19 Pf Form

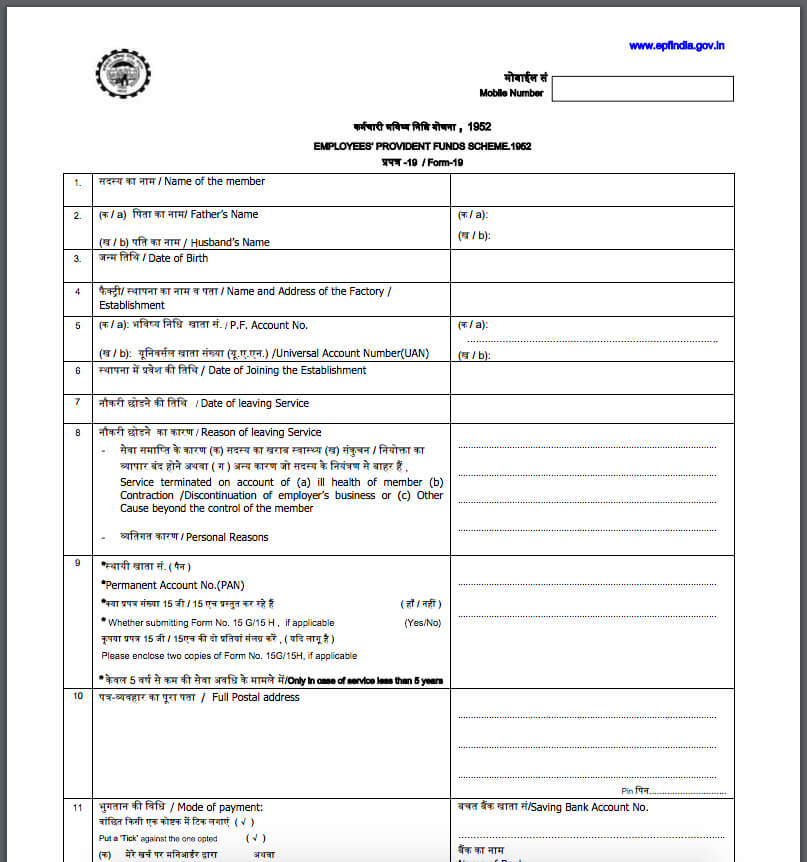

19 Pf Form - Pan is also mandatory for claiming final settlement. The employee has to provide his mobile number for final settlement. In case of the death of the member, the family members/nominee/legal heir should apply through form. Web pf claim form 19 can indeed be submitted using the pf a/c no. When individual wishes to withdraw the epf funds as the last settlement, he or she will fill out form 19. Account number for the provident fund. Web epf form no. If an employee has only paid pf contributions before 2014, he or she can apply for a uan at the nearest epfo office. Dates of job entry and leave. Employees must fill their complete details in the new form 11 and must have an active uan.

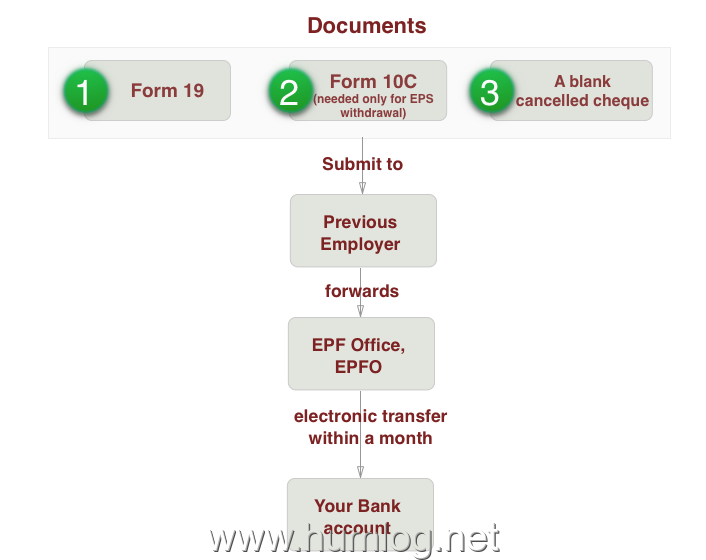

Download epf form here like epf registration form, epf withdrawal form 19, pf transfer form, form 19, form 31, form 10c and others employees provident forms. Go to www.irs.gov/form990pf for instructions and the latest information. Pf form no 19 can be filed without a uan, and the member will only have to mention his/her pf account number. Read on to know how to fill form 19 for the final pf settlement in a simple way. Account number for the provident fund. Settlement of my provident fund account. Web claim form 19 pf is only for employees who do not have a uan. Web epf form 10c | form 19 | form 31 | form 13 download. Web form 19 is an employee’s application form to withdraw their accumulated provident fund (pf) balance. Web pf claim form 19 can indeed be submitted using the pf a/c no.

