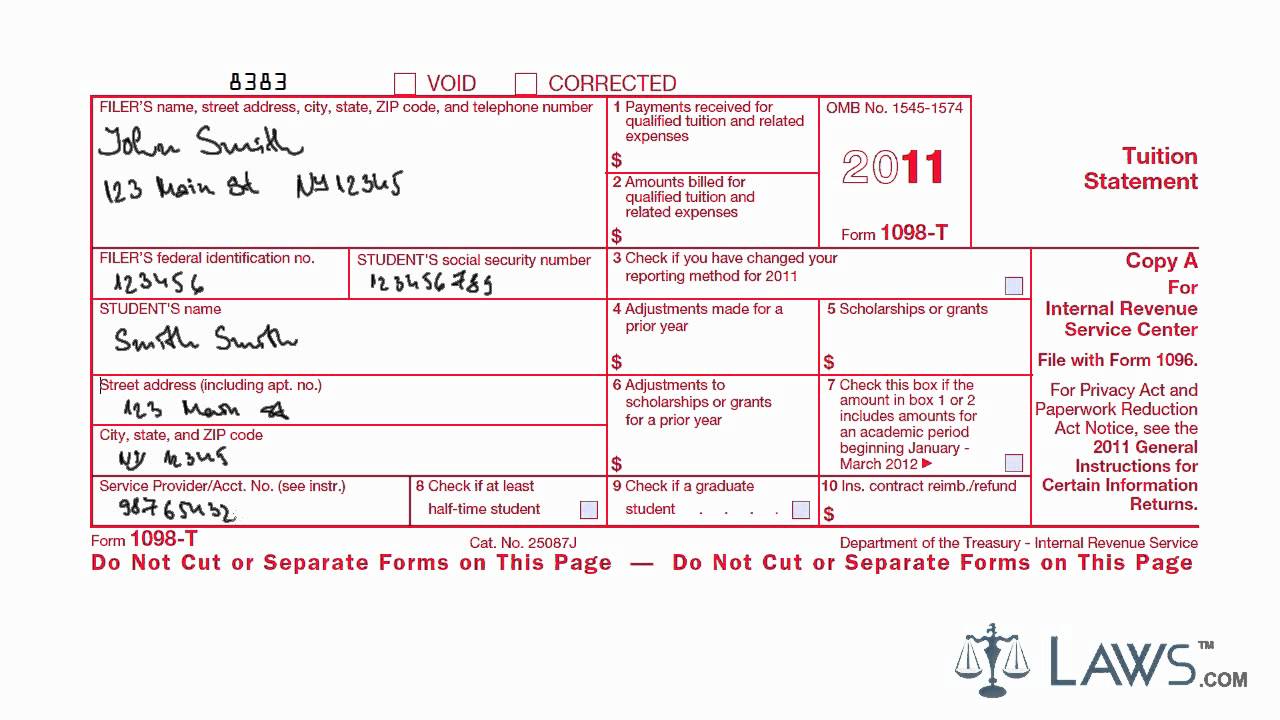

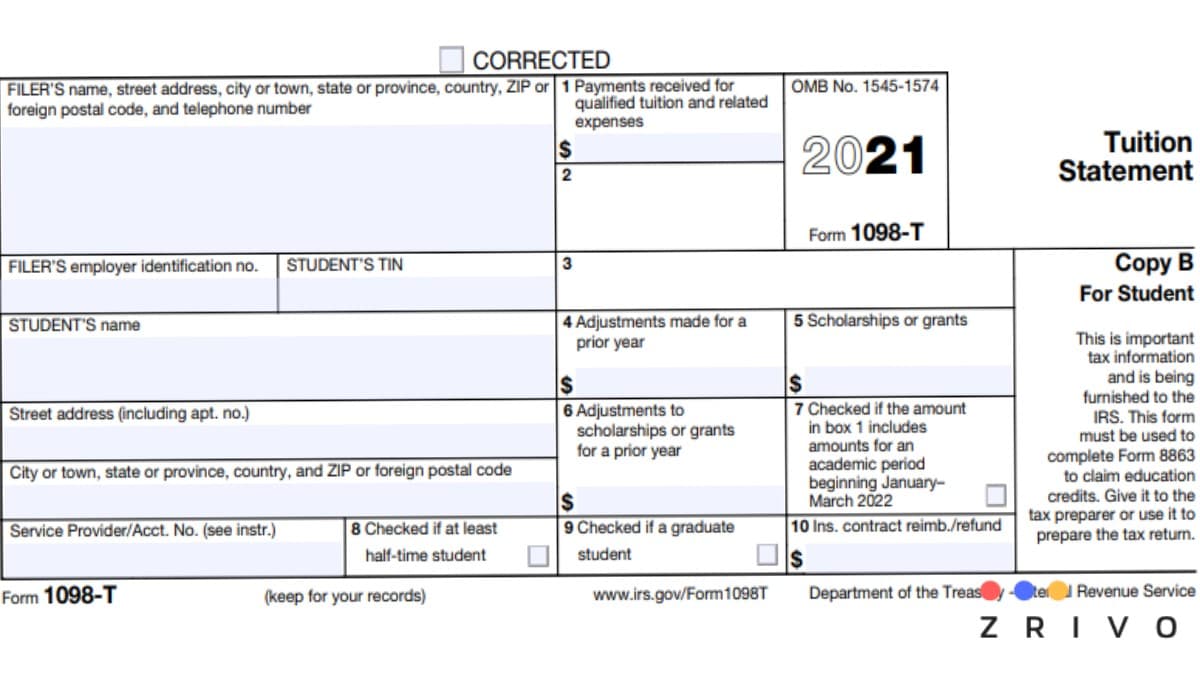

1098 T Form Example

1098 T Form Example - For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance. This box reports the total amount. Persons with a hearing or speech disability with access to. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Web online fillable copies b and c. Persons with a hearing or speech disability with access to. Payments received for qualified tuition and related expenses. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal. Payments received for qualified tuition and related expenses. It documents qualified tuition, fees, and other related course materials.

Ad complete irs tax forms online or print government tax documents. Payments received for qualified tuition and related expenses. Web for example, people with a mortgage would likely receive a form 1098 from their lender, reporting how much mortgage interest they paid during a tax year. This box reports the total amount. It provides the total dollar amount paid by the student for what is. Payments received for qualified tuition and related expenses. Persons with a hearing or speech disability with access to. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. It documents qualified tuition, fees, and other related course materials. Web online fillable copies b and c.

[5] courses for which no academic credit is offered (such as adjunct courses),. Web for example, people with a mortgage would likely receive a form 1098 from their lender, reporting how much mortgage interest they paid during a tax year. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Payments received for qualified tuition and related expenses. It documents qualified tuition, fees, and other related course materials. A college or university that received qualified tuition and related. Persons with a hearing or speech disability with access to. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal. Persons with a hearing or speech disability with access to. It provides the total dollar amount paid by the student for what is.

Understanding your IRS Form 1098T Student Billing

It provides the total dollar amount paid by the student for what is. Persons with a hearing or speech disability with access to. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition. Web for example, people with a mortgage.

Form 1098T Still Causing Trouble for Funded Graduate Students

For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! This box reports the total amount. It provides the total dollar amount paid by the student for what is. Payments received for qualified tuition and.

Irs Form 1098 T Box 4 Universal Network

Web for example, people with a mortgage would likely receive a form 1098 from their lender, reporting how much mortgage interest they paid during a tax year. It provides the total dollar amount paid by the student for what is. It documents qualified tuition, fees, and other related course materials. A college or university that received qualified tuition and related..

Learn How to Fill the Form 1098T Tuition Statement YouTube

Payments received for qualified tuition and related expenses. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Ad complete irs tax forms online or print government tax documents. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal. Complete, edit or print tax forms instantly.

