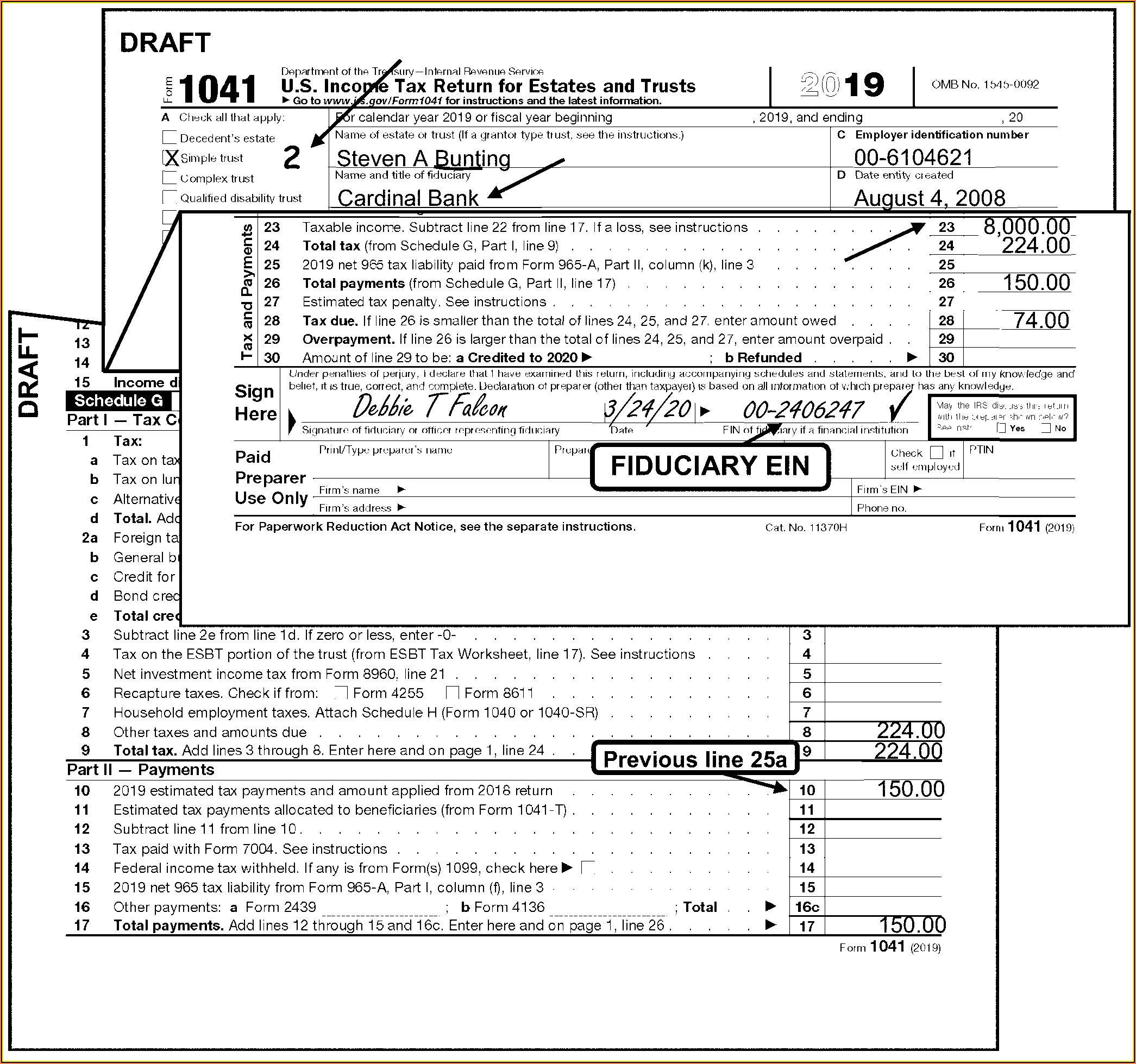

Irs Form 1041 Instructions 2019 Fill Out and Sign Printable PDF

1041 (2022) form 1041 (2022) page. 1041 (2022) form 1041 (2022) page. 2 schedule a charitable deduction. Estates and trusts with an adjusted gross income of. After doing the 1041's first page's step by step.

IRS 1041ES 20202022 Fill out Tax Template Online US Legal Forms

Web for paperwork reduction act notice, see the separate instructions. Tax is $3,129 + 37% of the amount over 12,950. Solved•by turbotax•2428•updated january 13, 2023. If taxable income is over 12,950: Every resident estate or trust that is required to file a federal form 1041.

