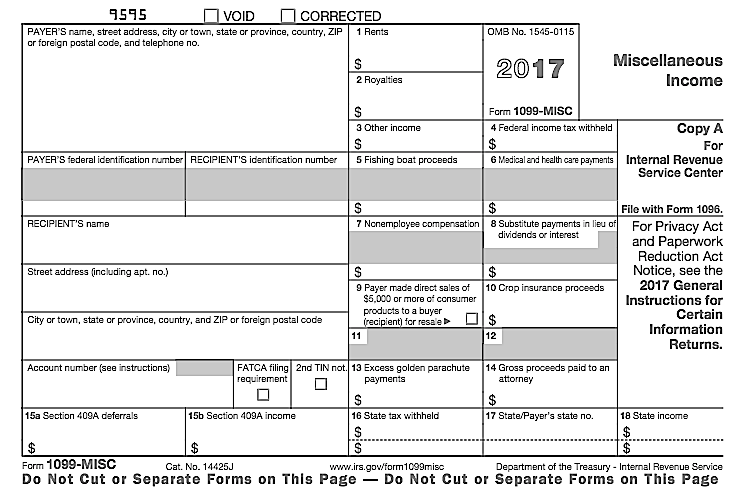

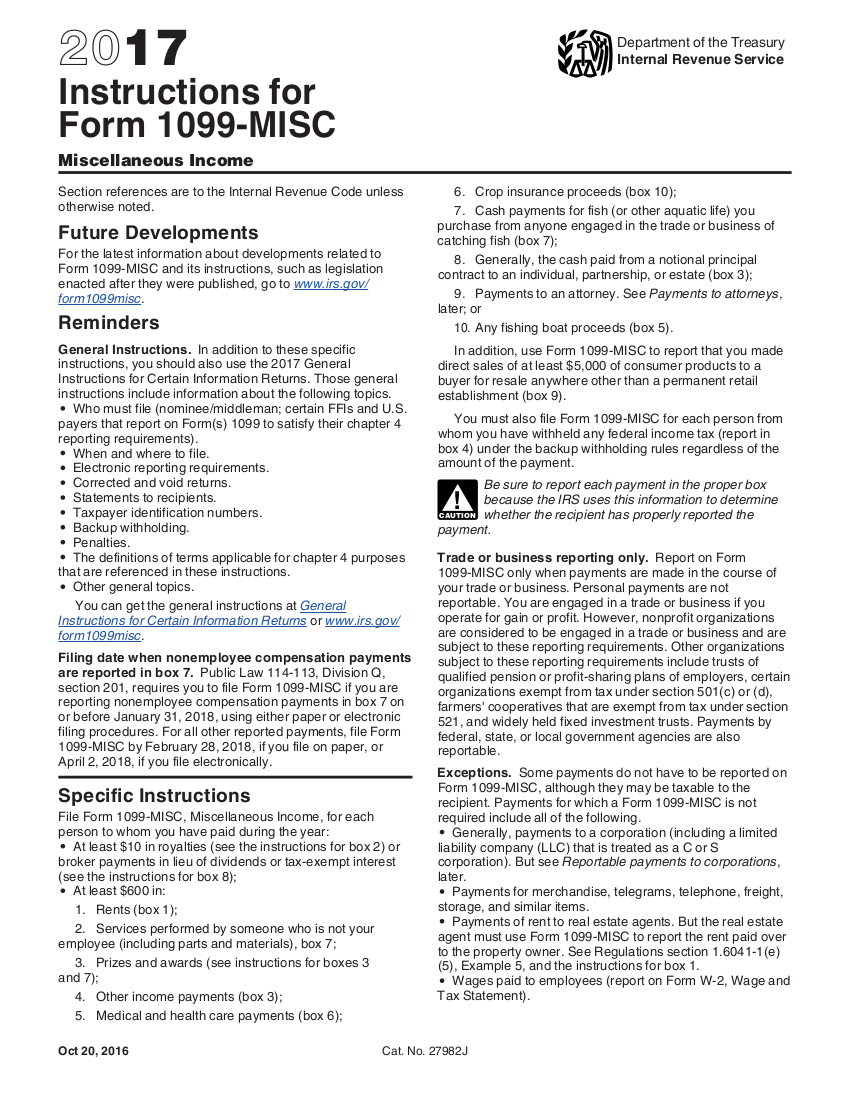

1099 Form 2017

1099 Form 2017 - Web fillable form 1099 (2017) misc. For 2017 misc 1099 forms, there are multiple reasons why you may have filed them. A a 1099 tax document is an irs tax form that lists. Web can i still file a 1099 for 2017? Web 22 rows significance for payee's tax return payees use the information provided on the 1099 forms to help them complete their own tax returns. From there, it is possible to access an instant and. (see instructions for details.) note:. If you opened an account with stockpile in 2017, you may be eligible to receive a 1099. This means that most users have until january 31, 2021 to get their 2017. Staples provides custom solutions to help organizations achieve their goals.

Web you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven) a debt you owed, or because an. Ad discover a wide selection of 1099 tax forms at staples®. The advanced tools of the editor will direct you through the. Web what is a 1099 form? Order your transcript by phone or online to be delivered by mail. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The statute of limitations for most 1099 forms is three years. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to. One of the reasons a business. Web can i still file a 1099 for 2017?

(see instructions for details.) note:. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web can i still file a 1099 for 2017? Staples provides custom solutions to help organizations achieve their goals. One of the reasons a business. The advanced tools of the editor will direct you through the. Transcripts will arrive in about 10 days. Web you received this form because a federal government agency or an applicable financial entity (a creditor) has discharged (canceled or forgiven) a debt you owed, or because an. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that.

