1099 Misc Form Printable

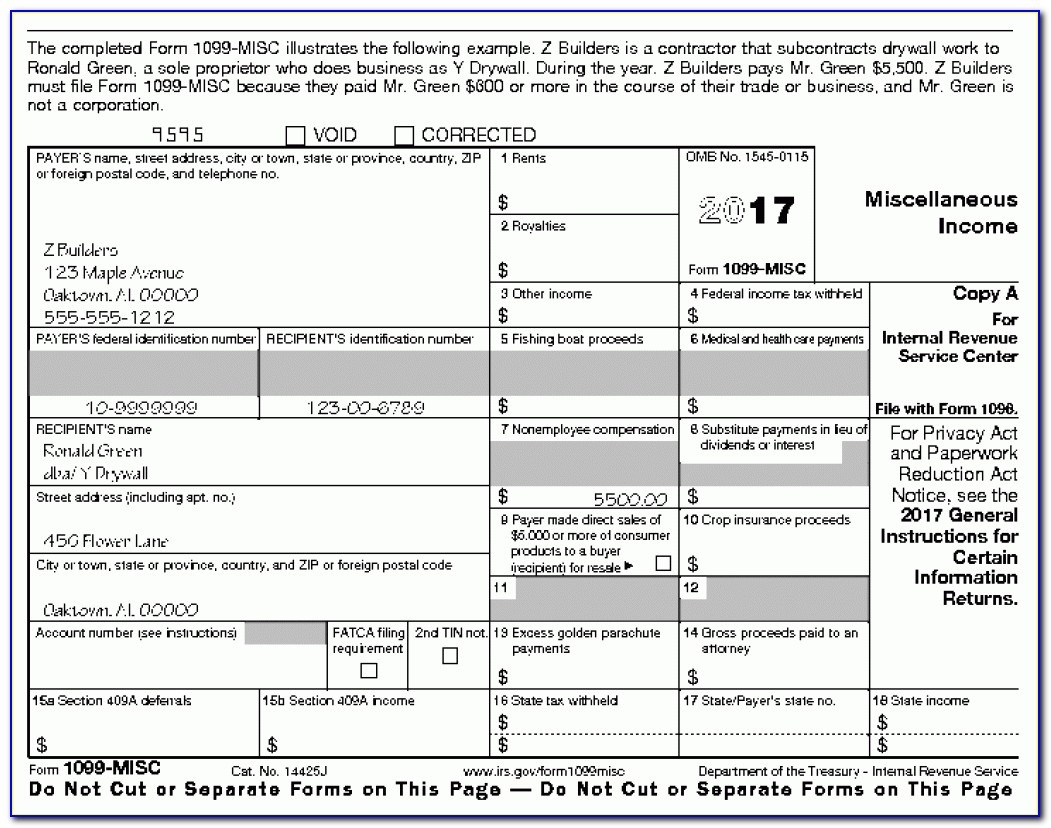

1099 Misc Form Printable - Current general instructions for certain information. All copy a forms must be printed on this paper. For internal revenue service center. If this form is incorrect or has been issued in error, contact the payer. Both the forms and instructions will be updated as needed. Medical and health care payments. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. It’s not just a matter of using a color printer loaded with red. For copies b,c, and 1, however, feel free to use whatever paper you like. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

It’s not just a matter of using a color printer loaded with red. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. Current general instructions for certain information. All copy a forms must be printed on this paper. Medical and health care payments. If this form is incorrect or has been issued in error, contact the payer. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For internal revenue service center. Both the forms and instructions will be updated as needed. For copies b,c, and 1, however, feel free to use whatever paper you like.

Current general instructions for certain information. If this form is incorrect or has been issued in error, contact the payer. For copies b,c, and 1, however, feel free to use whatever paper you like. It’s not just a matter of using a color printer loaded with red. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. These new “continuous use” forms no. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. For internal revenue service center. Both the forms and instructions will be updated as needed. Medical and health care payments.

1099MISC Instructions and How to File Square

If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. These new “continuous use” forms no. For copies b,c, and 1, however, feel free to use whatever paper you like. Current general instructions for certain information. Both the forms and instructions will be updated as needed.