Employees are eligible to claim pf amount after 2 months from the date of exit. Web epf withdrawal form 19 can be filled only after two months of leaving the job or on retirement. Web if you want to know about pf settlement, epf form 19, you have come to the right place. Web pf claim form 19 can indeed be submitted using the pf a/c no. Web epf members need to submit epf withdrawal form 19 to claim 12% of employer pf contribution and 3.67% of employer pf contribution. Employees must fill their complete details in the new form 11 and must have an active uan. If an employee has only paid pf contributions before 2014, he or she can apply for a uan at the nearest epfo office. Dates of job entry and leave. Bank account number and ifsc code (must be the same account as one's current employer's account) 15g/15h form. Web the epf form 19 is also known as composite claim form.

EPF Form 19 How to Fill for Final PF Settlement Online

Web epf members need to submit epf withdrawal form 19 to claim 12% of employer pf contribution and 3.67% of employer pf contribution. 15g form or 15h form. Web form 19 must be used when you wish to withdraw epf funds in the form of the final settlement. Following are the two types of form 19: The first two options.

PF Form 19

Log in to your uan account using at the epf member portal step 2: The form can be filled both online (at epf member portal) as well as offline. Every employee with a pf a/c is advised to combine their accounts by establishing a uan. It is only applicable to employees who do not have a universal account number (uan)..

PF Form 19 & 10C Money Order Cheque

Every employee with a pf a/c is advised to combine their accounts by establishing a uan. On the dotted line next to line 22 or line 34 (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ed67(e)”. When individual wishes to withdraw the epf funds as the last settlement, he or.

KNOWLEDGE BLOG ON "INDIAN LABOUR LAW AND HUMAN RESOURCE" ADVOCATE

Web pf claim form 19 can indeed be submitted using the pf a/c no. Pan is also mandatory for claiming final settlement. Education credits (american opportunity and lifetime learning credits) from jan. Web epf members need to submit epf withdrawal form 19 to claim 12% of employer pf contribution and 3.67% of employer pf contribution. Bank account number and ifsc.

PF Form 19

The first two options can be put to use at the time of leaving employment for the sake of retirement or even otherwise. It is also possible to file pf claim form 19 without a uan by simply stating the pf. Withholding certificate for pension or annuity payments. Web pf form 19 has to be filled when a member wants.

KNOWLEDGE BLOG ON "INDIAN LABOUR LAW AND HUMAN RESOURCE" ADVOCATE

Under the ‘online services’ tab, click on ‘claim (form 31, 19, 10c & 10d) step 3: Web form 19 is an employee’s application form to withdraw their accumulated provident fund (pf) balance. Kindly do not paste revenue stamp in case of payments through neft / electronic mode. Bank account number and ifsc code (must be the same account as one's.

PF Form 19 & 10C (Speciman Copy) Money Order Cheque

Web epf form 10c | form 19 | form 31 | form 13 download. Dates of job entry and leave. Web when can you use pf form 19? Call today(0261)2311521, +91 8000011521, +91. सदस्य का िाम / name of the member.

Samplepf Withdrawl Forms 19 Cheque Banking

Dates of job entry and leave. Thus, this form is also known as pf withdrawal form 19. Only those employees who have left their job and are not employed for two months or more can apply for pf withdrawal. Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf.

PF Withdrawal Form 19 Sample Cheque Payments

Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. In case of the death of the member, the family members/nominee/legal heir should apply through form. Bank account number and ifsc code (must be the same account as one's current employer's account) 15g/15h form. Web epf members need.

Pf Withdrawal Form 10c In English sydneydwnload

Web claim form 19 pf is only for employees who do not have a uan. Web 2019 irs tax forms, schedules. When individual wishes to withdraw the epf funds as the last settlement, he or she will fill out form 19. Employees are eligible to claim pf amount after 2 months from the date of exit. Thus, this form is.

Account Number For The Provident Fund.

Web epf members need to submit epf withdrawal form 19 to claim 12% of employer pf contribution and 3.67% of employer pf contribution. Every employee with a pf a/c is advised to combine their accounts by establishing a uan. Home (current) about us newsroom join us blog category gold rate business loans money management accounting and inventory The form can be filled both online (at epf member portal) as well as offline.

Bank Account Number And Ifsc Code ( It Must Correspond To The Same Account Used By The Present Employer).

Thus, this form is also known as pf withdrawal form 19. Kindly do not paste revenue stamp in case of payments through neft / electronic mode. Read on to know how to fill form 19 for the final pf settlement in a simple way. Only those employees who have left their job and are not employed for two months or more can apply for pf withdrawal.

Here Are Some Things To Remember While Filing Epf Form 19:

For all employees who made a pf contribution after 2014, the epfo has issued a uan. Web form 19 must be used when you wish to withdraw epf funds in the form of the final settlement. Start date and end date of employment Web claim form 19 pf is only for employees who do not have a uan.

Dates Of Job Entry And Leave.

Web form 19 is an employee’s application form to withdraw their accumulated provident fund (pf) balance. Following are the two types of form 19: The first two options can be put to use at the time of leaving employment for the sake of retirement or even otherwise. Web epf form 10c | form 19 | form 31 | form 13 download.