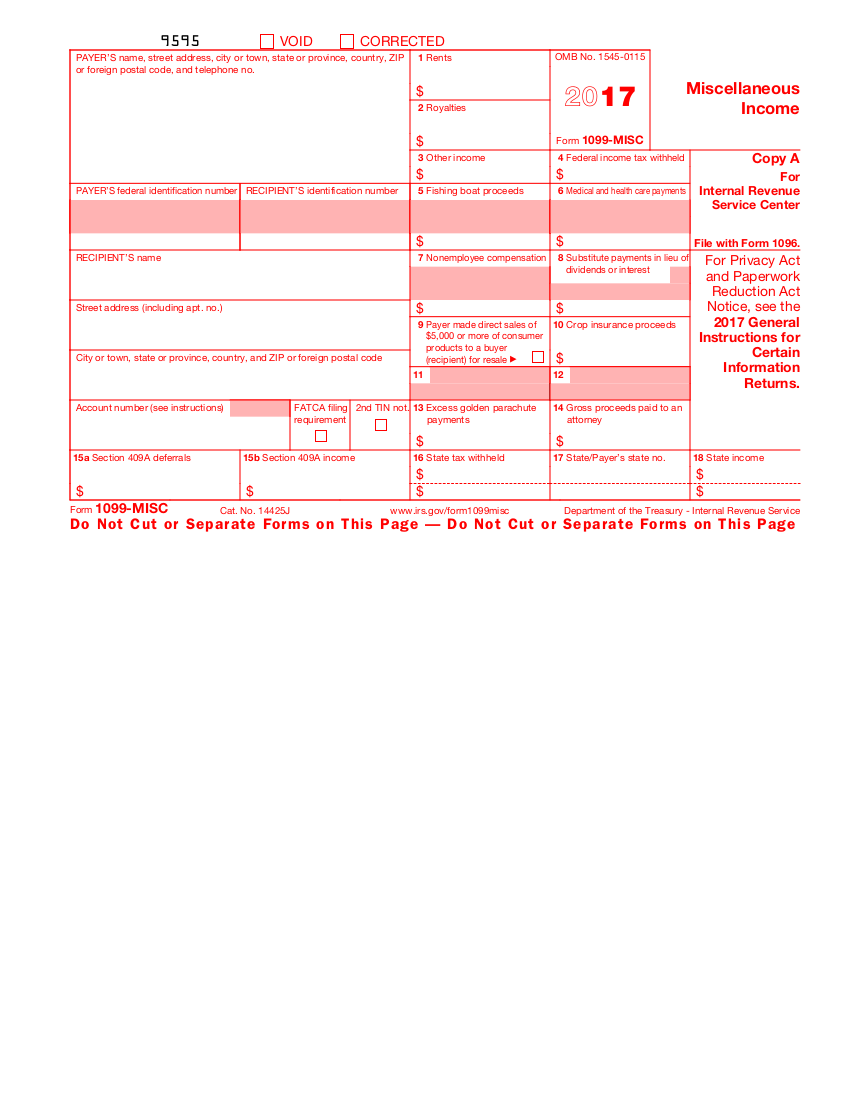

Printable 1099 Misc Form 2017 Pdf Form Resume Examples Bw9jzp497X

Is required by the irs; Order your transcript by phone or online to be delivered by mail. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web for those who need a replacement social security 1099 for 2017, you can go online by using your my social security account. Web what is a.

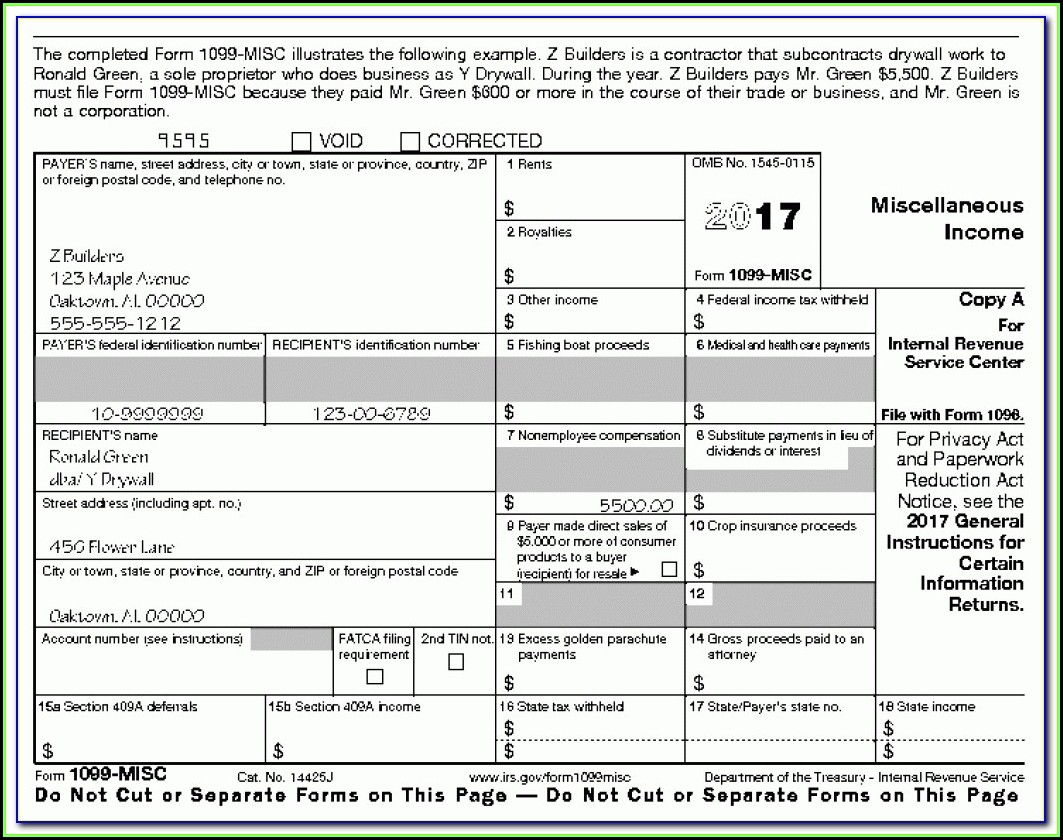

Irs Form 1099 Misc 2017 Printable Form Resume Examples gq96JoP9OR

Must be provided to the irs in case your business made payments independent and freelance workers in a total amount of at least $600. Order your transcript by phone or online to be delivered by mail. Web can i still file a 1099 for 2017? Go to www.irs.gov/freefile to see. Web for those who need a replacement social security 1099.