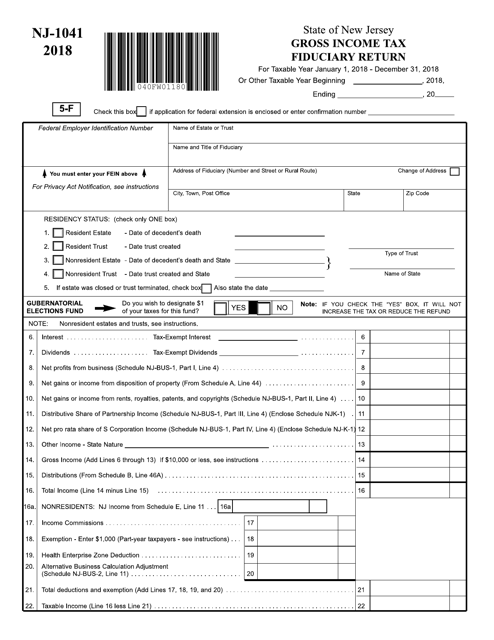

Form NJ1041 Download Fillable PDF or Fill Online Fiduciary Return

Every resident estate or trust that is required to file a federal form 1041. You cannot claim a credit for child and dependent care expenses if your filing status is. Web the irs directions for schedule g say: Web for paperwork reduction act notice, see the separate instructions. If taxable income is over 12,950:

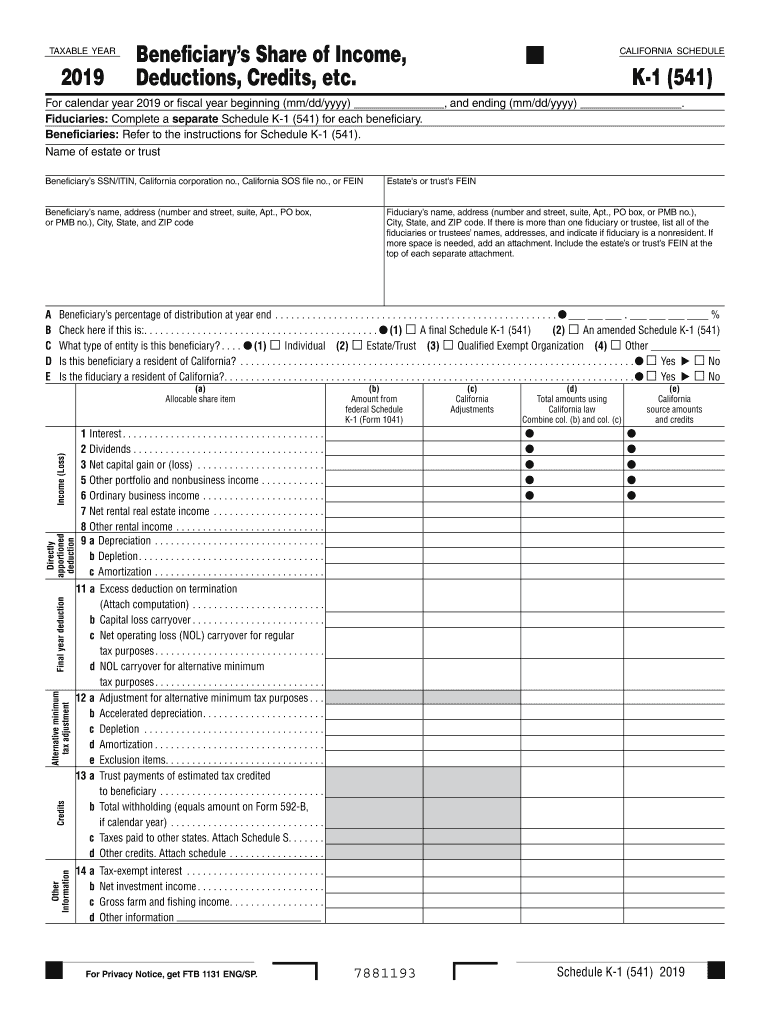

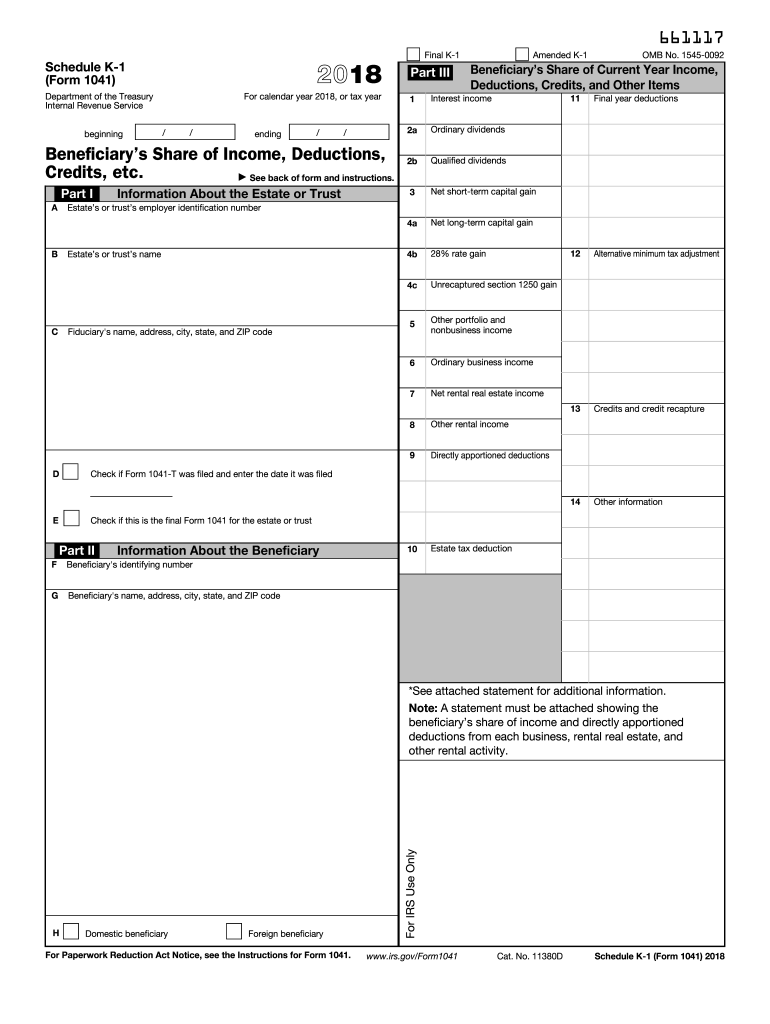

Instructions For Schedule K 1 Form 1041 For A Fill Out and Sign

Web the fiduciary (or one of the joint fiduciaries) must file form 1041 for a domestic trust taxable under section 641 that has: Ad download or email irs i1041 & more fillable forms, register and subscribe now! Any taxable income for the tax year, gross income of $600 or. 1041 (2022) form 1041 (2022) page. If taxable income is over.

Irs Shedule I Form Fill Out and Sign Printable PDF Template signNow

1041 (2022) form 1041 (2022) page. Tax is $3,129 + 37% of the amount over 12,950. A return must be filed by the following: Solved•by turbotax•2428•updated january 13, 2023. Web for paperwork reduction act notice, see the separate instructions.

2011 Form 1041 K 1 Instructions Trust Law Tax Deduction

Estates and trusts with an adjusted gross income of. Web certain estates and trusts cannot base their declaration of estimated tax on 100% of their prior year's tax liability. Ad download or email irs i1041 & more fillable forms, register and subscribe now! Tax is $3,129 + 37% of the amount over 12,950. After doing the 1041's first page's step.