1098T Student Business Services CSUF

It documents qualified tuition, fees, and other related course materials. It provides the total dollar amount paid by the student for what is. Web online fillable copies b and c. Payments received for qualified tuition and related expenses. Payments received for qualified tuition and related expenses.

1098T IRS Tax Form Instructions 1098T Forms

Ad complete irs tax forms online or print government tax documents. Persons with a hearing or speech disability with access to. Persons with a hearing or speech disability with access to. Payments received for qualified tuition and related expenses. This box reports the total amount.

Form 1098T Information Student Portal

For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal. This box reports the total amount. Persons with a hearing or speech disability with access to. [5] courses for which no.

1098T Information Bursar's Office Office of Finance UTHSC

Persons with a hearing or speech disability with access to. A college or university that received qualified tuition and related. Web for example, people with a mortgage would likely receive a form 1098 from their lender, reporting how much mortgage interest they paid during a tax year. For purposes of the tuition and fees deduction, qualified education expenses are tuition.

Frequently Asked Questions About the 1098T The City University of

This box reports the total amount. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! Persons with a hearing or speech disability with access to. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal. For purposes of the tuition and fees deduction, qualified education expenses are tuition and.

Persons With A Hearing Or Speech Disability With Access To.

Persons with a hearing or speech disability with access to. Web for example, people with a mortgage would likely receive a form 1098 from their lender, reporting how much mortgage interest they paid during a tax year. This box reports the total amount. Web this statement has been furnished to you by an eligible educational institution in which you are enrolled, or by an insurer who makes reimbursements or refunds of qualified tuition.

Persons With A Hearing Or Speech Disability With Access To.

For purposes of the tuition and fees deduction, qualified education expenses are tuition and certain related expenses required for enrollment or attendance. This box reports the total amount. [5] courses for which no academic credit is offered (such as adjunct courses),. Payments received for qualified tuition and related expenses.

Payments Received For Qualified Tuition And Related Expenses.

Complete, edit or print tax forms instantly. Web online fillable copies b and c. Ad complete irs tax forms online or print government tax documents. As of tax year 2018 and due to an irs change to institutional reporting requirements under federal.

It Provides The Total Dollar Amount Paid By The Student For What Is.

It documents qualified tuition, fees, and other related course materials. Ad 1098/1099 pro files 10% of all 1098/1099 filings in the united states! A college or university that received qualified tuition and related.