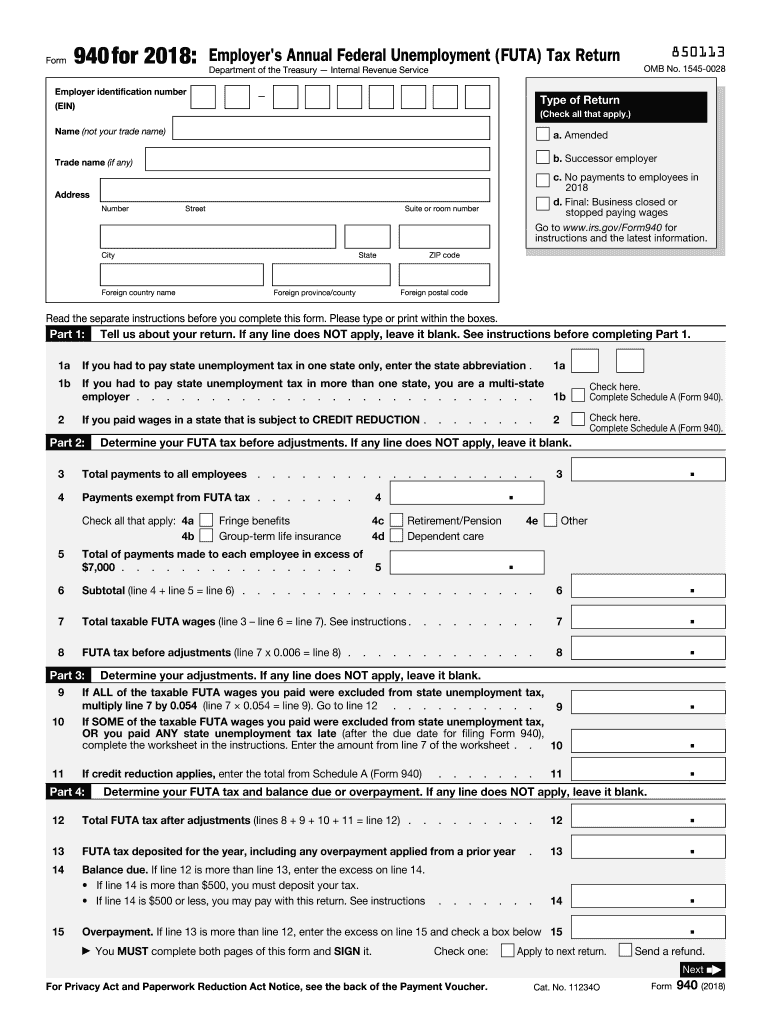

2018 Form 940

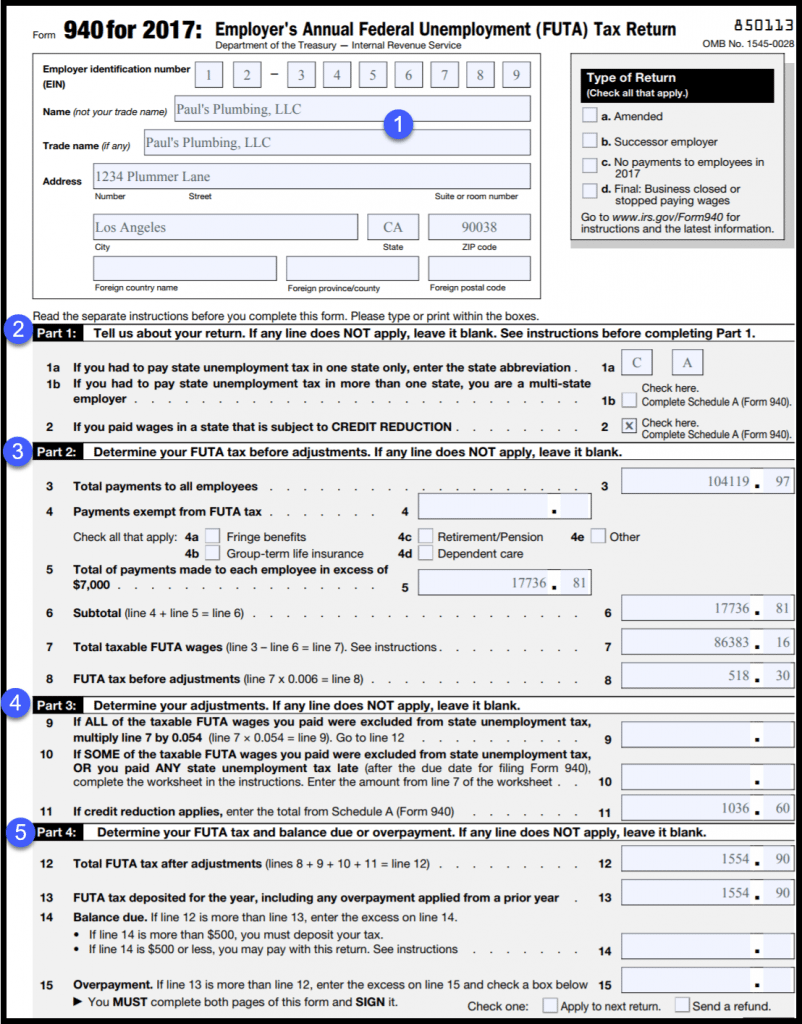

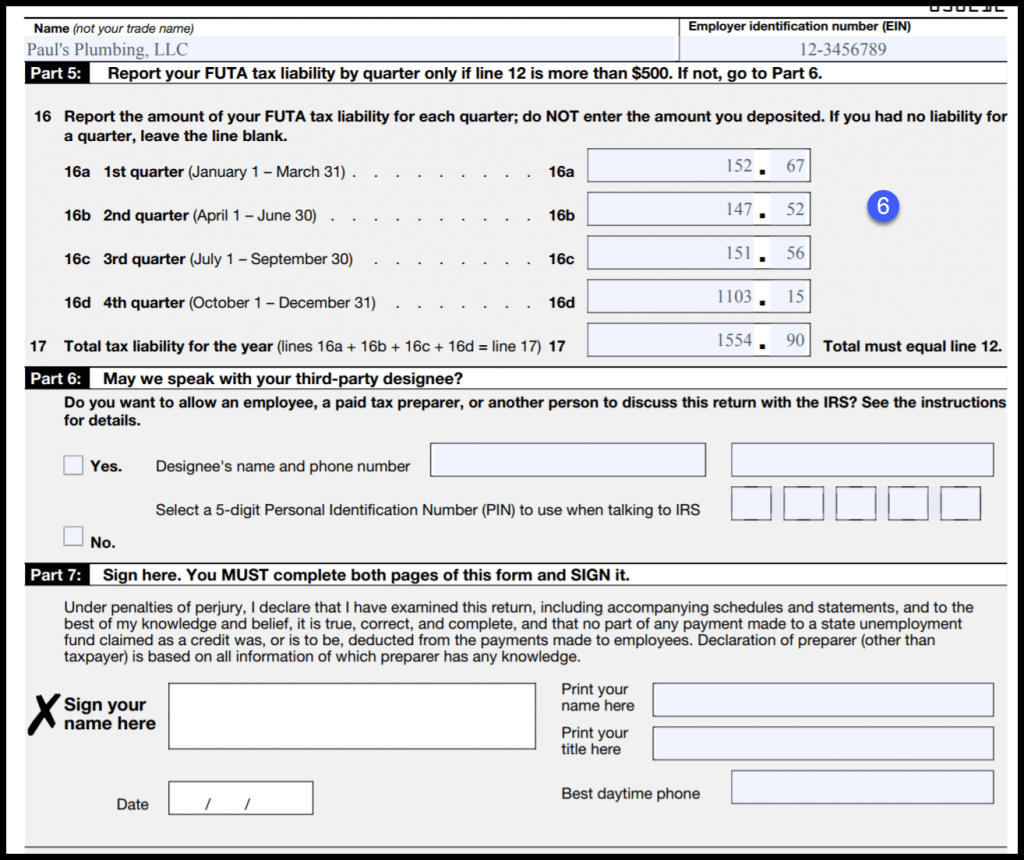

2018 Form 940 - Form 940 is due on jan. Businesses with employees are responsible for paying. Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. The schedule, which is used to report additional tax owed because of federal unemployment. 21 by the internal revenue service. 31 each year for the previous year. Instructions for form 940 (2020) pdf. Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains: Paid preparers must sign paper returns with a manual signature. Future developments for the latest information about developments related to form 940 and its instructions, such as.