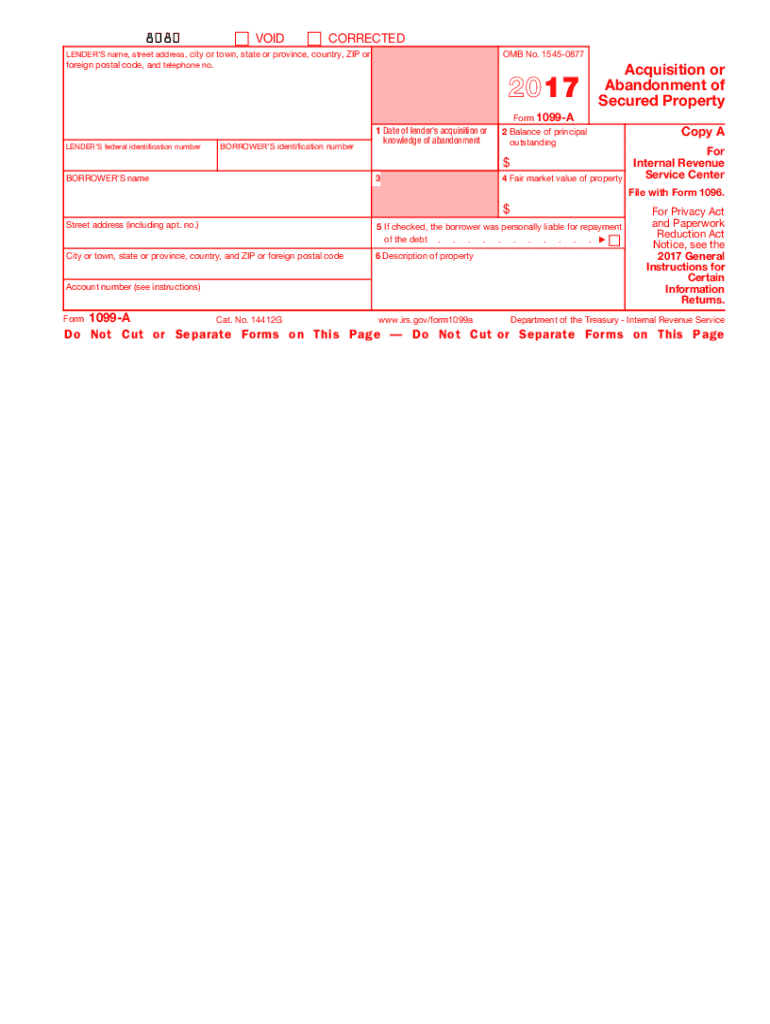

Irs 1099 Form 2017 Pdf Universal Network

From there, it is possible to access an instant and. Staples provides custom solutions to help organizations achieve their goals. Web 22 rows significance for payee's tax return payees use the information provided on the 1099 forms to help them complete their own tax returns. This means that most users have until january 31, 2021 to get their 2017. Web.

1099 A 2017 Fill Out and Sign Printable PDF Template signNow

Ad discover a wide selection of 1099 tax forms at staples®. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to. (see instructions for details.) note:. From there, it is possible to access an instant and. Ad ap leaders rely on iofm’s expertise to.

Tax Form 1099K The Lowdown for Amazon FBA Sellers

Fill & sign online button or tick the preview image of the document. One of the reasons a business. Web what is a 1099 form? This means that most users have until january 31, 2021 to get their 2017. (see instructions for details.) note:.