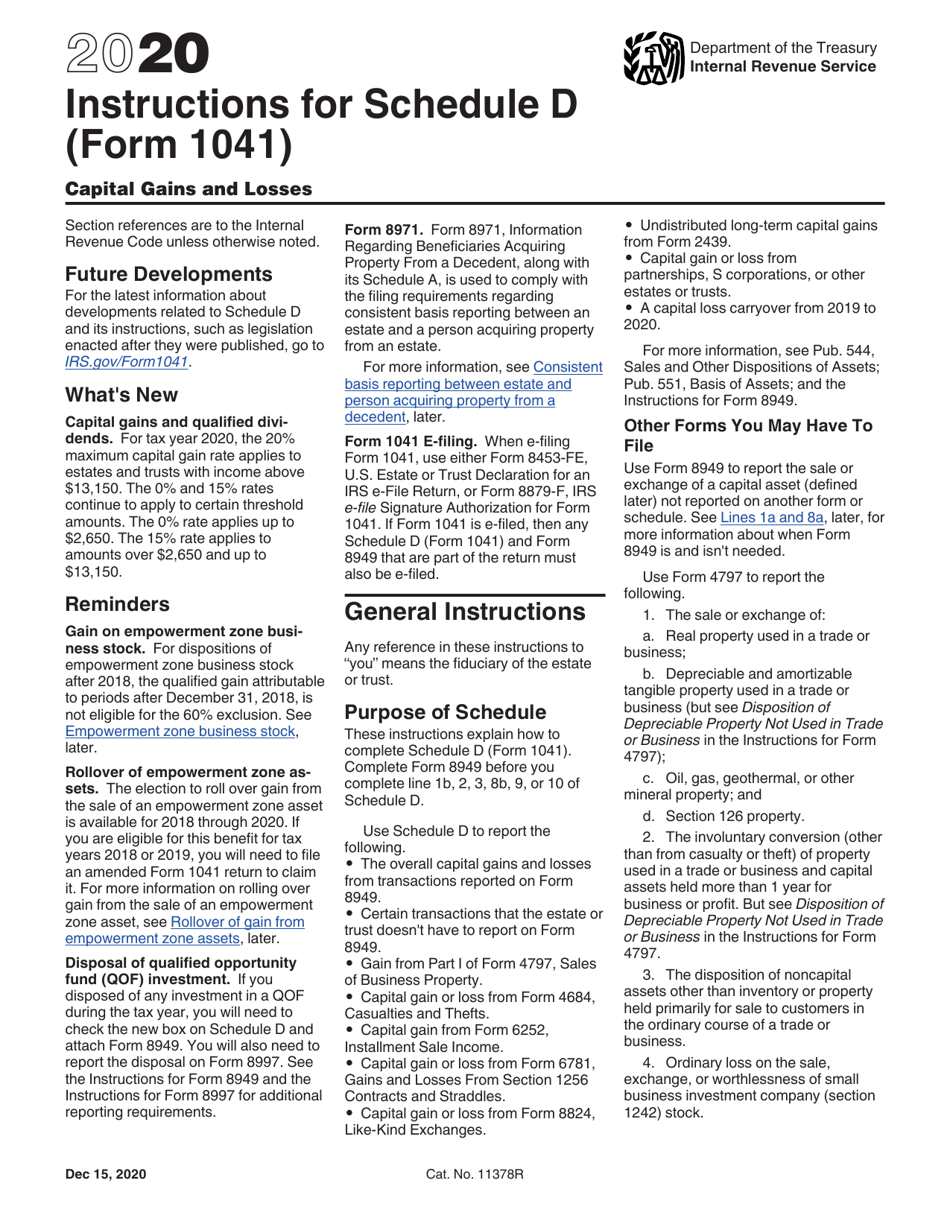

Download Instructions for IRS Form 1041 Schedule D Capital Gains and

Web for paperwork reduction act notice, see the separate instructions. 2 schedule a charitable deduction. You'll need turbotax business to file form. A return must be filed by the following: Tax is $3,129 + 37% of the amount over 12,950.

K1 Form Fill Out and Sign Printable PDF Template signNow

Tax is $3,129 + 37% of the amount over 12,950. 2 schedule a charitable deduction. If taxable income is over 12,950: Web the fiduciary (or one of the joint fiduciaries) must file form 1041 for a domestic trust taxable under section 641 that has: Web 2020 ohio it 1041 rev.

IRS Form 1041 Schedule I Download Fillable PDF or Fill Online

Web 2020 ia 1041 iowa fiduciary return tax.iowa.gov for calendar year 2020 or fiscal year beginning (mm/dd) ______ / ______ , 2020, and ending (mm/dd) ______ / _____ , 20. Web how do i file form 1041 for an estate or trust? Every resident estate or trust that is required to file a federal form 1041. Web who must complete.

1041 (2022) Form 1041 (2022) Page.

Web who must complete schedule i (form 1041) complete parts i and ii if the estate or trust is required to complete form 1041, schedule b, income distribution deduction. Estates and trusts with an adjusted gross income of. 1041 (2022) form 1041 (2022) page. 2 schedule a charitable deduction.

Web The Irs Directions For Schedule G Say:

Web how do i file form 1041 for an estate or trust? Solved•by turbotax•2428•updated january 13, 2023. (1) is required to file a federal income tax return for the taxable year, or (2) had. Tax is $3,129 + 37% of the amount over 12,950.

Web 2020 Ia 1041 Iowa Fiduciary Return Tax.iowa.gov For Calendar Year 2020 Or Fiscal Year Beginning (Mm/Dd) ______ / ______ , 2020, And Ending (Mm/Dd) ______ / _____ , 20.

Every resident estate or trust that is required to file a federal form 1041. Web for paperwork reduction act notice, see the separate instructions. Web certain estates and trusts cannot base their declaration of estimated tax on 100% of their prior year's tax liability. Ad download or email irs i1041 & more fillable forms, register and subscribe now!

2 Schedule A Charitable Deduction.

2 of 7 do not write in this area; After doing the 1041's first page's step by step. Web for paperwork reduction act notice, see the separate instructions. You cannot claim a credit for child and dependent care expenses if your filing status is.