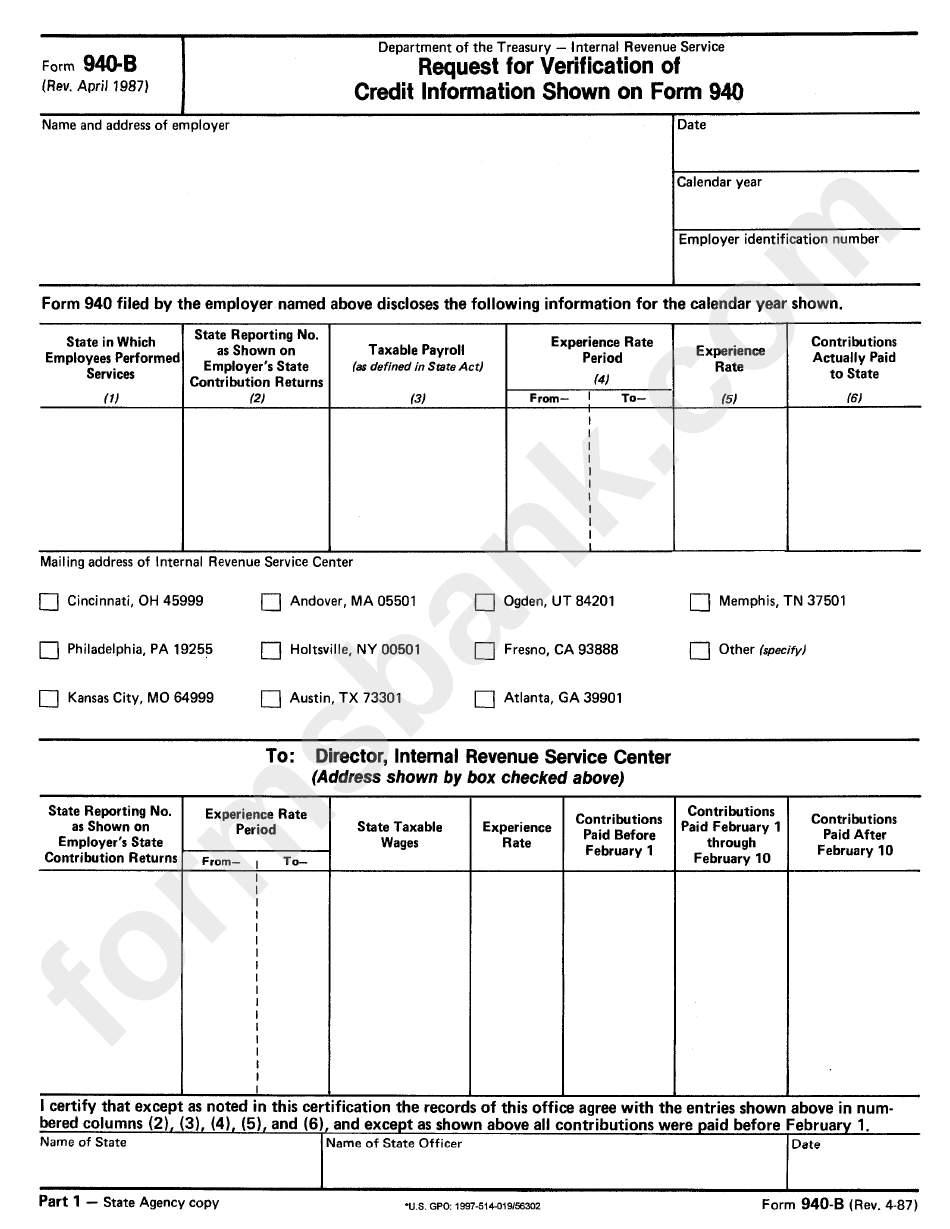

Web schedule a (form 940) for 2018: Web form 940 for 2018: The schedule, which is used to report additional tax owed because of federal unemployment. Businesses with employees are responsible for paying. Web a paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn't an employee of the filing entity. 21 by the internal revenue service. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much has already been paid, and the outstanding balance. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full.

Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains: 31 each year for the previous year. File this schedule with form 940. Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Pdf use our library of forms to. The schedule, which is used to report additional tax owed because of federal unemployment. Web a paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn't an employee of the filing entity. Form 940 is due on jan. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full.

2018 FUTA Tax Rate & Form 940 Instructions

Form 940 is due on jan. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web the form 940 for 2018 employer's annual federal unemployment tax return form is 3 pages long and contains: Pdf use our library of forms to. The form is due january 31, or february 10 for businesses that have already deposited.

Fill Free fillable form 940 for 2018 employer's annual federal

Web a paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn't an employee of the filing entity. The schedule, which is used to report additional tax owed because of federal unemployment. The form is due january 31, or.

File 940 Online EFile 940 for 4.95 FUTA Form 940 for 2022

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. The schedule, which is used to report additional tax owed because of federal unemployment. Businesses with employees are responsible for paying. Form 940 is.

Form 940 YouTube

Web form 940 for 2018: Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Employer identification number (ein) — name (not. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. 31 each year for the previous year.

2018 FUTA Tax Rate & Form 940 Instructions

The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Future developments for the latest information about developments related to form 940 and its instructions, such as. Form 940 is due on jan. File this schedule with form 940.