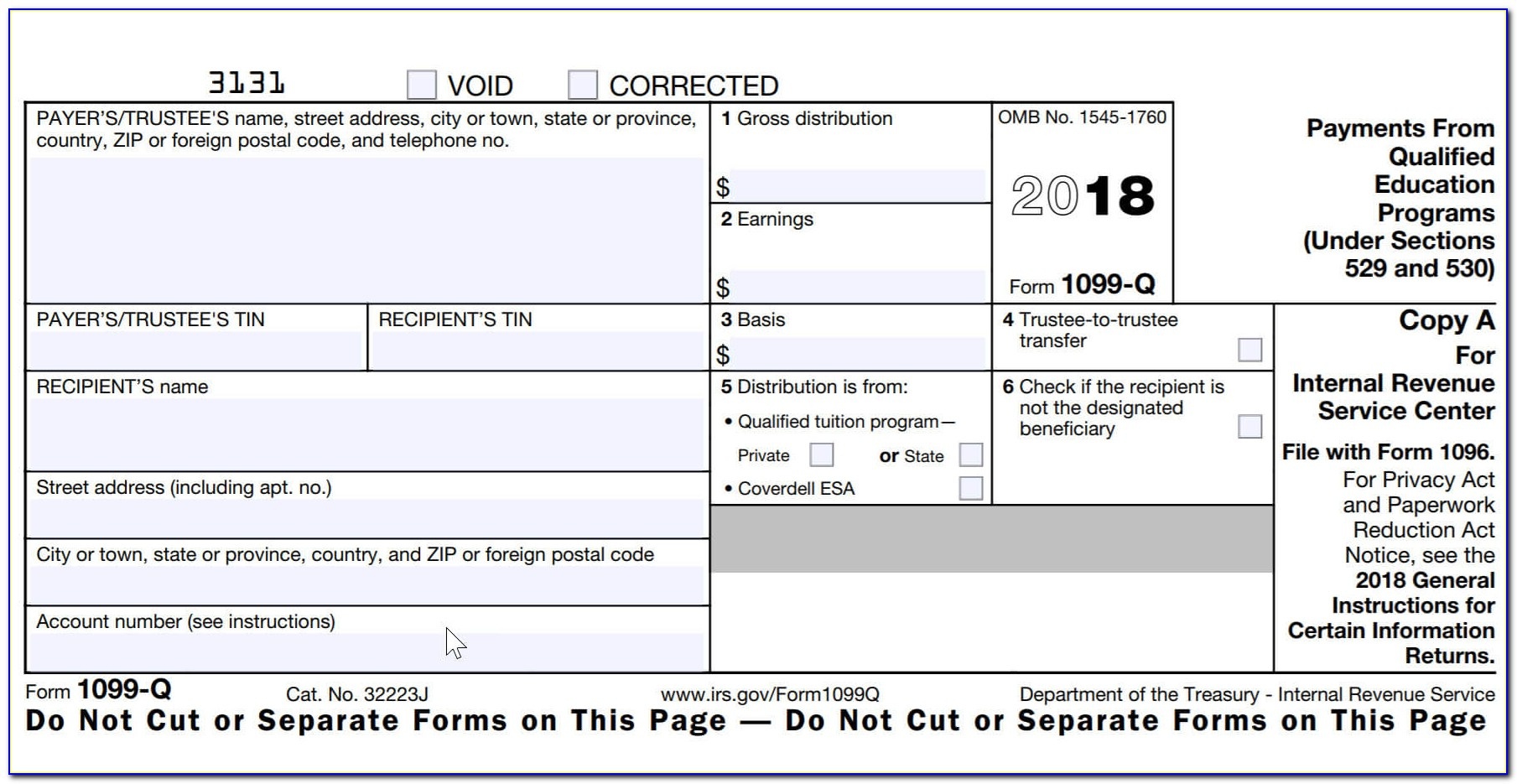

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Both the forms and instructions will be updated as needed. All copy a forms must be printed on this paper. Medical and health care payments. If this form is incorrect or has been issued in error, contact the payer. Current general instructions for certain information.

1099MISC Tax Basics

Both the forms and instructions will be updated as needed. All copy a forms must be printed on this paper. It’s not just a matter of using a color printer loaded with red. For copies b,c, and 1, however, feel free to use whatever paper you like. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

Free Printable 1099 Misc Forms Free Printable

Medical and health care payments. For copies b,c, and 1, however, feel free to use whatever paper you like. It’s not just a matter of using a color printer loaded with red. Current general instructions for certain information. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

11 Common Misconceptions About Irs Form 11 Form Information Free

For internal revenue service center. For copies b,c, and 1, however, feel free to use whatever paper you like. It’s not just a matter of using a color printer loaded with red. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Medical and health care payments.

EFile 1099 File Form 1099 Online Form 1099 for 2020

If this form is incorrect or has been issued in error, contact the payer. These new “continuous use” forms no. It’s not just a matter of using a color printer loaded with red. Medical and health care payments. For copies b,c, and 1, however, feel free to use whatever paper you like.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. These new “continuous use” forms no. Medical and health care payments. Both the forms and instructions will be updated as needed. If this form is incorrect or has been issued in error, contact the payer.

When is tax form 1099MISC due to contractors? GoDaddy Blog

All copy a forms must be printed on this paper. If this form is incorrect or has been issued in error, contact the payer. Current general instructions for certain information. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

1099MISC Form Printable and Fillable PDF Template

All copy a forms must be printed on this paper. Current general instructions for certain information. For copies b,c, and 1, however, feel free to use whatever paper you like. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Medical and health care payments.

11 Common Misconceptions About Irs Form 11 Form Information Free

Both the forms and instructions will be updated as needed. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. Medical and health care payments. It’s not just a matter of using a color printer loaded with red. For internal revenue service center.

Current General Instructions For Certain Information.

All copy a forms must be printed on this paper. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. For internal revenue service center. If this form is incorrect or has been issued in error, contact the payer.

Both The Forms And Instructions Will Be Updated As Needed.

Medical and health care payments. These new “continuous use” forms no. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. For copies b,c, and 1, however, feel free to use whatever paper you like.