Form 1099 Misc 2017 Printable Universal Network

Order your transcript by phone or online to be delivered by mail. (see instructions for details.) note:. Web the way to fill out the 1099 2017 form online: Staples provides custom solutions to help organizations achieve their goals. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

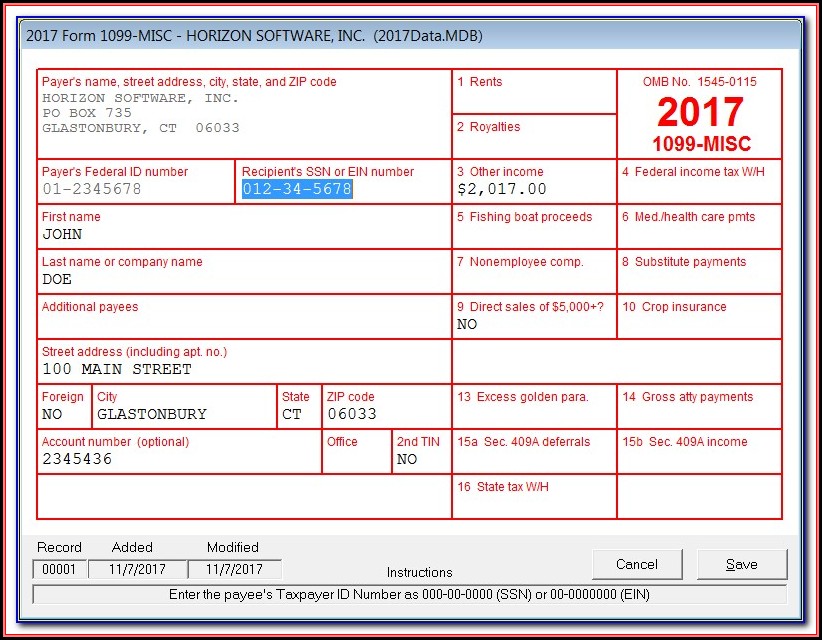

1099 (2017) Misc. Edit Forms Online PDFFormPro

Must be provided to the irs in case your business made payments independent and freelance workers in a total amount of at least $600. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web for those who need a replacement social security 1099 for 2017, you can go online by using your.

1099MISC forms The what, when & how Buildium

The irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that. This means that most users have until january 31, 2021 to get their 2017. In order to save paper, payers. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web.

The 1099MISC and Home Health Innovative Financial Solutions for Home

Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to. Web for those who need a replacement social security 1099 for 2017, you can go online by using your my social security account. Web can i still file a 1099 for 2017? The irs.

1099 (2017) Instructions Edit Forms Online PDFFormPro

The statute of limitations for most 1099 forms is three years. Web 22 rows significance for payee's tax return payees use the information provided on the 1099 forms to help them complete their own tax returns. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information.

Web Fillable Form 1099 (2017) Misc.

(see instructions for details.) note:. Web what is a 1099 form? Must be provided to the irs in case your business made payments independent and freelance workers in a total amount of at least $600. Web 22 rows significance for payee's tax return payees use the information provided on the 1099 forms to help them complete their own tax returns.

Order Your Transcript By Phone Or Online To Be Delivered By Mail.

In order to save paper, payers. From there, it is possible to access an instant and. If you opened an account with stockpile in 2017, you may be eligible to receive a 1099. One of the reasons a business.

Ad Ap Leaders Rely On Iofm’s Expertise To Keep Them Up To Date On Irs Regulations.

For 2017 misc 1099 forms, there are multiple reasons why you may have filed them. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. The statute of limitations for most 1099 forms is three years. Form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to.

Fill & Sign Online Button Or Tick The Preview Image Of The Document.

Web for those who need a replacement social security 1099 for 2017, you can go online by using your my social security account. Transcripts will arrive in about 10 days. Go to www.irs.gov/freefile to see. A a 1099 tax document is an irs tax form that lists.