Form 940B Request For Verification Of Credit Information Shown On

Web a paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn't an employee of the filing entity. Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Form 940 is due on jan. Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Paid preparers.

File 940 Online Efile FUTA Tax IRS Form 940 for 2018

File this schedule with form 940. Employer identification number (ein) — name (not. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. 21 by the internal revenue service. Web form 940 for 2018:

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

Web schedule a (form 940) for 2018: For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. 31 each year for the previous year. Instructions for form 940 (2020) pdf. The schedule, which is used to report additional tax owed because of federal unemployment.

When Are Payroll Taxes Due? Federal Deadlines

Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much.

Together With State Unemployment Tax Systems, The Futa Tax Provides Funds For Paying Unemployment Compensation To Workers Who Have.

Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Businesses with employees are responsible for paying. Employer identification number (ein) — name (not.

Web The Form 940 For 2018 Employer's Annual Federal Unemployment Tax Return Form Is 3 Pages Long And Contains:

Instructions for form 940 (2020) pdf. Pdf use our library of forms to. Web 2018 instructions for form 940 employer's annual federal unemployment (futa) tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web a paid preparer must sign form 940 and provide the information in the paid preparer use only section of part 7 if the preparer was paid to prepare form 940 and isn't an employee of the filing entity.

Web Schedule A (Form 940) For 2018:

Web the 2018 form 940, employer’s annual federal unemployment (futa) tax return, was released nov. Web form 940 shows the amount of federal unemployment taxes the employer owed the previous year, how much has already been paid, and the outstanding balance. The form is due january 31, or february 10 for businesses that have already deposited their unemployment taxes in full. 31 each year for the previous year.

Paid Preparers Must Sign Paper Returns With A Manual Signature.

File this schedule with form 940. 21 by the internal revenue service. Web form 940 for 2018: Future developments for the latest information about developments related to form 940 and its instructions, such as.